0000028412FALSE00000284122024-07-192024-07-19

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

---------------

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 19, 2024

COMERICA INCORPORATED

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 1-10706 | 38-1998421 |

| ------------ | ------------ | ------------ |

| (State or other Jurisdiction of Incorporation) | (Commission File Number) | (IRS Employer Identification Number) |

Comerica Bank Tower

1717 Main Street, MC 6404

Dallas, Texas 75201

--------------------------------------------------------------------

(Address of principal executive offices) (zip code)

833 571-0486

------------------------------------------------------------------------

(Registrant's telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

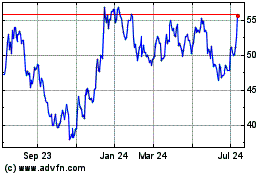

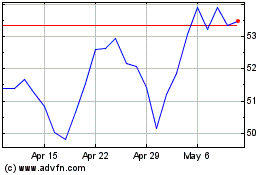

| Common Stock, $5 par value | | CMA | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR 230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR 240.12b-2).

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

ITEMS 2.02 and 7.01 RESULTS OF OPERATIONS AND FINANCIAL CONDITION AND REGULATION FD DISCLOSURE

Comerica Incorporated (“Comerica”) today released its financial results for the quarter ended June 30, 2024. A copy of the press release and the presentation slides which will be discussed on Comerica's webcast on these results and other matters are furnished herewith as Exhibits 99.1 and 99.2, respectively, and are incorporated herein by reference.

The information in this report (including Exhibits 99.1 and 99.2 hereto) is being "furnished" and shall not be deemed "filed" for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, is not subject to the liabilities of that section and is not deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, except as shall be expressly set forth by specific reference in such a filing.

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS

(d) Exhibits

104 The cover page from Comerica's Current Report on Form 8-K, formatted in Inline XBRL

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

COMERICA INCORPORATED

| | | | | |

| By: | /s/ Von E. Hays |

| Name: | Von E. Hays |

| Title: | Senior Executive Vice President and |

| Chief Legal Officer |

Date: July 19, 2024

SECOND QUARTER 2024 NET INCOME OF $206 MILLION, $1.49 PER SHARE

Period-End Loan Growth and Continued Strong Credit Quality

Successful Execution of Expense Management and Fee Income Initiatives

“Today we reported second quarter earnings per share of $1.49, an increase of $0.51 over first quarter results," said Curtis C. Farmer, Comerica Chairman and Chief Executive Officer. "Our focus on responsible growth drove an inflection in loan balances through quarter-end. While deposits remained pressured by persistently high rates, we grew customer-related interest-bearing deposits and maintained a favorable mix of noninterest-bearing balances. Fee income and expenses both improved quarter-over-quarter as we strive to balance strategic investments with efficiency, working towards positive operating leverage. Our proven approach to credit continued to be a competitive strength, resulting in net charge-offs of 9 basis points, below historical averages. Conservative capital management remained a priority with an estimated CET1 ratio of 11.55%, well above our 10% target.”

| | | | | | | | | | | | | | | | | | | | | | | |

| (dollar amounts in millions, except per share data) | 2nd Qtr '24 | | 1st Qtr '24 | | 2nd Qtr '23 | | | | | |

| FINANCIAL RESULTS | | | | | | | | | | |

| Net interest income | $ | 533 | | | $ | 548 | | | $ | 621 | | | | | | |

| Provision for credit losses | — | | | 14 | | | 33 | | | | | | |

| Noninterest income | 291 | | | 236 | | | 303 | | | | | | |

| Noninterest expenses | 555 | | | 603 | | | 535 | | | | | | |

| Pre-tax income | 269 | | | 167 | | | 356 | | | | | | |

| Provision for income taxes | 63 | | | 29 | | | 83 | | | | | | |

| Net income | $ | 206 | | | $ | 138 | | | $ | 273 | | | | | | |

| Diluted earnings per common share | $ | 1.49 | | | $ | 0.98 | | | $ | 2.01 | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Average loans | 51,071 | | | 51,372 | | | 55,368 | | | | | | |

| Average deposits | 63,055 | | | 65,310 | | | 64,332 | | | | | | |

| Return on average assets (ROA) | 1.05 | % | | 0.66 | % | | 1.21 | % | | | | | |

| Return on average common shareholders' equity (ROE) | 14.78 | | | 9.33 | | | 19.38 | | | | | | |

| Net interest margin | 2.86 | | | 2.80 | | | 2.93 | | | | | | |

| Efficiency ratio (a) | 67.77 | | | 76.91 | | | 57.70 | | | | | | |

| Common equity Tier 1 capital ratio (b) | 11.55 | | | 11.48 | | | 10.31 | | | | | | |

| Tier 1 capital ratio (b) | 12.08 | | | 12.01 | | | 10.80 | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | |

| |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

(a)Noninterest expenses as a percentage of the sum of net interest income and noninterest income excluding net gains (losses) from securities, a derivative contract tied to the conversion rate of Visa Class B shares and changes in the value of shares obtained through monetization of warrants.

(b)June 30, 2024 ratios are estimated. See Reconciliations of Non-GAAP Financial Measures and Regulatory Ratios for additional information.

Impact of Notable Items to Financial Results

The following table reconciles adjusted diluted earnings per common share, net income attributable to common shareholders and return ratios. See Reconciliations of Non-GAAP Financial Measures and Regulatory Ratios for additional information.

| | | | | | | | | | | | | | | | | | | | | |

| (dollar amounts in millions, except per share data) | 2nd Qtr '24 | | 1st Qtr '24 | | 2nd Qtr '23 | | | | |

| Diluted earnings per common share | $ | 1.49 | | | $ | 0.98 | | | $ | 2.01 | | | | | |

Net BSBY cessation hedging losses (a) | 0.01 | | | 0.21 | | | — | | | | | |

FDIC special assessment (b) | 0.02 | | | 0.09 | | | — | | | | | |

Modernization and expense recalibration initiatives (c) | 0.01 | | | 0.01 | | | 0.04 | | | | | |

| Adjusted diluted earnings per common share | $ | 1.53 | | | $ | 1.29 | | | $ | 2.05 | | | | | |

| Net income attributable to common shareholders | $ | 200 | | | $ | 131 | | | $ | 266 | | | | | |

Net BSBY cessation hedging losses (a) | 3 | | | 36 | | | — | | | | | |

FDIC special assessment (b) | 3 | | | 16 | | | — | | | | | |

Modernization and expense recalibration initiatives (c) | 2 | | | 1 | | | 7 | | | | | |

| Income tax impact of above items | (2) | | | (13) | | | (2) | | | | | |

| Adjusted net income attributable to common shareholders | $ | 206 | | | $ | 171 | | | $ | 271 | | | | | |

| ROA | 1.05 | % | | 0.66 | % | | 1.21 | % | | | | |

| Adjusted ROA | 1.07 | | | 0.86 | | | 1.24 | | | | | |

| ROE | 14.78 | | | 9.33 | | | 19.38 | | | | | |

| Adjusted ROE | 15.18 | | | 12.22 | | | 19.72 | | | | | |

(a)The planned cessation of the Bloomberg Short-Term Bank Yield Index (BSBY) announced in November 2023 resulted in the de-designation of certain interest rate swaps requiring reclassification of amounts recognized in accumulated other comprehensive income (AOCI) into earnings. Settlement of interest payments and changes in fair value for each impacted swap are recorded as risk management hedging losses until the swap is re-designated.

(b)Additional FDIC insurance expense resulting from the FDIC Board of Directors’ November 2023 approval of a special assessment to recover the loss to the Deposit Insurance Fund following the failures of Silicon Valley Bank and Signature Bank.

(c)Related to certain initiatives to transform the retail banking delivery model, align corporate facilities and optimize technology platforms, as well as calibrate expenses to enhance earnings power while creating capacity for strategic and risk management initiatives.

Second Quarter 2024 Compared to First Quarter 2024 Overview

Balance sheet items discussed in terms of average balances unless otherwise noted.

Loans decreased $301 million to $51.1 billion.

•Decreases of $291 million in Equity Fund Services and $126 million in Wealth Management, partially offset by an increase of $145 million in Commercial Real Estate.

◦Period-end loans increased $1.0 billion, which included increases of $407 million in National Dealer Services, $366 million in Equity Fund Services and $175 million in Environmental Services, partially offset by a decrease of $214 million in Corporate Banking.

•Average yield on loans (including swaps) decreased 1 basis point to 6.32%.

Securities decreased $578 million to $15.8 billion, reflecting paydowns and an increase in average unrealized losses.

•Period-end unrealized losses on securities remained relatively flat at $3.0 billion.

Deposits decreased $2.3 billion to $63.1 billion.

•Interest-bearing and noninterest-bearing deposits decreased $1.2 billion and $1.1 billion, respectively.

◦Brokered time deposits decreased $1.6 billion, while decreases of $682 million in general Middle Market and $220 million in Corporate Banking were partially offset by a $206 million increase in Retail Banking.

•The average cost of interest-bearing deposits decreased 5 basis points to 323 basis points, reflecting the decline in brokered time deposits, partially offset by continued strategic growth in core interest-bearing deposits.

Short-term borrowings decreased $1.9 billion to $666 million, reflecting a reduction in Federal Home Loan Bank (FHLB) advances, while medium- and long-term debt was relatively stable at $7.1 billion.

•Total liquidity capacity at period-end totaled $41.4 billion, including cash, available liquidity through the FHLB and the Federal Reserve Bank (FRB) discount window, as well as the market value of unencumbered investment securities.

Net interest income decreased $15 million to $533 million, and net interest margin increased 6 basis points to 2.86%.

•Decrease in net interest income driven by a decline in deposits held at the FRB, lower loan volume and the net impact of higher short-term rates, partially offset by lower brokered time deposits and FHLB advances.

•Improvement in net interest margin reflected a reduction in higher-cost funding sources, partially offset by lower deposits held at the FRB and the net impact of higher short-term rates.

Provision for credit losses decreased $14 million.

•The allowance for credit losses decreased $11 million to $717 million, reflecting changes in portfolio composition as well as continued improvement in the economic outlook.

•As a percentage of total loans, the allowance for credit losses was 1.38%, a decrease of 5 basis points.

Noninterest income increased $55 million to $291 million.

