Filed by Colombier Acquisition Corp.

pursuant to Rule 425 under the Securities Act of

1933

and deemed filed pursuant to Rule 14a-12

under the Securities Exchange Act of 1934

Subject Company: Colombier Acquisition Corp.

Commission File No. 001-40457

Date: June 9, 2023

The Big Money Show – Interview with Michael

Seifert

The Big Money Show, Fox Business

June 9, 2023

Taylor Riggs: Go woke go broke, just ask Target. The beer losing

out to Modelo for now the title of America's most popular. Target hit was another Wall Street downgrade, shares are down 26% this quarter

alone. Those company controversies are sending customers to a new Patriotic marketplace. It helps connect Americans to businesses that

represent their values. Joining us now PublicSq. founder and CEO Michael Seifert. How much demand have you been seeing in the last few

weeks or months?

Michael Seifert: Well, first of all, thank you for having me.

I can actually quantify, that since the Bud Light debacle began, about two months ago, we have doubled our entire membership base. So,

we went from half a million members right about to over a million membership accounts on the platform just in the last two months. And

it's because Americans are tired of feeling underrepresented. There's an entire faction of Americans that love their country, the Constitution

and the values that it protects, that have felt like companies like Bud Light, have forgotten them. Target, same deal. Target's primary

audience is the mama bears. And so, these moms are not happy at what's happening with their kids, so we wave our hand and say we're an

alternative here where you can trust that these brands are not going to lecture you about your political views. And in the process, we've

had the most successful two months of our existence.

Brian Brenberg: So, Mama Bear says I'm tired to Target I want

something else. She goes to PublicSq. and she finds what?

Michael Seifert: She finds pretty much everything you can imagine

that you would find at Target. In fact, we always surprise people. We have toilet paper, paper towels, housecleaning goods.

* * * * *

Additional Information and Where to Find It

In connection with the proposed transaction (the “Proposed

Transaction”), Colombier Acquisition Corp. (“Colombier”) has filed a registration statement on Form S-4 (as

amended and as may be further amended or supplemented from time to time, the “Form S-4” or the “Registration

Statement”) with the U.S. Securities and Exchange Commission (the “SEC”), which includes a preliminary proxy

statement and a prospectus in connection with the Proposed Transaction. STOCKHOLDERS OF COLOMBIER ARE ADVISED TO READ, WHEN AVAILABLE,

THE PRELIMINARY PROXY STATEMENT, ANY AMENDMENTS THERETO, THE DEFINITIVE PROXY STATEMENT, THE PROSPECTUS AND ALL OTHER RELEVANT DOCUMENTS

FILED OR THAT WILL BE FILED WITH THE SEC IN CONNECTION WITH THE PROPOSED TRANSACTION AS THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN

IMPORTANT INFORMATION. HOWEVER, THIS DOCUMENT WILL NOT CONTAIN ALL THE INFORMATION THAT SHOULD BE CONSIDERED CONCERNING THE PROPOSED TRANSACTION.

IT IS ALSO NOT INTENDED TO FORM THE BASIS OF ANY INVESTMENT DECISION OR ANY OTHER DECISION IN RESPECT OF THE PROPOSED TRANSACTION. When

available, the definitive proxy statement and other relevant documents will be mailed to the stockholders of Colombier as of a record

date to be established for voting on the Proposed Transaction. Stockholders and other interested persons will also be able to obtain copies

of the preliminary proxy statement, the definitive proxy statement, the Registration Statement and other documents filed by Colombier

with the SEC that will be incorporated by reference therein, without charge, once available, at the SEC’s website at www.sec.gov.

Colombier’s stockholders will also be able to

obtain a copy of such documents, without charge, by directing a request to: Colombier Acquisition Corp., 214 Brazilian Avenue, Suite 200-J,

Palm Beach, FL 33480; e-mail: IRCLBR@longacresquare.com. These documents, once available, can also be obtained, without charge, at the

SEC’s website at www.sec.gov.

