Ecovyst Inc. (NYSE: ECVT) (“Ecovyst” or the “Company”), a

leading integrated and innovative global provider of specialty

catalysts and services, today reported results for the second

quarter ended June 30, 2023 and updated fiscal 2023 guidance.

Second Quarter 2023 Results & Highlights

- Sales of $184.1 million, compared to $225.2 million in the

second quarter of 2022, the reduction driven primarily by lower

pass-through of sulfur costs of approximately $32 million.

- Net income of $26.1 million, up 36% year-over-year, with a net

income margin of 14.2% and with diluted net income per share of

$0.22, up 57% year-over-year; Adjusted net income of $34.6 million,

up 15% year-over-year, with Adjusted diluted earnings per share of

$0.29, up 32% year-over-year.

- Adjusted EBITDA of $79.3 million, up 9% year-over-year, with an

Adjusted EBITDA margin of 34.7%.

- Profitability driven by strong pricing, favorable mix, and

higher sales of renewable fuels, emission control, and

hydrocracking catalysts, offsetting lower virgin sulfuric acid and

silica catalyst sales volume.

- In conjunction with a secondary offering, repurchased 4,000,000

shares at an average price of $10.88, for total cost of $43.5

million.

- Formalized a strategic cooperation with Valoregen for

development of advanced plastic recycling technologies utilizing

the Opal InfinityTM catalyst portfolio of the Zeolyst Joint

Venture.

- Updating 2023 guidance to reflect anticipated softening of

demand in select end uses and the impact of an unforeseen outage

and production restriction at one of our sites.

Financial results and outlook include non-GAAP financial

measures. These non-GAAP measures are more fully described and are

reconciled from the respective measures determined under GAAP in

“Presentation of Non-GAAP Financial Measures” and the attached

appendix.

“During the second quarter of 2023, high refinery utilization

continued to support demand for our regeneration services and we

benefited from higher net pricing for regeneration volume. In

addition, and as anticipated, we saw stronger sales for emission

control, hydrocracking and renewable fuel catalysts in our Catalyst

Technologies segment, which also continued to benefit from

previously implemented price increases,” said Kurt J. Bitting,

Ecovyst’s Chief Executive Officer. “Although unplanned operational

downtime at our Ecoservices’ Dominguez facility at the end of the

quarter limited sales volume and increased maintenance costs, we

delivered second quarter 2023 Adjusted EBITDA of $79 million, up

9%, compared to the second quarter of 2022, with an associated

margin of 34.7%, which was up 680 basis points compared to the

year-ago quarter,” added Bitting.

Second Quarter 2023 Results

Sales for the quarter ended June 30, 2023 were $184.1 million,

compared to $225.2 million in the second quarter of 2022. The

change was primarily driven by a $32 million impact associated with

the pass-through of lower average sulfur costs compared to the

second quarter of 2022. In addition, lower virgin sulfuric acid

sales volume resulting from an unplanned production outage at

Ecoservices’ Dominguez facility and lower silica catalyst sales

were partially offset by stronger pricing for regeneration services

and higher pricing within Catalyst Technologies. Within the Zeolyst

Joint Venture, sales were higher on increased sales of catalyst

used in the production of renewable fuels, emission control and

hydrocracking catalysts.

Net income was $26.1 million, compared to net income of $19.2

million in the second quarter of 2022, with a diluted net income

per share of $0.22. Adjusted net income was $34.6 million with an

Adjusted diluted earnings per share of $0.29. Adjusted EBITDA was

$79.3 million, up $6.4 million or 9%, compared to $72.9 million in

the second quarter of 2022, with the change reflecting higher

pricing and favorable mix, partially offset by lower sales volume,

higher unplanned repair and maintenance costs and higher costs

associated with product networking.

Review of Segment Results and Business Trends

Demand across most product categories, end-uses and customers

remained positive. Through the second quarter of 2023, high

refinery utilization continued to support activity in our

regeneration services business, and we anticipate high refinery

utilization to continue for the balance of 2023. In addition,

strong demand resulted in higher sales of catalyst used in the

production of renewable fuels, emission control and hydrocracking

catalysts during the second quarter, compared to the second quarter

of 2022, and we expect continued higher sales of hydrocracking

catalysts in the second half of 2023, compared to the first half of

the year. However, sales volumes in Ecoservices were impacted in

the second quarter of 2023, primarily by the unplanned production

downtime at the Dominguez site, and we expect the outages and

resulting production restriction to adversely impact sales and

maintenance costs in the third quarter of 2023.

In addition, late in the second quarter of 2023, we saw evidence

of weaker demand fundamentals in nylon and polyethylene end uses,

which we believe are more driven by cyclical, global demand trends.

For the second half of 2023, we believe these weaker demand

fundamentals will adversely impact sales of virgin sulfuric acid

into nylon production. In addition, we now expect lower sales of

polyethylene catalysts for the balance of 2023, driven by declining

global polyethylene demand and lower polyethylene production plant

operating rates.

