|

As filed with the Securities and Exchange Commission

on July 17, 2024

|

| Registration No. 333- |

|

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

|

|

FORM S-8

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

|

|

(Exact name of registrant as specified in its charter)

|

|

Delaware

(State or other jurisdiction

of incorporation or organization) |

16-1213679

(I.R.S. Employer

Identification No.) |

5790 Widewaters Parkway

Dewitt, New York 13214

(Address of Principal Executive Offices) (Zip Code)

Community Financial System, Inc. Deferred Compensation Plan for Directors

Merchants Bancshares, Inc. 1996 Amended and Restated Compensation Plan for Non-Employee

Directors

Merchants Bancshares, Inc. and Subsidiaries Amended and Restated 2008 Compensation Plan for

Non-Employee Directors and Trustees

Merchants Bank Amended and Restated Deferred Compensation Plan for Directors

Merchants Bank Salary Continuation Plan

(Full title of the plan)

Michael N. Abdo, Esq.

Executive Vice President and General Counsel

5790 Widewaters Parkway

DeWitt, New York 13214

(Name and address of agent for service)

(315) 445-2282

(Telephone number, including area code, of agent for service)

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer |

x |

|

Accelerated filer |

¨ |

| Non-accelerated filer |

¨ |

|

Smaller reporting company |

¨ |

| |

|

Emerging growth company |

¨ |

If an emerging growth

company, indicated by check mark if the registration has elected not to use the extended transition period for complying with any

new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act.

¨

INTRODUCTION

This Registration Statement

on Form S-8 is filed by Community Financial System, Inc. (the “Registrant”) to register an additional (i) 25,000

shares of the Registrant’s common stock, par value $1.00 per share (“Common Stock”) under the Community Financial System, Inc.

Deferred Compensation Plan for Directors, as amended, (ii) 34,000 shares of Common Stock under the Merchants Bancshares, Inc.

1996 Amended and Restated Compensation Plan for Non-Employee Directors, (iii) 14,000 shares of Common Stock under the Merchants Bancshares, Inc.

and Subsidiaries Amended and Restated 2008 Compensation Plan for Non-Employee Directors and Trustees, (iv) 800 shares of Common Stock

under the Merchants Bank Amended and Restated Deferred Compensation Plan for Directors, and (v) 1,400 shares of Common Stock under

the Merchants Bank Salary Continuation Plan.

PART I

INFORMATION REQUIRED IN THE SECTION 10(a) PROSPECTUS

The documents containing the

information required in Part I of Form S-8 will be delivered to participants in the Community Financial System, Inc. Deferred

Compensation Plan for Directors, as amended, the Merchants Bancshares, Inc. 1996 Amended and Restated Compensation Plan for Non-Employee

Directors, the Merchants Bancshares, Inc. and Subsidiaries Amended and Restated 2008 Compensation Plan for Non-Employee Directors

and Trustees, the Merchants Bank Amended and Restated Deferred Compensation Plan for Directors and the Merchants Bank Salary Continuation

Plan in accordance with Form S−8 and Rule 428(b) under the Securities Act of 1933, as amended (the "Securities

Act"). Such documents are not required to be, and are not, filed with the Securities and Exchange Commission ("Commission")

either as part of this Registration Statement or as prospectuses or prospectus supplements pursuant to Rule 424 under the Securities

Act. These documents and the documents incorporated herein by reference pursuant to Item 3 of Part II of this Registration Statement,

taken together, constitute a prospectus that meets the requirements of Section 10(a) of the Securities Act.

PART II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

| Item 3. | Incorporation of Documents by Reference. |

The following documents, which

have been filed by the Registrant (Commission File No. 001-13695) with the Commission pursuant to the Securities Exchange Act of

1934 (the “Exchange Act”), are incorporated in this registration statement by reference:

(a) The Registrant’s

Annual Report on Form 10−K for the fiscal year ended December 31, 2023.

(b) The Registrant’s

Quarterly Reports on Form 10−Q for the fiscal quarter ended March 31, 2024.

(c) The Registrant’s

Current Reports on Form 8−K filed on January 5, 2024, January 19, 2024, May 16, 2024, and May 17, 2024.

(d) The Registrant’s

Definitive Proxy Statement for the Registrant’s 2024 Annual Meeting of Stockholders filed on March 29, 2024.

(e) The description

of the Company’s common stock contained in the Registration Statement on Form 8-A (File No. 001-13695) filed on December 9, 1997, including any amendments or reports filed for the purpose of updating such description.

All documents subsequently

filed by the Registrant pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Exchange Act (other than current reports on Form 8−K

furnished pursuant to Item 2.02 or Item 7.01 of Form 8−K, including any exhibits included with such information, unless otherwise

indicated therein), and prior to the filing of a post−effective amendment which indicates that all securities offered hereby have

been sold or which deregisters all securities then remaining unsold, shall be deemed to be incorporated by reference herein and to be

a part hereof from the date of filing of such documents.

Any statement contained herein

or in a document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded for purposes

of this registration statement to the extent that a statement contained herein or in any other subsequently filed document which also

is or is deemed to be incorporated by reference herein, or any document forming any part of the Section 10(a) prospectus to

be delivered to participants in connection herewith, modifies or supersedes such statement. Any statement so modified or superseded shall

not be deemed, except as so modified or superseded, to constitute part of this Registration Statement.

| Item 4. | Description of Securities. |

Not applicable.

| Item 5. | Interests of Named Experts and Counsel. |

Michael N. Abdo, Esq.,

who has rendered an opinion as to the validity of the common stock being registered by this Registration Statement, is an officer of the

Registrant and, as of July 17, 2024, beneficially owned 7,013 shares of Common Stock and held options to purchase 21,970 shares of

Common Stock.

| Item 6. | Indemnification of Directors and Officers. |

The Registrant is a Delaware

corporation. Section 145 of the Delaware General Corporation Law (the “DGCL”) provides that a corporation may indemnify

any person who was or is a party or is threatened to be made a party to any threatened, pending or completed action, suit or proceeding,

whether civil, criminal, administrative or investigative (other than an action by or in the right of the corporation) by reason of the

fact that the person is or was a director, officer, employee, or agent of the corporation, or is or was serving at the request of the

corporation as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise, against

expenses (including attorneys’ fees), judgments, fines and amounts paid in settlement actually and reasonably incurred by the person

in connection with such action, suit or proceeding, provided that such person acted in good faith and in a manner reasonably believed

to be in, or not opposed to, the best interests of the corporation, and, with respect to any criminal action or proceeding, had no reasonable

cause to believe that his or her conduct was illegal.

