- Semi-Annual Report (management company) (NSAR-A)

June 28 2011 - 4:39PM

Edgar (US Regulatory)

000 A000000 04/30/2011

000 C000000 0001287498

000 D000000 N

000 E000000 NF

000 F000000 Y

000 G000000 N

000 H000000 N

000 I000000 6.1

000 J000000 A

001 A000000 EV SHORT DURATION DIVERSIFIED INCOME FUND

001 B000000 811-21563

001 C000000 6174828260

002 A000000 Two International Place

002 B000000 BOSTON

002 C000000 MA

002 D010000 02110

003 000000 N

004 000000 N

005 000000 N

006 000000 N

007 A000000 N

007 B000000 0

007 C010100 1

008 A000001 Eaton Vance Management

008 B000001 A

008 C000001 801-15930

008 D010001 Boston

008 D020001 MA

008 D030001 02110

010 A000001 Eaton Vance Management

010 B000001 801-15930

010 C010001 Boston

010 C020001 MA

010 C030001 02110

012 A000001 American Stock Transfer & Trust Company

012 B000001 84-00416

012 C010001 New York

012 C020001 NY

012 C030001 10038

013 A000001 Deloitte & Touche LLP

013 B010001 Boston

013 B020001 MA

013 B030001 02116

013 B040001 5022

014 A000001 Eaton Vance Distributors, Inc.

014 B000001 8-47939

015 A000001 State Street Bank and Trust Company

015 B000001 C

015 C010001 Boston

015 C020001 MA

015 C030001 02116

|

015 E010001 X

018 000000 Y

019 A000000 Y

019 B000000 179

019 C000000 EATONVANCE

020 A000001 NYI Kaupthing Bank

020 C000001 1

021 000000 1

022 A000001 BANK OF AMERICA CORP

022 B000001 13-4078651

022 C000001 29567

022 D000001 24858

022 A000002 JP MORGAN

022 C000002 10192

022 D000002 24305

022 A000003 CITIGROUP GLOBAL MARKEST INC

022 C000003 15834

022 D000003 15234

022 A000004 DEUTSCHE BANK SECURITIES, INC.

022 C000004 21792

022 D000004 8511

022 A000005 Barclays Capital, Inc.

022 C000005 12384

022 D000005 5236

022 A000006 CREDIT SUISSE SECURITIES LLC

022 C000006 11161

022 D000006 5939

022 A000007 GOLDMAN SACHS & CO.

022 B000007 13-5108880

022 C000007 3172

022 D000007 9362

022 A000008 HSBC BANK

022 C000008 16388

022 D000008 0

022 A000009 STANDARD BANK

022 C000009 6585

022 D000009 0

022 A000010 BNP PARIBAS

022 C000010 5525

022 D000010 0

023 C000000 151824

023 D000000 95189

024 000000 Y

025 A000001 JP MORGAN

025 C000001 D

025 D000001 2789

025 A000002 GOLDMAN SACHS & CO

025 C000002 D

025 D000002 1357

025 A000003 CREDIT SUISSE SECURITIES LLC

025 C000003 D

|

025 D000003 1487

026 A000000 N

026 B000000 Y

026 C000000 N

026 D000000 Y

026 E000000 N

026 F000000 N

026 G010000 N

026 G020000 N

026 H000000 N

027 000000 N

028 A010000 0

028 A020000 0

028 A030000 0

028 A040000 0

028 B010000 0

028 B020000 0

028 B030000 0

028 B040000 0

028 C010000 0

028 C020000 0

028 C030000 0

028 C040000 0

028 D010000 0

028 D020000 0

028 D030000 0

028 D040000 0

028 E010000 0

028 E020000 0

028 E030000 0

028 E040000 0

028 F010000 0

028 F020000 0

028 F030000 0

028 F040000 0

028 G010000 0

028 G020000 0

028 G030000 0

028 G040000 0

028 H000000 0

030 A000000 0

030 B000000 0.00

030 C000000 0.00

031 A000000 0

031 B000000 0

032 000000 0

033 000000 0

035 000000 0

036 B000000 0

038 000000 0

042 A000000 0

|

042 B000000 0

042 C000000 0

042 D000000 0

042 E000000 0

042 F000000 0

042 G000000 0

042 H000000 0

043 000000 0

044 000000 0

045 000000 Y

046 000000 N

047 000000 Y

048 000000 0.750

048 A010000 0

048 A020000 0.000

048 B010000 0

048 B020000 0.000

048 C010000 0

048 C020000 0.000

048 D010000 0

048 D020000 0.000

048 E010000 0

048 E020000 0.000

048 F010000 0

048 F020000 0.000

048 G010000 0

048 G020000 0.000

048 H010000 0