Ecoservices

Our regeneration services support the production of alkylate, a

high value gasoline component critical for meeting stringent

gasoline standards and for producing premium grade gasoline.

Tightening of gasoline standards and increased demand for

higher-octane premium grade gasoline to power high compression,

more fuel efficient engines resulted in higher utilization for our

customers’ alkylation units. High U.S. refinery utilization in 2022

and through the first half of 2023 supported our customers’

production of alkylate and translated into strong demand for our

regeneration services. We expect refinery utilization to remain

high through the remainder of 2023. Sulfuric acid is a widely used

chemical and it plays a key role in producing a wide array of

materials, particularly those supporting green infrastructure.

While we expect our virgin sulfuric acid sales in 2023 to benefit

from mining activity for metals and minerals that provide

conductivity in low carbon technologies, as well as from demand in

a wide range of industrial applications, production downtime in the

second quarter limited sales of virgin sulfuric acid, and we expect

the production constraints to adversely impact virgin sulfuric acid

volume in the third quarter of 2023. Our catalyst activation

services provide for ex-situ sulfiding and pre-activation for

hydro-processing catalysts, with expected demand growth in both

traditional and renewable fuel production. We believe

sustainability trends will continue to favor our treatment services

business as customers seek the sustainability-focused waste

solutions offered by Ecoservices.

Sales were $158.1 million, compared to $193.0 million in the

second quarter of 2022. The change in sales reflects lower

pass-through of sulfur costs of approximately $32 million, and

lower virgin sulfuric acid sales volume resulting from production

constraints during the second quarter. These factors were partially

offset by higher average pricing for regeneration services.

Adjusted EBITDA was $60.1 million, compared to $60.0 million in the

second quarter of 2022. The nominal increase period-to-period was

largely attributable to higher pricing for regeneration services,

partially offset by lower virgin sulfuric acid sales volume and

higher unplanned repair and maintenance costs.

Catalyst Technologies

Our silica catalysts business supplies critical catalyst

components for the production of high-density polyethylene, a

high-strength and high-stiffness plastic used in bottles,

containers, and molded applications and linear low-density

polyethylene used predominately for films. While we expect

long-term demand for polyethylene films and packaging to remain

positive, late in the second quarter we saw evidence of softer

global demand and lower operating rates for polyethylene producers,

which we believe will impact sales of polyethylene catalysts in the

second half of 2023. Through the Zeolyst Joint Venture, we also

supply specialty catalysts to customers for use in the production

of both traditional and renewable fuels, petrochemicals, and

emission control systems for both on-road and non-road diesel

engines. Demand for traditional fuels remained positive and demand

for renewable fuels increased. We also supply niche custom

catalysts in the refining and petrochemical industries. We continue

to expect growth in demand for catalysts used in these

applications.

During the second quarter of 2023, silica catalysts sales were

$26.0 million, compared to $32.2 million in the second quarter of

2022, with the change reflecting lower sales of polyethylene

catalysts and the timing of event driven niche custom catalyst

orders used in the production of methyl methacrylate, partially

offset by higher average selling prices. Zeolyst Joint Venture

sales were $44.7 million, up 25%, compared to $35.9 million in the

second quarter of 2022. The increase in sales was due to the

comparative timing of customer orders for hydrocracking and

specialty catalysts sales and increased demand for catalysts used

in renewable fuel and emission control applications. Adjusted

EBITDA, which includes the Zeolyst Joint Venture, was $25.4

million, up $4.0 million or 19%, compared to $21.4 million in the

second quarter of 2022, with the change reflecting continued strong

pricing, favorable product mix and lower production costs.

Cash Flows and Balance Sheet

Cash flows from operating activities was $41.1 million for the

six months ended June 30, 2023, compared to $52.8 million for the

six months ended June 30, 2022. The decrease was driven by the

timing of dividends received from the Zeolyst Joint Venture. At

June 30, 2023, the Company had cash and cash equivalents of $29.2

million, total gross debt of $882.0 million and availability under

the ABL facility of $70.0 million, after giving effect to $4.0

million of outstanding letters of credit and no revolving credit

facility borrowings outstanding, for total available liquidity of

$99.2 million. The net debt to net income ratio was 12.7x as of

June 30, 2023 and the net debt leverage ratio was 3.2x as of June

30, 2023.

Updated 2023 Financial Outlook

“While our expectations for regeneration services demand and

sales of hydrocracking and other zeolite-based catalysts remains

positive for the second half of 2023, late in the second quarter we

began to see evidence of softer demand in end uses more linked to

global macroeconomic fundamentals, including lower demand

expectations and de-stocking from certain customers. These end uses

include nylon production, which is a significant outlet for our

virgin sulfuric acid, and polyethylene production, where global

demand operating rates have continued to decrease beyond our

forecast. In addition, the unplanned equipment outage and

production restriction at the Ecoservices’ Dominguez location late

in the second quarter continued into the third quarter, prior to

its resolution,” said Bitting.

