UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of September, 2022

EMPRESA DISTRIBUIDORA Y COMERCIALIZADORA NORTE S.A. (EDENOR)

(DISTRIBUTION AND MARKETING COMPANY OF THE NORTH )

(Translation of Registrant's Name Into English)

Argentina

(Jurisdiction of incorporation or organization)

Av. del Libertador 6363,

12th Floor,

City of Buenos Aires (A1428ARG),

Tel: 54-11-4346-5000

(Address of principal executive offices)

(Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.)

Form 20-F X Form 40-F

(Indicate by check mark whether the registrant by furnishing the information contained in this form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.)

Yes No X

(If "Yes" is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82- .)

Buenos Aires, September 21th,

2022

Messrs

COMISIÓN NACIONAL DE VALORES

25 de Mayo 175

Subgerencia de Emisoras

Presente

Messrs

BOLSAS Y MERCADOS ARGENTINOS SA

Sarmiento 299

Ref:

Empresa Distribuidora y Comercializadora Norte S.A –Material Fact.

Ending of bidding period -Results

Dear Sirs,

I hereby address you on behalf and as representive

of Empresa Distribuidora y Comercializadora Norte S.A. (EDENOR S.A.) (“Edenor” and/or the “Company”), in relation

to Simple Negotiable Obligations (not convertible into shares) Class 2 denominated in US Dollars at a fixed rate to be tendered with,

maturing in 26 months from the Date of Issuance and Settlement, for a nominal value of up to US$16,000,000.- extendable to US$30,000,000.-

(the “Class II ONs”) issued within the framework of the global program for the issuance of simple negotiable obligations (

not convertible into shares) for a nominal value of up to US$ 750,000,000.- (or its equivalent in other currencies) (the "Program"),

in accordance with the general terms and conditions detailed in the Program prospectus dated 11 April 2022 (the "Prospectus")

and pursuant to the terms of the prospectus supplement dated September 14, 2022 (the "Supplement"), supplemented by the subscription

notice of the same date (the "Subscription Notice"), and by the addendum to the Supplement and Subscription Notice dated September

15, 202 2 (the “Addendum”).

Empresa Distribuidora y Comercializadora Norte Sociedad Anónima

(EDENOR S.A.)

Avda. del Libertador 6363 – Buenos Aires, C1428ARG – Argentina.

Tel.: 4346-5400 Fax: 4346-5327

It is hereby reported that on September 20, 2022,

in accordance with the provisions of the Supplement, the Bidding Period for Class 2 ONs has ended, with the result of the bidding being

as follows:

1) Number of orders received: 2,473.

2) Nominal value of orders received: US$30,956,444.

3) Nominal Value to be issued: US$30,000,000.

4) Interest Rate of ON Class 2: 9.75%.

5) Issuance Price: At par. 100% of the Nominal Value of Class

2 ONs.

6) Issue and Settlement Date: September 22, 2022.

7) Redemption date and Maturity Date of Class 2 ONs: November

22, 2024.

8) Interest Payment Dates for Class 2 ONs: Interest will be

paid semi-annually, in arrears, as of the First Interest Payment Date (as this term is defined below), on the following dates (each one,

an “Interest Payment Date”, and together, the “Interest Payment Dates”): November 22, 2022 (the “First Interest

Payment Date”); May 22, 2023; November 22, 2023; May 22, 2024; and November 22, 2024. If any payment day of any amount under the

Notes is not a Business Day, such payment will be made on the immediately following Business Day. Any payment due under the Negotiable

Obligations made on said immediately following Business Day will have the same validity as if it had been made on the date on which it

was due, and no interest will be accrued during the period between said Interest Payment Date of the Negotiable Obligations and the immediately

subsequent Business Day, except in relation to the last Interest Payment Date of the Negotiable Obligations in respect of which, if it

is not a Business Day, the Issuer will pay the interest accrued between said date and the of your actual payment.

9) Term: 26 months.

10) Duration (in years): 2.

11) Proration factor: 90.3447%

Capitalized terms used herein and not specifically defined herein

have the meanings assigned to them in the Pricing Supplement.

Yours faithfully,

Silvana E Coria

Market Relations Officer

Empresa Distribuidora y Comercializadora Norte Sociedad Anónima

(EDENOR S.A.)

Avda. del Libertador 6363 – Buenos Aires, C1428ARG – Argentina.

Tel.: 4346-5400 Fax: 4346-5327

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

Empresa Distribuidora y Comercializadora Norte S.A. |

|

|

|

|

|

|

|

|

|

|

By: |

/s/ Germán Ranftl |

|

|

Germán Ranftl |

|

|

Chief Financial Officer |

Date:

September 21, 2022

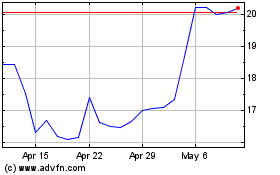

Empresa Distribuidora Y ... (NYSE:EDN)

Historical Stock Chart

From Oct 2024 to Nov 2024

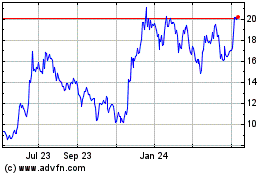

Empresa Distribuidora Y ... (NYSE:EDN)

Historical Stock Chart

From Nov 2023 to Nov 2024