Evergreen Resources Increases Proven Reserves 21% to 1.5 Tcfe; Company Reports New Hedges and Q4 2003 Charge of $2 Million

February 11 2004 - 5:01PM

PR Newswire (US)

Evergreen Resources Increases Proven Reserves 21% to 1.5 Tcfe;

Company Reports New Hedges and Q4 2003 Charge of $2 Million DENVER,

Feb. 11 /PRNewswire-FirstCall/ -- EVERGREEN RESOURCES, INC.

increased its proven reserves 21% during 2003 to an estimated 1.495

trillion cubic feet of natural gas equivalent (Tcfe) as of December

31, 2003, up from 1.239 trillion cubic feet (Tcf) at year-end 2002.

Evergreen added 302 billion cubic feet equivalent (Bcfe) of gas

reserves and produced 46.3 Bcfe during 2003 for a net reserve

increase of 256 Bcfe. The reserve increase is due primarily to

Evergreen's successful Raton Basin drilling program, which

accounted for 199 Bcfe of reserve additions. The remaining 103 Bcfe

of reserve additions came primarily through the acquisition of

Carbon Energy Corp. Evergreen replaced 653% of its 2003 production

at an all-sources cost of 81 cents per thousand cubic feet of gas

equivalent (Mcfe). This all-sources cost includes the costs of

drilling and completion operations, gas collection facilities,

acquisitions and exploration. Excluding acquisitions and

exploration costs, the company replaced 431% of its 2003 production

at a cost of approximately 50 cents per Mcfe. Excluding gas

collection facility expenses, finding and development costs were

approximately 32 cents per Mcfe. Of the year-end 2003 total

estimated reserves, 62% were classified as proved developed and the

remaining 38% as proved undeveloped. The year-end 2003 reserve

estimate was based on a total of 1,957 gross wells, including 555

classified as proved undeveloped locations. The year-end reserve

estimate included insignificant revisions. Independent petroleum

engineering consultants Netherland Sewell & Associates, Inc.

("NSAI") audited 100% ofthe Raton Basin well locations and prepared

the year-end reserve estimate for the Piceance/Uintah and Canadian

properties. Natural gas in the southern Colorado portion of the

Raton Basin constitutes 93% of Evergreen's net proven reserves.

Evergreen estimates that it has approximately 1,000 additional coal

bed methane wells to drill in the Raton Basin, including 468 proved

undeveloped locations. The balance of the company's year-end 2003

reserve total is comprised of natural gas and natural gas liquids

associated with the acquired Piceance/Uintah and Canadian

properties. The Piceance/Uintah properties had net proven reserves

of approximately 65 Bcfe, 51% of which are classified as proved

developed, while the acquired properties in south-central Alberta,

Canada contain an estimated 37 Bcfe of net proven reserves, 72% of

which are proved developed. Also of note, the name Carbon Energy

Canada has been changed to Evergreen Resources Canada, Ltd. and

continues to be a wholly owned subsidiary of Evergreen Resources,

Inc. The present value of estimated future net revenues from

Evergreen's proven reserves, discounted at 10%, was $2.713 billion

as of December 31, 2003, using an unescalated average net gas price

of $5.49 per thousand cubic feet (Mcf), based on guidelines

established by the Securities and Exchange Commission. This

compared to a PV10 of $1.635 billion at year-end 2002, which used

an unescalated gas price of $4.22 per Mcf. President and CEO Mark

S. Sexton commented, "Our developmentactivity in the Raton Basin

continues to generate predictable growth in our reserves and

production each year. Overall, since the Raton Basin went on line

in early 1995, we have increased our reserves at a compound annual

rate of 44%. We have discovered that both accelerated production

and additional reserves can be achieved in the Raton Basin through

increased-density drilling, and we are now drilling a fifth and

sixth well per square-mile section rather than four wells. We

estimate that our current wellsite inventory from the Raton Basin's

Raton and Vermejo coal formations is probably about 1,000 wells.

"With the addition of our exploratory CBM project in the Forest

City Basin of eastern Kansas, as well as the acquired Carbon Energy

properties, we plan to drill more than 400 wells in 2004. That

would be more than twice the level of our most active year." Fourth

Quarter 2003 Production Net gas sales in the fourth quarter totaled

12.8 Bcfe, or an average of 139.4 million cubic feet of gas

equivalent (MMcfe) per day, which is up 23% from the 10.5 Bcf total

and 113.8 MMcf-per-day average in the corresponding 2002 period.

