Form NPORT-P - Monthly Portfolio Investments Report on Form N-PORT (Public)

October 28 2024 - 11:40AM

Edgar (US Regulatory)

Schedule of Investments (unaudited)

August 31, 2024

ClearBridge Energy Midstream Opportunity Fund Inc.

(Percentages shown based on Fund net assets)

|

|

|

|

|

|

|

Master Limited Partnerships — 80.8%

|

Diversified Energy Infrastructure — 42.8%

|

|

|

|

|

Enterprise Products Partners LP

|

|

|

|

|

|

|

Plains All American Pipeline LP

|

|

|

Plains GP Holdings LP, Class A Shares

|

|

|

Total Diversified Energy Infrastructure

|

|

Gathering/Processing — 15.8%

|

Hess Midstream LP, Class A Shares

|

|

|

Western Midstream Partners LP

|

|

|

Total Gathering/Processing

|

|

Global Infrastructure — 3.0%

|

Brookfield Infrastructure Partners LP

|

|

|

Liquids Transportation & Storage — 0.9%

|

Delek Logistics Partners LP

|

|

|

Natural Gas Transportation & Storage — 3.6%

|

Cheniere Energy Partners LP

|

|

|

Oil/Refined Products — 14.2%

|

|

|

|

|

|

|

|

|

Total Oil/Refined Products

|

|

|

|

Suburban Propane Partners LP

|

|

|

|

|

Total Master Limited Partnerships (Cost — $245,597,934)

|

|

|

|

|

|

|

|

|

|

|

|

|

Oil, Gas & Consumable Fuels — 57.6%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Commercial Services & Supplies — 0.5%

|

Aris Water Solutions Inc., Class A Shares

|

|

|

|

|

Total Common Stocks (Cost — $158,856,140)

|

|

Total Investments before Short-Term Investments (Cost — $404,454,074)

|

|

See Notes to Schedule of Investments.

ClearBridge Energy Midstream Opportunity Fund Inc. 2024 Quarterly Report

Schedule of Investments (unaudited) (cont’d)

August 31, 2024

ClearBridge Energy Midstream Opportunity Fund Inc.

(Percentages shown based on Fund net assets)

|

|

|

|

|

|

|

Short-Term Investments — 3.0%

|

JPMorgan 100% U.S. Treasury Securities Money Market Fund,

Institutional Class (Cost — $9,389,579)

|

|

|

|

|

|

Total Investments** — 141.9% (Cost — $413,843,653)

|

|

Mandatory Redeemable Preferred Stock, at Liquidation Value — (7.8)%

|

|

Other Liabilities in Excess of Other Assets — (34.1)%

|

|

Total Net Assets Applicable to Common Shareholders — 100.0%

|

|

|

|

Non-income producing security.

|

|

|

The entire portfolio is subject to a lien, granted to the lender and Senior Note holders,

to the extent of the borrowings outstanding and any additional

expenses.

|

|

|

Rate shown is one-day yield as of the end of the reporting period.

|

This Schedule of Investments is unaudited and is intended to provide information about the Fund’s investments as of the date of the schedule. Other information regarding the Fund is available in the Fund’s most recent annual or semi-annual shareholder report.

See Notes to Schedule of Investments.

ClearBridge Energy Midstream Opportunity Fund Inc. 2024 Quarterly Report

Notes to Schedule of Investments (unaudited)

1. Organization and significant accounting policies

ClearBridge Energy Midstream Opportunity Fund Inc. (the “Fund”) was incorporated in Maryland on April 5, 2011, and is registered as a non-diversified, closed-end management investment company under the

Investment Company Act of 1940, as amended (the “1940 Act”). The Board of Directors authorized 99,433,261 shares of $0.001 par value common stock. The Fund’s investment objective is to provide long-term investors a high level of total return with an emphasis on cash distributions. There can be no assurance that the Fund will achieve its investment objective.

The Fund seeks to achieve its objective by investing primarily in energy midstream

entities. Under normal market conditions, the Fund invests at least 80% of its Managed Assets in energy midstream entities including

entities structured as both partnerships and corporations (the 80% policy). For purposes of the 80% policy, the

Fund considers investments in midstream entities as those entities that provide midstream services including the gathering,

transporting, processing, fractionation, storing, refining, and distribution of oil, natural gas liquids and natural gas. The

Fund considers an entity to be within the energy sector if it derives at least 50% of its revenues from the business of exploring,

developing, producing, gathering, transporting, processing, fractionating, storing, refining, distributing, mining or

marketing natural gas, natural gas liquids (including propane), crude oil, refined petroleum products or coal. “Managed Assets” means net assets plus the amount of borrowings and assets attributable to any preferred stock of the Fund that may

be outstanding.

The Fund follows the accounting and reporting guidance in Financial Accounting Standards

Board (“FASB”) Accounting Standards Codification Topic 946, Financial Services – Investment Companies (“ASC 946”). The following are significant accounting policies consistently followed by the Fund and are in conformity with U.S.

generally accepted accounting principles (“GAAP”), including, but not limited to, ASC 946.