This power to indemnify applies

to actions or suits brought by or in the right of the corporation to procure a judgment in its favor as well, but only to the extent of

expenses (including attorneys’ fees but excluding amounts paid in settlement) actually and reasonably incurred by the person in

connection with the defense or settlement of such action or suit if such person acted in good faith and in a manner reasonably believed

to be in, or not opposed to, the best interests of the corporation, except that no indemnification shall be made in respect of any claim,

issue or matter as to which such person shall have been adjudged to be liable to the corporation, unless and only to the extent that the

Delaware Court of Chancery or the court in which such action was brought shall determine upon application that, despite the adjudication

of liability but in view of all the circumstances of the case, such person is fairly and reasonably entitled to indemnity for such expenses

which the court shall deem proper.

Section 145 of the DGCL

further provides that to the extent a director or officer of a corporation has been successful in the defense of any action, suit or proceeding

referred to in subsections (a) and (b) of Section 145, or in the defense of any claim, issue or matter therein, he or she

shall be indemnified against expenses (including attorneys’ fees) actually and reasonably incurred by him or her in connection therewith;

that indemnification provided for by Section 145 shall not be deemed exclusive of any other rights to which the indemnified party

may be entitled; and that the corporation shall have power to purchase and maintain insurance on behalf of a director or officer of the

corporation against any liability asserted against him or her or incurred by him or her in any such capacity or arising out of his or

her status as such whether or not the corporation would have the power to indemnify him or her against such liabilities under Section 145.

Article 9 of the Registrant’s

Certificate of Incorporation provides that the Registrant’s directors shall not be liable to the Registrant or its shareholders

for monetary damages as a result of breach of fiduciary duty, except for liability in connection with a breach of a director’s duty

of loyalty, for acts or omissions not in good faith or involving intentional misconduct or a knowing violation of the law, for a transaction

from which a director derives an improper personal benefit, or for liability arising under Section 174 of the DGCL.

Article 7 of the Registrant’s

Bylaws provides that the Registrant shall indemnify any person made, or threatened to be made, a party to an action, suit or proceeding,

whether criminal, civil, administrative or investigative, by reason of the fact that he or she is or was a director or officer of the

registrant against expenses (including attorney’s fees), judgments, fines and amounts paid in settlement, to the fullest extent

and in the manner set forth in and permitted by the DGCL, and any other applicable law, as from time to time in effect.

The Registrant is insured

against liabilities it may incur by reason of its indemnification of officers and directors in accordance with its Bylaws. In addition,

as permitted under Delaware law, the Registrant maintains liability insurance covering directors and officers of the Registrant and its

subsidiaries.

The foregoing summaries are

necessarily subject to the complete texts of Section 145 of the DGCL, the Registrant’s Certificate of Incorporation, as amended,

and the Registrant’s Bylaws, as amended, referred to above and are qualified in their entirety by reference thereto.

| Item 7. | Exemption from Registration Claimed. |

Not applicable.

(a) The

undersigned Registrant hereby undertakes:

(1) To

file, during any period in which offers or sales are being made, a post-effective amendment to this Registration Statement:

| (i) | To include any prospectus required by Section 10(a)(3) of the Securities Act of 1933; |

| (ii) | To reflect in the prospectus any facts or events arising after the effective date of the Registration

Statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change

in the information set forth in the Registration Statement; and |

| (iii) | To include any material information with respect to the plan of distribution not previously disclosed

in the Registration Statement or any material change to such information in the Registration Statement; |

provided, however,

that paragraphs (1)(a)(i) and (1)(a)(ii) do not apply if the information required to be included in a post-effective amendment

by those paragraphs is contained in periodic reports filed with or furnished to the Commission by the registrant pursuant to Section 13

or Section 15(d) of the Securities Exchange Act of 1934 that are incorporated by reference in the Registration Statement.

(2) That,

for the purpose of determining any liability under the Securities Act of 1933, each such post-effective amendment shall be deemed to be

a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed

to be the initial bona fide offering thereof.

(3) To

remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination

of the offering.

(b) The

undersigned Registrant hereby undertakes that, for purposes of determining any liability under the Securities Act of 1933, each filing

of the Registrant’s annual report pursuant to Section 13(a) or Section 15(d) of the Securities Exchange Act

of 1934 (and, where applicable, each filing of an employee benefit plan’s annual report pursuant to section 15(d) of the Securities

Exchange Act of 1934) that is incorporated by reference in the Registration Statement shall be deemed to be a new registration statement

relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide

offering thereof.

(c) Insofar

as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers and controlling persons

of the Registrant pursuant to the foregoing provisions, or otherwise, the Registrant has been advised that in the opinion of the Securities

and Exchange Commission such indemnification is against public policy as expressed in the Act and is, therefore, unenforceable. In the

event that a claim for indemnification against such liabilities (other than the payment by the Registrant of expenses incurred or paid

by a director, officer or controlling person of the Registrant in the successful defense of any action, suit or proceeding) is asserted

by such director, officer or controlling person in connection with the securities being registered, the Registrant will, unless in the

opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question

whether such indemnification by it is against public policy as expressed in the Act and will be governed by the final adjudication of

such issue.

