- In their July 5, 2022 press release, Mr. Cooke and the Canagold

Board continued their tired script of endless excuses for why New

Polaris cannot move into feasibility, despite making a commitment

to do so 25 years ago.

- Canagold completely ignores a 98% decline in shareholder value

since 1994 and a cumulative deficit of over US$51 million in their

assessment of so-called value creation, yet continues to push for

20% option plan to reward their team.

- Both Mr. Cooke and the Board remain silent on Mr. Cooke’s

inexplicable trading activity.

- Institutional Shareholder Services Inc., the world’s leading

provider of corporate governance and responsible investment

solutions and leading proxy advisor, recommends Canagold

shareholders vote FOR change on Sun Valley’s BLUE

proxy only.

- Vote only the BLUE proxy FOR Sun Valley’s

nominees by 5:00 p.m. on Thursday, July 14, 2022. To vote, contact

Kingsdale Advisors at 1-888-213-0093 or at

contactus@kingsdaleadvisors.com.

Sun Valley Investments (“Sun Valley”), a strategic and

long-term focused investor of Canagold Resources Ltd. (TSX: CCM)

(“Canagold” or the “Company”), urges shareholders to

stop the value destruction at Canagold by Mr. Bradford Cooke and

the entrenched board of directors (the “Board”). Canagold’s

potential has been crippled by decades of business and financial

mismanagement at the hands of Mr. Cooke and the incumbent Board.

It’s time for a new chapter – it’s time for The New

Canagold.

CANAGOLD’S ‘RINSE AND REPEAT’ STORY FOR

STAGNATING NEW POLARIS

Canagold’s Feasibility

Fable

In their July 5, 2022 press release, Canagold claimed that New

Polaris “has not been stagnant” and the Company produced a laundry

list of excuses for not advancing this critical project. Canagold

also claimed they will “prepare for the feasibility study” and that

they are “on the path to feasibility.”

Shareholders have heard this story before. Canagold has been “on

the path to feasibility” since 1997, when Mr. Bradford Cooke, then

president and CEO of Canagold (then Canarc), claimed:

“Our aggressive feasibility program

appears to be paying dividends … the base case for production,

which provides Canarc with an attractive return on investment and

would make Canarc an intermediate size gold producer in the next 2½

years….” – March 3, 1997, press release

In that same 1997 press release, Canagold also stated:

“the goals of the current work program are to

… complete a feasibility study in 1998.”

Canagold recycled this story again in 2004, when the Company

(then Canarc) claimed:

“Canarc now plans to move ahead with a more

aggressive development program at New Polaris as part of

management’s focus to accelerate growth in shareholder value. The

goals of the development program will be to complete the in-fill

drilling and a feasibility study.” – October 13, 2004, press

release

So, for 25 years, Canagold has been telling shareholders that a

feasibility study is imminent. This is simple and clear proof of

total stagnation.

Yet there is no credible rationale for why New Polaris has not

advanced in 28 years. Canagold’s claim that the project could not

advance for 20 years until they “discovered” BIOX is just their

latest excuse.

In 1998, the excuse for delay was due to lack of financing,

caused by the BRE-X scandal:

“the Bre-X fiasco caused Canarc to lose the

additional financing needed to complete feasibility.” – May 27,

1998, press release

In 2002, the excuse for delay was due to the gold price:

“The New Polaris project has been on care and

maintenance since 1997 pending higher gold prices.” – February 4,

2002, press release

This new excuse is equally implausible, as Institutional

Shareholder Services Inc. (“ISS”) stated:

“it seems inappropriate to write off the

majority of the company's history, the decline in share value as a

result of multiple decades of financings, and the speed at which it

has been able to advance its core asset as being due to a case [of]

technology needing to catch up to asset complexity”

This is clearly the case as during the last 25 years, while Mr.

Cooke and Canagold did nothing, approximately 20 other projects

built processing plants for refractory ore – most of them using

BIOX.

Add to this that instead of moving forward to feasibility, in

the last 15 years Canagold has conducted five preliminary economic

assessments (“PEA”) or updates to them.

Do Mr. Cooke and Canagold define “success” as doing nothing

or as doing the same thing over and over again without any

results?

Canagold’s ‘Knowledge’ of Feasibility

and Standards

In their July 5, 2022 press release, Canagold claimed that

“Management's Project Plan Follows Industry Standards” and that “A

feasibility study can’t be started without reserves!”

Those two statements are contradictory. Canagold should be

following CIM standards that are an integral part of NI 43-101.

These standards define a mineral reserve as:

“A Mineral Reserve is the economically

mineable part of a measured and/or Indicated Mineral Resource. It

includes diluting materials and allowances for losses, which may

occur when the material is mined or extracted and is defined by

studies at pre-feasibility or feasibility level as appropriate

that include application of Modifying Factors.”