“Given that we expect weaker demand in the nylon and

polyethylene end uses, and with the combined impact of both lost

sales volume and higher maintenance and repair costs primarily

associated with the unplanned equipment outage and production

restriction at the Ecoservices’ Dominguez site, we are making a

moderate revision to our full-year Adjusted EBITDA expectations to

a range of $260 million - $275 million,” Bitting said. “Despite the

current downcycle conditions in the global nylon and polyethylene

end uses, we believe our balanced portfolio of products provides us

with attractive future growth opportunities associated with

sustainable technologies. These include the potential expansion of

production of renewable fuels, low-carbon technologies driving

growth in the mining sector, and future growth opportunities, as

evidenced by our recently announced collaboration with Valoregen on

plastics recycling.”

Based upon business trends and conditions as of today, the

Company’s full year 2023 guidance is as follows:

- Sales of $685 million to $715 million1 (changed from $730

million to $760 million to reflect lower expected virgin sulfuric

acid volume and lower expected volume of polyethylene

catalysts)

- Sales of $155 million to $165 million for proportionate 50%

share of Zeolyst Joint Venture, which is excluded from GAAP sales

(increased from $145 million to $155 million)

- Adjusted EBITDA2 of $260 million to $275 million (change from

$285 million to $300 million)

- Adjusted Free Cash Flow2 of $100 million to $115 million

(change from $115 million to $130 million)

- Capital expenditures of $50 million to $60 million (change from

$60 million to $70 million)

- Interest expense of $45 million to $50 million (no change)

- Depreciation & amortization (no change)

- Ecovyst - $80 million to $90 million

- Zeolyst J.V. - $14 million to $16 million

1Sales outlook for 2023 assumes lower average sulfur prices,

compared to 2022, and lower projected pass-through of sulfur costs

of approximately $90 million.

2In reliance upon the unreasonable efforts exemption provided

under Item 10(e)(1)(i)(B) of Regulation S-K, the Company is not

able to provide a reconciliation of its non-GAAP financial guidance

to the corresponding GAAP measures without unreasonable effort

because of the inherent difficulty in forecasting and quantifying

certain amounts necessary for such a reconciliation such as certain

non-cash, nonrecurring or other items that are included in net

income and EBITDA as well as the related tax impacts of these items

and asset dispositions / acquisitions and changes in foreign

currency exchange rates that are included in cash flow, due to the

uncertainty and variability of the nature and amount of these

future charges and costs. Because this information is uncertain,

the Company is unable to address the probable significance of the

unavailable information, which could be material to future

results.

Stock Repurchase Authorization

In April 2022, the Company’s Board of Directors approved a stock

repurchase program authorizing the repurchase of up to $450 million

of the Company’s outstanding common stock over the next four years.

To date, repurchases under the program have been funded using cash

on hand and cash generated from operations, with repurchases

conducted through negotiated transactions with the Company’s equity

sponsors, as well as through open market repurchases. Future

repurchases may also be conducted through negotiated transactions

with an equity sponsor, open market repurchases or other means,

including through Rule 10b-18 trading plans or through the use of

other techniques such as accelerated share repurchases.

During the second quarter of 2023, in connection with a

secondary offering of the Company’s common stock in May 2023, the

Company repurchased 4,000,000 shares of its common stock sold in

the offering from the underwriter at a price of $10.88 per share

concurrently with the closing of the offering, for a total of $43.5

million.

For possible future repurchases, the actual timing, number, and

nature of shares repurchased will depend on a variety of factors,

including stock price, trading volume, and general business and

market conditions. The repurchase program does not obligate the

Company to acquire any number of shares in any specific period, or

at all, and the repurchase program may be amended, suspended or

discontinued at any time at the Company’s discretion. As of June

30, 2023, $239.9 million was available for additional share

repurchases under the program.

Conference Call and Webcast Details

On Thursday, August 3, 2023, Ecovyst management will review the

second quarter results during a conference call and audio-only

webcast scheduled for 11:00 a.m. Eastern Time.

Conference Call: Investors may listen to the conference call

live via telephone by dialing 1 (800) 267-6316 (domestic) or

1 (203) 518-9848 (international) and use the participant

code ECVTQ223.

Webcast: An audio-only live webcast of the conference call and

presentation materials can be accessed at

https://investor.ecovyst.com. A replay of the conference

call/webcast will be made available at

https://investor.ecovyst.com/events-presentations.

About Ecovyst Inc.

Ecovyst Inc. and subsidiaries is a leading integrated and

innovative global provider of specialty catalysts and services. We

support customers globally through our strategically located

network of manufacturing facilities. We believe that our products,

which are predominantly inorganic, and services contribute to

improving the sustainability of the environment.

