Dillard’s, Inc. (NYSE: DDS) (the “Company” or “Dillard’s”)

announced operating results for the 13 and 26 weeks ended August 3,

2024. This release contains certain forward-looking statements.

Please refer to the Company’s cautionary statements included below

under “Forward-Looking Information.”

Dillard’s Chief Executive Officer William T. Dillard, II

stated, “We are disappointed with our weak performance in the

second quarter. While the consumer environment remained challenged,

our expenses were up, squeezing our profitability. We are working

to address this. We ended the quarter with over $1 billion in cash

and short-term investments.”

Highlights of the 26 Weeks (compared to the prior year

26 weeks):

- Total retail

sales decreased 3%

- Comparable

store sales decreased 3%

- Net income

of $254.5 million compared to $333.0 million

- Earnings per

share of $15.68 compared to $19.89

- Retail gross

margin of 42.7% of sales compared to 43.0% of sales

- Operating

expenses were $860.3 million (28.3% of sales) compared to $818.9

million (26.0% of sales)

- Ending

inventory was essentially unchanged

26-Week Results

Dillard’s reported net income for the 26 weeks ended August 3,

2024 of $254.5 million, or $15.68 per share, compared to $333.0

million, or $19.89 per share, for the 26 weeks ended July 29, 2023.

Included in net income for the prior year 26-week period is a

pretax gain of $2.0 million ($1.5 million after tax or $0.09 per

share) primarily related to the sale of a store property.

Sales – 26 Weeks

Net sales for the 26 weeks ended August 3, 2024 and July 29,

2023 were $3.039 billion and $3.151 billion, respectively. Net

sales includes the operations of the Company’s construction

business, CDI Contractors, LLC (“CDI”).

Total retail sales (which excludes CDI) for the 26 weeks ended

August 3, 2024 and July 29, 2023 were $2.919 billion and $3.013

billion, respectively. Total retail sales decreased 3% for the

26-week period ended August 3, 2024 compared to the 26-week period

ended July 29, 2023. Sales in comparable stores for that same

period decreased 3%.

Gross Margin – 26 Weeks

Consolidated gross margin for the 26 weeks ended August 3, 2024

was 41.2% of sales compared to 41.3% of sales for the 26 weeks

ended July 29, 2023.

Retail gross margin (which excludes CDI) for the 26 weeks ended

August 3, 2024 was 42.7% of sales compared to 43.0% of sales for

the 26 weeks ended July 29, 2023.

Inventory was essentially unchanged at August 3, 2024 compared

to July 29, 2023.

Selling, General & Administrative Expenses – 26

Weeks

Consolidated selling, general and administrative expenses

(“operating expenses”) for the 26 weeks ended August 3, 2024 were

$860.3 million (28.3% of sales) compared to $818.9 million (26.0%

of sales) for the 26 weeks ended July 29, 2023. The increase in

operating expenses is primarily due to increased payroll

expenses.

Highlights of the Second Quarter (compared to the prior

year second quarter):

- Total retail

sales decreased 5%

- Comparable

store sales decreased 5%

- Net income

of $74.5 million compared to $131.5 million

- Earnings per

share of $4.59 compared to $7.98

- Retail gross

margin of 39.1% of sales compared to 40.4% of sales

- Operating

expenses were $433.6 million (29.1% of sales) compared to $412.6

million (26.3% of sales)

Second Quarter Results

Dillard’s reported net income for the 13 weeks ended August 3,

2024 of $74.5 million, or $4.59 per share, compared to $131.5

million, or $7.98 per share, for the 13 weeks ended July 29,

2023.

Sales – Second Quarter

Net sales for the 13 weeks ended August 3, 2024 and July 29,

2023 were $1.490 billion and $1.567 billion,

respectively.

Total retail sales for the 13 weeks ended August 3, 2024 and

July 29, 2023 were $1.426 billion and $1.499 billion, respectively.

Total retail sales decreased 5% for the 13-week period ended August

3, 2024 compared to the 13-week period ended July 29, 2023. Sales

in comparable stores for that same period decreased 5%. Cosmetics

was the strongest performing merchandise category, with the weakest

performances noted in men’s apparel and accessories and shoes.