Participants in the Solicitation

Colombier, PSQ Holdings, Inc. (“PublicSq.”)

and their respective directors and executive officers may be deemed participants in the solicitation of proxies of Colombier’s stockholders

in connection with the Proposed Transaction. Colombier’s stockholders and other interested persons may obtain more detailed information

regarding the names, affiliations, and interests of certain of Colombier executive officers and directors in the solicitation by reading

Colombier’s final prospectus (the “IPO Prospectus”) filed with the SEC on June 9, 2021, in connection with Colombier’s

initial public offering, Colombier’s Annual Report on Form 10-K for the year ended December 31, 2022, as filed with the SEC on March

24, 2023, and Colombier’s other filings with the SEC. A list of the names of such directors and executive officers and information

regarding their interests in the Proposed Transaction, which may, in some cases, be different from those of stockholders generally, will

be set forth in the Registration Statement relating to the Proposed Transaction when it becomes available. These documents can be obtained

free of charge from the source indicated above.

No Offer or Solicitation

This communication shall not constitute a solicitation

of a proxy, consent or authorization with respect to any securities or in respect of the Proposed Transaction. This communication shall

not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any

states or jurisdictions in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities

laws of such state or jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of

Section 10 of the Securities Act of 1933, as amended or an exemption therefrom.

Forward-Looking Statements

This communication may contain forward-looking statements within the meaning

of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934, and for purposes of the “safe harbor”

provisions under the United States Private Securities Litigation Reform Act of 1995. Any statements other than statements of historical

fact contained herein are forward-looking statements. Such forward-looking statements include, but are not limited to, expectations, hopes,

beliefs, intentions, plans, prospects, financial results or strategies regarding PublicSq. and the Proposed Transaction and the future

held by the respective management teams of Colombier or PublicSq., the anticipated benefits and the anticipated timing of the Proposed

Transaction, future financial condition and performance of PublicSq. and expected financial impacts of the Proposed Transaction (including

future revenue, pro forma enterprise value and cash balance), the satisfaction of closing conditions to the Proposed Transaction, financing

transactions, if any, related to the Proposed Transaction, the level of redemptions of Colombier’s public stockholders and the products

and markets and expected future performance and market opportunities of PublicSq. These forward-looking statements generally are identified

by the words “anticipate,” “believe,” “could,” “expect,” “estimate,” “future,”

“intend,” “may,” “might,” “strategy,” “opportunity,” “plan,” “project,”

“possible,” “potential,” “project,” “predict,” “scales,” “representative

of,” “valuation,” “should,” “will,” “would,” “will be,” “will

continue,” “will likely result,” and similar expressions, but the absence of these words does not mean that a statement

is not forward-looking. Forward-looking statements are predictions, projections and other statements about future events that are based

on current expectations and assumptions and, as a result, are subject to risks and uncertainties. Many factors could cause actual future

events to differ materially from the forward-looking statements in this communication, including, without limitation: (i) the risk that

the Proposed Transaction may not be completed in a timely manner or at all, which may adversely affect the price of Colombier’s

securities, (ii) the risk that the Proposed Transaction may not be completed by Colombier’s business combination deadline and the

potential failure to obtain an extension of the business combination deadline if sought by Colombier, (iii) the failure to satisfy the

conditions to the consummation of the Proposed Transaction, including, among others, the condition that Colombier has cash or cash equivalents

of at least $33 million (subject to reduction for (x) transaction expenses of Colombier and PublicSq., up to an aggregate of $15 million,

and (y) the aggregate amount of any additional private financing transactions by PublicSq. consummated prior to closing in accordance

with the terms of the Merger Agreement), and the requirement that the Merger Agreement and the transactions contemplated thereby be approved

by the stockholders of Colombier and by the stockholders of PublicSq., respectively, (iv) the failure to obtain regulatory approvals,

as applicable, required to consummate the Proposed Transaction, (v) the occurrence of any event, change or other circumstance that could

give rise to the termination of the Merger Agreement, (vi) the effect of the announcement or pendency of the Proposed Transaction on PublicSq.’s

business relationships, operating results, and business generally, (vii) risks that the Proposed Transaction disrupts current plans and

operations of PublicSq., (viii) the outcome of any legal proceedings that may be instituted against PublicSq. or against Colombier related

to the Merger Agreement or the Proposed Transaction, (ix) the ability to satisfy and maintain the listing of Colombier’s securities

on the New York Stock Exchange or another national securities exchange, (x) changes in the competitive industries and markets in which

