Cenovus announces Atlantic assets restructuring plan

September 08 2021 - 5:16PM

Cenovus Energy Inc. (TSX: CVE) (NYSE: CVE) has entered into

agreements with its partners in the Atlantic region to restructure

its working interests in the Terra Nova and White Rose projects,

providing improved economics for the company’s regional portfolio.

These agreements will increase Cenovus’s working interest in

Terra Nova and, if a decision is taken to restart West White Rose,

reduce the company’s working interest in the White Rose field.

Cenovus’s working interest in Terra Nova will be 34%, up from

13%. The company will receive $78 million from the exiting partners

as a contribution towards future Terra Nova asset retirement

obligations. The Terra Nova asset life extension project will

proceed, extending the life of the field to 2033. Production is

expected to resume before the end of 2022, with gross production

expected to reach approximately 29,000 barrels per day in

2023. Including funding from the Government of Newfoundland and

Labrador, the net to Cenovus outlay to restart Terra Nova is

expected to be approximately $60 million to first oil.

“Sanctioning the Terra Nova asset life extension provides a

superior value proposition for our shareholders compared with the

alternative of abandoning and decommissioning the project,” said

Alex Pourbaix, Cenovus President & Chief Executive Officer.

“While we are still evaluating whether to proceed with West White

Rose, the capital risk in our portfolio will be reduced if we

decide to move forward.”

Cenovus and Suncor, as part of the restructuring, have entered

into an agreement whereby Cenovus will decrease its working

interest in the White Rose field and satellite extensions while

Suncor will take a larger stake, contingent upon approval of the

West White Rose project restarting. Cenovus would reduce its stake

in the original field to 60% from 72.5% and to 56.375% from 68.875%

in the satellite extensions. Cenovus and its partners continue to

evaluate their options on the West White Rose Project, with a

decision to be made by mid-2022.

Cenovus continues to progress swiftly towards its $10 billion

net debt target, which it expects to achieve later this year. At

that point the company expects to begin allocating some of its free

funds flow toward enhancing shareholder returns.

Advisory Presentation Basis

Production volumes are presented on a before royalties basis,

unless otherwise stated.

Non-GAAP Measures and Additional SubtotalsThis

presentation contains references to net debt, which is a non-GAAP

measure. This measure does not have a standardized meaning as

prescribed by IFRS. Readers should not consider this measure in

isolation or as a substitute for analysis of the company’s results

as reported under IFRS. This measure is defined differently by

different companies and therefore is not comparable to similar

measures presented by other issuers. For definitions, as well as

reconciliations to GAAP measures, and more information on this and

other non-GAAP measures and additional subtotals, refer to

“Non-GAAP Measures and Additional Subtotals” on page 1 of Cenovus’s

Management’s Discussion and Analysis (MD&A) for the period

ended June 30, 2021 (available on SEDAR at sedar.com, on EDGAR at

sec.gov and Cenovus’s website at cenovus.com.)

Forward-looking Information This news release

contains certain forward-looking statements and forward-looking

information (collectively referred to as “forward-looking

information”) within the meaning of applicable securities

legislation, including the United States Private Securities

Litigation Reform Act of 1995, about our current expectations,

estimates and projections about the future, based on certain

assumptions made by us in light of our experience and perception of

historical trends. Although we believe that the expectations

represented by such forward-looking information are reasonable,

there can be no assurance that such expectations will prove to be

correct.

Forward-looking information in this news release is identified

by words such as “achieve”, “contingent”, “continue”, “expected”,

“forward”, “future”, “plan", “progress”, “target”, “will”, and

similar expressions, and includes suggestions of future outcomes,

including, but not limited to, statements about: general and 2021

priorities; Cenovus’s increased working interest in Terra Nova; the

amount to be received from the exiting partners as a contribution

towards future Terra Nova asset retirement obligations; the

extension of the life of the Terra Nova field; the expectation that

production from Terra Nova will resume before the end of 2022;

expected production from Terra Nova in 2023; the expected net to

Cenovus outlay to restart Terra Nova to first oil; the reduction to

the capital risk in our portfolio if we proceed with West White

Rose; plans to decrease our working interest in White Rose

contingent upon approval of the restart of West White Rose;

expected timing of the decision to restart West White Rose; our $10

billion net debt target and expected timing to achieve it; and

plans to consider opportunities for incremental shareholder returns

and investment in the business.

Developing forward-looking information involves reliance on a

number of assumptions and consideration of certain risks and

uncertainties, some of which are specific to Cenovus and others

that apply to the industry generally. The factors or assumptions on

which the forward-looking information is based include, but are not

limited to: our ability to achieve net debt of $10 billion by the

end of 2021; approval of the West White Rose project restart; our

ability to access sufficient capital and insurance coverage to

pursue development plans; and the assumptions inherent in our 2021

guidance available on cenovus.com.

Except as required by applicable securities laws, Cenovus

disclaims any intention or obligation to publicly update or revise

any forward-looking statements, whether as a result of new

information, future events or otherwise. Readers are cautioned that

the foregoing lists are not exhaustive and are made as at the date

hereof. Events or circumstances could cause actual results to

differ materially from those estimated or projected and expressed

in, or implied by, the forward-looking information. For additional

information regarding Cenovus’s material risk factors, the

assumptions made, and risks and uncertainties which could cause

actual results to differ from the anticipated results, refer to

“Risk Management and Risk Factors” and “Advisory” in Cenovus’s

MD&A for the period ended June 30, 2021 and to the risk

factors, assumptions and uncertainties described in other documents

Cenovus files from time to time with securities regulatory

authorities in Canada (available on SEDAR at sedar.com, on EDGAR at

sec.gov and Cenovus’s website at cenovus.com).

Additional information concerning Husky’s business and assets as of

December 31, 2020 may be found in Husky’s MD&A and Annual

Information Form, each of which is filed and available on SEDAR

under Cenovus’s profile at sedar.com.

Cenovus Energy Inc.

Cenovus Energy Inc. is an integrated energy company with oil and

natural gas production operations in Canada and the Asia Pacific

region, and upgrading, refining and marketing operations in Canada

and the United States. The company is focused on managing its

assets in a safe, innovative and cost-efficient manner, integrating

environmental, social and governance considerations into its

business plans. Cenovus common shares and warrants are listed on

the Toronto and New York stock exchanges, and the company’s

preferred shares are listed on the Toronto Stock Exchange. For more

information, visit cenovus.com.

Find Cenovus on Facebook, Twitter, LinkedIn, YouTube and

Instagram.

Cenovus contacts:

|

Investors |

Media |

| Investor Relations general

line403-766-7711 |

Media Relations general

line403-766-7751 |

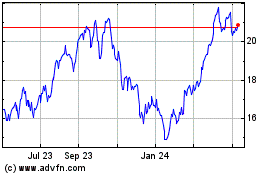

Cenovus Energy (NYSE:CVE)

Historical Stock Chart

From Jun 2024 to Jul 2024

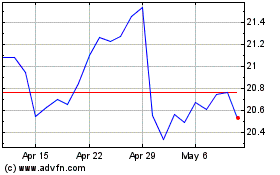

Cenovus Energy (NYSE:CVE)

Historical Stock Chart

From Jul 2023 to Jul 2024