We have two uniquely positioned specialty businesses:

Ecoservices provides sulfuric acid recycling to the North

American refining industry for the production of alkylate and

provides on-purpose virgin sulfuric acid for water treatment,

mining, and industrial applications; and Catalyst

Technologies provides finished silica catalysts and catalyst

supports necessary to produce high strength and high stiffness

plastics and, through its Zeolyst Joint Venture, supplies zeolites

used for catalysts that help produce renewable fuels, remove

nitrogen oxides from diesel engine emissions as well as sulfur from

fuels during the refining process. For more information, see our

website at https://www.ecovyst.com.

Presentation of Non-GAAP Financial Measures

In addition to the results provided in accordance with U.S.

generally accepted accounting principles (“GAAP”) throughout this

press release, the Company has provided non-GAAP financial measures

— Adjusted EBITDA, Adjusted EBITDA margin, Adjusted net income,

Adjusted free cash flow, Adjusted diluted earnings per share, and

net debt leverage ratio (collectively, “Non-GAAP Financial

Measures”) — which present results on a basis adjusted for certain

items. The Company uses these Non-GAAP Financial Measures for

business planning purposes and in measuring its performance

relative to that of its competitors. The Company believes that

these Non-GAAP Financial Measures are useful financial metrics to

assess its operating performance from period-to-period by excluding

certain items that the Company believes are not representative of

its core business. These Non-GAAP Financial Measures are not

intended to replace, and should not be considered superior to, the

presentation of the Company’s financial results in accordance with

GAAP. The use of the Non-GAAP Financial Measures terms may differ

from similar measures reported by other companies and may not be

comparable to other similarly titled measures. These Non-GAAP

Financial Measures are reconciled from the respective measures

under GAAP in the appendix below.

Zeolyst Joint Venture

The Company’s zeolite catalysts product group operates through

its Zeolyst Joint Venture, which is accounted for as an equity

method investment in accordance with GAAP. The presentation of the

Zeolyst Joint Venture’s sales represents 50% of the sales of the

Zeolyst Joint Venture. The Company does not record sales by the

Zeolyst Joint Venture as revenue and such sales are not

consolidated within the Company’s results of operations. However,

the Company’s Adjusted EBITDA reflects the share of earnings of the

Zeolyst Joint Venture that have been recorded as equity in net

income from affiliated companies in the Company’s consolidated

statements of income for such periods and includes Zeolyst Joint

Venture adjustments on a proportionate basis based on the Company’s

50% ownership interest. Accordingly, the Company’s Adjusted EBITDA

margins are calculated including 50% of the sales of the Zeolyst

Joint Venture for the relevant periods in the denominator.

Note on Forward-Looking Statements

Some of the information contained in this press release

constitutes “forward-looking statements.” Forward-looking

statements can be identified by words such as “anticipates,”

“intends,” “plans,” “seeks,” “believes,” “estimates,” “expects,”

“projects” and similar references to future periods.

Forward-looking statements are based on our current expectations

and assumptions regarding our business, the economy and other

future conditions. Because forward-looking statements relate to the

future, they are subject to inherent uncertainties, risks and

changes in circumstances that are difficult to predict. Examples of

forward-looking statements include, but are not limited to,

statements regarding our future results of operations, financial

condition, liquidity, prospects, growth, strategies, capital

allocation program (including the stock repurchase program),

product and service offerings, expected demand trends and our 2023

financial outlook. Our actual results may differ materially from

those contemplated by the forward-looking statements. We caution

you, therefore, against relying on any of these forward-looking

statements. They are neither statements of historical fact nor

guarantees or assurances of future performance. Important factors

that could cause actual results to differ materially from those in

the forward-looking statements include, but are not limited to,

regional, national or global political, economic, business,

competitive, market and regulatory conditions, including the

tariffs and trade disputes, currency exchange rates, the effects of

inflation and other factors, including those described in the

sections titled “Risk Factors” and “Management’s Discussion &

Analysis of Financial Condition and Results of Operations” in our

filings with the SEC, which are available on the SEC’s website at

www.sec.gov. These forward-looking statements speak only as of the

date of this release. Factors or events that could cause our actual

results to differ may emerge from time to time, and it is not

possible for us to predict all of them. We undertake no obligation

to update any forward-looking statement, whether as a result of new

information, future developments or otherwise, except as may be

required by applicable law.