PublicSq. operates, or plans to operate; variations in performance across competitors, changes in laws and regulations affecting PublicSq.’s

business and changes in the combined capital structure, (xi) the ability to implement business plans, growth, marketplace and other expectations

after the completion of the Proposed Transaction, and identify and realize additional opportunities, (xii) the potential inability of

PublicSq. to achieve its business and consumer growth and technical development plans, (xiii) the ability of PublicSq. to enforce its

current or future intellectual property, including patents and trademarks, along with potential claims of infringement by PublicSq. of

the intellectual property rights of others, (xiv) risk of loss of key influencers, media outlets and promoters of PublicSq.’s business

or a loss of reputation of PublicSq. or reduced interest in the mission and values of PublicSq. and the segment of the consumer marketplace

it intends to serve and (xv) the risk of economic downturn, increased competition, a changing regulatory landscape and related impacts

that could occur in the highly competitive consumer marketplace, both online and through “bricks and mortar” operations. The

foregoing list of factors is not exhaustive. Recipients should carefully consider such factors and the other risks and uncertainties described

and to be described in the “Risk Factors” section of Colombier’s IPO Prospectus, Colombier’s Annual Report on

Form 10-K for the year ended December 31, 2022, as filed with the SEC on March 24, 2023, the Registration Statement, and subsequent periodic

reports filed by Colombier with the SEC, and other documents filed or to be filed by Colombier from time to time with the SEC. These filings

identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those

contained in the forward-looking statements. Forward-looking statements speak only as of the date they are made. Recipients are cautioned

not to put undue reliance on forward-looking statements, and neither PublicSq. nor Colombier assume any obligation to, nor intend to,

update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise, except as required

by law. Neither PublicSq. nor Colombier gives any assurance that either PublicSq. or Colombier, or the combined company, will achieve

its expectations.

Information Sources; No Representations

The communication furnished herewith has been prepared

for use by Colombier and PublicSq. in connection with the Proposed Transaction. The information therein does not purport to be all-inclusive.

The information therein is derived from various internal and external sources, with all information relating to the business, past performance,

results of operations and financial condition of Colombier derived entirely from Colombier and all information relating to the business,

past performance, results of operations and financial condition of PublicSq. derived entirely from PublicSq. No representation is made

as to the reasonableness of the assumptions made with respect to the information therein, or to the accuracy or completeness of any projections

or modeling or any other information contained therein. Any data on past performance or modeling contained therein is not an indication

as to future performance.

No representations or warranties, express or implied,

are given in respect of the communication. To the fullest extent permitted by law in no circumstances will Colombier or PublicSq., or

any of their respective subsidiaries, affiliates, shareholders, representatives, partners, directors, officers, employees, advisors or

agents, be responsible or liable for any direct, indirect or consequential loss or loss of profit arising from the use of the this communication

(including without limitation any projections or models), any omissions, reliance on information contained within it, or on opinions communicated

in relation thereto or otherwise arising in connection therewith, which information relating in any way to the operations of PublicSq.

has been derived, directly or indirectly, exclusively from PublicSq. and has not been independently verified by Colombier. Neither the

independent auditors of Colombier nor the independent auditors of or PublicSq. audited, reviewed, compiled or performed any procedures

with respect to any projections or models for the purpose of their inclusion in the communication and, accordingly, neither of them expressed

any opinion or provided any other form of assurances with respect thereto for the purposes of the communication.

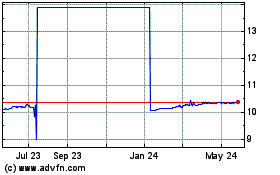

Colombier Acquisition (NYSE:CLBR)

Historical Stock Chart

From Oct 2024 to Nov 2024

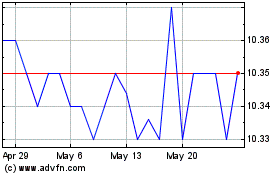

Colombier Acquisition (NYSE:CLBR)

Historical Stock Chart

From Nov 2023 to Nov 2024