•Driven by a $42 million increase in risk management hedging income, as well as increases of $7 million each in capital markets and fiduciary income and a $4 million increase in brokerage fees, partially offset by a $5 million decrease in deferred compensation asset returns (offset in noninterest expenses).

◦The increase in risk management hedging income included a $39 million improvement related to BSBY cessation as well as a $3 million increase in price alignment income received for centrally cleared risk management positions.

Noninterest expenses decreased $48 million to $555 million.

•Decreases of $25 million in salaries and benefits expense, $17 million in FDIC insurance expense (primarily driven by special assessment) and $12 million in other noninterest expenses, partially offset by a $4 million increase in advertising.

◦Seasonal impacts to salaries and benefits expense included decreases of $19 million in annual stock-based compensation, $5 million in payroll taxes and $3 million in 401(k) expense, partially offset by a $2 million increase in staff insurance. Salaries and benefits expense also included increases of $4 million in severance costs and $3 million from annual merit increases, mostly offset by a $5 million decrease in deferred compensation expense (offset in other noninterest income).

◦Other noninterest expenses included decreases of $9 million in consulting expenses and $4 million in operational losses as well as $3 million in asset impairment costs included in the first quarter which did not repeat in the second quarter, partially offset by smaller increases in other categories.

Common equity Tier 1 capital ratio of 11.55% and a Tier 1 capital ratio of 12.08%.

See Reconciliations of Non-GAAP Financial Measures and Regulatory Ratios for additional information.

•Declared dividends of $95 million on common stock and $5 million on preferred stock.

•Tangible common equity ratio was 6.49%.

Net Interest Income

Balance sheet items presented and discussed in terms of average balances.

| | | | | | | | | | | | | | | | | | | | | |

| (dollar amounts in millions) | 2nd Qtr '24 | | 1st Qtr '24 | | 2nd Qtr '23 | | | | |

| | | | | | | | | |

| Net interest income | $ | 533 | | | $ | 548 | | | $ | 621 | | | | | |

| Net interest margin | 2.86 | % | | 2.80 | % | | 2.93 | % | | | | |

| Selected balances: | | | | | | | | | |

| Total earning assets | $ | 71,829 | | | $ | 75,807 | | | $ | 82,311 | | | | | |

| Total loans | 51,071 | | | 51,372 | | | 55,368 | | | | | |

| Total investment securities | 15,750 | | | 16,328 | | | 17,865 | | | | | |

| Federal Reserve Bank deposits | 4,474 | | | 7,526 | | | 8,409 | | | | | |

| | | | | | | | | |

| Total deposits | 63,055 | | | 65,310 | | | 64,332 | | | | | |

| Total noninterest-bearing deposits | 25,357 | | | 26,408 | | | 30,559 | | | | | |

| Short-term borrowings | 666 | | | 2,581 | | | 10,568 | | | | | |

| Medium- and long-term debt | 7,082 | | | 6,903 | | | 7,073 | | | | | |

Net interest income decreased $15 million, and net interest margin increased 6 basis points, compared to first quarter 2024. Amounts shown in parentheses below represent the impacts to net interest income and net interest margin, respectively, with impacts of hedging program included with rate.

•Interest income on loans decreased $5 million and reduced net interest margin by 1 basis point, driven by lower loan balances (-$7 million, -2 basis points) and other portfolio dynamics (+$2 million, +1 basis point).

◦The net impact of change in rate on loan interest income was nominal during the quarter.

◦BSBY cessation negatively impacted net interest income and net interest margin by $3 million and 2 basis points for second quarter 2024, compared to a positive impact of $3 million and 1 basis point for first quarter 2024.

•Interest income on investment securities decreased $1 million.

•Interest income on short-term investments decreased $42 million and reduced net interest margin by 10 basis points, primarily reflecting a decrease of $3.1 billion in deposits with the Federal Reserve Bank.

•Interest expense on deposits decreased $12 million and improved net interest margin by 7 basis points, reflecting lower average interest-bearing deposit balances (+$16 million, +9 basis points), partially offset by higher rates (-$4 million, -2 basis points).

•Interest expense on debt decreased $21 million and improved net interest margin by 10 basis points, driven by a decrease of $1.9 billion in short-term FHLB advances (+$27 million, +14 basis points), partially offset by an increase of $179 million in medium- and long-term debt (-$3 million, -2 basis points) and higher rates (-$3 million, -2 basis points).

The net impact of higher rates to second quarter 2024 net interest income was a decrease of $7 million and a reduction of 4 basis points to net interest margin.

Credit Quality

“Credit quality remained strong with net charge-offs of 9 basis points, below historical averages,” said Farmer. “Despite ongoing inflationary pressures and elevated interest rates, we saw lower criticized loans and a modest decline in our allowance for credit losses to 1.38% of total loans. We continue to incrementally monitor select portfolios with higher relative pressure, but feel overall metrics and trends remain manageable. Our proven approach to credit, coupled with our intentional portfolio diversification, continues to deliver strong results and positions us well for the future.”

| | | | | | | | | | | | | | | | | |

| (dollar amounts in millions) | 2nd Qtr '24 | | 1st Qtr '24 | | 2nd Qtr '23 |

| Charge-offs | $ | 28 | | | $ | 21 | | | $ | 11 | |

| Recoveries | 17 | | | 7 | | | 13 | |

| Net charge-offs (recoveries) | 11 | | | 14 | | | (2) | |

| Net charge-offs (recoveries)/Average total loans | 0.09 | % | | 0.10 | % | | (0.01 | %) |

| Provision for credit losses | $ | — | | | $ | 14 | | | $ | 33 | |

| | | | | |

| Nonperforming loans and nonperforming assets (NPAs) | 226 | | | 217 | | | 186 | |

| | | | | |

| NPAs/Total loans and foreclosed property | 0.44 | % | | 0.43 | % | | 0.33 | % |

| Loans past due 90 days or more and still accruing | $ | 11 | | | $ | 32 | | | $ | 9 | |

| Allowance for loan losses | 686 | | | 691 | | | 684 | |

| Allowance for credit losses on lending-related commitments (a) | 31 | | | 37 | | | 44 | |

| Total allowance for credit losses | 717 | | | 728 | | | 728 | |

| | | | | |

| | | | | |

| Allowance for credit losses/Period-end total loans | 1.38 | % | | 1.43 | % | | 1.31 | % |

| | | | | |

| Allowance for credit losses/Nonperforming loans | 3.2x | | 3.4x | | 3.9x |

(a) Included in accrued expenses and other liabilities on the Consolidated Balance Sheets.

•The allowance for credit losses totaled $717 million at June 30, 2024 and decreased by 5 basis points to 1.38% of total loans, reflecting changes in portfolio composition as well as continued improvement in the economic outlook.

•Criticized loans decreased $258 million to $2.4 billion, or 4.7% of total loans. Criticized loans are generally consistent with the Special Mention, Substandard and Doubtful categories defined by regulatory authorities.

◦The decrease in criticized loans was primarily driven by general Middle Market.

•Nonperforming assets increased $9 million to $226 million, or 0.44% of total loans and foreclosed property, compared to 0.43% in first quarter 2024.

•Net charge-offs totaled $11 million, compared to net charge-offs of $14 million in first quarter 2024.

Strategic Lines of Business

Comerica's operations are strategically aligned into three major business segments: the Commercial Bank, the Retail Bank and Wealth Management. The Finance Division is also reported as a segment. For a summary of business segment quarterly results, see the Business Segment Financial Results tables included later in this press release. From time to time, Comerica may make reclassifications among the segments to reflect management's current view of the segments, and methodologies may be modified as the management accounting system is enhanced and changes occur in the organizational structure and/or product lines. The financial results provided are based on the internal business unit structures of Comerica and methodologies in effect at June 30, 2024. A discussion of business segment results will be included in Comerica’s Form 10-Q for the quarter ended June 30, 2024.

Conference Call and Webcast

Comerica will host a conference call and live webcast to review second quarter 2024 financial results at 7 a.m. CT Friday, July 19, 2024. Interested parties may access the conference call by calling (877) 484-6065 or (201) 689-8846. The call and supplemental financial information, as well as a replay of the Webcast, can also be accessed via Comerica's "Investor Relations" page at www.comerica.com. Comerica’s presentation may include forward-looking statements, such as descriptions of plans and objectives for future or past operations, products or services; forecasts of revenue, earnings or other measures of economic performance and profitability; and estimates of credit trends and stability.

Comerica Incorporated is a financial services company headquartered in Dallas, Texas, and strategically aligned by three business segments: the Commercial Bank, the Retail Bank and Wealth Management. Comerica is one of the 25 largest U.S. commercial bank financial holding companies and focuses on building relationships and helping people and businesses be successful. Comerica provides more than 380 banking centers across the country with locations in Arizona, California, Florida, Michigan and Texas. Founded 175 years ago in Detroit, Michigan, Comerica continues to expand into new regions, including its Southeast Market, based in North Carolina, and Mountain West Market in Colorado. Comerica has offices in 17 states and services 14 of the 15 largest U.S. metropolitan areas, as well as Canada and Mexico.

This press release contains (and Comerica’s related upcoming conference call and live webcast will discuss) both financial measures based on accounting principles generally accepted in the United States (GAAP) and non-GAAP based financial measures, which are used where management believes it to be helpful in understanding Comerica's results of operations or financial position. Where non-GAAP financial measures are used, the comparable GAAP financial measure, as well as a reconciliation to the comparable GAAP financial measure, can be found in this press release or in the investor relations portions of Comerica’s website, www.comerica.com. These disclosures should not be viewed as a substitute for operating results determined in accordance with GAAP, nor are they necessarily comparable to non-GAAP performance measures that may be presented by other companies.