Gross Margin – Second Quarter

Consolidated gross margin for the 13 weeks ended August 3, 2024

was 37.6% of sales compared to 38.8% of sales for the 13 weeks

ended July 29, 2023.

Retail gross margin for the 13 weeks ended August 3, 2024 was

39.1% of sales compared to 40.4% of sales for the 13 weeks ended

July 29, 2023. The retail gross margin performance was essentially

flat compared to the prior year second quarter in men’s apparel and

accessories and decreased slightly in cosmetics and juniors’ and

children’s apparel. Moderate gross margin decreases were noted in

shoes, ladies’ accessories and lingerie, home and furniture, and

ladies’ apparel.

Selling, General & Administrative Expenses – Second

Quarter

Consolidated operating expenses for the 13 weeks ended August 3,

2024 were $433.6 million (29.1% of sales) compared to $412.6

million (26.3% of sales) for the 13 weeks ended July 29, 2023. The

increase in operating expenses was primarily due to increased

payroll expenses. The Company is working to better align expenses

to sales performance.

Other Information

The Company closed its Eastwood Mall Clearance Center in Niles,

Ohio (120,000 square feet) in June, 2024.

The Company operates 273 Dillard’s stores, including 28

clearance centers, spanning 30 states (totaling 46.5 million square

feet) and an Internet store at dillards.com.

Total shares outstanding (Class A and Class B Common Stock) at

August 3, 2024 and July 29, 2023 were 16.2 million and 16.4

million, respectively.

|

Dillard’s, Inc. and SubsidiariesCondensed Consolidated Statements

of Income (Unaudited)(In Millions, Except Per Share Data) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

13 Weeks Ended |

|

26 Weeks Ended |

|

| |

|

August 3, 2024 |

|

July 29, 2023 |

|

August 3, 2024 |

|

July 29, 2023 |

|

| |

|

|

|

|

% of |

|

|

|

|

% of |

|

|

|

|

% of |

|

|

|

|

% of |

|

| |

|

|

|

|

Net |

|

|

|

|

Net |

|

|

|

|

Net |

|

|

|

|

Net |

|

| |

|

Amount |

|

Sales |

|

Amount |

|

Sales |

|

Amount |

|

Sales |

|

Amount |

|

Sales |

|

| Net sales |

|

$ |

1,489.9 |

|

|

100.0 |

|

% |

$ |

1,567.4 |

|

100.0 |

% |

$ |

3,039.0 |

|

|

100.0 |

|

% |

$ |

3,151.3 |

|

100.0 |

% |

| Service charges and other

income |

|

|

24.7 |

|

|

1.7 |

|

|

|

30.0 |

|

1.9 |

|

|

48.5 |

|

|

1.6 |

|

|

|

60.0 |

|

1.9 |

|

| |

|

|

1,514.6 |

|

|

101.7 |

|

|

|

1,597.4 |

|

101.9 |

|

|

3,087.5 |

|

|

101.6 |

|

|

|

3,211.3 |

|

101.9 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of sales |

|

|

930.3 |

|

|

62.4 |

|

|

|

958.8 |

|

61.2 |

|

|

1,788.2 |

|

|

58.8 |

|

|

|

1,850.1 |

|

58.7 |

|

| Selling, general and

administrative expenses |

|

|

433.6 |

|

|

29.1 |

|

|

|

412.6 |

|

26.3 |

|

|

860.3 |

|

|

28.3 |

|

|

|

818.9 |

|

26.0 |

|

| Depreciation and

amortization |

|

|

46.4 |

|

|

3.1 |

|

|

|

44.8 |

|

2.9 |

|

|

92.5 |

|

|

3.0 |

|

|

|

90.6 |

|

2.9 |

|

| Rentals |

|

|

4.9 |

|

|

0.3 |

|

|

|

5.0 |

|

0.3 |

|

|

10.0 |

|

|

0.3 |

|

|

|

9.3 |

|

0.3 |

|

| Interest and debt (income)

