Current Report Filing (8-k)

May 19 2021 - 5:10PM

Edgar (US Regulatory)

0001016281False00010162812021-05-192021-05-19

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 19, 2021 (May 17, 2021)

Carriage Services, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

|

1-11961

|

|

76-0423828

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

3040 Post Oak Boulevard, Suite 300

Houston, Texas 77056

(Address, including zip code, of principal executive offices)

Registrant's telephone number, including area code:

(713) 332-8400

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

Trading Symbol

|

Name of each exchange on which registered

|

|

Common Stock, par value $.01 per share

|

CSV

|

New York Stock Exchange

|

|

|

|

|

ITEM 5.02 DEPARTURE OF DIRECTORS OR CERTAIN OFFICERS; ELECTION OF DIRECTORS; APPOINTMENT OF CERTAIN OFFICERS; COMPENSATORY ARRANGEMENTS OF CERTAIN OFFICERS.

On May 17, 2021, James R. Schenck, a member of the Carriage Services, Inc. (the “Company”) Board of Directors (the “Board”), provided notice of his resignation from the Board of the Company, effective on that date. Mr. Schenck’s resignation was not a result of any disagreement with the Company on any matter related to its operations, policies or practices. The Company is grateful for Mr. Schenck’s service on the Board since 2016, including his service as Chair of the Corporate Governance Committee and as a member of the Audit Committee and the Compensation Committee. The Board has no immediate plans to fill the vacancy created by Mr. Schenck’s resignation.

ITEM 5.07 SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS.

The 2021 Annual Meeting of Stockholders of the Company was held on May 18, 2021. The matters presented for a vote and the related results are as follows:

PROPOSAL 1 - ELECTION OF DIRECTORS

Proposal 1 was the election of the nominees to serve as Class I directors for a three-year term expiring on the date of the 2024 annual meeting. The result of the vote was as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nominee

|

|

Votes For

|

|

Votes Withheld

|

|

Broker Non-Votes

|

|

Melvin C. Payne

|

|

8,422,478

|

|

5,146,662

|

|

2,196,105

|

|

James R. Schenck

|

|

4,488,173

|

|

9,080,968

|

|

2,196,105

|

Pursuant to the foregoing vote, Mr. Payne was duly elected as a Class I director. Mr. Schenck resigned from his position on the Board prior to the vote being finalized.

PROPOSAL 2 - ADVISORY VOTE ON NAMED EXECUTIVE OFFICER COMPENSATION

Proposal 2 was to approve, on an advisory basis, our Named Executive Officer compensation. The result of the vote was as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Votes For

|

|

Votes Against

|

|

Abstentions

|

|

Broker Non-Votes

|

|

12,359,064

|

|

1,128,656

|

|

81,587

|

|

2,195,939

|

Pursuant to the foregoing vote, the Named Executive Officer compensation, as disclosed in the Proxy Statement for the 2021 Annual Meeting of Stockholders of the Company, was approved. The Board and the Compensation Committee will carefully consider the voting results when making future decisions regarding executive compensation.

PROPOSAL 3 – APPROVAL OF THE THIRD AMENDMENT TO THE AMENDED AND RESTATED CARRIAGE SERVICES, INC. 2007 EMPLOYEE STOCK PURCHASE PLAN

Proposal 3 was the approval of the Third Amendment to the Amended and Restated Carriage Services, Inc. 2007 Employee Stock Purchase Plan. The result of the vote was as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Votes For

|

|

Votes Against

|

|

Abstentions

|

|

Broker Non-Votes

|

|

13,489,642

|

|

31,037

|

|

48,627

|

|

2,195,939

|

Pursuant to the foregoing vote, the Third Amendment to the Amended and Restated Carriage Services, Inc. 2007 Employee Stock Purchase Plan was approved.

PROPOSAL 4 – APPROVAL OF THE FIRST AMENDMENT TO THE CARRIAGE SERVICES, INC. 2017 OMNIBUS INCENTIVE PLAN

Proposal 4 was the approval of the First Amendment to the Carriage Services, Inc. 2017 Omnibus Incentive Plan. The result of the vote was as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Votes For

|

|

Votes Against

|

|

Abstentions

|

|

Broker Non-Votes

|

|

7,819,568

|

|

5,688,530

|

|

61,209

|

|

2,195,939

|

Pursuant to the foregoing vote, the First Amendment to the Carriage Services, Inc. 2017 Omnibus Incentive Plan was approved.

PROPOSAL 5 – RATIFICATION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Proposal 5 was the ratification of Grant Thornton LLP as the independent registered public accounting firm for the fiscal year ending December 31, 2021. The result of the vote was as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Votes For

|

|

Votes Against

|

|

Abstentions

|

|

Broker Non-Votes

|

|

15,689,819

|

|

25,042

|

|

50,384

|

|

0

|

Pursuant to the foregoing vote, the appointment of Grant Thornton LLP as the independent registered public accounting firm for the fiscal year ending December 31, 2021 was ratified.

ITEM 7.01. REGULATION FD DISCLOSURE

On May 18, 2021, the Board authorized an increase in the Company’s share repurchase program to permit the Company to purchase up to an additional $25 million of its outstanding common shares. Prior to the Board’s approval of the increase, as of March 31, 2021, the Company had approximately $25.6 million authorization remaining under the original repurchase program. Accordingly, as of May 18, 2021, the Company had approximately $50.6 million of share repurchase authorization remaining under the revised repurchase program. The Company may repurchase shares from time to time in the open market or in other privately negotiated transactions, subject to market conditions and applicable Security and Exchange Commission rules. There is no specified expiration date for the Company’s repurchase program.

In accordance with General Instruction B.2 of Form 8-K, the information furnished under “Item 7.01. Regulation FD Disclosure,” shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall such information be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, Carriage Services, Inc. has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CARRIAGE SERVICES, INC.

|

|

|

|

|

|

|

Dated: May 19, 2021

|

By:

|

|

/s/ Steven D. Metzger

|

|

|

|

|

Steven D. Metzger

|

|

|

|

|

Senior Vice President, General Counsel & Secretary

|

|

|

|

|

|

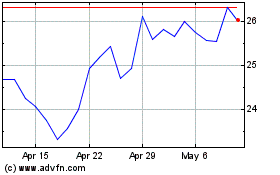

Carriage Services (NYSE:CSV)

Historical Stock Chart

From Apr 2024 to May 2024

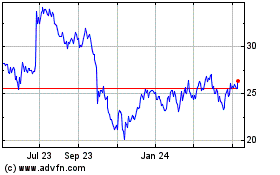

Carriage Services (NYSE:CSV)

Historical Stock Chart

From May 2023 to May 2024