Forward-looking Statements

Any statements in this news release that are not historical facts are forward-looking statements as defined in the Private Securities Litigation Reform Act of 1995. Words such as “achieve, anticipate, aspire, assume, believe, can, commit, confident, continue, could, designed, enhances, estimate, expect, feel, forecast, forward, future, goal, grow, initiative, intend, look forward, maintain, may, might, mission, model, objective, opportunity, outcome, on track, outlook, plan, position, potential, project, propose, remain, seek, should, strategy, strive, target, trend, until, well-positioned, will, would” or similar expressions, as they relate to Comerica, or to economic, market or other environmental conditions or its management, are intended to identify forward-looking statements. These forward-looking statements are predicated on the beliefs and assumptions of Comerica's management based on information known to Comerica's management as of the date of this news release and do not purport to speak as of any other date. Forward-looking statements may include descriptions of plans and objectives of Comerica's management for future or past operations, products or services, and forecasts of Comerica's revenue, earnings or other measures of economic performance, including statements of profitability, business segments and subsidiaries as well as estimates of credit trends and global stability. Such statements reflect the view of Comerica's management as of this date with respect to future events and are subject to risks and uncertainties. Should one or more of these risks materialize or should underlying beliefs or assumptions prove incorrect, Comerica's actual results could differ materially from those discussed. Factors that could cause or contribute to such differences include credit risks (changes in customer behavior; unfavorable developments concerning credit quality; and declines or other changes in the businesses or industries of Comerica's customers); market risks (changes in monetary and fiscal policies; fluctuations in interest rates and their impact on deposit pricing; and transitions away from the Bloomberg Short-Term Bank Yield Index towards new interest rate benchmarks); liquidity risks (Comerica's ability to maintain adequate sources of funding and liquidity; reductions in Comerica's credit rating; and the interdependence of financial service companies and their soundness); technology risks (cybersecurity risks and heightened legislative and regulatory focus on cybersecurity and data privacy); operational risks (operational, systems or infrastructure failures; reliance on other companies to provide certain key components of business infrastructure; the impact of legal and regulatory proceedings or determinations; losses due to fraud; and controls and procedures failures); compliance risks (changes in regulation or oversight, or changes in Comerica’s status with respect to existing regulations or oversight; the effects of stringent capital requirements; and the impacts of future legislative, administrative or judicial changes to tax regulations); strategic risks (damage to Comerica's reputation; Comerica's ability to utilize technology to efficiently and effectively develop, market and deliver new products and services; competitive product and pricing pressures among financial institutions within Comerica's markets; the implementation of Comerica's strategies and business initiatives; management's ability to maintain and expand customer relationships; management's ability to retain key officers and employees; and any future strategic acquisitions or divestitures); and other general risks (changes in general economic, political or industry conditions; negative effects from inflation; the effectiveness of methods of reducing risk exposures; the effects of catastrophic events, including pandemics; physical or transition risks related to climate change; changes in accounting standards; the critical nature of Comerica's accounting policies, processes and management estimates; the volatility of Comerica’s stock price; and that an investment in Comerica’s equity securities is not insured or guaranteed by the FDIC). Comerica cautions that the foregoing list of factors is not all-inclusive. For discussion of factors that may cause actual results to differ from expectations, please refer to our filings with the Securities and Exchange Commission. In particular, please refer to “Item 1A. Risk Factors” beginning on page 14 of Comerica's Annual Report on Form 10-K for the year ended December 31, 2023. Forward-looking statements speak only as of the date they are made. Comerica does not undertake to update forward-looking statements to reflect facts, circumstances, assumptions or events that occur after the date the forward-looking statements are made. For any forward-looking statements made in this news release or in any documents, Comerica claims the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995.

| | | | | |

| Media Contacts: | Investor Contacts: |

| Nicole Hogan | Kelly Gage |

| (214) 462-6657 | (833) 571-0486 |

| |

| Louis H. Mora | Lindsey Baird |

| (214) 462-6669 | (833) 571-0486 |

| | | | | | | | | | | | | | | | | | | | |

| CONSOLIDATED FINANCIAL HIGHLIGHTS (unaudited) | | | |

| Comerica Incorporated and Subsidiaries | | | | | | |

| Three Months Ended | | Six Months Ended |

| June 30, | March 31, | June 30, | | June 30, |

| (in millions, except per share data) | 2024 | 2024 | 2023 | | 2024 | 2023 |

| PER COMMON SHARE AND COMMON STOCK DATA | | | | | | |

| Diluted earnings per common share | $ | 1.49 | | $ | 0.98 | | $ | 2.01 | | | $ | 2.47 | | $ | 4.40 | |

| | | | | | |

| Cash dividends declared | 0.71 | | 0.71 | | 0.71 | | | 1.42 | | 1.42 | |

| Average diluted shares (in thousands) | 133,763 | | 133,369 | | 132,356 | | | 133,565 | | 132,455 | |

| PERFORMANCE RATIOS | | | | | | |

| Return on average common shareholders' equity | 14.78 | % | 9.33 | % | 19.38 | % | | 12.00 | % | 21.73 | % |

| Return on average assets | 1.05 | | 0.66 | | 1.21 | | | 0.85 | | 1.37 | |

| Efficiency ratio (a) | 67.77 | | 76.91 | | 57.70 | | | 72.24 | | 56.58 | |

| CAPITAL | | | | | | |

| Common equity tier 1 capital (b), (c) | $ | 8,586 | | $ | 8,469 | | $ | 8,311 | | | | |

| Tier 1 capital (b), (c) | 8,980 | | 8,863 | | 8,705 | | | | |

| Risk-weighted assets (b) | 74,338 | | 73,794 | | 80,624 | | | | |

| Common equity tier 1 capital ratio (b), (c) | 11.55 | % | 11.48 | % | 10.31 | % | | | |

| Tier 1 capital ratio (b), (c) | 12.08 | | 12.01 | | 10.80 | | | | |

| Total capital ratio (b) | 14.02 | | 13.98 | | 12.79 | | | | |

| Leverage ratio (b) | 10.90 | | 10.23 | | 9.38 | | | | |

| Common shareholders' equity per share of common stock | $ | 43.49 | | $ | 42.69 | | $ | 39.48 | | | | |

| Tangible common equity per share of common stock (c) | 38.65 | | 37.84 | | 34.59 | | | | |

| Common equity ratio | 7.24 | % | 7.12 | % | 5.73 | % | | | |

| Tangible common equity ratio (c) | 6.49 | | 6.36 | | 5.06 | | | | |

| AVERAGE BALANCES | | | | | | |

| Commercial loans | $ | 26,292 | | $ | 26,451 | | $ | 31,663 | | | $ | 26,372 | | $ | 31,093 | |

| Real estate construction loans | 4,553 | | 5,174 | | 3,708 | | | 4,863 | | 3,528 | |

| Commercial mortgage loans | 14,171 | | 13,642 | | 13,801 | | | 13,906 | | 13,633 | |

| Lease financing | 798 | | 810 | | 776 | | | 804 | | 770 | |

| International loans | 1,111 | | 1,141 | | 1,268 | | | 1,126 | | 1,247 | |

| Residential mortgage loans | 1,898 | | 1,882 | | 1,858 | | | 1,890 | | 1,846 | |

| Consumer loans | 2,248 | | 2,272 | | 2,294 | | | 2,260 | | 2,306 | |

| Total loans | 51,071 | | 51,372 | | 55,368 | | | 51,221 | | 54,423 | |

| Earning assets | 71,829 | | 75,807 | | 82,311 | | | 73,818 | | 79,857 | |

| Total assets | 79,207 | | 83,617 | | 90,355 | | | 81,412 | | 87,761 | |

| Noninterest-bearing deposits | 25,357 | | 26,408 | | 30,559 | | | 25,883 | | 33,389 | |

| Interest-bearing deposits | 37,698 | | 38,902 | | 33,773 | | | 38,300 | | 32,683 | |

| Total deposits | 63,055 | | 65,310 | | 64,332 | | | 64,183 | | 66,072 | |

| Common shareholders' equity | 5,454 | | 5,683 | | 5,544 | | | 5,568 | | 5,440 | |

| Total shareholders' equity | 5,848 | | 6,077 | | 5,938 | | | 5,962 | | 5,834 | |

| NET INTEREST INCOME | | | | | | |

| Net interest income | $ | 533 | | $ | 548 | | $ | 621 | | | $ | 1,081 | | $ | 1,329 | |

| Net interest margin | 2.86 | % | 2.80 | % | 2.93 | % | | 2.83 | % | 3.24 | % |

| CREDIT QUALITY | | | | | | |

| Nonperforming assets | $ | 226 | | $ | 217 | | $ | 186 | | | | |

| Loans past due 90 days or more and still accruing | 11 | | 32 | | 9 | | | | |

| Net charge-offs (recoveries) | 11 | | 14 | | (2) | | | $ | 25 | | $ | (4) | |

| Allowance for loan losses | 686 | | 691 | | 684 | | | | |

| Allowance for credit losses on lending-related commitments | 31 | | 37 | | 44 | | | | |

| Total allowance for credit losses | 717 | | 728 | | 728 | | | | |

| Allowance for credit losses as a percentage of total loans | 1.38 | % | 1.43 | % | 1.31 | % | | | |

| Net loan charge-offs (recoveries) as a percentage of average total loans | 0.09 | | 0.10 | | (0.01) | | | 0.10 | % | (0.01 | %) |

Nonperforming assets as a percentage of total loans and foreclosed property | 0.44 | | 0.43 | | 0.33 | | | | |

| Allowance for credit losses as a multiple of total nonperforming loans | 3.2x | 3.4x | 3.9x | | | |

| OTHER KEY INFORMATION | | | | | | |

| Number of banking centers | 381 | | 408 | | 409 | | | | |

| Number of employees - full time equivalent | 7,608 | | 7,619 | | 7,672 | | | | |

(a) Noninterest expenses as a percentage of the sum of net interest income and noninterest income excluding net gains (losses) from securities, a derivative contract tied to the conversion rate of Visa Class B shares and changes in the value of shares obtained through monetization of warrants.

(b) June 30, 2024 ratios are estimated.

