Current Report Filing (8-k)

August 02 2021 - 4:23PM

Edgar (US Regulatory)

0000790051false00007900512021-08-022021-08-020000790051us-gaap:CommonStockMember2021-08-022021-08-020000790051us-gaap:PreferredStockMember2021-08-022021-08-02

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________________________________________

FORM 8-K

_____________________________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

_____________________________________________________

Date of Report (Date of earliest event reported): August 2, 2021

www.carlisle.com

CARLISLE COMPANIES INCORPORATED

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

|

1-9278

|

|

31-1168055

|

|

(State or other jurisdiction of incorporation or organization)

|

|

(Commission File Number)

|

|

(I.R.S. Employer Identification No.)

|

480-781-5000

(Registrant’s telephone number, including area code)

16430 North Scottsdale Road, Suite 400, Scottsdale, Arizona 85254

(Address of principal executive office, including zip code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of exchange on which registered

|

|

Common Stock, $1 par value

|

|

CSL

|

|

New York Stock Exchange

|

|

Preferred Stock Purchase Rights, $1 par value

|

|

n/a

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

☐ Emerging growth company

☐ If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 2.01. Completion of Acquisition or Disposition of Assets.

On August 2, 2021, certain direct and indirect wholly-owned subsidiaries of Carlisle Companies Incorporated, a Delaware corporation (the “Company”) (each of such direct and indirect wholly-owned subsidiaries of the Company, a “Seller” and, collectively, the “Sellers”), and certain direct and indirect wholly-owned subsidiaries of BRWS Parent LLC, a Delaware limited liability company and a portfolio company of One Rock Capital Partners (“CentroMotion”) (each of such direct and indirect wholly-owned subsidiaries, a “Buyer” and, collectively, the “Buyers”), completed the transactions contemplated by the Equity and Asset Purchase Agreement (the “Agreement”), dated as of May 24, 2021, by and among the Sellers and the Buyers.

Pursuant to the Agreement, the Sellers sold to the Buyers, and the Buyers purchased from the Sellers, equity interests and assets comprising the Company’s Carlisle Brake & Friction business segment (the “Acquired Business”) in exchange for (i) cash in the amount of $250 million, subject to certain adjustments, and (ii) the right to receive a post-closing earn-out payment of up to $125 million in incremental cash proceeds (the “Earn-Out Payment”), based on the EBITDA (earnings before interest, taxes, depreciation and amortization) of the Acquired Business for the year ending December 31, 2021. The calculation of EBITDA for the purpose of determining the Earn-Out Payment is subject to certain adjustments contained in the Agreement.

The material terms of the Agreement and details of the identities of the parties were previously reported in Item 1.01 of the Current Report on Form 8-K filed on May 26, 2021 with the United States Securities and Exchange Commission and are incorporated herein by reference. The description of the Agreement included or incorporated by reference in this Current Report on Form 8-K (this “Report”) is a summary only and is qualified in its entirety by reference to the full text of the Agreement, a copy of which is filed as Exhibit 2.1 to this Report and is incorporated by reference herein.

Item 7.01. Regulation FD Disclosure.

On August 2, 2021, the Company announced the closing of the transactions contemplated by the Purchase Agreement. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The information in this Item 7.01 of this Current Report on Form 8-K, including Exhibit 99.1, is being furnished herewith and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

|

|

|

|

|

|

|

|

|

|

Exhibit

Number

|

|

Exhibit Title

|

|

|

|

Equity and Asset Purchase Agreement, dated May 24, 2021, by and among Carlisle Fluid Technologies, Inc., Carlisle Global II Limited, Carlisle Industrial Brake & Friction, Inc., Carlisle International B.V., Carlisle Asia Pacific Ltd., Carlisle Intangible, LLC, Carlisle, LLC, Engineered Components and Systems, LLC, CMBF, LLC, Power-Packer Europa B.V., Power Packer North America, Inc., EC&S Holdings Hong Kong Limited and BRWS Parent LLC (solely for purposes of Section 8.3 thereto)

|

|

|

|

Press Release of Carlisle Companies Incorporated, dated August 2, 2021

|

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

*Schedules have been omitted pursuant to Item 601(b)(2) of Regulation S-K. A copy of any omitted schedule will be furnished supplementally to the Securities and Exchange Commission upon request.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CARLISLE COMPANIES INCORPORATED

|

|

|

|

|

|

|

Date:

|

August 2, 2021

|

By:

|

/s/ Robert M. Roche

|

|

|

|

|

Robert M. Roche

|

|

|

|

|

Vice President and Chief Financial Officer

|

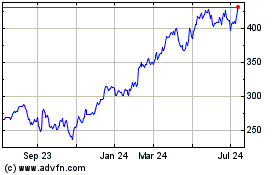

Carlisle Companies (NYSE:CSL)

Historical Stock Chart

From Aug 2024 to Sep 2024

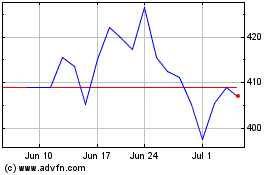

Carlisle Companies (NYSE:CSL)

Historical Stock Chart

From Sep 2023 to Sep 2024