expense, net |

|

|

(3.9 |

) |

|

(0.3 |

) |

|

|

0.1 |

|

0.0 |

|

|

(7.4 |

) |

|

(0.2 |

) |

|

|

0.3 |

|

0.0 |

|

| Other expense |

|

|

6.2 |

|

|

0.4 |

|

|

|

4.7 |

|

0.3 |

|

|

12.3 |

|

|

0.4 |

|

|

|

9.4 |

|

0.3 |

|

| Gain on disposal of assets |

|

|

— |

|

|

0.0 |

|

|

|

0.2 |

|

0.0 |

|

|

0.3 |

|

|

0.0 |

|

|

|

2.0 |

|

0.1 |

|

| Income before income taxes |

|

|

97.1 |

|

|

6.5 |

|

|

|

171.6 |

|

10.9 |

|

|

331.9 |

|

|

10.9 |

|

|

|

434.7 |

|

13.8 |

|

| Income taxes |

|

|

22.6 |

|

|

|

|

|

40.1 |

|

|

|

|

77.4 |

|

|

|

|

|

101.7 |

|

|

|

| Net income |

|

$ |

74.5 |

|

|

5.0 |

|

% |

$ |

131.5 |

|

8.4 |

% |

$ |

254.5 |

|

|

8.4 |

|

% |

$ |

333.0 |

|

10.6 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic and diluted earnings per

share |

|

$ |

4.59 |

|

|

|

|

$ |

7.98 |

|

|

|

$ |

15.68 |

|

|

|

|

$ |

19.89 |

|

|

|

| Basic and diluted weighted

average shares outstanding |

|

|

16.2 |

|

|

|

|

|

16.5 |

|

|

|

|

16.2 |

|

|

|

|

|

16.7 |

|

|

|

|

Dillard’s, Inc. and SubsidiariesCondensed Consolidated Balance

Sheets (Unaudited)(In Millions) |

| |

|

|

|

|

|

|

| |

|

August 3, |

|

July 29, |

| |

|

2024 |

|

2023 |

| Assets |

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

946.7 |

|

$ |

774.3 |

|

Accounts receivable |

|

|

64.5 |

|

|

59.7 |

|

Short-term investments |

|

|

123.7 |

|

|

150.2 |

|

Merchandise inventories |

|

|

1,191.4 |

|

|

1,192.7 |

|

Federal and state income taxes |

|

|

35.5 |

|

|

— |

|

Other current assets |

|

|

91.7 |

|

|

103.3 |

|

Total current assets |

|

|

2,453.5 |

|

|

2,280.2 |

| |

|

|

|

|

|

|

| Property and equipment, net |

|

|

1,044.9 |

|

|

1,098.9 |

| Operating lease assets |

|

|

39.0 |

|

|

30.4 |

| Deferred income taxes |

|

|

63.9 |

|

|

46.0 |

| Other assets |

|

|

60.6 |

|

|

56.9 |

| |

|

|

|

|

|

|

| Total assets |

|

$ |

3,661.9 |

|

$ |

3,512.4 |

| |

|

|

|

|

|

|

| Liabilities and stockholders’