(c) See Reconciliations of Non-GAAP Financial Measures and Regulatory Ratios.

| | | | | | | | | | | | | | |

| CONSOLIDATED BALANCE SHEETS |

| Comerica Incorporated and Subsidiaries | | | | |

| | | | |

| June 30, | March 31, | December 31, | June 30, |

| (in millions, except share data) | 2024 | 2024 | 2023 | 2023 |

| (unaudited) | (unaudited) | | (unaudited) |

| ASSETS | | | | |

| Cash and due from banks | $ | 719 | | $ | 689 | | $ | 1,443 | | $ | 1,413 |

| | | | |

| Interest-bearing deposits with banks | 4,093 | | 4,446 | | 8,059 | | 8,810 |

| Other short-term investments | 396 | | 366 | | 399 | | 389 |

| Investment securities available-for-sale | 15,656 | | 16,246 | | 16,869 | | 17,415 |

| | | | |

| Commercial loans | 27,113 | | 26,019 | | 27,251 | | 31,745 |

| Real estate construction loans | 4,554 | | 4,558 | | 5,083 | | 3,983 |

| Commercial mortgage loans | 14,156 | | 14,266 | | 13,686 | | 13,851 |

| Lease financing | 806 | | 793 | | 807 | | 756 |

| International loans | 1,087 | | 1,070 | | 1,102 | | 1,282 |

| Residential mortgage loans | 1,896 | | 1,889 | | 1,889 | | 1,894 |

| Consumer loans | 2,238 | | 2,227 | | 2,295 | | 2,253 |

| Total loans | 51,850 | | 50,822 | | 52,113 | | 55,764 |

| Allowance for loan losses | (686) | | (691) | | (688) | | (684) |

| Net loans | 51,164 | | 50,131 | | 51,425 | | 55,080 |

| Premises and equipment | 474 | | 462 | | 445 | | 397 |

| Accrued income and other assets | 7,095 | | 7,104 | | 7,194 | | 7,257 |

| Total assets | $ | 79,597 | | $ | 79,444 | | $ | 85,834 | | $ | 90,761 |

| LIABILITIES AND SHAREHOLDERS' EQUITY | | | | |

| Noninterest-bearing deposits | $ | 24,522 | | $ | 25,833 | | $ | 27,849 | | $ | 31,067 |

| Money market and interest-bearing checking deposits | 29,016 | | 28,550 | | 28,246 | | 24,397 |

| Savings deposits | 2,247 | | 2,342 | | 2,381 | | 2,760 |

| Customer certificates of deposit | 3,775 | | 3,941 | | 3,723 | | 2,630 |

| Other time deposits | 2,879 | | 2,894 | | 4,550 | | 5,159 |

| Foreign office time deposits | 20 | | 18 | | 13 | | 2 |

| Total interest-bearing deposits | 37,937 | | 37,745 | | 38,913 | | 34,948 |

| Total deposits | 62,459 | | 63,578 | | 66,762 | | 66,015 |

| Short-term borrowings | 1,250 | | — | | 3,565 | | 9,558 |

| Accrued expenses and other liabilities | 2,615 | | 2,695 | | 2,895 | | 2,632 |

| Medium- and long-term debt | 7,112 | | 7,121 | | 6,206 | | 6,961 |

| Total liabilities | 73,436 | | 73,394 | | 79,428 | | 85,166 |

| Fixed-rate reset non-cumulative perpetual preferred stock, series A, no par value, $100,000 liquidation preference per share: | | | | |

| Authorized - 4,000 shares | | | | |

| Issued - 4,000 shares | 394 | | 394 | | 394 | | 394 |

| Common stock - $5 par value: | | | | |

| Authorized - 325,000,000 shares | | | | |

| Issued - 228,164,824 shares | 1,141 | | 1,141 | | 1,141 | | 1,141 |

| Capital surplus | 2,210 | | 2,202 | | 2,224 | | 2,212 |

| Accumulated other comprehensive loss | (3,463) | | (3,457) | | (3,048) | | (3,756) |

| Retained earnings | 11,867 | | 11,765 | | 11,727 | | 11,648 |

Less cost of common stock in treasury - 95,559,986 shares at 6/30/24, 95,683,776 shares at 03/31/24, 96,449,879 shares at 6/30/23 | (5,988) | | (5,995) | | (6,032) | | (6,044) |

| Total shareholders' equity | 6,161 | | 6,050 | | 6,406 | | 5,595 |

| Total liabilities and shareholders' equity | $ | 79,597 | | $ | 79,444 | | $ | 85,834 | | $ | 90,761 |

| | | | | | | | | | | | | | | | | |

| CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME |

| Comerica Incorporated and Subsidiaries | | | | | |

| | | | | |

| Three Months Ended | | Six Months Ended |

| June 30, | | June 30, |

| (in millions, except per share data) | 2024 | 2023 | | 2024 | 2023 |

| (unaudited) | (unaudited) | | (unaudited) | (unaudited) |

| INTEREST INCOME | | | | | |

| Interest and fees on loans | $ | 803 | | $ | 852 | | | $ | 1,611 | | $ | 1,629 | |

| Interest on investment securities | 101 | | 108 | | | 203 | | 221 | |

| Interest on short-term investments | 67 | | 114 | | | 176 | | 173 | |

| Total interest income | 971 | | 1,074 | | | 1,990 | | 2,023 | |

| INTEREST EXPENSE | | | | | |

| Interest on deposits | 305 | | 201 | | | 622 | | 319 | |

| Interest on short-term borrowings | 9 | | 142 | | | 46 | | 208 | |

| Interest on medium- and long-term debt | 124 | | 110 | | | 241 | | 167 | |

| Total interest expense | 438 | | 453 | | | 909 | | 694 | |

| Net interest income | 533 | | 621 | | | 1,081 | | 1,329 | |

| Provision for credit losses | — | | 33 | | | 14 | | 63 | |

| Net interest income after provision for credit losses | 533 | | 588 | | | 1,067 | | 1,266 | |

| NONINTEREST INCOME | | | | | |

| Card fees | 64 | | 72 | | | 130 | | 141 | |

| Fiduciary income | 58 | | 62 | | | 109 | | 120 | |

| Service charges on deposit accounts | 46 | | 47 | | | 91 | | 93 | |

| Capital markets income | 37 | | 39 | | | 67 | | 78 | |

| Commercial lending fees | 17 | | 18 | | | 33 | | 36 | |

| Risk management hedging income (loss) | 17 | | 7 | | | (8) | | 15 | |

| Brokerage fees | 14 | | 8 | | | 24 | | 16 | |

| Bank-owned life insurance | 11 | | 14 | | | 21 | | 24 | |

| Letter of credit fees | 10 | | 11 | | | 20 | | 21 | |

| | | | | |

| Other noninterest income | 17 | | 25 | | | 40 | | 41 | |

| Total noninterest income | 291 | | 303 | | | 527 | | 585 | |

| NONINTEREST EXPENSES | | | | | |

| Salaries and benefits expense | 323 | | 306 | | | 671 | | 632 | |

| Outside processing fee expense | 68 | | 68 | | | 136 | | 132 | |

| Software expense | 45 | | 43 | | | 89 | | 83 | |

| Occupancy expense | 44 | | 41 | | | 88 | | 82 | |

| FDIC insurance expense | 19 | | 16 | | | 55 | | 29 | |

| Equipment expense | 13 | | 12 | | | 25 | | 24 | |

| Advertising expense | 12 | | 10 | | | 20 | | 18 | |

| Other noninterest expenses | 31 | | 39 | | | 74 | | 86 | |

| Total noninterest expenses | 555 | | 535 | | | 1,158 | | 1,086 | |

| Income before income taxes | 269 | | 356 | | | 436 | | 765 | |

| Provision for income taxes | 63 | | 83 | | | 92 | | 168 | |

| NET INCOME | 206 | | 273 | | | 344 | | 597 | |

| Less: | | | | | |

| Income allocated to participating securities | 1 | | 2 | | | 2 | | 3 | |

| Preferred stock dividends | 5 | | 5 | | | 11 | | 11 | |

| Net income attributable to common shares | $ | 200 | | $ | 266 | | | $ | 331 | | $ | 583 | |

| Earnings per common share: | | | | | |

| Basic | $ | 1.50 | | $ | 2.02 | | | $ | 2.49 | | $ | 4.43 | |

| Diluted | 1.49 | | 2.01 | | | 2.47 | | 4.40 | |

| Comprehensive income (loss) | 200 | | (312) | | | (71) | | 583 | |

| Cash dividends declared on common stock | 95 | | 94 | | | 189 | | 188 | |

| Cash dividends declared per common share | 0.71 | | 0.71 | | | 1.42 | | 1.42 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| CONSOLIDATED QUARTERLY STATEMENTS OF COMPREHENSIVE INCOME (unaudited) |

| Comerica Incorporated and Subsidiaries | | | | | | | | | | |

| | | | | | | | | | | |

| Second | First | Fourth | Third | Second | | Second Quarter 2024 Compared to: |

| Quarter | Quarter | Quarter | Quarter | Quarter | | First Quarter 2024 | | Second Quarter 2023 |

| (in millions, except per share data) | 2024 | 2024 | 2023 | 2023 | 2023 | | Amount | Percent | | Amount | Percent |

| INTEREST INCOME | | | | | | | | | | | |

| Interest and fees on loans | $ | 803 | | $ | 808 | | $ | 849 | | $ | 862 | | $ | 852 | | | $ | (5) | | (1 | %) | | $ | (49) | | (6 | %) |

| Interest on investment securities | 101 | | 102 | | 104 | | 105 | | 108 | | | (1) | | (1) | | | (7) | | (7) | |

| Interest on short-term investments | 67 | | 109 | | 96 | | 136 | | 114 | | | (42) | | (38) | | | (47) | | (41) | |

| Total interest income | 971 | | 1,019 | | 1,049 | | 1,103 | | 1,074 | | | (48) | | (5) | | | (103) | | (10) | |

| INTEREST EXPENSE | | | | | | | | | | | |

| Interest on deposits | 305 | | 317 | | 302 | | 271 | | 201 | | | (12) | | (4) | | | 104 | | 51 | |

| Interest on short-term borrowings | 9 | | 37 | | 58 | | 125 | | 142 | | | (28) | | (74) | | | (133) | | (93) | |

| Interest on medium- and long-term debt | 124 | | 117 | | 105 | | 106 | | 110 | | | 7 | | 6 | | | 14 | | 12 | |

| Total interest expense | 438 | | 471 | | 465 | | 502 | | 453 | | | (33) | | (7) | | | (15) | | (4) | |

| Net interest income | 533 | | 548 | | 584 | | 601 | | 621 | | | (15) | | (3) | | | (88) | | (14) | |

| Provision for credit losses | — | | 14 | | 12 | | 14 | | 33 | | | (14) | | (98) | | | (33) | | (99) | |