SIGNATURES

Pursuant to the requirements

of the Securities Act of 1933, the Registrant certifies that it has reasonable grounds to believe that it meets all of the requirements

for filing on Form S-8 and has duly caused the Registration Statement to be signed on its behalf by the undersigned, thereunto duly

authorized, in City of DeWitt, State of New York, on the 17th day of July, 2024.

| |

COMMUNITY FINANCIAL SYSTEM, INC. |

| |

|

|

| |

By: |

/s/ Dimitar K. Karaivanov |

| |

|

Dimitar A. Karaivanov |

| |

|

President and Chief Executive Officer |

POWER OF ATTORNEY

KNOW ALL MEN BY THESE PRESENTS,

that each person whose signature appears below constitutes and appoints Dimitar A. Karaivanov and Joseph E. Sutaris, and each of them,

his or her true and lawful attorneys−in−fact and agents, with full power of substitution and re−substitution, for him

or her in his or her name, place and stead, in any and all capacities, to sign any or all amendments to this Registration Statement, and

to file the same, with all exhibits thereto, and all other documents in connection therewith, with the Securities and Exchange Commission,

granting unto said attorneys−in−fact and agents, and each of them, full power and authority to do and perform each and every

act and thing requisite and necessary to be done in and about the premises, as fully to all intents and purposes as he or she might or

could do in person, hereby ratifying and confirming all that said attorneys−in−fact and agents, or any of them, or their or

his or her substitute or substitutes, may lawfully do or cause to be done by virtue thereof.

Pursuant to the requirements

of the Securities Act of 1933, this Registration Statement has been signed by the following persons in the capacities and on the dates

indicated.

| SIGNATURE |

|

TITLE |

|

DATE |

| |

|

|

|

|

| /s/ Dimitar A. Karaivanov |

|

President, Chief Executive Officer and Director |

|

July 17, 2024 |

| Dimitar A. Karaivanov |

|

(Principal Executive Officer) |

|

|

| |

|

|

|

|

| /s/ Joseph E. Sutaris |

|

Treasurer and Chief Financial Officer |

|

July 17, 2024 |

| Joseph E. Sutaris |

|

(Principal Financial Officer) |

|

|

| |

|

|

|

|

| /s/ Eric E. Stickels |

|

Chair of the Board |

|

July 17, 2024 |

| Eric E. Stickels |

|

|

|

|

| |

|

|

|

|

| /s/ Mark J. Bolus |

|

Director |

|

July 17, 2024 |

| Mark J. Bolus |

|

|

|

|

| |

|

|

|

|

| /s/ Neil E. Fesette |

|

Director |

|

July 17, 2024 |

| Neil E. Fesette |

|

|

|

|

| |

|

|

|

|

| /s/ Jeffery J. Knauss |

|

Director |

|

July 17, 2024 |

| Jeffery J. Knauss |

|

|

|

|

| |

|

|

|

|

| /s/ Kerrie D. MacPherson |

|

Director |

|

July 17, 2024 |

| Kerrie D. MacPherson |

|

|

|

|

| |

|

|

|

|

| /s/ John Parente |

|

Director |

|

July 17, 2024 |

| John Parente |

|

|

|

|

| |

|

|

|

|

| /s/ Raymond C. Pecor, III |

|

Director |

|

July 17, 2024 |

| Raymond C. Pecor, III |

|

|

|

|

| |

|

|

|

|

| /s/ Susan E. Skerritt |

|

Director |

|

July 17, 2024 |

| Susan E. Skerritt |

|

|

|

|

| |

|

|

|

|

| /s/ Sally A. Steele |

|

Director |

|

July 17, 2024 |

| Sally A. Steele |

|

|

|

|

| |

|

|

|

|

| /s/ Michele P. Sullivan |

|

Director |

|

July 17, 2024 |

| Michele P. Sullivan |

|

|

|

|

| |

|

|

|

|

| /s/ John F. Whipple, Jr. |

|

Director |

|

July 17, 2024 |

| John F. Whipple, Jr. |

|

|

|

|

| |

|

|

|

|

INDEX TO EXHIBITS

Exhibit

Number |

|

Description of Exhibit |

| |

|

|

| 4.1 |

|

Amended and Restated Certificate of Incorporation of Registrant. Incorporated by reference to Exhibit No. 3.1 to the Current Report on Form 8-K filed with the Commission on May 16, 2024 |

| |

|

|

| 4.2 |

|

Bylaws of Registrant, as amended and restated. Incorporated by reference to Exhibit 3.2 to the Current Report on Form 8-K filed with the Commission on May 16, 2024. |

| |

|

|

| 5.1+ |

|

Opinion of Michael N. Abdo, Esq. regarding to the validity of the shares being registered. |

| |

|

|

| 23.1+ |

|

Consent of PricewaterhouseCoopers LLP. |

| |

|

|

| 23.2+ |

|

Consent of Michael N. Abdo, Esq. (included in Exhibit 5.1). |

| |

|

|

| 99.1+ |

|

Community Financial System, Inc. Deferred Compensation Plan for Directors, amended and restated. |

| |

|

|

| 99.2 |

|

Merchants Bancshares, Inc. and Subsidiaries Amended and Restated 1996 Compensation Plan for Non-Employee Directors. Incorporated by reference to Exhibit 10.3 to Merchants Bancshares, Inc.'s Annual Report on Form 10-K filed with the Commission on March 15, 2011. |

| |

|

|

| 99.3 |

|

Merchants Bancshares, Inc. and Subsidiaries Amended and Restated 2008 Compensation Plan for Non-Employee Directors and Trustees. Incorporated by reference to Exhibit 10.4 to Merchants Bancshares, Inc.'s Annual Report on Form 10-K filed with the Commission on March 15, 2011. |

| |

|

|

| 99.4 |

|

Merchants Bank Amended and Restated Deferred Compensation Plan for Directors. Incorporated by reference to Exhibit 10.7 to Merchants Bancshares, Inc.'s Annual Report on Form 10-K filed with the Commission on March 15, 2011. |

| |

|

|

| 99.5 |

|

Merchants Bank Salary Continuation Plan. Incorporated by reference to Exhibit 10.9 to Merchants Bancshares, Inc.'s Annual Report on Form 10-K filed with the Commission on March 15, 2011. |

| |

|

|

| 107 |

|

Filing fee table |

+ Filed herewith.