Fourth quarter average net gas sales were up 9% from the third

quarter of 2003, during which net gas sales averaged 127.7 MMcf per

day. The sequential increase in gas sales was primarily the result

of new production from acquired properties. Evergreen has now

increased its daily net sales for 35 consecutive quarters. Fourth

quarter results brought total net production in 2003 to 46.3 Bcf

compared to 39 Bcf in 2002, representing a 19% year-over-year

increase. Hedging Activity Evergreen has entered into several new

financial commodity-swap agreements for the period between January

1, 2004 and October 31, 2004. Thenew hedging agreements bring the

average weighted net sales price for the company's 2004 hedges to

$4.67 per Mcf. After consideration of fuel costs and basis

differential, this average hedged price equates to a NYMEX price in

excess of $5.00 per Mcf. The following summarizes Evergreen's

hedging position for each quarter of 2004: Q1 Q2 Q3 Q4 Average

Daily Hedged Volumes 129 MMcf 123 MMcf 123 MMcf 80 MMcf Percent of

Total Estimated Sales 78% 68% 64% 39% Net Realized Hedged Price

$4.79 $4.66 $4.66 $4.54 Fourth Quarter 2003 Charge to Earnings As

previously reported in filings with the Securities and Exchange

Commission, Evergreenwas named as a defendant in a class action

lawsuit filed in the Denver District Court on December 26, 2002.

The plaintiffs are royalty owners and overriding royalty owners who

alleged that they were underpaid royalties and sought to recover

damages and declaratory and injunctive relief. Due to a preliminary

settlement between the parties, Evergreen is taking an after-tax

charge to earnings of $2.0 million or 5 cents per diluted share in

the fourth quarter of 2003. This total includes the settlement,

legal fees and other associated costs. The court recently approved

the preliminary settlement agreement. Final approval may come in

April 2004. Evergreen Resources is an independent energy company

engaged primarily in the exploration, development,production,

operation and acquisition of unconventional natural gas properties.

Evergreen is one of the leading developers of coal bed methane

reserves in the United States. Evergreen's current operations are

principally focused on developing and expanding its coal bed

methane project located in the Raton Basin in southern Colorado.

Evergreen has also begun coal bed methane projects in Alaska and in

the Forest City Basin of eastern Kansas and holds conventional oil

and gas producing property interests in the Piceance Basin of

western Colorado, the Uintah Basin of eastern Utah, and in the

Western Sedimentary Basin in south-central Alberta, Canada. This

press release contains forward-looking statements within the

meaning of federal securities laws, including statements regarding,

among other things, the company's growth strategies; anticipated

trends in the company's business and its future results of

operations; market conditions in the oil and gas industry; the

ability of the company to make and integrate acquisitions; and the

impact of government regulations. These forward-looking statements

are based largely on the company's expectations and are subject to

a number of risks and uncertainties, many of which are beyond the

company's control. Actual results could differ materially from

those implied by these forward-looking statements as a result of,

among other things, a decline in natural gas production, a decline

in natural gas prices, incorrect estimations of required capital

expenditures, increases in the cost of drilling, completion and gas

collection, an increase in the cost of production and operations,

an inability to meet projections, and/or changes in general

economic conditions. In light of these and other risks and

uncertainties of which the company may be unaware or which the

company currently deems immaterial, there can be no assurance that

actual results will be as projected in the forward-looking

statements. These and other risks and uncertainties are described

in more detail in the company's most recent Annual Report on Form

10-K filed with the Securities and Exchange Commission.

http://www.evergreengas.com/ DATASOURCE: Evergreen Resources, Inc.

CONTACT: John B. Kelso, Director of Investor Relations of Evergreen

Resources, Inc., +1-303-298-8100 Web site:

http://www.evergreengas.com/

Copyright

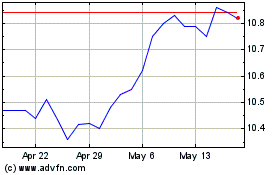

Eaton Vance Short Durati... (NYSE:EVG)

Historical Stock Chart

From Jun 2024 to Jul 2024

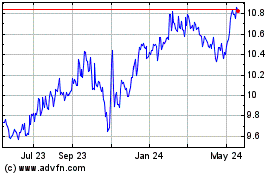

Eaton Vance Short Durati... (NYSE:EVG)

Historical Stock Chart

From Jul 2023 to Jul 2024