Net interest income after provision for credit losses | 533 | | 534 | | 572 | | 587 | | 588 | | | (1) | | — | | | (55) | | (9) | |

| NONINTEREST INCOME | | | | | | | | | | | |

| Card fees | 64 | | 66 | | 68 | | 71 | | 72 | | | (2) | | (3) | | | (8) | | (11) | |

| Fiduciary income | 58 | | 51 | | 56 | | 59 | | 62 | | | 7 | | 13 | | | (4) | | (6) | |

| Service charges on deposit accounts | 46 | | 45 | | 45 | | 47 | | 47 | | | 1 | | 1 | | | (1) | | (2) | |

| Capital markets income | 37 | | 30 | | 34 | | 35 | | 39 | | | 7 | | 23 | | | (2) | | (6) | |

| Commercial lending fees | 17 | | 16 | | 17 | | 19 | | 18 | | | 1 | | 5 | | | (1) | | (9) | |

| Risk management hedging income (loss) | 17 | | (25) | | (74) | | 17 | | 7 | | | 42 | | n/m | | 10 | | n/m |

| Brokerage fees | 14 | | 10 | | 8 | | 6 | | 8 | | | 4 | | 34 | | | 6 | | 71 | |

| Bank-owned life insurance | 11 | | 10 | | 10 | | 12 | | 14 | | | 1 | | 16 | | | (3) | | (20) | |

| Letter of credit fees | 10 | | 10 | | 11 | | 10 | | 11 | | | — | | — | | | (1) | | (10) | |

| | | | | | | | | | | |

| Other noninterest income | 17 | | 23 | | 23 | | 19 | | 25 | | | (6) | | (22) | | | (8) | | (29) | |

| Total noninterest income | 291 | | 236 | | 198 | | 295 | | 303 | | | 55 | | 23 | | | (12) | | (4) | |

| NONINTEREST EXPENSES | | | | | | | | | | | |

| Salaries and benefits expense | 323 | | 348 | | 359 | | 315 | | 306 | | | (25) | | (7) | | | 17 | | 5 | |

| Outside processing fee expense | 68 | | 68 | | 70 | | 75 | | 68 | | | — | | — | | | — | | — | |

| Software expense | 45 | | 44 | | 44 | | 44 | | 43 | | | 1 | | 2 | | | 2 | | 6 | |

| Occupancy expense | 44 | | 44 | | 45 | | 44 | | 41 | | | — | | — | | | 3 | | 7 | |

| FDIC insurance expense | 19 | | 36 | | 132 | | 19 | | 16 | | | (17) | | (45) | | | 3 | | 26 | |

| Equipment expense | 13 | | 12 | | 14 | | 12 | | 12 | | | 1 | | 9 | | | 1 | | 4 | |

| Advertising expense | 12 | | 8 | | 10 | | 12 | | 10 | | | 4 | | 35 | | | 2 | | 17 | |

| Other noninterest expenses | 31 | | 43 | | 44 | | 34 | | 39 | | | (12) | | (28) | | | (8) | | (20) | |

| Total noninterest expenses | 555 | | 603 | | 718 | | 555 | | 535 | | | (48) | | (8) | | | 20 | | 4 | |

| Income before income taxes | 269 | | 167 | | 52 | | 327 | | 356 | | | 102 | | 62 | | | (87) | | (24) | |

| Provision for income taxes | 63 | | 29 | | 19 | | 76 | | 83 | | | 34 | | n/m | | (20) | | (24) | |

| NET INCOME | 206 | | 138 | | 33 | | 251 | | 273 | | | 68 | | 50 | | | (67) | | (25) | |

| Less: | | | | | | | | | | | |

| Income allocated to participating securities | 1 | | 1 | | — | | 1 | | 2 | | | — | | — | | | (1) | | (12) | |

| Preferred stock dividends | 5 | | 6 | | 6 | | 6 | | 5 | | | (1) | | — | | | — | | — | |

| Net income attributable to common shares | $ | 200 | | $ | 131 | | $ | 27 | | $ | 244 | | $ | 266 | | | $ | 69 | | 52 | % | | $ | (66) | | (25 | %) |

| Earnings per common share: | | | | | | | | | | | |

| Basic | $ | 1.50 | | $ | 0.99 | | $ | 0.20 | | $ | 1.85 | | $ | 2.02 | | | $ | 0.51 | | 52 | % | | $ | (0.52) | | (26 | %) |

| Diluted | 1.49 | | 0.98 | | 0.20 | | 1.84 | | 2.01 | | | 0.51 | | 52 | | | (0.52) | | (26) | |

| Comprehensive income (loss) | 200 | | (271) | | 1,525 | | (533) | | (312) | | | 471 | | n/m | | 512 | | n/m |

| Cash dividends declared on common stock | 95 | | 94 | | 93 | | 94 | | 94 | | | 1 | | — | | | 1 | | 1 | |

| Cash dividends declared per common share | 0.71 | | 0.71 | | 0.71 | | 0.71 | | 0.71 | | | — | | — | | | — | | — | |

n/m - not meaningful

| | | | | | | | | | | | | | | | | | | | |

| ANALYSIS OF THE ALLOWANCE FOR CREDIT LOSSES (unaudited) |

| Comerica Incorporated and Subsidiaries | | | | | | |

| | | | | | |

| 2024 | | 2023 |

| (in millions) | 2nd Qtr | 1st Qtr | | 4th Qtr | 3rd Qtr | 2nd Qtr |

| Balance at beginning of period: | | | | | | |

| Allowance for loan losses | $ | 691 | | $ | 688 | | | $ | 694 | | $ | 684 | | $ | 641 | |

| Allowance for credit losses on lending-related commitments | 37 | | 40 | | | 42 | | 44 | | 52 | |

| Allowance for credit losses | 728 | | 728 | | | 736 | | 728 | | 693 | |

| | | | | | |

| Loan charge-offs: | | | | | | |

| Commercial | 19 | | 20 | | | 13 | | 9 | | 9 | |

| | | | | | |

| Commercial mortgage | 6 | | — | | | 1 | | 3 | | — | |

| Lease financing | 3 | | — | | | — | | — | | — | |

| International | — | | — | | | 11 | | 1 | | 1 | |

| | | | | | |

| Consumer | — | | 1 | | | — | | 1 | | 1 | |

| Total loan charge-offs | 28 | | 21 | | | 25 | | 14 | | 11 | |

| Recoveries on loans previously charged-off: | | | | | | |

| Commercial | 15 | | 6 | | | 3 | | 5 | | 12 | |

| | | | | | |

| Commercial mortgage | 1 | | — | | | 2 | | 2 | | 1 | |

| | | | | | |

| | | | | | |

| | | | | | |

| Consumer | 1 | | 1 | | | — | | 1 | | — | |

| Total recoveries | 17 | | 7 | | | 5 | | 8 | | 13 | |

| Net loan charge-offs (recoveries) | 11 | | 14 | | | 20 | | 6 | | (2) | |

| Provision for credit losses: | | | | | | |

| Provision for loan losses | 6 | | 17 | | | 14 | | 16 | | 41 | |

| Provision for credit losses on lending-related commitments | (6) | | (3) | | | (2) | | (2) | | (8) | |

| Provision for credit losses | — | | 14 | | | 12 | | 14 | | 33 | |

| | | | | | |

| Balance at end of period: | | | | | | |

| Allowance for loan losses | 686 | | 691 | | | 688 | | 694 | | 684 | |

| Allowance for credit losses on lending-related commitments | 31 | | 37 | | | 40 | | 42 | | 44 | |

| Allowance for credit losses | $ | 717 | | $ | 728 | | | $ | 728 | | $ | 736 | | $ | 728 | |

| | | | | | |

| | | | | | |

| Allowance for credit losses as a percentage of total loans | 1.38 | % | 1.43 | % | | 1.40 | % | 1.38 | % | 1.31 | % |

| | | | | | |

| Net loan charge-offs (recoveries) as a percentage of average total loans | 0.09 | | 0.10 | | | 0.15 | | 0.05 | | (0.01) | |

| | | | | | |

| | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| NONPERFORMING ASSETS (unaudited) |

| Comerica Incorporated and Subsidiaries | | | | | | | |

| | | | | | | |

| 2024 | | 2023 |

| (in millions) | 2nd Qtr | 1st Qtr | | 4th Qtr | 3rd Qtr | | 2nd Qtr |

| SUMMARY OF NONPERFORMING ASSETS AND PAST DUE LOANS | | | | | | | |

| Nonperforming loans: | | | | | | | |

| Business loans: | | | | | | | |

| Commercial | $ | 94 | | $ | 88 | | | $ | 75 | | $ | 83 | | | $ | 93 | |

| Real estate construction | — | | — | | | 2 | | 2 | | | 2 | |

| Commercial mortgage | 69 | | 67 | | | 41 | | 30 | | | 37 | |

| Lease financing | 1 | | — | | | — | | — | | | — | |

| International | 13 | | 16 | | | 20 | | 3 | | | 4 | |

| Total nonperforming business loans | 177 | | 171 | | | 138 | | 118 | | | 136 | |

| Retail loans: | | | | | | | |

| Residential mortgage | 23 | | 23 | | | 19 | | 19 | | | 33 | |

| Consumer: | | | | | | | |

| Home equity | 26 | | 23 | | | 21 | | 17 | | | 17 | |

| | | | | | | |

| Total nonperforming retail loans | 49 | | 46 | | | 40 | | 36 | | | 50 | |

| Total nonperforming loans and nonperforming assets | 226 | | 217 | | | 178 | | 154 | | | 186 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Nonperforming loans as a percentage of total loans | 0.44 | % | 0.43 | % | | 0.34 | % | 0.29 | % | | 0.33 | % |

Nonperforming assets as a percentage of total loans and foreclosed property | 0.44 | | 0.43 | | | 0.34 | | 0.29 | | | 0.33 | |

| Allowance for credit losses as a multiple of total nonperforming loans | 3.2x | 3.4x | | 4.1x | 4.8x | | 3.9x |

| Loans past due 90 days or more and still accruing | $ | 11 | | $ | 32 | | | $ | 20 | | $ | 45 | | | $ | 9 | |

| ANALYSIS OF NONACCRUAL LOANS | | | | | | | |

| Nonaccrual loans at beginning of period | $ | 217 | | $ | 178 | | | $ | 154 | | $ | 186 | | | $ | 221 | |

| Loans transferred to nonaccrual (a) | 45 | | 83 | | | 54 | | 14 | | | 17 | |

| Nonaccrual loan gross charge-offs | (28) | | (21) | | | (25) | | (14) | | | (11) | |

| Loans transferred to accrual status (a) | — | | (2) | | | — | | (7) | | | — | |

| Nonaccrual loans sold | (2) | | (12) | | | (1) | | — | | | (3) | |

| Payments/other (b) | (6) | | (9) | | | (4) | | (25) | | | (38) | |

| Nonaccrual loans at end of period | $ | 226 | | $ | 217 | | | $ | 178 | | $ | 154 | | | $ | 186 | |

(a)Based on an analysis of nonaccrual loans with book balances greater than $2 million.