This means that you cannot have reserves without feasibility

studies and, as it is the feasibility study that defines the

reserves, almost all projects start the study without reserves.

Canagold’s statement that you can’t start a feasibility study

without reserves indicates a lack of understanding of standards and

of the purpose of a feasibility study, or perhaps they are

confusing resources and reserves.

Sun Valley’s Plan for the Project vs

Canagold’s

Canagold claimed “The Dissident's "Strategic" Plan is Fatally

Flawed, and Displays Their Ignorance of Industry Standards as

Compared to Canagold's Superior Project Plan”.

They seemed to claim this for two reasons: 1) the totally

erroneous idea that you can’t do a feasibility study without

reserves (as discussed above), and 2) because the environmental

baseline won’t be completed until late next year.

Our schedule was based on the timelines given by Canagold. On

November 24, 2020, Canagold stated that:

“Initial site preparation work has been

completed to facilitate the environmental baseline study and infill

drilling required to advance to a feasibility study…”

“Canarc has contracted Hemmera Envirochem

Inc. and they have initiated twelve months of environmental

baseline studies required to submit an Environmental Assessment

Certificate application”

The baseline studies should have been completed by the end of

2021. However, without explaining the delay, Canagold did indicate

on January 12, 2022, that the studies would be completed this

year.

“2022 Plans:

Complete baseline studies, summarize and

analyze baseline sampling results and complete geotechnical and

engineering work needed to support the Environmental Assessment

application.”

We are somewhat surprised to hear that what was originally a

one-year study vital to starting the permitting will now take three

years without Canagold actually explaining the massive delay in

this critical task to shareholders.

Canagold’s ‘Superior Project Plan’

Shows Zero Knowledge of Canadian and International

Standards

Canagold claims they will do “a more detailed mine plan and

carry out an interim economic study to convert measured and

indicated resources to proven and probable reserves” and that their

“plan follows best practices and industry standards on the path to

feasibility”.

Again, these statements are totally contradictory and show zero

understanding of Canadian and international standards, as well as

zero understanding or willingness to deliver what the project

needs.

An “interim economic study” does not exist in NI 43-101, CIM

or CRIRSCO standards and CANNOT POSSIBLY lead to reserves, because

these standards all clearly state that reserves must be defined in

a pre-feasibility or feasibility study.

This means Canagold’s ‘plan’ is to conduct more useless,

non-standard studies, or maybe “interim economic study” is a

euphemism for yet another PEA, and to be “on the path to

feasibility”. This is the same old “advancing towards feasibility”

promises that they have been making since at least 2015. This is a

promise of a long and winding path to nowhere.

The project needs what it has needed for years, it needs

management that:

- will stop making excuses for lack of progress

- will stop making plans for more PEAs or undefined “interim

economic” studies

- will DO a feasibility study

CANAGOLD DISPUTES THAT A NEGATIVE 98%

RETURN IS NOT VALUE DESTRUCTION

Canagold stated that the Company has invested $33.6 million

directly into New Polaris and that under “Mr. Cooke’s guidance, the

New Polaris gold mine project … has an estimated after tax Net

Present Value of US$333 million.”

Money spent does not equate to progress and a Net Present

Value is not a return on investment.

The truth is, Canagold has destroyed shareholder value for 28

years, with a negative 98% return and an accumulated deficit of

US$51 million. This is not progress.

Despite Canagold’s misleading claims of progress, it is clear

that buyers and sellers of Canagold’s stock disagree as shares are

only worth $0.285 per share or less than $25 million for the entire

Company.1 In contrast, Sun Valley has offered and is still offering

premium financing at whichever is the higher of:

- $0.32 per common share and $0.42 in respect of the issuance of

flow-through common shares, or

- A premium to the weighted average trading price for the 20

trading days before the closing of the private placement of 20% per

common share or a 60% in respect of the issuance of flow-through

common shares.

Canagold is bleeding yet Mr. Cooke and the Board rejected

multiple, premium financing offers so as to maintain control of the

Company.

MR. COOKE AND THE BOARD DISMISS GOOD

GOVERNANCE WHILE REWARDING THEMSELVES AT THE EXPENSE OF

SHAREHOLDERS

Despite the decades of underperformance and ongoing shareholder

value destruction, Mr. Cooke and the Board have rewarded themselves

and the Company’s executives with hefty payouts:

- Mr. Cooke was rewarded with over $2.6 million in cash

- The Board increased 2021 executive compensation plans, with

increases ranging from 173% to 355%

- In 2021, the Board also gave themselves an 1,127% increase in

the value of directors’ fees. Mr. Cooke’s director fees increased

by a whopping 685% to $199,497 from $25,400. Now, the Board is

looking to reload their stock option plan and dilute shareholders

by 20% – a plan that ISS recommended shareholders vote

AGAINST.