ECOVYST INC. AND

SUBSIDIARIES

CONDENSED CONSOLIDATED

STATEMENTS OF INCOME

(in millions, except share and

per share amounts)

Three months ended

June 30,

Six months ended

June 30,

2023

2022

% Change

2023

2022

% Change

Sales

$

184.1

$

225.2

(18.3

)%

$

345.0

$

404.9

(14.8

)%

Cost of goods sold

123.1

165.3

(25.5

)%

247.5

297.3

(16.8

)%

Gross profit

61.0

59.9

1.8

%

97.5

107.6

(9.4

)%

Selling, general and administrative

expenses

21.4

22.8

(6.1

)%

42.5

46.3

(8.2

)%

Other operating expense, net

6.3

9.7

(35.1

)%

13.0

17.4

(25.3

)%

Operating income

33.3

27.4

21.5

%

42.0

43.9

(4.3

)%

Equity in net (income) from affiliated

companies

(11.4

)

(8.5

)

34.1

%

(11.6

)

(14.3

)

(18.9

)%

Interest expense, net

9.2

8.9

3.4

%

19.0

17.3

9.8

%

Other expense, net

0.6

0.5

20.0

%

0.2

0.8

(75.0

)%

Income before income taxes

34.9

26.5

31.7

%

34.4

40.1

(14.2

)%

Provision for income taxes

8.8

7.3

20.5

%

9.7

13.0

(25.4

)%

Effective tax rate

25.2

%

27.5

%

28.3

%

32.4

%

Net income

$

26.1

$

19.2

35.9

%

$

24.7

$

27.1

(8.9

)%

Earnings per share:

Basic earnings per share

$

0.22

$

0.14

$

0.20

$

0.20

Diluted earnings per share

$

0.22

$

0.14

$

0.20

$

0.19

Weighted average shares outstanding:

Basic

118,651,402

138,035,764

120,335,414

137,876,185

Diluted

119,920,742

139,149,560

121,831,942

139,175,659

ECOVYST INC. AND

SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE

SHEETS

(in millions, except share and

per share amounts)

June 30, 2023

December 31,

2022

ASSETS

Cash and cash equivalents

$

29.2

$

110.9

Accounts receivable, net

78.2

74.8

Inventories, net

47.6

44.4

Derivative assets

17.3

18.5

Prepaid and other current assets

24.9

19.1

Total current assets

197.2

267.7

Investments in affiliated companies

438.4

436.0

Property, plant and equipment, net

587.2

584.9

Goodwill

404.2

403.2

Other intangible assets, net

123.5

129.9

Right-of-use lease assets

29.6

28.3

Other long-term assets

33.9

34.6

Total assets

$

1,814.0

$

1,884.6

LIABILITIES

Current maturities of long-term debt

$

9.0

$

9.0

Accounts payable

34.6

40.0

Operating lease liabilities—current

9.1

8.2

Accrued liabilities

50.3

72.2

Total current liabilities

103.0

129.4

Long-term debt, excluding current

portion

862.4

865.9

Deferred income taxes

137.1

136.2

Operating lease liabilities—noncurrent

20.5

20.0

Other long-term liabilities

23.3

25.8

Total liabilities

1,146.3

1,177.3

Commitments and contingencies

EQUITY

Common stock ($0.01 par); authorized

shares 450,000,000; issued shares 140,744,045 and 139,571,272 on

June 30, 2023 and December 31, 2022, respectively; outstanding

shares 116,263,742 and 122,186,238 on June 30, 2023 and December

31, 2022, respectively

1.4

1.4

Preferred stock ($0.01 par); authorized

shares 50,000,000; no shares issued or outstanding on June 30, 2023

and December 31, 2022

—

—

Additional paid-in capital

1,101.3

1,091.5

Accumulated deficit

(217.4

)

(242.0

)

Treasury stock, at cost; shares 24,480,303

and 17,385,034 on June 30, 2023 and December 31, 2022,

respectively

(224.5

)

(149.6

)

Accumulated other comprehensive income

6.9

6.0

Total equity

667.7

707.3

Total liabilities and equity

$

1,814.0

$

1,884.6

ECOVYST INC. AND

SUBSIDIARIES

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

Six months ended

June 30,

2023

2022

Cash flows from operating activities:

(in millions)

Net income

$

24.7

$

27.1

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation

34.1

32.2

Amortization

7.0

7.1

Amortization of deferred financing costs

and original issue discount

1.0

1.0

Foreign currency exchange (gain) loss

(0.6

)

1.1

Deferred income tax provision

1.3

11.3

Net loss on asset disposals

2.3

0.7

Stock compensation

9.1

12.7

Equity in net income from affiliated

companies

(11.6

)

(14.3

)

Dividends received from affiliated

companies

10.0

30.0

Other, net

6.2

(4.4

)

Working capital changes that provided

(used) cash:

Receivables

(3.0

)

(33.2

)

Inventories

(3.0

)

(3.1

)

Prepaids and other current assets

(5.7

)

—

Accounts payable

(1.5

)

9.7

Accrued liabilities

(29.2

)

(25.1

)

Net cash provided by operating

activities

41.1

52.8

Cash flows from investing activities:

Purchases of property, plant and

equipment

(39.2

)

(25.8

)

Payments for business divestiture, net of

cash

—

(3.7

)

Other, net

—

—

Net cash used in investing activities

(39.2

)

(29.5

)

Cash flows from financing activities:

Draw down of revolving credit

facilities

14.5

—

Repayments of revolving credit

facilities

(14.5

)

