Claros Mortgage Trust, Inc. (NYSE: CMTG) (the “Company” or

“CMTG”) today reported its financial results for the quarter ended

September 30, 2022. The Company’s third quarter 2022 GAAP net

income was $42.1 million, or $0.30 per diluted share of common

stock, and Distributable Earnings (a non-GAAP financial measure

defined below) was $47.1 million, or $0.33 per diluted share of

common stock.

Third Quarter 2022 Highlights

- Originated approximately $878 million of total loan commitments

across six investments, of which $614 million was funded at

closing. New originations had a weighted average coupon of SOFR +

5.3% and a weighted average LTV of 67.4%.

- Funded approximately $186 million of follow-on fundings related

to the existing loan portfolio.

- Received loan repayment proceeds of $559 million.

- Paid a cash dividend of $0.37 per share of common stock for the

third quarter of 2022.

Subsequent to Quarter-End

- On November 8, CMTG’s Board of Directors authorized the

repurchase of up to $100 million of the Company’s common stock. The

repurchase program does not obligate the Company to acquire any

particular amount of shares and may be suspended or discontinued at

any time at the Company’s discretion.

“A focus on asset management execution coupled with a

disciplined approach to transitional lending opportunities enabled

us to deliver strong results for the quarter,” said Richard Mack,

Chief Executive Officer and Chairman of CMTG. “While uncertainty

and volatility are dominant macroeconomic themes right now, we

continued to diversify our portfolio with a majority of our $878

million in new loan originations in the third quarter

collateralized by cash-flowing multifamily assets.”

“As we move through the fourth quarter and into 2023, we believe

the depth of our team’s experience in managing our portfolio

through market volatility as well as our conservative underwriting

practices, moderate leverage, and strong balance sheet with ample

liquidity set us up well to capture the compelling investment

opportunities in the marketplace.”

Teleconference Details

A conference call to discuss CMTG’s financial results will be

held on Thursday, November 10, 2022, at 10:00 a.m. ET. The

conference call may be accessed by dialing 1-844-200-6205 and

referencing the Claros Mortgage Trust, Inc. teleconference call;

access code 466886.

The conference call will also be broadcast live over the

internet and may be accessed through the Investor Relations section

of CMTG’s website at www.clarosmortgage.com. The earnings

presentation accompanying this release and containing supplemental

information about the Company’s financial results may also be

accessed through this website in advance of the call.

For those unable to listen to the live broadcast, a webcast

replay will be available on CMTG’s website or by dialing

1-866-813-9403, access code 646223, beginning approximately two

hours after the event.

About Claros Mortgage Trust,

Inc.

CMTG is a real estate investment trust that is focused primarily

on originating senior and subordinate loans on transitional

commercial real estate assets located in major markets across the

U.S. CMTG is externally managed and advised by Claros REIT

Management LP, an affiliate of Mack Real Estate Credit Strategies,

L.P. Additional information can be found on the Company’s website

at www.clarosmortgage.com.

Forward-Looking

Statements

Certain statements contained in this press release may be

considered forward-looking statements within the meaning of Section

27A of the Securities Act of 1933, as amended, and Section 21E of

the Securities Exchange Act of 1934, as amended. CMTG intends for

all such forward-looking statements to be covered by the applicable

safe harbor provisions for forward-looking statements contained in

those acts. Such forward-looking statements can generally be

identified by CMTG’s use of forward-looking terminology such as

“may,” “will,” “expect,” “intend,” “anticipate,” “estimate,”

“believe,” “continue,” “seek,” “objective,” “goal,” “strategy,”

“plan,” “focus,” “priority,” “should,” “could,” “potential,”

“possible,” “look forward,” “optimistic,” or other similar words.

Readers are cautioned not to place undue reliance on these

forward-looking statements, which speak only as of the date of this

press release. Such statements are subject to certain risks and

uncertainties, including known and unknown risks, which could cause

actual results to differ materially from those projected or

anticipated. Therefore, such statements are not intended to be a

guarantee of CMTG’s performance in future periods. Except as

required by law, CMTG does not undertake any obligation to update

or revise any forward-looking statements contained in this

release.

Definitions

Distributable Earnings:

Distributable Earnings is a non-GAAP measure used to evaluate

the Company’s performance excluding the effects of certain

transactions, non-cash items and GAAP adjustments, as determined by

our Manager, which the Company believes are not necessarily

indicative of the Company’s current performance and operations.