- Canagold’s Compensation Committee reviews the compensation of

senior officers and management, and the Board provides approvals,

without any formal objectives, criteria and analysis. Mr. Cooke

sits on the Compensation Committee, contrary to good corporate

governance practices.

This is the same Board that has refused to discuss Sun

Valley’s premium financing offer for the benefit of all

shareholders and has ignored Mr. Cooke’s inexplicable trading

activity, where he sold Canagold shares ahead of a major private

placement opportunity in 2020 then repurchased shares shortly after

at a deeply discounted price – a practice he appears to have done

more than once.

SUN VALLEY’S PLAN TO PUT CANAGOLD AND

NEW POLARIS ON THE RIGHT TRACK

Canagold stated that the Company “requires an independent and

experienced Board” – and we agree. That’s why Sun Valley nominated

three outside, highly-experienced, respected and diverse industry

leaders. Our nominees – Dr. Carmen Letton, Ms. Sofia Bianchi and

Mr. Andrew Trow – bring combined expertise in metals and mining,

strategy and leadership, operations, corporate governance and

finance.

Once elected, Dr. Letton, Ms. Bianchi and Mr. Trow will provide

the much-needed independent oversight to advance New Polaris as

fast as reasonably possible for the benefit of all

shareholders.

The aim is to:

- Ensure Canagold is funded quickly with financing at a premium

to the current values

- Initiate the feasibility study without further delay

- Initiate the permitting process in Q2 2023

- Increase the resource base with a view of moving inferred

resources to indicated resources

- Restructure the Board with highly qualified directors in mining

and governance and focused on shareholders.

VOTE ONLY THE BLUE PROXY

TODAY

Sun Valley has the right plan and the resources to turn Canagold

around. As announced on July 7, 2022, ISS recommends Canagold

shareholders vote FOR change using Sun Valley’s BLUE proxy

only.

Don’t wait, voting is fast and easy. Please vote well in

advance of the proxy voting deadline of Thursday, July 14, 2022, at

5:00 p.m. ET. If you have questions or need help voting, contact

Kingsdale Advisors at 1-888-213-0093 or at

contactus@kingsdaleadvisors.com.

Advisors Kingsdale Advisors is acting as strategic

shareholder and communications advisor to Sun Valley. McMillan LLP

is acting as legal counsel to Sun Valley.

About Sun Valley Sun Valley is a private equity firm

focussed on the precious metals industry with portfolio companies

and branch offices in the Americas, Europe and Asia. Sun Valley

seeks to invest in sustainable development projects and operations

with growth potential, low cash costs of production, or the

operating flexibility to insulate against volatility in the

commodity markets.

Cautionary Statement Regarding Forward-Looking Statements

This press release contains forward-looking information within the

meaning of applicable securities laws. In general, forward-looking

information refers to disclosure about future conditions, courses

of action, and events. All statements contained in this press

release that are not clearly historical in nature or that

necessarily depend on future events are forward-looking, and the

use of any of the words “anticipates”, “believes”, “expects”,

“intends”, “plans”, “will”, “would”, and similar expressions are

intended to identify forward-looking statements. These statements

are based on current expectations of Sun Valley and currently

available information. Forward-looking statements are not

guarantees of future performance, involve certain risks and

uncertainties that are difficult to predict, and are based upon

assumptions as to future events that may not prove to be accurate.

Sun Valley undertakes no obligation to update publicly or revise

any forward-looking statements, whether as a result of new

information, future events, or otherwise, except as required by

applicable securities legislation.

Disclaimer The information contained or referenced herein

is for information purposes only in order to provide the views of

Sun Valley and the matters which Sun Valley believes to be of

concern to shareholders described herein. The information is not

tailored to specific investment objectives, the financial

situations, suitability, or particular need of any specific

person(s) who may receive the information, and should not be taken

as advice in considering the merits of any investment decision. The

views expressed herein represent the views and opinions of Sun

Valley, whose opinions may change at any time and which are based

on analyses of Sun Valley and its advisors.

1 As of close on Friday, July 8, 2022.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220710005052/en/

Sun Valley: Daniel Henao Partner / VP Business Development

Phone: 6042607046 Email: dhenao@sunvalleyinv.com

Kingsdale Advisors: Tom Graham Executive Vice President, Western

Canada Direct: 587-330-1924 Email:

tgraham@kingsdaleadvisors.com

Media: Hyunjoo Kim Vice President, Strategic Communications and

Marketing Direct: 416-867-2357 Email:

hkim@kingsdaleadvisors.com

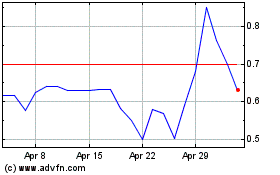

Concord Medical Services (NYSE:CCM)

Historical Stock Chart

From Dec 2024 to Jan 2025

Concord Medical Services (NYSE:CCM)

Historical Stock Chart

From Jan 2024 to Jan 2025