—

Repayments of long-term debt

(4.5

)

(4.5

)

Repurchases of common shares

(73.4

)

(7.1

)

Tax withholdings on equity award

vesting

(0.9

)

(0.3

)

Repayment of financing obligation

(1.4

)

—

Other, net

0.3

—

Net cash used in financing activities

(79.9

)

(11.9

)

Effect of exchange rate changes on cash

and cash equivalents

(3.7

)

(1.1

)

Net change in cash and cash

equivalents

(81.7

)

10.3

Cash and cash equivalents at beginning of

period

110.9

140.9

Cash and cash equivalents at end of

period

$

29.2

$

151.2

Appendix Table A-1: Reconciliation of

Net Income to Adjusted EBITDA

Three months ended

June 30,

Six months ended

June 30,

2023

2022

2023

2022

(in millions)

Reconciliation of net income to

Adjusted EBITDA

Net income

$

26.1

$

19.2

$

24.7

$

27.1

Provision for income taxes

8.8

7.3

9.7

13.0

Interest expense, net

9.2

8.9

19.0

17.3

Depreciation and amortization

21.0

19.7

41.2

39.2

EBITDA

65.1

55.1

94.6

96.6

Joint venture depreciation, amortization

and interest(a)

3.2

4.0

6.8

8.1

Amortization of investment in affiliate

step-up(b)

1.6

1.6

3.2

3.2

Net loss on asset disposals(c)

1.1

0.6

2.3

0.7

Foreign currency exchange (gain)

loss(d)

(0.4

)

0.5

(1.1

)

1.1

LIFO expense(e)

1.1

0.2

2.5

0.4

Transaction and other related costs(f)

1.2

0.8

2.6

5.1

Equity-based compensation

5.0

5.4

9.1

12.7

Restructuring, integration and business

optimization expenses(g)

1.1

5.3

2.1

5.7

Other(h)

0.3

(0.6

)

0.1

(1.5

)

Adjusted EBITDA

$

79.3

$

72.9

$

122.2

$

132.1

Descriptions to Ecovyst Non-GAAP

Reconciliations

(a) We use Adjusted EBITDA as a performance measure

to evaluate our financial results. Because our Catalyst

Technologies segment includes our 50% interest in the Zeolyst Joint

Venture, we include an adjustment for our 50% proportionate share

of depreciation, amortization and interest expense of the Zeolyst

Joint Venture. (b) Represents the amortization of the fair

value adjustments associated with the equity affiliate investment

in the Zeolyst Joint Venture as a result of the combination of the

businesses of PQ Holdings Inc. and Ecoservices Operations LLC in

May 2016. We determined the fair value of the equity affiliate

investment and the fair value step-up was then attributed to the

underlying assets of the Zeolyst Joint Venture. Amortization is

primarily related to the fair value adjustments associated with

fixed assets and intangible assets, including customer

relationships and technical know-how. (c) When asset

disposals occur, we remove the impact of net gain/loss of the

disposed asset because such impact primarily reflects the non-cash

write-off of long-lived assets no longer in use. (d)

Reflects the exclusion of the foreign currency transaction gains

and losses in the statements of income related to the non-permanent

intercompany debt denominated in local currency translated to U.S.

dollars. (e) Represents non-cash adjustments to the

Company’s LIFO reserves for certain inventories in the U.S. that

are valued using the LIFO method, effectively reflecting the

results as if these inventories were valued using the FIFO method,

which we believe provides a means of comparison to other companies

that may not use the same basis of accounting for inventories. (f)

Relates to certain transaction costs, including debt

financing, due diligence and other costs related to transactions

that are completed, pending or abandoned, that we believe are not

representative of our ongoing business operations. (g)

Includes the impact of restructuring, integration and business

optimization expenses, which are incremental costs that are not

representative of our ongoing business operations. (h) Other

consists of adjustments for items that are not core to our ongoing

business operations. These adjustments include environmental

remediation and other legal costs, expenses for capital and

franchise taxes, and defined benefit pension and postretirement

plan (benefits) costs, for which our obligations are under plans

that are frozen. Also included in this amount are adjustments to

eliminate the benefit realized in cost of goods sold of the

allocation of a portion of the contract manufacturing payments

under the five-year agreement with the buyer of the Performance

Chemicals business to the financing obligation under the failed

sale-leaseback. Included in this line-item are rounding

discrepancies that may arise from rounding from dollars (in

thousands) to dollars (in millions).