048 H020000 0.000

048 I010000 0

048 I020000 0.000

048 J010000 0

048 J020000 0.000

048 K010000 0

048 K020000 0.000

049 000000 N

050 000000 N

051 000000 N

052 000000 N

053 A000000 Y

053 B000000 Y

053 C000000 N

054 A000000 Y

054 B000000 Y

054 C000000 N

054 D000000 N

054 E000000 N

054 F000000 N

054 G000000 Y

054 H000000 Y

054 I000000 N

|

054 J000000 Y

054 K000000 N

054 L000000 N

054 M000000 Y

054 N000000 N

054 O000000 N

055 A000000 N

055 B000000 Y

056 000000 Y

057 000000 N

058 A000000 N

059 000000 Y

060 A000000 Y

060 B000000 Y

061 000000 0

062 A000000 Y

062 B000000 0.1

062 C000000 0.0

062 D000000 0.8

062 E000000 0.0

062 F000000 0.0

062 G000000 0.0

062 H000000 0.0

062 I000000 0.0

062 J000000 0.2

062 K000000 0.0

062 L000000 24.7

062 M000000 0.0

062 N000000 41.8

062 O000000 0.0

062 P000000 1.3

062 Q000000 62.4

062 R000000 3.5

063 A000000 0

063 B000000 8.4

064 A000000 N

064 B000000 N

066 A000000 N

067 000000 N

068 A000000 N

068 B000000 N

069 000000 N

070 A010000 Y

070 A020000 Y

070 B010000 N

070 B020000 N

070 C010000 Y

070 C020000 N

070 D010000 Y

070 D020000 N

070 E010000 Y

|

070 E020000 N

070 F010000 Y

070 F020000 N

070 G010000 Y

070 G020000 Y

070 H010000 Y

070 H020000 N

070 I010000 Y

070 I020000 Y

070 J010000 Y

070 J020000 Y

070 K010000 Y

070 K020000 N

070 L010000 Y

070 L020000 Y

070 M010000 Y

070 M020000 Y

070 N010000 Y

070 N020000 N

070 O010000 Y

070 O020000 Y

070 P010000 Y

070 P020000 N

070 Q010000 N

070 Q020000 N

070 R010000 Y

070 R020000 Y

071 A000000 75671

071 B000000 71644

071 C000000 398009

071 D000000 18

072 A000000 6

072 B000000 10851

072 C000000 0

072 D000000 0

072 E000000 9

072 F000000 2140

072 G000000 0

072 H000000 0

072 I000000 9

072 J000000 314

072 K000000 0

072 L000000 41

072 M000000 6

072 N000000 0

072 O000000 0

072 P000000 814

072 Q000000 0

072 R000000 73

072 S000000 29

072 T000000 0

|

072 U000000 0

072 V000000 0

072 W000000 34

072 X000000 3460

072 Y000000 376

072 Z000000 7776

072AA000000 911

072BB000000 0

072CC010000 5474

072CC020000 0

072DD010000 11710

072DD020000 0

072EE000000 0

073 A010000 0.6200

073 A020000 0.0000

073 B000000 0.0000

073 C000000 0.0000

074 A000000 5426

074 B000000 2787

074 C000000 85145

074 D000000 366615

074 E000000 0

074 F000000 4483

074 G000000 0

074 H000000 4

074 I000000 9438

074 J000000 3597

074 K000000 1

074 L000000 8868

074 M000000 152

074 N000000 486516

074 O000000 11486

074 P000000 309

074 Q000000 117000

074 R010000 0

074 R020000 2229

074 R030000 0

074 R040000 7968

074 S000000 0

074 T000000 347524

074 U010000 18887

074 U020000 0

074 V010000 18.40

074 V020000 0.00

074 W000000 0.0000

074 X000000 13378

074 Y000000 0

075 A000000 0

075 B000000 345937

076 000000 16.79

077 A000000 N

|

078 000000 N

080 C000000 0

081 B000000 0

082 B000000 0

083 B000000 0

084 B000000 0

086 A010000 0

086 A020000 0

086 B010000 0

086 B020000 0

086 C010000 0

086 C020000 0

086 D010000 0

086 D020000 0

086 E010000 0

086 E020000 0

086 F010000 0

086 F020000 0

087 A010000 COMMON SHARES

087 A020000 27828V104

087 A030000 EVG

088 A000000 Y

088 B000000 N

088 C000000 N

088 D000000 N

SIGNATURE BARBARA E. CAMPBELL

TITLE TREASURER

|

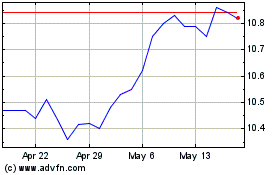

Eaton Vance Short Durati... (NYSE:EVG)

Historical Stock Chart

From Sep 2024 to Oct 2024

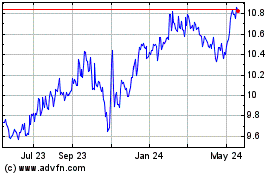

Eaton Vance Short Durati... (NYSE:EVG)

Historical Stock Chart

From Oct 2023 to Oct 2024