EXHIBIT 5.1

5790 Widewaters Parkway

DeWitt, New York 13214

Michael N. Abdo

Executive Vice President and General Counsel

July 17, 2024

Community Financial System, Inc.

5790 Widewaters Parkway

DeWitt, New York 13214

Ladies and Gentlemen:

I am the Executive Vice

President and General Counsel of Community Financial System, Inc., a Delaware corporation (the “Company”) and have

acted as its counsel in connection with the registration statement on Form S-8 (the “Registration Statement”) being

filed with the Securities and Exchange Commission (the “Commission”) under the Securities Act of 1933, as amended (the

“Act”), relating to the registration of 75,200 shares of common stock, $1.00 par value per share (the

“Shares”), which may be issued pursuant to the Community Financial System, Inc. Deferred Compensation Plan for

Directors, as amended, the Merchants Bancshares, Inc. 1996 Amended and Restated Compensation Plan for Non-Employee Directors,

the Merchants Bancshares, Inc. and Subsidiaries Amended and Restated 2008 Compensation Plan for Non-Employee Directors and

Trustees, the Merchants Bank Amended and Restated Deferred Compensation Plan for Directors and the Merchants Bank Salary

Continuation Plan (collectively, the “Plans”).

For purposes of this letter, I

have examined such documents, records, certificates, and other instruments as I deemed necessary as a basis for this opinion. As to questions

of fact material to the opinion expressed below, I have, when relevant facts were not independently established by me, relied upon

certificates of officers of the Company or other evidence satisfactory to me. In all such examinations, I have assumed (i) the

genuineness of all signatures, (ii) the authenticity of all documents tendered to me as originals, and (iii) the conformity

to original documents of all documents submitted to me as copies. For purposes of rendering the opinion expressed below, I have assumed

that (i) any conditions to the issuance and sale of the Shares pursuant to each Plan made thereunder have been or will be satisfied

in full at the time of each issuance of Shares pursuant to such Plan, (ii) at the time of issuance and sale of each of the Shares

pursuant thereto, each Plan will remain in effect and will not have been amended or modified in any manner that affects adversely the

validity of the Shares upon issuance under the terms of such Plan, and (iii) at the time of issuance and sale of each of the Shares,

there will be authorized but unissued shares of common stock available to the Company in sufficient amounts.

Based upon the foregoing and

subject to the assumptions, limitations, and qualifications set forth herein, I am of the opinion that, subject to the Registration

Statement becoming effective under the Act and compliance with all other applicable securities laws, the Shares have been duly authorized

by the Company and that, when issued in accordance with the terms of the Plans, will be legally issued, fully paid and non-assessable.

I am a member of the bar of

the State of New York, and the opinion expressed herein is limited to matters controlled by the federal securities laws of the United

States of America and the General Corporation Law of the State of Delaware, and I do not express any opinion herein concerning any other

law. This opinion speaks as of today’s date and is limited to present statutes, regulations or judicial interpretations. In rendering

this opinion, I assume no obligation to revise or supplement this opinion should present laws, regulations or judicial interpretations

be changed by legislative or regulatory action, judicial decision or otherwise.

I am furnishing this opinion

in connection with the filing of the Registration Statement with the Commission and this opinion is not to be used, circulated, quoted

or otherwise referred to for any other purpose without my express written consent.

I hereby consent to the filing

of this letter as an exhibit to the Registration Statement and to the reference made to me under the heading “Interests of Named

Experts and Counsel” set forth in the Registration Statement. In giving this consent, I do not thereby admit that I am included

in the category of persons whose consent is required under Section 7 of the Act or the rules and regulations of the Commission.

| |

Very truly yours, |

| |

|

| |

/s/ Michael N. Abdo |

| |

|

| |

Michael N. Abdo, Esq. |

| |

Executive Vice President and General Counsel |

EXHIBIT 23.1

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING

FIRM

We hereby consent to the incorporation by

reference in this Registration Statement on Form S-8 of Community Financial System, Inc. of our report dated

February 29, 2024 relating to the financial statements and the effectiveness of internal control over financial reporting,

which appears in Community Bank System, Inc.’s Annual Report on Form 10-K for the year ended December 31,

2023.

/s/ PricewaterhouseCoopers LLP

Buffalo, N.Y.

July 17, 2024

EXHIBIT 99.1

COMMUNITY FINANCIAL SYSTEM, INC.

DEFERRED COMPENSATION PLAN FOR DIRECTORS

Amended and Restated as of May 15, 2024

ARTICLE I

PURPOSE AND DEFINITIONS

Section 1.01 – Purpose:

The Company’s Board

of Directors adopted the Community Financial System, Inc. Deferred Compensation Plan for Directors, effective as of January 19,

1994, to provide a uniform mechanism for the elective deferral by members of the Board of Directors of fees payable to them by the Company

and its subsidiaries for their services as directors. The Plan has been amended since 1994. In order to conform to Internal Revenue Code

Section 409A, the Plan is amended and restated in its entirety in this document, which shall be effective as of January 1, 2005.

This amended and restated Plan shall govern the rights and obligations of Plan participants and Community Financial System, Inc.

with respect to all deferred compensation benefits earned under this Plan and all predecessor versions of this Plan, including all benefits

earned by a participant prior to January 1, 2005.

Section 1.02

– Definitions:

For purpose of this plan,

the following terms shall have the meanings ascribed to them below:

(a) “Account”

shall mean the special unfunded memorandum account or accounts maintained by the Company on its books for a Participant under this Plan

in accordance with Section 3.01.

(b) “Beneficiary”

shall mean the beneficiary or beneficiaries designated by a Participant, as provided by Section 3.03, to receive Benefits payable

(if any) subsequent to such Participant’s death.