(b)Includes net changes related to nonaccrual loans with balances less than or equal to $2 million, payments on nonaccrual loans with book balances greater than $2 million and transfers of nonaccrual loans to foreclosed property.

| | | | | | | | | | | | | | | | | | | | | | | |

| ANALYSIS OF NET INTEREST INCOME (unaudited) |

| Comerica Incorporated and Subsidiaries | | | | | | | |

| Six Months Ended |

| June 30, 2024 | | June 30, 2023 |

| Average | | Average | | Average | | Average |

| (dollar amounts in millions) | Balance | Interest | Rate | | Balance | Interest | Rate |

| Commercial loans (a) | $ | 26,372 | | $ | 694 | | 5.30 | % | | $ | 31,093 | | $ | 847 | | 5.50 | % |

| Real estate construction loans | 4,863 | | 203 | | 8.40 | | | 3,528 | | 138 | | 7.90 | |

| Commercial mortgage loans | 13,906 | | 516 | | 7.46 | | | 13,633 | | 466 | | 6.90 | |

| Lease financing | 804 | | 25 | | 6.16 | | | 770 | | 14 | | 3.58 | |

| International loans | 1,126 | | 44 | | 7.91 | | | 1,247 | | 48 | | 7.85 | |

| Residential mortgage loans | 1,890 | | 36 | | 3.79 | | | 1,846 | | 31 | | 3.35 | |

| Consumer loans | 2,260 | | 93 | | 8.28 | | | 2,306 | | 85 | | 7.43 | |

| Total loans | 51,221 | | 1,611 | | 6.33 | | | 54,423 | | 1,629 | | 6.04 | |

| Mortgage-backed securities (b) | 14,536 | | 200 | | 2.29 | | | 16,200 | | 214 | | 2.28 | |

| U.S. Treasury securities (c) | 1,503 | | 3 | | 0.33 | | | 2,113 | | 7 | | 0.63 | |

| Total investment securities | 16,039 | | 203 | | 2.13 | | | 18,313 | | 221 | | 2.10 | |

| Interest-bearing deposits with banks (d) | 6,184 | | 169 | | 5.48 | | | 6,839 | | 168 | | 4.95 | |

| Other short-term investments | 374 | | 7 | | 4.00 | | | 282 | | 5 | | 3.27 | |

| Total earning assets | 73,818 | | 1,990 | | 5.20 | | | 79,857 | | 2,023 | | 4.94 | |

| Cash and due from banks | 771 | | | | | 1,313 | | | |

| Allowance for loan losses | (690) | | | | | (626) | | | |

| Accrued income and other assets | 7,513 | | | | | 7,217 | | | |

| Total assets | $ | 81,412 | | | | | $ | 87,761 | | | |

| Money market and interest-bearing checking deposits (e) | $ | 28,890 | | 464 | | 3.21 | | | $ | 25,253 | | 241 | | 1.92 | |

| Savings deposits | 2,320 | | 3 | | 0.22 | | | 3,011 | | 3 | | 0.19 | |

| Customer certificates of deposit | 3,883 | | 72 | | 3.71 | | | 2,092 | | 18 | | 1.81 | |

| Other time deposits | 3,184 | | 83 | | 5.28 | | | 2,294 | | 56 | | 4.94 | |

| Foreign office time deposits | 23 | | — | | 4.39 | | | 33 | | 1 | | 3.81 | |

| Total interest-bearing deposits | 38,300 | | 622 | | 3.26 | | | 32,683 | | 319 | | 1.96 | |

| Federal funds purchased | 13 | | — | | 5.39 | | | 46 | | 1 | | 4.60 | |

| Other short-term borrowings | 1,611 | | 46 | | 5.65 | | | 7,979 | | 207 | | 5.23 | |

| | | | | | | |

| Medium- and long-term debt | 6,992 | | 241 | | 6.88 | | | 5,462 | | 167 | | 6.12 | |

| Total interest-bearing sources | 46,916 | | 909 | | 3.88 | | | 46,170 | | 694 | | 3.02 | |

| Noninterest-bearing deposits | 25,883 | | | | | 33,389 | | | |

| Accrued expenses and other liabilities | 2,651 | | | | | 2,368 | | | |

| Shareholders' equity | 5,962 | | | | | 5,834 | | | |

| Total liabilities and shareholders' equity | $ | 81,412 | | | | | $ | 87,761 | | | |

| Net interest income/rate spread | | $ | 1,081 | | 1.32 | | | | $ | 1,329 | | 1.92 | |

| | | | | | | |

| | | | | | | |

| Impact of net noninterest-bearing sources of funds | | | 1.51 | | | | | 1.32 | |

| Net interest margin (as a percentage of average earning assets) | | | 2.83 | % | | | | 3.24 | % |

(a)Interest income on commercial loans included net expense from cash flow swaps of $344 million and $269 million for the six months ended June 30, 2024 and 2023, respectively.

(b)Average balances included $3.0 billion and $2.6 billion of unrealized losses for the six months ended June 30, 2024 and 2023, respectively; yields calculated gross of these unrealized gains and losses.

(c)Average balances included $64 million and $126 million of unrealized losses for the six months ended June 30, 2024 and 2023, respectively; yields calculated gross of these unrealized gains and losses.

(d)Average balances excluded $3 million and $27 million of collateral posted and netted against derivative liability positions for the six months ended June 30, 2024 and 2023, respectively; yields calculated gross of derivative netting amounts.

(e)Average balances excluded $125 million and $98 million of collateral received and netted against derivative asset positions for the six months ended June 30, 2024 and 2023, respectively; rates calculated gross of derivative netting amounts.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| ANALYSIS OF NET INTEREST INCOME (unaudited) |

| Comerica Incorporated and Subsidiaries | | | | | | | | | | | |

| Three Months Ended |

| June 30, 2024 | | March 31, 2024 | | June 30, 2023 |

| Average | | Average | | Average | | Average | | Average | | Average |

| (dollar amounts in millions) | Balance | Interest | Rate | | Balance | Interest | Rate | | Balance | Interest | Rate |

| Commercial loans (a) | $ | 26,292 | | $ | 346 | | 5.29 | % | | $ | 26,451 | | $ | 348 | | 5.30 | % | | $ | 31,663 | | $ | 437 | | 5.54 | % |

| Real estate construction loans | 4,553 | | 95 | | 8.43 | | | 5,174 | | 108 | | 8.37 | | | 3,708 | | 75 | | 8.11 | |

| Commercial mortgage loans | 14,171 | | 263 | | 7.47 | | | 13,642 | | 253 | | 7.46 | | | 13,801 | | 245 | | 7.12 | |

| Lease financing | 798 | | 13 | | 6.20 | | | 810 | | 12 | | 6.11 | | | 776 | | 10 | | 5.21 | |

| International loans | 1,111 | | 22 | | 8.02 | | | 1,141 | | 22 | | 7.80 | | | 1,268 | | 24 | | 7.80 | |

| Residential mortgage loans | 1,898 | | 18 | | 3.83 | | | 1,882 | | 18 | | 3.74 | | | 1,858 | | 16 | | 3.40 | |

| Consumer loans | 2,248 | | 46 | | 8.24 | | | 2,272 | | 47 | | 8.32 | | | 2,294 | | 45 | | 7.78 | |

| Total loans | 51,071 | | 803 | | 6.32 | | | 51,372 | | 808 | | 6.33 | | | 55,368 | | 852 | | 6.18 | |

| Mortgage-backed securities (b) | 14,290 | | 99 | | 2.29 | | | 14,782 | | 101 | | 2.28 | | | 16,004 | | 106 | | 2.28 | |

| U.S. Treasury securities (c) | 1,460 | | 2 | | 0.39 | | | 1,546 | | 1 | | 0.28 | | | 1,861 | | 2 | | 0.44 | |

| Total investment securities | 15,750 | | 101 | | 2.14 | | | 16,328 | | 102 | | 2.12 | | | 17,865 | | 108 | | 2.10 | |

| Interest-bearing deposits with banks (d) | 4,642 | | 64 | | 5.40 | | | 7,726 | | 105 | | 5.47 | | | 8,701 | | 110 | | 5.11 | |

| Other short-term investments | 366 | | 3 | | 3.99 | | | 381 | | 4 | | 4.01 | | | 377 | | 4 | | 3.75 | |

| Total earning assets | 71,829 | | 971 | | 5.20 | | | 75,807 | | 1,019 | | 5.20 | | | 82,311 | | 1,074 | | 5.07 | |

| Cash and due from banks | 603 | | | | | 938 | | | | | 1,163 | | | |

| Allowance for loan losses | (691) | | | | | (688) | | | | | (642) | | | |

| Accrued income and other assets | 7,466 | | | | | 7,560 | | | | | 7,523 | | | |

| Total assets | $ | 79,207 | | | | | $ | 83,617 | | | | | $ | 90,355 | | | |

| Money market and interest-bearing checking deposits (e) | $ | 29,080 | | 236 | | 3.24 | | | $ | 28,700 | | 228 | | 3.18 | | | $ | 24,177 | | 132 | | 2.17 | |

| Savings deposits | 2,287 | | 2 | | 0.22 | | | 2,352 | | 1 | | 0.23 | | | 2,877 | | 2 | | 0.21 | |

| Customer certificates of deposit | 3,901 | | 36 | | 3.67 | | | 3,868 | | 36 | | 3.76 | | | 2,306 | | 12 | | 2.20 | |

| Other time deposits | 2,403 | | 31 | | 5.28 | | | 3,964 | | 52 | | 5.28 | | | 4,395 | | 54 | | 4.98 | |

| Foreign office time deposits | 27 | | — | | 4.42 | | | 18 | | — | | 4.35 | | | 18 | | 1 | | 4.03 | |

| Total interest-bearing deposits | 37,698 | | 305 | | 3.23 | | | 38,902 | | 317 | | 3.28 | | | 33,773 | | 201 | | 2.37 | |

| Federal funds purchased | — | | — | | — | | | 26 | | — | | 5.39 | | | 9 | | — | | 5.00 | |

| Other short-term borrowings | 666 | | 9 | | 5.63 | | | 2,555 | | 37 | | 5.65 | | | 10,559 | | 142 | | 5.39 | |

| | | | | | | | | | | |

| Medium- and long-term debt | 7,082 | | 124 | | 6.98 | | | 6,903 | | 117 | | 6.77 | | | 7,073 | | 110 | | 6.24 | |

| Total interest-bearing sources | 45,446 | | 438 | | 3.85 | | | 48,386 | | 471 | | 3.90 | | | 51,414 | | 453 | | 3.52 | |

| Noninterest-bearing deposits | 25,357 | | | | | 26,408 | | | | | 30,559 | | | |

| Accrued expenses and other liabilities | 2,556 | | | | | 2,746 | | | | | 2,444 | | | |

| Shareholders' equity | 5,848 | | | | | 6,077 | | | | | 5,938 | | | |

| Total liabilities and shareholders' equity | $ | 79,207 | | | | | $ | 83,617 | | | | | $ | 90,355 | | | |

| Net interest income/rate spread | | $ | 533 | | 1.35 | | | | $ | 548 | | 1.30 | | | | $ | 621 | | 1.55 | |

| Impact of net noninterest-bearing sources of funds | | | 1.51 | | | | | 1.50 | | | | | 1.38 | |

| Net interest margin (as a percentage of average earning assets) | | | 2.86 | % | | | | 2.80 | % | | | | 2.93 | % |