equity |

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

Trade accounts payable and accrued expenses |

|

$ |

768.8 |

|

$ |

803.1 |

|

Current portion of operating lease liabilities |

|

|

11.5 |

|

|

8.1 |

|

Federal and state income taxes |

|

|

— |

|

|

115.6 |

|

Total current liabilities |

|

|

780.3 |

|

|

926.8 |

| |

|

|

|

|

|

|

| Long-term debt |

|

|

321.5 |

|

|

321.4 |

| Operating lease liabilities |

|

|

27.5 |

|

|

22.3 |

| Other liabilities |

|

|

383.7 |

|

|

332.4 |

| Subordinated debentures |

|

|

200.0 |

|

|

200.0 |

| Stockholders’ equity |

|

|

1,948.9 |

|

|

1,709.5 |

| |

|

|

|

|

|

|

| Total liabilities and

stockholders’ equity |

|

$ |

3,661.9 |

|

$ |

3,512.4 |

|

Dillard’s, Inc. and SubsidiariesCondensed Consolidated Statements

of Cash Flows (Unaudited)(In Millions) |

| |

|

|

|

|

|

|

| |

|

26 Weeks Ended |

| |

|

August 3, |

|

July 29, |

| |

|

2024 |

|

|

2023 |

|

| Operating activities: |

|

|

|

|

|

|

| Net income |

|

$ |

254.5 |

|

|

$ |

333.0 |

|

| Adjustments to reconcile net

income to net cash provided by operating activities: |

|

|

|

|

|

|

|

Depreciation and amortization of property and other deferred

cost |

|

|

93.4 |

|

|

|

91.4 |

|

|

Gain on disposal of assets |

|

|

(0.3 |

) |

|

|

(2.0 |

) |

|

Accrued interest on short-term investments |

|

|

(7.1 |

) |

|

|

(3.1 |

) |

| Changes in operating assets and

liabilities: |

|

|

|

|

|

|

|

Increase in accounts receivable |

|

|

(3.9 |

) |

|

|

(2.7 |

) |

|

Increase in merchandise inventories |

|

|

(97.4 |

) |

|

|

(72.5 |

) |

|

Decrease (increase) in other current assets |

|

|

3.8 |

|

|

|

(12.4 |

) |

|

(Increase) decrease in other assets |

|

|

(1.5 |

) |

|

|

4.5 |

|

|

Decrease in trade accounts payable and accrued expenses and other

liabilities |

|

|

(3.2 |

) |

|

|

(24.9 |

) |

|

(Decrease) increase in income taxes |

|

|

(62.4 |

) |

|

|

86.6 |

|

| Net cash provided by operating

activities |

|

|

175.9 |

|

|

|

397.9 |

|

| |

|

|

|

|

|

|

| Investing activities: |

|

|

|

|

|

|

| Purchase of property and

equipment and capitalized software |

|

|

(61.1 |

) |

|

|

(63.8 |

) |

| Proceeds from disposal of

assets |

|

|

0.3 |

|

|

|

2.1 |

|

| Purchase of short-term

investments |

|

|

(319.5 |

) |

|

|

(148.1 |

) |

| Proceeds from maturities of

short-term investments |

|

|

350.9 |

|

|

|

150.0 |

|

| Net cash used in investing

activities |

|

|

(29.4 |

) |

|

|

(59.8 |

) |

| |

|

|

|

|

|

|

| Financing activities: |

|

|

|

|

|

|

| Cash dividends paid |

|

|

(8.1 |

) |

|

|

(6.8 |

) |

| Purchase of treasury stock |

|

|

— |

|

|

|

(217.3 |

) |

| Net cash used in financing

activities |

|

|

(8.1 |

) |

|

|

(224.1 |

) |

| |

|

|

|

|

|

|

| Increase in cash and cash

equivalents and restricted cash |

|

|

138.4 |

|

|

|

114.0 |

|

| Cash and cash equivalents and

restricted cash, beginning of period |

|

|

808.3 |

|

|

|

660.3 |

|

| Cash and cash equivalents, end of

period |

|

$ |

946.7 |

|

|

$ |

774.3 |

|

| |

|

|

|

|

|

|

| Non-cash transactions: |

|

|

|

|

|

|

| Accrued capital expenditures |

|

$ |

8.4 |

|

|

$ |

12.0 |

|

| Accrued purchase of treasury

stock and excise taxes |

|

|

— |

|

|

|

2.2 |

|

| Stock awards |

|

|

1.6 |

|

|

|

1.3 |

|

| Lease assets obtained in exchange

for new operating lease liabilities |

|

|

2.2 |

|

|

|

2.0 |

|

Estimates for 2024

The Company is providing the following estimates for certain

financial statement items for the 52-week period ending February 1,

2025 based upon current conditions. Actual results may differ

significantly from these estimates as conditions and factors change

- See “Forward-Looking Information.”

| |

|

|

|

|

|

|

| |

|

In Millions |

| |

|

2024 |

|

|

2023 |

|

| |

|

Estimated |

|

Actual |

| Depreciation and

amortization |

|

$ |

185 |

|

|

$ |

180 |

|

| Rentals |

|

|

22 |

|

|

|

22 |

|

| Interest and debt (income)

expense, net |

|

|

(13 |

) |

|

|

(5 |

) |

| Capital expenditures |

|

|

120 |

|

|

|

133 |

|

Forward-Looking Information

This report contains certain forward-looking statements. The

following are or may constitute forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995: (a) statements including words such as “may,” “will,”

