CTO Realty Growth Announces Acquisition of 446,500 Square Foot Retail Power Center in Dallas, Texas for $61.2 Million

June 12 2023 - 7:30AM

CTO Realty Growth, Inc. (NYSE: CTO) (the “Company” or “CTO”) today

announced the acquisition of Plaza at Rockwall, a 446,500 square

foot multi-tenant retail power center in the Rockwall submarket of

Dallas, Texas (the “Property”) for a purchase price of $61.2

million. The purchase price represents a going-in cap rate above

the range of the Company’s current guidance for initial cash

yields.

“The Plaza at Rockwall is a great addition to

our high-quality, growth markets-focused portfolio, allowing us to

increase exposure to the Dallas-Fort Worth metroplex in a high

barriers-to-entry submarket with accretive demographics,” said John

P. Albright, President and Chief Executive Officer of CTO Realty

Growth. “This acquisition is a terrific opportunity to invest at an

attractive cost basis with a strong in-place yield, and it further

diversifies our portfolio’s tenant mix, increasing our exposure to

leading retailers such as Best Buy, Dick’s Sporting Goods,

HomeGoods, and Ulta Beauty. Future cash flow growth will be driven

by meaningful long-term re-leasing and repositioning opportunities,

which are supported by excellent demographics from one of the most

affluent submarkets in Texas."

Plaza at Rockwall is situated on 42 acres along

I-30, just over 20 miles northeast of downtown Dallas, Texas. The

Property is 95% occupied and is anchored by Best Buy, Ulta Beauty,

Dick’s Sporting Goods, JCPenney, Belk, Five Below, and HomeGoods.

Plaza at Rockwall is located within one of the wealthiest and

fastest growing counties in Texas, benefiting from a five-mile

population of nearly 99,000, five-mile average household incomes of

more than $142,500, and a five-year projected five-mile population

growth rate of 1.25% annually. Following the Company’s acquisition

of the Property, Dallas-Fort Worth continues to be the Company’s

second largest market exposure with approximately 18% of the

Company’s in-place annualized cash base rent coming from the

metropolitan statistical area.

The Property was purchased using draws from the

Company’s unsecured revolving credit facility. The acquisition was

structured as a reverse like-kind exchange in anticipation of

possible future income property dispositions by the Company.

About CTO Realty Growth,

Inc.

CTO Realty Growth, Inc. is a publicly traded

real estate investment trust that owns and operates a portfolio of

high-quality, retail-based properties located primarily in higher

growth markets in the United States. CTO also externally manages

and owns a meaningful interest in Alpine Income Property Trust,

Inc. (NYSE: PINE), a publicly traded net lease REIT.

We encourage you to review our most recent investor presentation

and supplemental financial information, which is available on our

website at www.ctoreit.com.

Safe Harbor

Certain statements contained in this press

release (other than statements of historical fact) are

forward-looking statements within the meaning of Section 27A of the

Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. Forward-looking

statements can typically be identified by words such as “believe,”

“estimate,” “expect,” “intend,” “anticipate,” “will,” “could,”

“may,” “should,” “plan,” “potential,” “predict,” “forecast,”

“project,” and similar expressions, as well as variations or

negatives of these words.

Although forward-looking statements are made

based upon management’s present expectations and reasonable beliefs

concerning future developments and their potential effect upon the

Company, a number of factors could cause the Company’s actual

results to differ materially from those set forth in the

forward-looking statements. Such factors may include, but are not

limited to: the Company’s ability to remain qualified as a REIT;

the Company’s exposure to U.S. federal and state income tax law

changes, including changes to the REIT requirements; general

adverse economic and real estate conditions; macroeconomic and

geopolitical factors, including but not limited to inflationary

pressures, interest rate volatility, global supply chain

disruptions, and ongoing geopolitical war; the ultimate geographic

spread, severity and duration of pandemics such as the COVID-19

Pandemic and its variants, actions that may be taken by

governmental authorities to contain or address the impact of such

pandemics, and the potential negative impacts of such pandemics on

the global economy and the Company’s financial condition and

results of operations; the inability of major tenants to continue

paying their rent or obligations due to bankruptcy, insolvency or a

general downturn in their business; the loss or failure, or decline

in the business or assets of PINE; the completion of 1031 exchange

transactions; the availability of investment properties that meet

the Company’s investment goals and criteria; the uncertainties

associated with obtaining required governmental permits and

satisfying other closing conditions for planned acquisitions and

sales; and the uncertainties and risk factors discussed in the

Company’s Annual Report on Form 10-K for the fiscal year ended

December 31, 2022 and other risks and uncertainties discussed from

time to time in the Company’s filings with the U.S. Securities and

Exchange Commission.

There can be no assurance that future

developments will be in accordance with management’s expectations

or that the effect of future developments on the Company will be

those anticipated by management. Readers are cautioned not to place

undue reliance on these forward-looking statements, which speak

only as of the date of this press release. The Company undertakes

no obligation to update the information contained in this press

release to reflect subsequently occurring events or

circumstances.

| Contact: |

Matthew M. Partridge |

| |

Senior Vice President, Chief Financial Officer and

Treasurer |

| |

(407) 904-3324 |

| |

mpartridge@ctoreit.com |

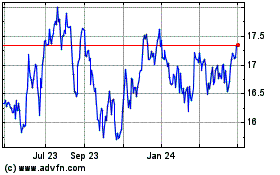

CTO Realty Growth (NYSE:CTO)

Historical Stock Chart

From Dec 2024 to Jan 2025

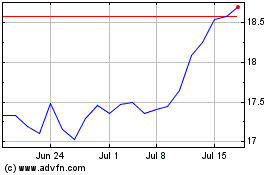

CTO Realty Growth (NYSE:CTO)

Historical Stock Chart

From Jan 2024 to Jan 2025