(c) “Benefits”

shall mean the benefits payable to a Participant or (his Beneficiary) under the terms of this Plan, as more particularly described in

Section 3.01.

(d) “Board

of Directors” shall mean the Board of Directors of the Company.

(e) “Change

in Control” shall mean a change in the ownership or effective control of the Company, or a change in the ownership of a substantial

portion of the assets of the Company, determined in either case in accordance with guidance provided by the United States Secretary of

the Treasury pursuant to Internal Revenue Code Section 409A.

(f) “Change

of Election Form” shall mean the written agreement between the Company and a Participant, in a form provided by the Plan Administrator,

pursuant to which the Participant modifies or revokes his election to defer Fees to be earned in a subsequent Plan Year, delays the Distribution

Date and/or changes the number of installments in which Benefits shall be paid. Change of Election Forms must be filed with the Plan Administrator

no later than the applicable date(s) determined pursuant to Sections 2.02(c) and 3.01. Subject to the other terms of the Plan,

and such limitations as may be imposed by the Plan Administrator, a Change of Election Form may be made applicable to a Participant’s

entire Benefit or to Benefits attributable to Fees deferred during one or more calendar years, as designated by the Participant.

(g) “Company”

shall mean Community Financial System, Inc., a Delaware Corporation and registered bank holding company, and Community Bank, N.A.,

a national banking association.

(h) “Deferred

Fees” shall mean the Fees which a Participant elects to defer pursuant to his Participation Agreement, as provided by Section 2.02.

(i) “Deferred

Shares” shall mean Shares which could have been purchased with Deferred Fees and Dividend Equivalents.

(j) “Director”

shall mean a member of the Board of Directors, provided that such member is not an employee of the Company.

(k) “Distribution

Date” shall mean the date or dates elected by a Participant pursuant to his Participation Agreement as the date on which the payment

of Benefits under this Plan is to commence.

(l) “Dividend

Equivalents” shall mean an amount equal to the dividends which would have been received (without reduction for taxes which would

have been payable on such dividends) had Shares equal in number to Deferred Shares then credited to the Account been issued and outstanding.

(m) “Fees”

shall mean the fees payable to a Director in his/her capacity as a Director, as authorized by the Company’s ByLaws, as in effect

from time to time.

(n) “Participant”

shall mean any Director who has elected to defer any portion of his Fees pursuant to Section 2.02.

(o) “Participation

Agreement” shall mean the written agreement between the Company and a Participant, in a form provided by the Plan Administrator,

which sets forth certain provisions and elections relative to the Plan, the amount of the Deferred Fees, the time, form and manner of

paying Benefits, and such other terms and conditions determined by the Plan Administrator to be appropriate and consistent with the terms

of this Plan.

(p) “Plan”

shall mean the Deferred Compensation Plan for Directors, as amended and restated in this document, which may be amended from time to time.

(q) “Plan

Administrator” shall mean the Trust Department of Community Bank, National Association, or such other person, committee, or entity

which may be designated by the Board of Directors as Plan Administrator from time to time.

(r) “Plan

Year” shall mean each calendar year.

(s) “Shares”

shall mean shares of the Common Stock of the Company.

ARTICLE II

DEFERRAL ELECTION

Section 2.01 – Eligibility:

All Directors who are not

employees of the Company shall be eligible to participate in this Plan.

Section 2.02

– Enrollment in Plan:

(a) A

Director may become a Participant and agree to defer Fees not yet earned by entering into a Participation Agreement prior to the first

day of the Plan Year in which the Participation Agreement is to become effective; provided, however, that a new Director may enter into

a Participation Agreement for Fees not yet earned, if the new Director’s Participation Agreement is executed and delivered to the

Plan Administrator within thirty (30) days of the date the new Director commenced service as a member of the Board of Directors.

(b) The

Deferred Fees in a given Plan Year may be any percentage (in any multiple of 5%) of the Participant’s Fees, but in no event less

than $500 in any Plan Year.

(c) Except

to the extent otherwise provided by this Plan, a Participant may modify or revoke his Participation Agreement with respect to any Fees

to be earned in a subsequent Plan Year by delivery of an executed Change of Election Form to the Plan Administrator at least thirty

(30) days prior to the beginning of the Plan Year for which such revocation or modification is to be effective. Notwithstanding any such

revocation or modification, unless the Participant’s distribution election is modified, amounts previously deferred shall be paid

as previously elected by the Participant.

ARTICLE III

BENEFITS

Section 3.01

– Stock Benefits:

(a) The

Plan Administrator shall establish an Account for each Participant and shall credit to such Account:

(1) on

the date such Participant would have otherwise received payment of his Deferred Fees, such number of Deferred Shares that equals the number

of Shares which could have been purchased with such Deferred Fees; and

(2) until

the Distribution Date, or later if the Participant elects to receive distributions over the three, five or ten year period provided for

in Section 3.01(d), such additional number of Deferred Shares which could have been purchased with Dividend Equivalents.

(b) The

number of Deferred Shares shall be subject to adjustment, as the Plan Administrator deems appropriate, to reflect stock dividends, stock

splits, stock combination, and reorganization affecting Shares.

(c) The

Account shall be payable to the Participant (or his Beneficiary) only in Shares, in a number equal to the Deferred Shares credited to

the Participant’s Account; provided, however, that fractional Shares may, at option of the Company, be paid in cash by the Company.

(d) As

of the Distribution Date, the Account shall be payable, at the Participant’s election as set forth in his Participation Agreement

or applicable Change of Election Form, in either: (1) lump sum; or (2) three, five, or ten annual installments. Except as provided

in Section 3.01(e), such election shall be irrevocable.

(1) In

the event the Participant elects to receive his distribution in the form of installments as provided for in Section 3.01(d), the

first such distribution shall be on the Distribution Date, and all subsequent distributions shall be made on or about January 2 of

each calendar year thereafter.