“could,” “should,” “believe,” “expect,” “future,” “potential,”

“anticipate,” “intend,” “plan,” “estimate,” “continue,” or the

negative or other variations thereof; (b) statements regarding

matters that are not historical facts; and (c) statements about the

Company’s future occurrences, plans and objectives, including

statements regarding management’s expectations and forecasts for

the 52-week period ended February 1, 2025 and beyond, statements

concerning the opening of new stores or the closing of existing

stores, statements concerning capital expenditures and sources of

liquidity and statements concerning estimated taxes. The Company

cautions that forward-looking statements contained in this report

are based on estimates, projections, beliefs and assumptions of

management and information available to management at the time of

such statements and are not guarantees of future performance. The

Company disclaims any obligation to update or revise any

forward-looking statements based on the occurrence of future

events, the receipt of new information or otherwise.

Forward-looking statements of the Company involve risks and

uncertainties and are subject to change based on various important

factors. Actual future performance, outcomes and results may differ

materially from those expressed in forward-looking statements made

by the Company and its management as a result of a number of risks,

uncertainties and assumptions. Representative examples of those

factors include (without limitation) general retail industry

conditions and macro-economic conditions including inflation,

rising interest rates, a potential U.S. Federal government

shutdown, economic recession and changes in traffic at malls and

shopping centers; economic and weather conditions for regions in

which the Company’s stores are located and the effect of these

factors on the buying patterns of the Company’s customers,

including the effect of changes in prices and availability of oil

and natural gas; the availability of and interest rates on consumer

credit; the impact of competitive pressures in the department store

industry and other retail channels including specialty, off-price,

discount and Internet retailers; changes in the Company’s ability

to meet labor needs amid nationwide labor shortages and an intense

competition for talent; changes in consumer spending patterns, debt

levels and their ability to meet credit obligations; high levels of

unemployment; changes in tax legislation (including the Inflation

Reduction Act of 2022); changes in legislation and governmental

regulations, affecting such matters as the cost of employee

benefits or credit card income, such as the Consumer Financial

Protection Bureau’s recent amendment to Regulation Z to limit the

dollar amounts credit card companies can charge for late fees;

adequate and stable availability and pricing of materials,

production facilities and labor from which the Company sources its

merchandise; changes in operating expenses, including employee

wages, commission structures and related benefits; system failures

or data security breaches; possible future acquisitions of store

properties from other department store operators; the continued

availability of financing in amounts and at the terms necessary to

support the Company’s future business; fluctuations in SOFR and

other base borrowing rates; potential disruption from terrorist

activity and the effect on ongoing consumer confidence; epidemic,

pandemic or public health issues and their effects on public

health, our supply chain, the health and well-being of our

employees and customers and the retail industry in general;

potential disruption of international trade and supply chain

efficiencies; global conflicts (including the ongoing conflicts in

the Middle East and Ukraine) and the possible impact on consumer

spending patterns and other economic and demographic changes of

similar or dissimilar nature, and other risks and uncertainties,

including those detailed from time to time in our periodic reports

filed with the Securities and Exchange Commission, particularly

those set forth under the caption “Item 1A, Risk Factors” in the

Company’s Annual Report on Form 10-K for the fiscal year ended

February 3, 2024.

| |

|

| CONTACT: |

|

| Dillard’s, Inc. |

|

| Julie J. Guymon |

|

| 501-376-5965 |

|

| julie.guymon@dillards.com |

|

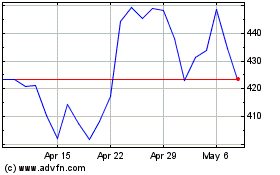

Dillards (NYSE:DDS)

Historical Stock Chart

From Oct 2024 to Nov 2024

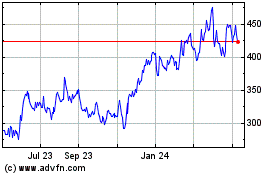

Dillards (NYSE:DDS)

Historical Stock Chart

From Nov 2023 to Nov 2024