Appendix Table A-2: Reconciliation of

Net Income and EPS to Adjusted Net Income and Adjusted

EPS(1)

Three months ended

June 30,

2023

2022

Pre-tax amount

Tax expense (benefit)

After-tax amount

Per share, basic

Per share, diluted

Pre-tax amount

Tax expense (benefit)

After-tax amount

Per share, basic

Per share, diluted

(in millions, except share and

per share amounts)

Net income

$

34.9

$

8.8

$

26.1

$

0.22

$

0.22

$

26.5

$

7.3

$

19.2

$

0.14

$

0.14

Amortization of investment in affiliate

step-up(b)

1.6

0.4

1.2

0.01

0.01

1.6

0.4

1.2

0.01

0.01

Net loss on asset disposals(c)

1.1

0.3

0.8

0.01

0.01

0.6

0.2

0.4

—

—

Foreign currency exchange (gain)

loss(d)

(0.4

)

(0.2

)

(0.2

)

—

—

0.5

0.1

0.4

—

—

LIFO expense(e)

1.1

0.3

0.8

0.01

0.01

0.2

—

0.2

—

—

Transaction and other related costs(f)

1.2

0.3

0.9

0.01

0.01

0.8

0.2

0.6

—

—

Equity-based compensation

5.0

1.0

4.0

0.03

0.03

5.4

0.7

4.7

0.03

0.03

Restructuring, integration and business

optimization expenses(g)

1.1

0.3

0.8

0.01

0.01

5.3

1.4

3.9

0.03

0.03

Other(h)

0.3

0.1

0.2

(0.01

)

(0.01

)

(0.6

)

(0.1

)

(0.5

)

0.01

0.01

Adjusted Net Income(1)

$

45.9

$

11.3

$

34.6

$

0.29

$

0.29

$

40.3

$

10.2

$

30.1

$

0.22

$

0.22

Weighted average shares outstanding

118,651,402

119,920,742

138,035,764

139,149,560

Six months ended

June 30,

2023

2022

Pre-tax amount

Tax expense (benefit)

After-tax amount

Per share, basic

Per share, diluted

Pre-tax amount

Tax expense (benefit)

After-tax amount

Per share, basic

Per share, diluted

(in millions, except share and

per share amounts)

Net income

$

34.4

$

9.7

$

24.7

$

0.20

$

0.20

$

40.1

$

13.0

$

27.1

$

0.20

$

0.19

Amortization of investment in affiliate

step-up(b)

3.2

0.8

2.4

0.02

0.02

3.2

0.8

2.4

0.02

0.02

Net loss on asset disposals(c)

2.3

0.6

1.7

0.01

0.01

0.7

0.2

0.5

—

—

Foreign currency exchange (gain)

loss(d)

(1.1

)

(0.2

)

(0.9

)

(0.01

)

(0.01

)

1.1

0.2

0.9

0.01

0.01

LIFO expense(e)

2.5

0.7

1.8

0.02

0.02

0.4

0.1

0.3

—

—

Transaction and other related costs(f)

2.6

0.7

1.9

0.02

0.02

5.1

1.2

3.9

0.03

0.03

Equity-based compensation

9.1

0.8

8.3

0.07

0.07

12.7

0.4

12.3

0.09

0.09

Restructuring, integration and business

optimization expenses(g)

2.1

0.6

1.5

0.01

0.01

5.7

1.5

4.2

0.03

0.03

Other(h)

0.1

—

0.1

0.01

—

(1.5

)

(0.4

)

(1.1

)

(0.01

)

(0.01

)

Adjusted Net Income(1)

$

55.2

$

13.7

$

41.5

$

0.35

$

0.34

$

67.5

$

17.0

$

50.5

$

0.37

$

0.36

Weighted average shares outstanding

120,335,414

121,831,942

137,876,185

139,175,659

See Appendix Table A-1 for Descriptions to Ecovyst Non-GAAP

Reconciliations in the table above.

(1)

We define adjusted net income as net income adjusted for

non-operating income or expense and the impact of certain non-cash

or other items that are included in net income that we do not

consider indicative of our ongoing operating performance. Adjusted

net income is presented as a key performance indicator as we

believe it will enhance a prospective investor’s understanding of

our results of operations and financial condition. Adjusted net

income may not be comparable with net income or adjusted net income

as defined by other companies. The adjustments to net income

are shown net of applicable tax rates of 26.2% and 26.0% for the

six months ended June 30, 2023 and 2022, respectively, except for

the foreign currency exchange (gain) loss and equity-based

compensation. The tax effect on equity-based compensation is

derived by removing the tax effect of any equity-based compensation

expense disallowed as a result of its inclusion within IRC Sec.

162m, and adding the tax effect of equity-based stock compensation

shortfall recorded as a discrete item. The tax effect of the

foreign currency exchange (gain) loss is derived from tax effecting

the actual year to date foreign currency exchange (gain) loss by

the respective local country statutory rates which is recorded as a

discrete item.