(2) Each

of the installment distributions provided to the Participant shall equal a number of Shares derived by dividing the number of Deferred

Shares remaining in the Participant’s Account by the number of remaining installments distributable to the Participant.

(3) For

the purposes of determining the amount of an installment payment, “market value” shall be the closing price of the Company’s

stock on the last business day immediately preceding the date of the installment payment.

(4) As

provided in Section 3.01(a)(2), and in accordance with the Company’s dividend reinvestment practices for common stock owners,

the number of Deferred Shares credited to the Participant’s Account shall include such additional number of Deferred Shares which

could have been purchased with Dividend Equivalents that are credited during the installment payment period.

(e) To

the extent a distribution would otherwise be made or commence on a specified Distribution Date elected by a Participant, the Participant

may elect to delay the Distribution Date or change the number of installments, provided that the election will not take effect until the

first day of the 12th month that follows the Plan Administrator’s receipt of the election, the first payment with respect

to which such election is made must be deferred at least five years from the previously-specified Distribution Date, and the election

must be received by the Plan Administrator at least 12 months prior to the date of the first scheduled payment. A distribution election

may not be altered after Benefit payments commence pursuant to that election. Further, except as provided in Section 4.01, no distribution

election may be altered to accelerate a Distribution Date. For purposes of Internal Revenue Code Section 409A, installment payments

shall be considered a single payment.

(f) Notwithstanding

any other term or provision in the Plan, a Participant may make or change a distribution election with respect to Fees deferred prior

to December 31, 2006 by filing a completed Change of Election Form with the Plan Administrator on or before December 31,

2006; provided, however, that no such Change of Election Form may postpone payments otherwise due in 2006 or accelerate into 2006

payments otherwise due after 2006.

(g) In

the event of a Participant’s death prior to payment of the Account in full, the balance of his Account shall be payable to his Beneficiary

in accordance with the terms of this Section and the Participant’s election under his Participation Agreement.

(h) The

Participant (or his Beneficiary) shall have no right to sell, assign, transfer or otherwise convey or encumber his right to receive any

payment of Benefits or any other rights to the Account.

(i) The

Company shall not set aside money in trust or escrow or commit any act to secure payment of the Benefits but shall make payment when

due by delivering Shares from the Company’s treasury Shares or authorized but issued Shares (with fractional Shares paid in cash

at the option of the Company from the Company’s general assets). Participants (or their Beneficiaries) shall have no rights against

the Company, except as general unsecured creditors of the Company, with respect to their Accounts and Benefits.

Section 3.02

– Change in Control:

Upon the occurrence of a Change

in Control, each Participant will receive an immediate distribution of shares of Common Stock equal to the number of Deferred Shares credited

to the Participant. Upon the distribution of all benefits pursuant to this Section 3.02, the Plan shall terminate.

Section 3.03

– Beneficiary Designations:

(a) A

Participant may designate, pursuant to his Participation Agreement, one or more Beneficiaries to receive payment of his Benefits in the

event of his death. Such designation may be changed by filing written notice with the Plan Administrator in a form provided by the Plan

Administrator. If no designation is made, the Participant’s estate shall be deemed to be the Participant’s Beneficiary.

(b) Payments

shall be made equally to all Beneficiaries if more than one Beneficiary is designated and the Participant fails to provide otherwise pursuant

to his Participation Agreement or a subsequent written notice to the Plan Administrator.

(c) All

elections and designations made by the Participant shall be binding upon his Beneficiary.

Section 3.04

– Forfeitability:

Amounts credited to a Participant’s

Account and Benefits under this plan shall not be subject to forfeiture for any reason other than termination or removal of the Participant

as a Director for “cause” (as defined below). In the event the Participant is terminated or removed as a Director for cause,

he shall forfeit all amounts credited to his Account and all Benefits to which he would otherwise be entitled under the terms of this

Plan and his Participation Agreement. For the purposes of this Section, “cause” shall mean acts of dishonesty or moral turpitude

which materially affect the Company, conduct tending to damage the reputation of the Company, conviction of a felony, or willful neglect

or refusal to perform his duties as a Director to the Company.

ARTICLE IV

WITHDRAWALS

Section 4.01

– Emergency:

(a) In

the case of an unforeseeable emergency prior or subsequent to the commencement of Benefit payments, a Participant may apply to the Plan

Administrator for withdrawal of an amount reasonably necessary to satisfy the emergency need. If such application for withdrawal is approved

by the Plan Administrator, the withdrawal will be effective at the later of the date specified in the Participant’s application

or the date of approval by the Plan Administrator and shall be payable in lump sum within thirty (30) days of such effective date.

(b) For

the purposes of this Plan, the term “unforeseeable emergency” means a severe financial hardship to the Participant resulting

from a sudden and unexpected illness or accident of the Participant or a dependent of the Participant, loss of the Participant’s

property due to casualty, or other similar extraordinary and unforeseeable circumstances arising as a result of events beyond the control

of the Participant. Unexpected and unreimbursed expenses which cause great hardship to one Participant may not cause such hardship to

another Participant. Means available to one Participant for meeting a real emergency of a financial nature may not be available to another

Participant. Withdrawals for foreseeable expenditures normally budgetable, such as down payments on a home or purchase of an auto or college

expense, will not be permitted. The Plan Administrator shall not permit withdrawal for unforeseeable emergency to the extent that such

hardship is or may be relieved:

(1) through

reimbursement of compensation by insurance or otherwise;

(2) by

liquidation of the Participant’s assets, to the extent the liquidation of such assets would not itself cause severe financial hardship;

or

(3) by

the cessation of the deferral of Fees under the Plan.

(c) In

no event shall the amount of a withdrawal for unforeseeable emergency exceed the amount of Benefits which would have been available if

the Participant had terminated his participation in this Plan at the time of withdrawal. Notwithstanding any other provision of this Plan,

if a Participant makes a withdrawal, the amount of the Participant’s Benefits under the Plan shall be appropriately reduced to reflect

such withdrawal. The remainder of any payable Benefits shall be payable in accordance with otherwise applicable provisions of this Plan

and the Participant’s Participation Agreement.

