Report of Foreign Issuer (6-k)

March 24 2016 - 6:09AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of March, 2016

EMPRESA DISTRIBUIDORA Y COMERCIALIZADORA NORTE S.A. (EDENOR)

(DISTRIBUTION AND MARKETING COMPANY OF THE NORTH )

(Translation of Registrant's Name Into English)

Argentina

(Jurisdiction of incorporation or organization)

Av. del Libertador 6363,

12th Floor,

City of Buenos Aires (A1428ARG),

Tel: 54-11-4346-5000

(Address of principal executive offices)

(Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.)

Form 20-F

X

Form 40-F

(Indicate by check mark whether the registrant by furnishing the information contained in this form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.)

Yes

No

X

(If "Yes" is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82-

.)

Buenos Aires, March 8, 2016

Messrs.

BUENOS AIRES STOCK EXCHANGE

Messrs

.

NATIONAL SECURITIES COMMISSION

175 25 de Mayo Street

Issuers Division

Dear Sirs,

As required by section 62 of the Buenos Aires Stock Exchange Regulations and Resolution No. 2/12, I hereby inform you that at the Company Board of Directors meeting held on March 8, 2016, the following documents were approved: Annual Report, Statement of Financial Position, Statement of Comprehensive Income, Statement of Changes in Equity, Statement of Cash Flows, Notes to the Financial Statements, Informative Summary and the information required by section 68 of the aforementioned regulations, related to the year ended December 31, 2015.

The profit for the year ended December 31, 2015 amounts to $ 1.1 billion, as compared to the $ 779.7 million loss recorded in the year ended December 31, 2014. Furthermore, the operating profit amounts to $ 2.2 billion due to the recording of income, not transferred to the electricity rate, for $ 5.6 billion resulting from the partial recognition of higher costs set forth in the Adjustment Agreement entered into by and between the Company and the Federal Government in November 2005, the application of the theoretical electricity rate schedule authorized by SE Resolution No. 32/2015, the recognition as income of PUREE-related funds, and the regularization of loans for consumption (mutuums) granted to cover higher salary costs, which demonstrated that it was necessary to definitively restore the economic and financial equation of the public service, object of the concession, that had deteriorated as a consequence of the freezing of electricity rates and the constant increase in costs. The new administration has begun to revert this situation thanks to the implementation, as from February 1, 2016, of a new electricity rate schedule, whose impact will have to be assessed in the fiscal year underway.

In the previously mentioned framework, the Company has continued making investments, which reached a record high annual amount of $ 2.5 billion, mainly allocated to improving service quality and safety levels and meeting the increasing demand.

Empresa Distribuidora y Comercializadora Norte S.A.

Av. Del Libertador 6363 Piso 1° – (C1428ARG) Capital Federal – Tel.: (54-11) 4346-5088 / 5113 – Fax: (54-11) 4346-5301

The amounts disclosed below are stated in thousands of Argentine pesos and arise from the Financial Statements:

Year ended

December 31, 2015

|

|

|

|

|

Profit for the year

|

|

|

|

|

|

|

|

Attributable to the owners of the parent

|

Profit

|

1,142,443

|

|

Attributable to non-controlling interests

|

|

0

|

|

|

Profit

|

1,142,443

|

|

Other comprehensive loss for the year

|

|

|

|

|

|

|

|

Attributable to the owners of the parent

|

Loss

|

(2,391)

|

|

Attributable to non-controlling interests

|

|

0

|

|

|

Loss

|

(2,391)

|

|

Total comprehensive income for the year

|

|

|

|

|

|

|

|

Attributable to the owners of the parent

|

Income

|

1,140,051

|

|

Attributable to non-controlling interests

|

|

0

|

|

|

Income

|

1,140,051

|

|

|

|

|

|

Detail of Equity

|

|

|

|

Share Capital– Nominal Value (1)

|

|

906,455

|

|

Share Capital – Adjustment to Capital (2)

|

|

408,063

|

|

Additional paid-in capital

|

|

3,452

|

|

Legal Reserve

|

|

0

|

|

Other Comprehensive Loss

|

|

(42,253)

|

|

Unappropriated Retained Earnings

|

|

249,336

|

|

Total attributable to the owners of the Company

|

|

1,525,053

|

|

Non-controlling interests

|

|

0

|

|

Total Equity

|

|

1,525,053

|

(1)

Includes 9,412 related to treasury shares.

(2)

Includes 10,347 related to treasury shares.

Furthermore, and as required by sub-sections o), p) and q) of section 62, we inform the following:

|

Class of shares

|

Number of shares

|

% on Share Capital

|

|

|

|

|

|

A

|

462,292,111

|

51.00

|

|

B

|

442,210,385

|

48.78

|

|

C

|

1,952,604

|

0.22

|

|

Total

|

906,455,100

|

100.00

|

Empresa Distribuidora y Comercializadora Norte S.A.

Av. Del Libertador 6363 Piso 1° – (C1428ARG) Capital Federal – Tel.: (54-11) 4346-5088 / 5113 – Fax: (54-11) 4346-5301

The class “A” shares are owned by Electricidad Argentina S.A. (EASA), domiciled at 3302 Ortiz de Ocampo Street, Building 4 of the City of Buenos Aires. The class “B” shares are currently traded at the New York Stock Exchange (through American Depositary Shares –“ADSs”) and the Buenos Aires Stock Exchange. As of December 31, 2015, the Company has 9,412,500 treasury shares.

An amount of 1,952,604 class “C” shares, which are held by Banco de la Nación Argentina as trustee of the Company Employee Stock Ownership Program, remains outstanding. Moreover, IEASA S.A., domiciled at 3302 Ortiz de Ocampo Street, Building 4 of the City of Buenos Aires, owns 99.99% of EASA’s voting shares.

The Company does not have debt securities convertible into shares, nor there exist stock options of the Company’s shares.

The development of the Unappropriated Retained Earnings account is as follows:

|

|

In thousands of Argentine pesos

|

|

Accumulated deficit at beginning of year

|

(893,107)

|

|

Profit for the year

|

1,142,443

|

|

Unappropriated Retained Earnings at end of year

|

249,336

|

The Board of Directors proposes that the profit for the year be allocated as follows:

|

|

In thousands of Argentine pesos

|

|

To Legal Reserve

|

57,172

|

|

To Voluntary Reserve for Future Investments and Other Financial Requirements

|

192,164

|

Yours sincerely,

VICTOR A RUIZ

|

Officer in charge of Market Relations

|

Empresa Distribuidora y Comercializadora Norte S.A.

Av. Del Libertador 6363 Piso 1° – (C1428ARG) Capital Federal – Tel.: (54-11) 4346-5088 / 5113 – Fax: (54-11) 4346-5301

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

Empresa Distribuidora y Comercializadora Norte S.A.

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Leandro Montero

|

|

|

Leandro Montero

|

|

|

Chief Financial Officer

|

Date: March 22, 2016

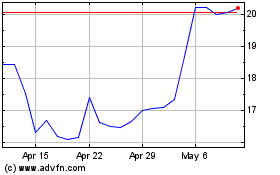

Empresa Distribuidora Y ... (NYSE:EDN)

Historical Stock Chart

From Jun 2024 to Jul 2024

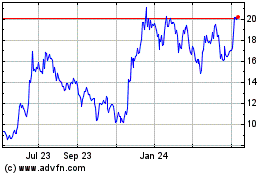

Empresa Distribuidora Y ... (NYSE:EDN)

Historical Stock Chart

From Jul 2023 to Jul 2024