(a) Investment valuation. Equity securities for which market quotations are available are valued at the last

reported sales price or official closing price on the primary market or exchange on which they trade.

The valuations for fixed income securities (which may include, but are not limited to, corporate, government, municipal,

mortgage-backed, collateralized mortgage obligations and asset-backed securities) and certain derivative instruments

are typically the prices supplied by independent third party pricing services, which may use market prices or broker/dealer

quotations or a variety of valuation techniques and methodologies. The independent third party pricing services typically

use inputs that are observable such as issuer details, interest rates, yield curves, prepayment speeds, credit risks/spreads,

default rates and quoted prices for similar securities. Investments in open-end funds are valued at the closing net asset

value per share of each fund on the day of valuation. When the Fund holds securities or other assets that are denominated

in a foreign currency, the Fund will normally use the currency exchange rates as of 4:00 p.m. (Eastern Time). If independent

third party pricing services are unable to supply prices for a portfolio investment, or if the prices supplied are deemed

by the manager to be unreliable, the market price may be determined by the manager using quotations from one or more broker/dealers

or at the transaction price if the security has recently been purchased and no value has yet been obtained from

a pricing service or pricing broker. When reliable prices are not readily available, such as when the value of a security has

been significantly affected by events after the close of the exchange or market on which the security is principally traded,

but before the Fund calculates its net asset value, the Fund values these securities as determined in accordance with procedures approved by the Fund’s Board of Directors.

Pursuant to policies adopted by the Board of Directors, the Fund’s manager has been designated as the valuation designee and is responsible for the oversight of the daily valuation process. The Fund’s manager is assisted by the Global Fund Valuation Committee (the “Valuation Committee”). The Valuation Committee is responsible for making fair value determinations, evaluating the effectiveness of the Fund’s pricing policies, and reporting to the Fund’s manager and the Board of Directors. When determining the reliability of third party pricing information for investments

owned by the Fund, the Valuation Committee, among other things, conducts due diligence reviews of pricing vendors,

monitors the daily change in prices and reviews transactions among market participants.

The Valuation Committee will consider pricing methodologies it deems relevant and

appropriate when making fair value determinations. Examples of possible methodologies include, but are not limited to,

multiple of earnings; discount from market of a similar freely traded security; discounted cash-flow analysis; book value or

a multiple thereof; risk premium/yield analysis; yield to maturity; and/or fundamental investment analysis. The Valuation

Committee will also consider factors it deems relevant and appropriate in light of the facts and circumstances. Examples of

possible factors include, but are not limited to, the type of security; the issuer’s financial statements; the purchase price of the security; the discount from market value of unrestricted securities of the same class at the time of purchase; analysts’ research and observations from financial institutions; information regarding any transactions or offers with respect

to the security; the existence of merger

ClearBridge Energy Midstream Opportunity Fund Inc. 2024 Quarterly Report

Notes to Schedule of Investments (unaudited) (cont’d)

proposals or tender offers affecting the security; the price and extent of public

trading in similar securities of the issuer or comparable companies; and the existence of a shelf registration for restricted securities.

For each portfolio security that has been fair valued pursuant to the policies adopted

by the Board of Directors, the fair value price is compared against the last available and next available market quotations.

The Valuation Committee reviews the results of such back testing monthly and fair valuation occurrences are reported to

the Board of Directors quarterly.

The Fund uses valuation techniques to measure fair value that are consistent with

the market approach and/or income approach, depending on the type of security and the particular circumstance. The market

approach uses prices and other relevant information generated by market transactions involving identical or comparable

securities. The income approach uses valuation techniques to discount estimated future cash flows to present value.

GAAP establishes a disclosure hierarchy that categorizes the inputs to valuation techniques

used to value assets and liabilities at measurement date. These inputs are summarized in the three broad levels

listed below:

•

Level 1 — unadjusted quoted prices in active markets for identical investments

•

Level 2 — other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.)

•

Level 3 — significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments)

The inputs or methodologies used to value securities are not necessarily an indication

of the risk associated with investing in those securities.

The following is a summary of the inputs used in valuing the Fund’s assets carried at fair value:

|

|

|

|

|

Other Significant

Observable Inputs

(Level 2)

|

Significant

Unobservable

Inputs

(Level 3)

|

|

|

|

|

|

|

|

Master Limited Partnerships

|

|

|

|

|

|

|

|

|

|

|

Total Long-Term Investments

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

See Schedule of Investments for additional detailed categorizations.

|

ClearBridge Energy Midstream Opportunity Fund Inc. 2024 Quarterly Report

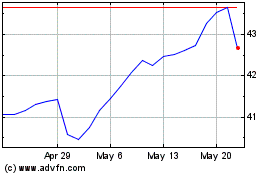

ClearBridge Energy Midst... (NYSE:EMO)

Historical Stock Chart

From Dec 2024 to Jan 2025

ClearBridge Energy Midst... (NYSE:EMO)

Historical Stock Chart

From Jan 2024 to Jan 2025