(d) In

the event a Participant receives a withdrawal for an unforeseeable emergency, then the Participant’s election to defer Fees for

the calendar year of the withdrawal shall be cancelled with respect to Fees earned following the date of the withdrawal. Fees deferred

prior to such cancellation shall be payable in accordance with the otherwise applicable provisions of this Plan and the Participant’s

Participation Agreement. Subject to the election provisions of the Plan, a Participant whose election to defer Fees is cancelled in accordance

with this Section 4.01(d) may elect to defers Fees earned in a subsequent calendar year by completing a new Participation Agreement.

(e) Unforeseeable

emergency withdrawals pursuant to this Article IV shall be subject in all events to the applicable requirements of Internal Revenue

Code Section 409A.

ARTICLE V

NONASSIGNABILITY CLAUSE

Section 5.01

– Nonassignability:

No Participant or Beneficiary

nor any other designee shall have any right to commute, sell, assign, pledge, transfer or otherwise convey or encumber the right to receive

any payments under this Plan, which payments and rights are expressly declared to be nonassignable and nontransferable. Nor shall any

unpaid Benefits be subject to attachment, garnishment or execution, or be transferable by operation of law in the event of bankruptcy

or insolvency of the Participant except to the extent otherwise required by law.

ARTICLE VI

PLAN ADMINISTRATOR

Section 6.01

– Duties of Plan Administrator:

The Plan Administrator shall

be charged with the general administration of the Plan on behalf of the Company, and shall have all powers necessary to accomplish those

purposes, including, but not by way of limitation, the following:

(a) To

construe, interpret and administer the Plan;

(b) To

make allocations and determinations required by the Plan;

(c) To

compute and certify to the Company the amount and kind of Benefits payable to Participants or their Beneficiaries;

(d) To

authorize all disbursements by the Company pursuant to the Plan;

(e) To

maintain the necessary records for the administration of the Plan;

(f) To

make and publish such rules for the regulation of the Plan consistent with its terms;

(g) To

enter into Participation Agreements with Participants on behalf of the Company; and

(h) To

accept, review and implement Change of Election Forms.

Section 6.02

– Compensation, Indemnity and Liability:

The Plan Administrator shall

receive such compensation for its services under this Plan as agreed to by the Company. The Plan Administrator shall not be liable for

any act or omission on its part, except its own willful misconduct or gross negligence. The Company shall indemnify and save harmless

the Plan Administrator against any and all expenses and liabilities arising out of the performance of its duties under this Plan, except

expenses and liabilities arising out of its own willful misconduct or gross negligence.

Section 6.03

– Determinations of Plan Administrator:

The Plan, each Participation

Agreement, and each Change of Election Form shall be interpreted and applied in all circumstances in a manner that is consistent

with the Company's intentions that the Plan satisfy the requirements of Internal Revenue Code Section 409A and that Benefits accumulated

and paid pursuant to the Plan shall not be subject to the premature income recognition or adverse tax provisions of Internal Revenue Code

Section 409A. All determinations of the Plan Administrator in the interpretation and administration of this Plan (including, but

not limited to, determinations as to the amounts of the Benefits payable to a Participant or his Beneficiary) shall be conclusive and

binding upon Participants and their Beneficiaries.

ARTICLE VII

SOURCE OF PAYMENTS

Section 7.01

– Source of Payments:

Unless otherwise directed

by the Board, all Benefits under this Plan shall be paid by the Company in the form of Shares delivered from the Company’s treasury

Shares or authorized but unissued Shares (with fractional Shares paid in cash from the general assets of the Company). No special fund

shall be established and no special segregation of assets shall be made to assure the payment of Benefits under this Plan. A Participant

shall have no right, title or interest whatever in or to any investments which the Company may make to aid it in meeting its obligations

under this Plan, pursuant to Section 7.02 or otherwise. Nothing contained in this Plan and no action taken pursuant to its provisions

shall create or be construed to create a trust of any kind or a fiduciary relationship between the Company or the Plan Administrator and

any Participant or any other person. To the extent any person acquires a right to receive payments under this Plan from the Company, such

right shall be no greater than the right of an unsecured general creditor of the Company.

Section 7.02

– Reserves:

For the purpose of aiding

the Company in providing for payments under this Plan, the Company may maintain a reserve fund which shall remain, at all times, a part

of the general assets of the Company. The Company shall not be obliged to maintain such a reserve fund. If a reserve fund is maintained,

its funds may be invested in securities, certificates of deposit, insurance or annuity contracts, or any other assets selected by the

Company in its sole discretion, without the approval or direction of any Participant.

Section 7.03

– Constructive Receipt:

It is intended that Deferred

Fees and Benefits under this Plan shall not be includible in a Participant’s gross income until actual receipt of such amounts by

the Participant. However, neither the Company nor the Plan Administrator represent or warrant to any Participant that, under existing

or future law, rules, regulations, or determinations of the Internal Revenue Service of any court, such amounts shall not be includible

in a Participant’s gross income prior to actual receipt.

ARTICLE VIII

MISCELLANEOUS

Section 8.01

– Continued Employment:

Participation in this Plan

shall not give any Participant the right to be retained as a Director or employee of the Company.

Section 8.02

– Taxes and Fees:

(a) The

Company shall be entitled to reduce any amount payable or creditable to a Participant (including, but not limited to, Deferred Fees, the

Fees which the Participant does not elect to defer, and Benefits under this Plan) or to otherwise require adequate provision for payment

of FICA, FUTA, and Federal and state income tax withholding, or similar taxes which the Company is required by law to withhold.

(b) In

addition, the amount of any Benefit payable to a Participant (or his Beneficiary) shall be reduced by the fees and expenses paid by the

Company to the Plan Administrator with regard to the administration and provision of such Benefits in the event such Participant’s

employment as a Director is terminated prior to his Distribution Date for any reason other than the merger or consolidation of the Company

into another corporation or organization with the other corporation or organization being the survivor.