(a)Interest income on commercial loans included net expense from cash flow swaps of $174 million, $170 million and $150 million for the three months ended June 30, 2024, March 31, 2024 and June 30, 2023, respectively.

(b)Average balances included $3.1 billion, $2.9 billion and $2.7 billion of unrealized losses for the three months ended June 30, 2024, March 31, 2024 and June 30, 2023, respectively; yields calculated gross of these unrealized losses.

(c)Average balances included $58 million, $71 million and $117 million of unrealized losses for the three months ended June 30, 2024, March 31, 2024 and June 30, 2023, respectively; yields calculated gross of these unrealized losses.

(d)Average balances excluded $8 million, included $2 million and included $46 million of collateral posted and netted against derivative liability positions for the three months ended June 30, 2024, March 31, 2024 and June 30, 2023, respectively; yields calculated gross of derivative netting amounts.

(e)Average balances excluded $121 million, $130 million and $231 million of collateral received and netted against derivative asset positions for the three months ended June 30, 2024, March 31, 2024 and June 30, 2023, respectively; rates calculated gross of derivative netting amounts.

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| CONSOLIDATED STATEMENTS OF CHANGES IN SHAREHOLDERS' EQUITY (unaudited) | |

| Comerica Incorporated and Subsidiaries | | | | | | |

| | | | | Accumulated Other Comprehensive Loss | | | | |

| Nonredeemable Preferred Stock | Common Stock | | | | Total Shareholders' Equity | |

| Shares Outstanding | Amount | Capital Surplus | Retained Earnings | Treasury Stock | |

| (in millions, except per share data) | |

| BALANCE AT MARCH 31, 2023 | $ | 394 | | 131.5 | | $ | 1,141 | | $ | 2,209 | | $ | (3,171) | | $ | 11,476 | | $ | (6,055) | | $ | 5,994 | |

| | | | | | | | | |

| Net income | — | | — | | — | | — | | — | | 273 | | — | | 273 | |

| Other comprehensive loss, net of tax | — | | — | | — | | — | | (585) | | — | | — | | (585) | |

| Cash dividends declared on common stock ($0.71 per share) | — | | — | | — | | — | | — | | (94) | | — | | (94) | |

| Cash dividends declared on preferred stock | — | | — | | — | | — | | — | | (5) | | — | | (5) | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Net issuance of common stock under employee stock plans | — | | 0.2 | | — | | (4) | | — | | (2) | | 11 | | 5 | |

| | | | | | | | | |

| Share-based compensation | — | | — | | — | | 7 | | — | | — | | — | | 7 | |

| | | | | | | | | |

| BALANCE AT JUNE 30, 2023 | $ | 394 | | 131.7 | | $ | 1,141 | | $ | 2,212 | | $ | (3,756) | | $ | 11,648 | | $ | (6,044) | | $ | 5,595 | |

| BALANCE AT MARCH 31, 2024 | $ | 394 | | 132.5 | | $ | 1,141 | | $ | 2,202 | | $ | (3,457) | | $ | 11,765 | | $ | (5,995) | | $ | 6,050 | |

| | | | | | | | | |

| Net income | — | | — | | — | | — | | — | | 206 | | — | | 206 | |

| Other comprehensive loss, net of tax | — | | — | | — | | — | | (6) | | — | | — | | (6) | |

| Cash dividends declared on common stock ($0.71 per share) | — | | — | | — | | — | | — | | (95) | | — | | (95) | |

| Cash dividends declared on preferred stock | — | | — | | — | | — | | — | | (5) | | — | | (5) | |

| | | | | | | | | |

| | | | | | | | | |

| Net issuance of common stock under employee stock plans | — | | 0.1 | | — | | (1) | | — | | (4) | | 7 | | 2 | |

| Share-based compensation | — | | — | | — | | 9 | | — | | — | | — | | 9 | |

| | | | | | | | | |

| BALANCE AT JUNE 30, 2024 | $ | 394 | | 132.6 | | $ | 1,141 | | $ | 2,210 | | $ | (3,463) | | $ | 11,867 | | $ | (5,988) | | $ | 6,161 | |

| BALANCE AT DECEMBER 31, 2022 | $ | 394 | | 131.0 | | $ | 1,141 | | $ | 2,220 | | $ | (3,742) | | $ | 11,258 | | $ | (6,090) | | $ | 5,181 | |

| | | | | | | | | |

| Net income | — | | — | | — | | — | | — | | 597 | | — | | 597 | |

| Other comprehensive loss, net of tax | — | | — | | — | | — | | (14) | | — | | — | | (14) | |

| Cash dividends declared on common stock ($1.42 per share) | — | | — | | — | | — | | — | | (188) | | — | | (188) | |

| Cash dividends declared on preferred stock | — | | — | | — | | — | | — | | (11) | | — | | (11) | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Net issuance of common stock under employee stock plans | — | | 0.7 | | — | | (43) | | — | | (8) | | 46 | | (5) | |

| | | | | | | | | |

| Share-based compensation | — | | — | | — | | 35 | | — | | — | | — | | 35 | |

| | | | | | | | | |

| BALANCE AT JUNE 30, 2023 | $ | 394 | | 131.7 | | $ | 1,141 | | $ | 2,212 | | $ | (3,756) | | $ | 11,648 | | $ | (6,044) | | $ | 5,595 | |

| BALANCE AT DECEMBER 31, 2023 | $ | 394 | | 131.9 | | $ | 1,141 | | $ | 2,224 | | $ | (3,048) | | $ | 11,727 | | $ | (6,032) | | $ | 6,406 | |

| Cumulative effect of change in accounting principle (a) | — | | — | | — | | — | | — | | (4) | | — | | (4) | |

| Net income | — | | — | | — | | — | | — | | 344 | | — | | 344 | |

| Other comprehensive loss, net of tax | — | | — | | — | | — | | (415) | | — | | — | | (415) | |

| Cash dividends declared on common stock ($1.42 per share) | — | | — | | — | | — | | — | | (189) | | — | | (189) | |

| Cash dividends declared on preferred stock | — | | — | | — | | — | | — | | (11) | | — | | (11) | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Net issuance of common stock under employee stock plans | — | | 0.7 | | — | | (50) | | — | | — | | 44 | | (6) | |

| | | | | | | | | |

| Share-based compensation | — | | — | | — | | 36 | | — | | — | | — | | 36 | |

| | | | | | | | | |

| BALANCE AT JUNE 30, 2024 | $ | 394 | | 132.6 | | $ | 1,141 | | $ | 2,210 | | $ | (3,463) | | $ | 11,867 | | $ | (5,988) | | $ | 6,161 | | |

(a)Effective January 1, 2024, the Corporation adopted ASU 2023-02, which expanded the permitted use of the proportional amortization method to certain tax credit investments.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| BUSINESS SEGMENT FINANCIAL RESULTS (unaudited) |

| Comerica Incorporated and Subsidiaries | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| (dollar amounts in millions) | Commercial | | Retail | | Wealth | | | | | | |

| Three Months Ended June 30, 2024 | Bank | | Bank | | Management | | Finance | | Other | | Total |

| Earnings summary: | | | | | | | | | | | |

| Net interest income (expense) | $ | 465 | | | $ | 203 | | | $ | 48 | | | $ | (220) | | | $ | 37 | | | $ | 533 | |

| Provision for credit losses | — | | | 1 | | | (2) | | | — | | | 1 | | | — | |

| Noninterest income | 146 | | | 33 | | | 78 | | | 33 | | | 1 | | | 291 | |

| Noninterest expenses | 250 | | | 177 | | | 88 | | | 1 | | | 39 | | | 555 | |

| Provision (benefit) for income taxes | 85 | | | 14 | | | 10 | | | (46) | | | — | | | 63 | |

| Net income (loss) | $ | 276 | | | $ | 44 | | | $ | 30 | | | $ | (142) | | | $ | (2) | | | $ | 206 | |

| Net charge-offs | $ | 8 | | | $ | 2 | | | $ | 1 | | | $ | — | | | $ | — | | | $ | 11 | |

| Selected average balances: | | | | | | | | | | | |

| Assets | $ | 45,843 | | | $ | 3,029 | | | $ | 5,299 | | | $ | 18,448 | | | $ | 6,588 | | | $ | 79,207 | |

| Loans | 43,709 | | | 2,322 | | | 5,026 | | | — | | | 14 | | | 51,071 | |

| Deposits | 31,176 | | | 24,590 | | | 3,951 | | | 3,032 | | | 306 | | | 63,055 | |

| Statistical data: | | | | | | | | | | | |

| Return on average assets (a) | 2.42 | % | | 0.71 | % | | 2.25 | % | | n/m | | n/m | | 1.05 | % |

| Efficiency ratio (b) | 40.97 | | | 76.15 | | | 70.78 | | | n/m | | n/m | | 67.77 | |