Appendix Table A-3: Sales and Adjusted

EBITDA by Business Segment

Three months ended

June 30,

Six months ended

June 30,

2023

2022

% Change

2023

2022

% Change

Sales:

Ecoservices

$

158.1

$

193.0

(18.1

)%

$

295.8

$

347.0

(14.8

)%

Silica Catalysts

26.0

32.2

(19.3

)%

49.2

57.9

(15.0

)%

Total sales

$

184.1

$

225.2

(18.3

)%

$

345.0

$

404.9

(14.8

)%

Zeolyst Joint Venture sales

$

44.7

$

35.9

24.5

%

$

66.8

$

64.9

2.9

%

Adjusted EBITDA:

Ecoservices

$

60.1

$

60.0

0.2

%

$

96.9

$

109.3

(11.3

)%

Catalyst Technologies

25.4

21.4

18.7

%

38.4

38.4

—

%

Unallocated corporate expenses

(6.2

)

(8.5

)

(27.1

)%

(13.1

)

(15.6

)

(16.0

)%

Total Adjusted EBITDA

$

79.3

$

72.9

8.8

%

$

122.2

$

132.1

(7.5

)%

Adjusted EBITDA Margin:

Ecoservices

38.0

%

31.1

%

32.8

%

31.5

%

Catalyst Technologies(1)

35.9

%

31.4

%

33.1

%

31.3

%

Total Adjusted EBITDA Margin(1)

34.7

%

27.9

%

29.7

%

28.1

%

(1)

Adjusted EBITDA margin calculation includes proportionate

50% share of sales from the Zeolyst Joint Venture.

Appendix Table A-4: Adjusted Free Cash

Flow

Six months ended

June 30,

2023

2022

(in millions)

Net cash provided by operating

activities

$

41.1

$

52.8

Less:

Purchases of property, plant and

equipment(1)

(39.2

)

(25.8

)

Free cash flow

$

1.9

$

27.0

Adjustments to free cash flow:

Cash paid for costs related to segment

disposals

—

14.1

Adjusted free cash flow(2)

$

1.9

$

41.1

Net cash used in investing

activities(3)

$

(39.2

)

$

(29.5

)

Net cash used in financing activities

$

(79.9

)

$

(11.9

)

(1)

Excludes the Company’s proportionate 50% share of capital

expenditures from the Zeolyst Joint Venture.

(2)

We define adjusted free cash flow as net cash provided by

operating activities less purchases of property, plant and

equipment, adjusted for cash flows that are unusual in nature

and/or infrequent in occurrence that neither relate to our core

business nor reflect the liquidity of our underlying business.

Historically these adjustments include proceeds from the sale of

assets, net interest proceeds on swaps designated as net investment

hedges, the cash paid for segment disposals and cash paid for debt

financing costs included in cash from operating activities.

Adjusted free cash flow is a non-GAAP financial measure that we

believe will enhance a prospective investor’s understanding of our

ability to generate additional cash from operations and is an

important financial measure for use in evaluating our financial

performance. Our presentation of adjusted free cash flow is not

intended to replace, and should not be considered superior to, the

presentation of our net cash provided by operating activities

determined in accordance with GAAP. Additionally, our definition of

adjusted free cash flow is limited, in that it does not represent

residual cash flows available for discretionary expenditures, due

to the fact that the measure does not deduct the payments required

for debt service and other contractual obligations or payments made

for business acquisitions. Therefore, we believe it is important to

view adjusted free cash flow as a measure that provides

supplemental information to our consolidated statements of cash

flows. You should not consider adjusted free cash flow in isolation

or as an alternative to the presentation of our financial results

in accordance with GAAP. The presentation of adjusted free cash

flow may differ from similar measures reported by other companies

and may not be comparable to other similarly titled measures.

(3)

Net cash used in investing activities includes purchases of

property, plant and equipment, which is also included in our

computation of adjusted free cash flow.

Appendix Table A-5: Net Debt Leverage

Ratio

June 30, 2023

June 30, 2022

(in millions, except

ratios)

Total debt

$

882.0

$

891.0

Less:

Cash and cash equivalents

29.2

151.2

Net debt

$

852.8

$

739.8

Trailing twelve months(1):

Net income

67.4

39.6

Adjusted EBITDA(2)

266.8

264.7

Net debt to net income ratio

12.7 x

18.7 x

Net debt leverage ratio

3.2 x

2.8 x

___________________

(1)

Calculated on a continuing

operations basis.

(2)

Refer to Appendix Table A-1:

Reconciliation of Net Income to Adjusted EBITDA for the

reconciliation to the most comparable GAAP financial measure.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230803360570/en/

Investor Contact: Gene Shiels (484) 617-1225

gene.shiels@ecovyst.com

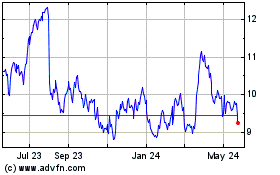

Ecovyst (NYSE:ECVT)

Historical Stock Chart

From Jan 2025 to Feb 2025

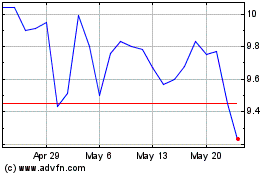

Ecovyst (NYSE:ECVT)

Historical Stock Chart

From Feb 2024 to Feb 2025