Section 8.03

– Amendment or Termination of Plan:

The Company shall have the

right to amend or terminate this Plan at any time; provided, however, no such amendment or termination shall affect in any way the Benefits

which the Participant or his Beneficiary is entitled to receive as of the date of such amendment or termination.

Section 8.04

– Change of Business Form:

The Company shall not merge

or consolidate with any other corporation or organization or terminate its existence without having made adequate provision for the fulfillment

of its obligations under this Plan and the Participant Agreements.

Section 8.05

– Construction:

Words of masculine gender

shall mean and include correlative words of the feminine and neutral genders and words importing the singular shall mean and include the

plural number and vice versa.

Section 8.06

– Effective Date:

This Plan is effective as of January 1,

2005.

Section 8.07

– Law:

This Plan shall be governed

by the laws of the State of New York, other than its law respecting choice of law, to the extent not preempted by any Federal law.

| |

COMMUNITY FINANCIAL SYSTEM, INC. |

| |

COMMUNITY BANK, N.A. |

| |

|

| |

By: |

/s/ Maureen Gillan-Myer |

| |

Title: |

EVP and Chief Human Resources Officer |

| |

Date: |

May 15, 2024 |

EXHIBIT 107

Calculation of Filing

Fee Tables

FORM S-8

(Form Type)

Community

FINANCIAL System, Inc.

(Exact Name of Registrant

as Specified in its Charter)

Table 1: Newly Registered

Securities

Security

Type |

|

Security

Class Title |

|

Fee

Calculation

Rule |

|

Amount

Registered(1) |

|

Proposed

Maximum

Offering

Price Per

Unit(2) |

|

Proposed

Maximum

Aggregate

Offering Price |

|

Fee

Rate |

|

Amount

of

Registration Fee (3) |

| Equity |

|

Common

Stock, par value $1.00 per share |

|

Other |

|

25,000(4) |

|

$47.51 |

|

$1,187,750 |

|

0.00014760 |

|

$175.31 |

| Equity |

|

Common

Stock, par value $1.00 per share |

|

Other |

|

34,000(5) |

|

$47.51 |

|

$1,615,340 |

|

0.00014760 |

|

$238.42 |

| Equity |

|

Common

Stock, par value $1.00 per share |

|

Other |

|

14,000(6) |

|

$47.51 |

|

$665,140 |

|

0.00014760 |

|

$98.17 |

| Equity |

|

Common

Stock, par value $1.00 per share |

|

Other |

|

800(7) |

|

$47.51 |

|

$38,008 |

|

0.00014760 |

|

$5.61 |

| Equity |

|

Common

Stock, par value $1.00 per share |

|

Other |

|

1,400(8) |

|

$47.51 |

|

$66,514 |

|

0.00014760 |

|

$9.82 |

| |

|

|

|

|

| |

|

Total

Offering Amounts |

|

$3,572,752 |

|

|

|

$527.34 |

| |

|

|

|

|

| |

|

Total

Fee Offsets(9) |

|

|

|

|

|

$0 |

| |

|

|

|

|

| |

|

Net

Fee Due |

|

|

|

|

|

$527.34 |

| (1) | This registration statement registers the shares of Common Stock set forth above, and pursuant to Rule 416 of the Securities

Act of 1933, as amended (the "Securities Act"), this registration statement shall be deemed to cover any additional shares of

Common Stock which may be issuable under the Community Financial System, Inc. Deferred Compensation Plan for Directors, as amended,

the Merchants Bancshares, Inc. 1996 Amended and Restated Compensation Plan for Non-Employee Directors, the Merchants Bancshares, Inc.

and Subsidiaries Amended and Restated 2008 Compensation Plan for Non-Employee Directors and Trustees, the Merchants Bank Amended and Restated

Deferred Compensation Plan for Directors and the Merchants Bank Salary Continuation Plan to reflect stock splits, stock dividends, mergers

and other capital changes. |

| (2) | Pursuant to Rules 457(c) and (h) under the Securities Act, the proposed maximum offering price per share and the proposed

maximum aggregate offering price are estimated for the purpose of calculating the amount of the registration fee and are based on the

average of the high and low sales price of the Registrant’s Common Stock as reported on the New York Stock Exchange on July 10,

2024. |

| (3) | Rounded up to the nearest penny. |

| (4) | Represents 25,000 additional shares of Common Stock reserved for issuance under the Community Financial System, Inc. Deferred

Compensation Plan for Directors, as amended. |

| (5) | Represents 34,000 additional shares of Common Stock reserved for issuance under the Merchants Bancshares, Inc. 1996 Amended and

Restated Compensation Plan for Non-Employee Directors. |

| (6) | Represents 14,000 additional shares of Common Stock reserved for issuance under the Merchants Bancshares, Inc. and Subsidiaries

Amended and Restated 2008 Compensation Plan for Non-Employee Directors and Trustees. |

| (7) | Represents 800 additional shares of Common Stock reserved for issuance under the Merchants Bank Amended and Restated Deferred Compensation

Plan for Directors. |

| (8) | Represents 1,400 additional shares of Common Stock reserved for issuance under the Merchants Bank Salary Continuation Plan. |

| (9) | The Registrant does not have any fee offsets. |

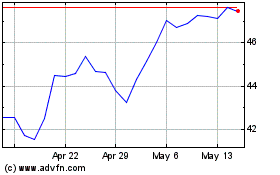

Community Financial System (NYSE:CBU)

Historical Stock Chart

From Jun 2024 to Jul 2024

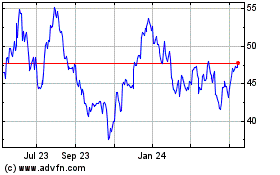

Community Financial System (NYSE:CBU)

Historical Stock Chart

From Jul 2023 to Jul 2024