| | | | | | | | | | | |

| Commercial | | Retail | | Wealth | | | | | | |

| Three Months Ended March 31, 2024 | Bank | | Bank | | Management | | Finance | | Other | | Total |

| Earnings summary: | | | | | | | | | | | |

| Net interest income (expense) | $ | 477 | | | $ | 200 | | | $ | 47 | | | $ | (217) | | | $ | 41 | | | $ | 548 | |

| Provision for credit losses | 16 | | | (1) | | | 1 | | | — | | | (2) | | | 14 | |

| Noninterest income | 147 | | | 29 | | | 65 | | | (11) | | | 6 | | | 236 | |

| Noninterest expenses | 275 | | | 182 | | | 96 | | | 2 | | | 48 | | | 603 | |

| Provision (benefit) for income taxes | 56 | | | 8 | | | 2 | | | (41) | | | 4 | | | 29 | |

| Net income (loss) | $ | 277 | | | $ | 40 | | | $ | 13 | | | $ | (189) | | | $ | (3) | | | $ | 138 | |

| Net charge-offs | $ | 14 | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | 14 | |

| Selected average balances: | | | | | | | | | | | |

| Assets | $ | 46,485 | | | $ | 3,025 | | | $ | 5,444 | | | $ | 19,057 | | | $ | 9,606 | | | $ | 83,617 | |

| Loans | 43,911 | | | 2,297 | | | 5,152 | | | — | | | 12 | | | 51,372 | |

| Deposits | 32,212 | | | 24,384 | | | 3,900 | | | 4,539 | | | 275 | | | 65,310 | |

| Statistical data: | | | | | | | | | | | |

| Return on average assets (a) | 2.40 | % | | 0.64 | % | | 0.88 | % | | n/m | | n/m | | 0.66 | % |

| Efficiency ratio (b) | 44.05 | | | 79.14 | | | 86.66 | | | n/m | | n/m | | 76.91 | |

| | | | | | | | | | | |

| Commercial | | Retail | | Wealth | | | | | | |

| Three Months Ended June 30, 2023 | Bank | | Bank | | Management | | Finance | | Other | | Total |

| Earnings summary: | | | | | | | | | | | |

| Net interest income (expense) | $ | 504 | | | $ | 214 | | | $ | 51 | | | $ | (173) | | | $ | 25 | | | $ | 621 | |

| Provision for credit losses | 33 | | | (4) | | | 2 | | | — | | | 2 | | | 33 | |

| Noninterest income | 158 | | | 29 | | | 83 | | | 29 | | | 4 | | | 303 | |

| Noninterest expenses | 248 | | | 171 | | | 89 | | | 2 | | | 25 | | | 535 | |

| Provision (benefit) for income taxes | 90 | | | 18 | | | 11 | | | (36) | | | — | | | 83 | |

| Net income (loss) | $ | 291 | | | $ | 58 | | | $ | 32 | | | $ | (110) | | | $ | 2 | | | $ | 273 | |

| Net (recoveries) charge-offs | $ | (3) | | | $ | — | | | $ | 1 | | | $ | — | | | $ | — | | | $ | (2) | |

| Selected average balances: | | | | | | | | | | | |

| Assets | $ | 50,945 | | | $ | 2,931 | | | $ | 5,624 | | | $ | 20,649 | | | $ | 10,206 | | | $ | 90,355 | |

| Loans | 47,813 | | | 2,214 | | | 5,341 | | | — | | | — | | | 55,368 | |

| Deposits | 31,030 | | | 24,002 | | | 3,942 | | | 4,980 | | | 378 | | | 64,332 | |

| Statistical data: | | | | | | | | | | | |

| Return on average assets (a) | 2.29 | % | | 0.94 | % | | 2.31 | % | | n/m | | n/m | | 1.21 | % |

| Efficiency ratio (b) | 37.44 | | | 69.73 | | | 66.21 | | | n/m | | n/m | | 57.70 | |

(a)Return on average assets is calculated based on the greater of average assets or average liabilities and attributed equity.

(b)Noninterest expenses as a percentage of the sum of net interest income and noninterest income excluding net gains (losses) from securities, a derivative contract tied to the conversion rate of Visa Class B shares and changes in the value of shares obtained through monetization of warrants.

n/m - not meaningful

| | | | | | | | | | | | | | | | | |

| RECONCILIATIONS OF NON-GAAP FINANCIAL MEASURES AND REGULATORY RATIOS (unaudited) |

| Comerica Incorporated and Subsidiaries | | | | |

| | | | | |

Comerica believes non-GAAP measures are meaningful because they reflect adjustments commonly made by management, investors, regulators and analysts to evaluate the adequacy of common equity and performance trends. Comerica believes adjusted net income, earnings per share, ROA and ROE provide a greater understanding of ongoing operations and financial results by removing the impact of notable items from net income, net income available to common shareholders, average assets and average common shareholders’ equity. Notable items are meaningful because they provide greater detail of how certain events or initiatives affect Comerica’s results for a more informed understanding of those results. Tangible common equity is used by Comerica to measure the quality of capital and the return relative to balance sheet risk.

| | | | | | | | | | | | | | | | | | | | |

| Second | First | Second | | Six Months Ended |

| Quarter | Quarter | Quarter | | June 30, |

| (dollar amounts in millions, except per share data) | 2024 | 2024 | 2023 | | 2024 | 2023 |

| Adjusted Earnings per Common Share: | | | | | | |

| Net income attributable to common shareholders | $ | 200 | | $ | 131 | | $ | 266 | | | $ | 331 | | $ | 583 | |

| Net BSBY cessation hedging losses (a) | 3 | | 36 | | — | | | 39 | | — | |

| FDIC special assessment (b) | 3 | | 16 | | — | | | 19 | | — | |

| Modernization and expense recalibration initiatives (c) | 2 | | 1 | | 7 | | | 3 | | 23 | |

| Income tax impact of above items | (2) | | (13) | | (2) | | | (15) | | (6) | |

| Adjusted net income attributable to common shareholders | $ | 206 | | $ | 171 | | $ | 271 | | | $ | 377 | | $ | 600 | |

| Diluted average common shares (in millions) | 134 | | 133 | | 132 | | | 134 | | 132 | |

| Diluted earnings per common share: | | | | | | |

| Reported | $ | 1.49 | | $ | 0.98 | | $ | 2.01 | | | $ | 2.47 | | $ | 4.40 | |

| Adjusted | 1.53 | | 1.29 | | 2.05 | | | 2.82 | | 4.53 | |

| Adjusted Net Income, ROA and ROE: | | | | | | |

| Net income | $ | 206 | | $ | 138 | | $ | 273 | | | $ | 344 | | $ | 597 | |

| Net BSBY cessation hedging losses (a) | 3 | | 36 | | — | | | 39 | | — | |

| FDIC special assessment (b) | 3 | | 16 | | — | | | 19 | | — | |

| Modernization and expense recalibration initiatives (c) | 2 | | 1 | | 7 | | | 3 | | 23 | |

| Income tax impact of above items | (2) | | (13) | | (2) | | | (15) | | (6) | |

| Adjusted net income | $ | 212 | | $ | 178 | | $ | 278 | | | $ | 390 | | $ | 614 | |

| Average assets | $ | 79,207 | | $ | 83,617 | | $ | 90,355 | | | $ | 81,412 | | $ | 87,761 | |

| Impact of adjusted items to average assets | — | | — | | (1) | | | (2) | | (1) | |

| Adjusted average assets | $ | 79,207 | | $ | 83,617 | | $ | 90,354 | | | $ | 81,410 | | $ | 87,760 | |

| ROA: | | | | | | |

| Reported | 1.05 | % | 0.66 | % | 1.21 | % | | 0.85 | % | 1.37 | % |

| Adjusted | 1.07 | | 0.86 | | 1.24 | | | 0.96 | | 1.41 | |

| Average common shareholder’s equity | $ | 5,454 | | $ | 5,683 | | $ | 5,544 | | | $ | 5,568 | | $ | 5,440 | |

| Impact of adjusted items to average common shareholders’ equity | — | | 1 | | 3 | | | 6 | | 4 | |

| Adjusted average common shareholder’s equity | $ | 5,454 | | $ | 5,684 | | $ | 5,547 | | | $ | 5,574 | | $ | 5,444 | |

| ROE: | | | | | | |

| Reported | 14.78 | % | 9.33 | % | 19.38 | % | | 12.00 | % | 21.73 | % |

| Adjusted | 15.18 | | 12.22 | | 19.72 | | | 13.66 | | 22.35 | |

(a)The planned cessation of BSBY announced in November 2023 resulted in the de-designation of certain interest rate swaps requiring reclassification of amounts recognized in AOCI into earnings. Settlement of interest payments and changes in fair value for each impacted swap are recorded as risk management hedging losses until the swap is re-designated.

(b)Additional FDIC insurance expense resulting from the FDIC Board of Directors’ November 2023 approval of a special assessment to recover the loss to the Deposit Insurance Fund following the failures of Silicon Valley Bank and Signature Bank.

(c)Related to certain initiatives to transform the retail banking delivery model, align corporate facilities and optimize technology platforms, as well as calibrate expenses to enhance earnings power while creating capacity for strategic and risk management initiatives.

Common equity tier 1 capital ratio removes preferred stock from the Tier 1 capital ratio as defined by and calculated in conformity with bank regulations. The tangible common equity ratio removes the effect of intangible assets from capital and total assets. Tangible common equity per share of common stock removes the effect of intangible assets from common shareholders' equity per share of common stock.

| | | | | | | | | | | |

| June 30, | March 31, | June 30, |

| (in millions, except share data) | 2024 | 2024 | 2023 |

| Common Equity Tier 1 Capital (a): | | | |

| Tier 1 capital | $ | 8,980 | | $ | 8,863 | | $ | 8,705 | |

| Less: | | | |

| Fixed-rate reset non-cumulative perpetual preferred stock | 394 | | 394 | | 394 | |

| Common equity tier 1 capital | $ | 8,586 | | $ | 8,469 | | $ | 8,311 | |

| Risk-weighted assets | $ | 74,338 | | $ | 73,794 | | $ | 80,624 | |

| Tier 1 capital ratio | 12.08 | % | 12.01 | % | 10.80 | % |

| Common equity tier 1 capital ratio | 11.55 | | 11.48 | | 10.31 | |