Distributable Earnings is a non-GAAP measure, which the Company

defines as net income as determined in accordance with GAAP,

excluding (i) non-cash stock-based compensation expense (income),

(ii) incentive fees, (iii) real estate depreciation and

amortization, (iv) any unrealized gains or losses from

mark-to-market valuation changes (other than permanent impairments)

that are included in net income for the applicable period, (v)

one-time events pursuant to changes in GAAP and (vi) certain

non-cash items, which in the judgment of the Company’s Manager,

should not be included in Distributable Earnings. Distributable

Earnings is substantially the same as Core Earnings excluding

incentive fees, as defined in the Management Agreement, for the

periods presented.

The Company believes that Distributable Earnings provides

meaningful information to consider in addition to the Company’s net

income and cash flows from operating activities determined in

accordance with GAAP. The Company believes the Distributable

Earnings measure helps it to evaluate the Company’s performance

excluding the effects of certain transactions, non-cash items and

GAAP adjustments, as determined by the Company’s Manager, that it

believes are not necessarily indicative of the Company’s current

performance and operations. Distributable Earnings does not

represent net income or cash flows from operating activities and

should not be considered as an alternative to GAAP net income, an

indication of the Company’s cash flows from operating activities, a

measure of the Company’s liquidity or an indication of funds

available for the Company’s cash needs. In addition, the Company’s

methodology for calculating Distributable Earnings may differ from

the methodologies employed by other companies to calculate the same

or similar supplemental performance measures and, accordingly, the

Company’s reported Distributable Earnings may not be comparable to

the Distributable Earnings reported by other companies.

In order to maintain the Company’s status as a REIT, the Company

is required to distribute at least 90% of its REIT taxable income,

determined without regard to the deduction for dividends paid and

excluding net capital gain, as dividends. Distributable Earnings,

and other similar measures, have historically been a useful

indicator of mortgage REITs’ ability to cover their dividends, and

to mortgage REITs themselves in determining the amount of any

dividends. Distributable Earnings is a key factor considered by the

board of directors in setting the dividend and as such the Company

believes Distributable Earnings is useful to investors.

Accordingly, the Company believes providing Distributable Earnings

on a supplemental basis to the Company’s net income as determined

in accordance with GAAP is helpful to its stockholders in assessing

the overall performance of its business.

While Distributable Earnings excludes the impact of the

Company’s unrealized current provision for credit losses, loan

losses are charged off and recognized through Distributable

Earnings when deemed non-recoverable. Non-recoverability is

determined (i) upon the resolution of a loan (i.e. when the loan is

repaid, fully or partially, or in the case of foreclosure, when the

underlying asset is sold), or (ii) with respect to any amount due

under any loan, when such amount is determined to be

non-collectible.

Claros Mortgage Trust,

Inc. Reconciliation of Distributable Earnings to Net Income

Attributable to Common Stockholders (Amounts in thousands,

except share and per share data)

Three Months Ended

September 30, 2022

June 30, 2022

Net income attributable to common

stock(1):

$

42,071

$

63,234

Adjustments:

Non-cash stock-based compensation

expense

3,426

604

Provision for current expected credit loss

reserve

2,352

8,530

Depreciation expense

2,064

1,998

Unrealized gain on interest rate cap

(2,776

)

(2,837

)

Distributable Earnings prior to

principal charge-offs

$

47,137

$

71,529

Principal charge-offs

-

(11,500

)

Distributable Earnings

$

47,137

$

60,029

Weighted average diluted shares –

Distributable Earnings

141,589,433

140,045,514

Basic and diluted earnings per share

$

0.30

$

0.45

Distributable Earnings per share prior to

principal charge-offs, basic and diluted

$

0.33

$

0.51

Distributable Earnings per share, basic

and diluted

$

0.33

$

0.43

- Net income attributable to common stock for the three months

ended June 30, 2022 includes a realized gain on sale of loan of

$30.1 million, or $0.21 per share of Distributable Earnings.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20221109005997/en/

Investor Relations: Claros Mortgage Trust, Inc.

Anh Huynh 212-484-0090 cmtgIR@mackregroup.com Media

Relations: Financial Profiles Kelly McAndrew

203-613-1552 Kmcandrew@finprofiles.com

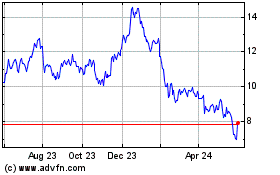

Claros Mortgage (NYSE:CMTG)

Historical Stock Chart

From Oct 2024 to Nov 2024

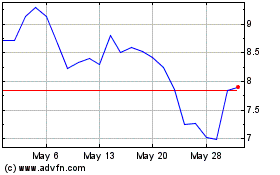

Claros Mortgage (NYSE:CMTG)

Historical Stock Chart

From Nov 2023 to Nov 2024