Darling Ingredients Inc. (NYSE: DAR) today issued the following

statement regarding fourth quarter and fiscal year 2024

earnings.

Fourth quarter and fiscal year 2024 earnings for Darling

Ingredients’ 50/50 joint venture known as Diamond Green Diesel

(DGD) were released today by Darling Ingredients’ joint venture

(JV) partner within its renewable diesel segment as part of its

2024 consolidated results.

Darling Ingredients’ joint venture partner today reported that

its renewable diesel segment earned approximately $170 million in

operating income for the three months ended Dec. 31, 2024. In the

same period, DGD on a stand-alone basis incurred a lower of

cost-or-market (LCM) valuation adjustment of approximately $118

million. For the 12 months ended Dec. 31, 2024, the JV partner

reported that its renewable diesel segment earned approximately

$507 million in operating income. In the same period, DGD on a

stand-alone basis incurred a lower of cost-or-market valuation

adjustment of approximately $176 million.

In the three months ended Dec. 31, 2024, DGD sold/shipped 292.8

million gallons of renewable fuels. For the 12 months ended Dec.

31, 2024, DGD sold/shipped 1.25 billion gallons of renewable fuels.

As determined on a stand-alone basis by Darling Ingredients, DGD

EBITDA per gallon for the three months ended Dec. 31, 2024 was

$0.40; EBITDA per gallon excluding LCM was $0.81. As determined on

a stand-alone basis by Darling Ingredients, DGD EBITDA per gallon

for the 12 months ended Dec. 31, 2024, was $0.46; EBITDA per gallon

excluding LCM was $0.60.

“DGD continues to outperform its peers on many metrics, and

sustainable aviation fuel (SAF) is on line and producing on spec.

With the recent clarity provided on the 45Z Clean Fuels Production

Credit, we believe we have the line of sight needed to implement

and monetize these credits,” said Randall C. Stuewe, Chairman and

Chief Executive Officer. “In the fourth quarter of 2024, Darling

Ingredients’ core business had its strongest performance of the

year. As fat prices trend upward, the company has started 2025 with

strong momentum we expect will continue to build.”

Darling Ingredients will host a conference call at 9 a.m.

Eastern Time (8 a.m. Central Time) on February 6, 2025, to discuss

fourth quarter and fiscal year 2024 financial results, which will

be released earlier that day. At this time, the company will

provide additional details regarding its 2025 outlook. A

presentation accompanying supplemental financial data will also be

available at darlingii.com/investors.

To access the call as a listener, please register for the

audio-only webcast.

To join the call as a participant to ask a question, please

register in advance to receive a confirmation email with the

dial-in number and PIN for immediate access on Feb. 6, or call

833-470-1428 (United States) or 404-975-4839 (international) using

access code 054278.

A replay of the call will be available online via the webcast

registration link two hours after the call ends. A transcript will

be posted at darlingii.com/investors within 24 hours.

About Diamond Green Diesel

Diamond Green Diesel (DGD) is a 50/50 joint venture between

Darling Ingredients Inc. and Valero Energy Corporation. With more

than 1.2 billion gallons produced annually, DGD is one of the

world’s largest producers of renewable diesel and sustainable

aviation fuel.

About Darling Ingredients

A pioneer in circularity, Darling Ingredients Inc. (NYSE: DAR)

takes material from the animal agriculture and food industries, and

transforms them into valuable ingredients that nourish people, feed

animals and crops, and fuel the world with renewable energy. The

company operates over 260 facilities in more than 15 countries and

processes about 15% of the world’s animal agricultural by-products,

produces about 30% of the world’s collagen (both gelatin and

hydrolyzed collagen), and is one of the largest producers of

renewable energy. To learn more, visit darlingii.com. Follow us on

LinkedIn.

Use of Non-GAAP Financial Measures:

EBITDA per gallon is not a recognized accounting measurement

under GAAP; it should not be considered as an alternative to net

income or equity in income of Diamond Green Diesel, as a measure of

operating results, or as an alternative to cash flow as a measure

of liquidity and is not intended to be a presentation in accordance

with GAAP. EBITDA per gallon is presented here not as an

alternative to net income or equity in income of Diamond Green

Diesel, but rather as a measure of Diamond Green Diesel's operating

performance. Since EBITDA per gallon (generally, net income plus

interest expense, taxes, depreciation and amortization divided by

total gallons sold) is not calculated identically by all companies,

this presentation may not be comparable to EBITDA per gallon

presentations disclosed by other companies. Management believes

that EBITDA per gallon is useful in evaluating Diamond Green

Diesel's operating performance compared to that of other companies

in its industry because the calculation of EBITDA per gallon

generally eliminates the effects of financing, income taxes and

certain non-cash and other items presented on a per gallon basis

that may vary for different companies for reasons unrelated to

overall operating performance.

Cautionary Statements Regarding Forward-Looking

Information:

This release may contain “forward-looking statements,” which

include information concerning the Company’s financial performance,

plans, objectives, goals, strategies, future earnings, cash flow,

performance and other information that is not historical

information. When used in this release, the words “expects,”

“anticipates,” “projects,” “plans,” “intends,” “believes,” “will”

and variations of such words or similar expressions are intended to

identify forward-looking statements. All forward-looking statements

are based upon current expectations and beliefs and various

assumptions. There can be no assurance that the Company will

realize these expectations or that these beliefs will prove

correct. There are a number of risks and uncertainties that could

cause actual results to differ materially from the results

expressed or implied by the forward-looking statements contained in

this release. These include issues related to administration,

guidance and/or regulations associated with biofuel policies,

including the Section 45Z Clean Fuel Production Credit, and risks

associated with the qualification and sale of such credits.

Numerous other factors, many of which are beyond the Company’s

control, could cause actual results to differ materially from those

expressed as forward-looking statements. Other risk factors include

those that are discussed in the Company’s filings with the

Securities and Exchange Commission. Any forward-looking statement

speaks only as of the date on which it is made, and the Company

undertakes no obligation to update any forward-looking statements

to reflect events or circumstances after the date on which it is

made or to reflect the occurrence of anticipated or unanticipated

events or circumstances.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250130261664/en/

Media: Jillian Fleming Director, Global Communications

(972) 541-7115; jillian.fleming@darlingii.com

Investors: Suann Guthrie Senior VP, Investor Relations,

Sustainability & Communications (469) 214-8202;

suann.guthrie@darlingii.com

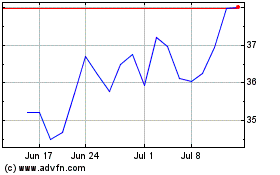

Darling Ingredients (NYSE:DAR)

Historical Stock Chart

From Jan 2025 to Feb 2025

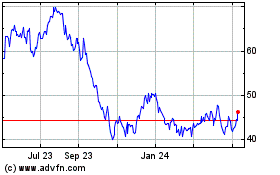

Darling Ingredients (NYSE:DAR)

Historical Stock Chart

From Feb 2024 to Feb 2025