Form DEFA14A - Additional definitive proxy soliciting materials and Rule 14(a)(12) material

October 10 2023 - 6:02AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a)

OF THE SECURITIES EXCHANGE ACT OF 1934

(Amendment No. )

|

Filed by the Registrant |

|

Filed by a Party other than the Registrant |

Check the appropriate box: |

|

Preliminary Proxy Statement |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

Definitive Proxy Statement |

|

Definitive Additional Materials |

|

Soliciting Material under §240.14a-12 |

CARDINAL HEALTH, INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if

other than the Registrant)

Cardinal Health, Inc.

7000 Cardinal Place

Dublin, OH 43017

SUPPLEMENT TO PROXY STATEMENT

FOR THE 2023 ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON NOVEMBER 15, 2023

On September 27, 2023, Cardinal

Health, Inc. (the “Company”) filed its definitive proxy statement (the “Proxy Statement”) for the

2023 Annual Meeting of Shareholders, which will be held virtually at 8:00 a.m., Eastern Time, on Wednesday, November 15,

2023. The Company is filing this supplement to the Proxy Statement (the “Supplement”) to correct the number of

restricted share units (“RSUs”) granted to named executive officers as reported in the “All Other Stock

Awards: Number of Shares of Stock or Units” column of the Grants of Plan-Based Awards for Fiscal 2023 table in the Proxy Statement. The full Grants of Plan-Based Awards for Fiscal 2023 table, as corrected, is included

below.

This Supplement should be read in conjunction with

the Proxy Statement. Except as specifically supplemented by the information contained herein, this Supplement does not modify any

other information set forth in the Proxy Statement. Information on how to vote your shares, or change or revoke your prior vote or

voting instruction, is available in the Proxy Statement.

Grants of Plan-Based

Awards for Fiscal 2023

The table below supplements our Summary Compensation Table by providing

additional information about our plan-based compensation for fiscal 2023.

| | |

| |

| |

Estimated Potential Payouts

Under

Non-Equity Incentive Plan Awards(1) | |

Estimated Potential Payouts

Under

Equity Incentive Plan Awards(2) | |

All Other

Stock Awards:

Number of | | Grant Date |

|

Name/

Award Type | |

Grant Date | |

Approval

Date | |

Threshold

($) | |

Target

($) | |

Maximum

($) | |

Threshold

(#) | |

Target

(#) | |

Maximum

(#) | |

Shares of

Stock or Units

(#)(3) | | Fair Value of

Stock Awards

($)(4) |

|

| Hollar | |

| |

| |

| | |

| | |

| | |

| | |

| | |

| | |

| | | |

|

| Annual Incentive | |

| |

| |

| 361,175 | |

| 1,805,877 | |

| 3,521,460 | |

| | |

| | |

| | |

| | | |

|

| PSUs(5) | |

8/15/2022 | |

8/9/2022 | |

| | |

| | |

| | |

| 57,882 | |

| 115,764 | |

| 270,888 | |

| | | 8,928,878 |

|

| RSUs(5) | |

8/15/2022 | |

8/9/2022 | |

| | |

| | |

| | |

| | |

| | |

| | |

| 84,322 | | 5,900,010 |

|

| Alt | |

| |

| |

| | |

| | |

| | |

| | |

| | |

| | |

| | | |

|

| Annual Incentive | |

| |

| |

| 82,545 | |

| 412,726 | |

| 804,816 | |

| | |

| | |

| | |

| | | |

|

| PSUs(6) | |

2/15/2023 | |

12/14/2022 | | | |

| | |

| | |

| | 15,908 |

| | 31,815 |

| | 74,447 |

| | |

| 2,815,628 |

|

| RSUs(6) | |

2/15/2023 | |

12/14/2022 | | | |

| | |

| | |

| | |

| | |

| | |

| | 12,726 |

| 1,000,009 |

|

| Mason | |

| |

| |

| | |

| | |

| | |

| | |

| | |

| | |

| | | |

|

| Annual Incentive | |

| |

| |

| 139,192 | |

| 695,959 | |

| 1,357,120 | |

| | |

| | |

| | |

| | | |

|

| PSUs | |

8/15/2022 | |

8/9/2022 | |

| | |

| | |

| | |

| 12,863 | |

| 25,725 | |

| 60,197 | |

| | | 1,984,169 |

|

| RSUs | |

8/15/2022 | |

8/9/2022 | |

| | |

| | |

| | |

| | |

| | |

| | |

| 17,150 | | 1,199,986 |

|

| Weitzman | |

| |

| |

| | |

| | |

| | |

| | |

| | |

| | |

| | | |

|

| Annual Incentive | |

| |

| |

| 114,140 | |

| 570,701 | |

| 1,112,867 | |

| | |

| | |

| | |

| | | |

|

| PSUs | |

8/15/2022 | |

8/15/2022 | |

| | |

| | |

| | |

| 3,573 | |

| 7,146 | |

| 16,722 | |

| | | 551,171 |

|

| RSUs | |

8/15/2022 | |

8/15/2022 | |

| | |

| | |

| | |

| | |

| | |

| | |

| 17,865 | | 1,250,014 |

|

| PSUs(7) | |

9/15/2022 | |

9/3/2022 | |

| | |

| | |

| | |

| 5,649 | |

| 11,297 | |

| 26,345 | |

| | | 871,338 |

|

| Mayer | |

| |

| |

| | |

| | |

| | |

| | |

| | |

| | |

| | | |

|

| Annual Incentive | |

| |

| |

| 133,384 | |

| 666,918 | |

| 1,300,490 | |

| | |

| | |

| | |

| | | |

|

| PSUs | |

8/15/2022 | |

8/9/2022 | |

| | |

| | |

| | |

| 11,791 | |

| 23,582 | |

| 55,182 | |

| | | 1,818,880 |

|

| RSUs | |

8/15/2022 | |

8/9/2022 | |

| | |

| | |

| | |

| | |

| | |

| | |

| 15,721 | | 1,099,998 |

|

| Kaufmann | |

| |

| |

| | |

| | |

| | |

| | |

| | |

| | |

| | | |

|

| Annual Incentive(8) | |

| |

| |

| 69,904 | |

| 349,521 | |

| 681,566 | |

| | |

| | |

| | |

| | | |

|

| English | |

| |

| |

| | |

| | |

| | |

| | |

| | |

| | |

| | | |

|

| Annual Incentive | |

| |

| |

| 26,232 | |

| 131,159 | |

| 255,760 | |

| | |

| | |

| | |

| | | |

|

| PSUs(9) | |

8/15/2022 | |

8/10/2022 | |

| | |

| | |

| | |

| 4,288 | |

| 8,575 | |

| 20,066 | |

| | | 661,390 |

|

| RSUs | |

8/15/2022 | |

8/10/2022 | |

| | |

| | |

| | |

| | |

| | |

| | |

| 2,144 | | 150,015 |

|

| Crawford | |

| |

| |

| | |

| | |

| | |

| | |

| | |

| | |

| | | |

|

| Annual Incentive(10) | |

| |

| |

| 56,135 | |

| 280,673 | |

| 547,312 | |

| | |

| | |

| | |

| | | |

|

| PSUs(10) | |

8/15/2022 | |

8/9/2022 | |

| | |

| | |

| | |

| 12,863 | |

| 25,725 | |

| 60,197 | |

| | | 1,984,169 |

|

| RSUs(10) | |

8/15/2022 | |

8/9/2022 | |

| | |

| | |

| | |

| | |

| | |

| | |

| 17,150 | | 1,199,986 |

|

| (1) |

This information relates to annual cash incentive award opportunities

with respect to fiscal 2023 performance. Amounts actually earned under the annual cash incentive awards are reported in the

Summary Compensation Table under the “Non-Equity Incentive Plan Compensation” column. |

| (2) |

“Equity Incentive Plan Awards” are PSUs granted during the fiscal

year under our 2021 LTIP. PSUs are eligible to vest after a three-year performance period based on (i) the sum of non-GAAP diluted EPS CAGR and average annual dividend yield, (ii) cost savings, and (iii) an Our Path Forward measure,

with a modifier based on TSR relative to the S&P 500 Health Care Index. PSUs accrue cash dividend equivalents that are

payable when, and only to the extent that, the PSUs vest. |

| (3) |

“All Other Stock Awards” are RSUs granted during the fiscal year

under our 2021 LTIP that vest ratably over three years and accrue cash dividend equivalents that are payable when, and only

to the extent that, the RSUs vest. |

| (4) |

We valued PSUs using a Monte Carlo simulation valuation model based on

the probable outcome of the performance conditions as of the grant date. The Monte Carlo model applies a risk-free interest

rate and expected volatility assumptions. The risk-free interest rate is assumed to equal the yield on U.S. Treasury

bonds on the grant date with remaining terms consistent with the remaining performance measurement period. Expected volatility

is based on the average of historical volatility over a look-back period commensurate with the remaining performance

measurement period ending on the grant date and the implied volatility from exchange-traded options as of the grant

date. The assumed per-share value was $77.13 for the PSUs granted on August 15, 2022 and September 15, 2022, using a

risk-free rate of 3.12% and expected volatility of 32.41%, and $88.50 for the PSUs granted on February 15, 2023, using

a risk-free rate of 4.47% and expected volatility of 26.81%. We valued RSUs by multiplying the closing price of our

common shares on the NYSE on the grant date by the number of RSUs awarded. Accounting values differ from the compensation

values of PSU and RSU awards discussed in the CD&A. |

| (5) |

Mr. Hollar received an additional accounting value of $1,653,513

of PSUs and an additional accounting value of $1,500,017 of RSUs in connection with his appointment to CEO. |

| (6) |

Mr. Alt received these PSUs and RSUs when he joined us as CFO. His sign-on bonus and initial long-term incentive awards were intended to address compensation forfeited at his former employer.

|

| (7) |

Ms. Weitzman received these PSUs in connection with her promotion to CEO,

Pharmaceutical Segment. |

| (8) |

Mr. Kaufmann received a prorated portion of his fiscal 2023 annual incentive

award as a benefit under the Severance Plan. |

| (9) |

Ms. English received an additional accounting value of $551,171 of PSUs in

connection with her appointment to Interim CFO. |

| (10) |

Mr. Crawford received a prorated portion of his fiscal 2023 annual incentive

award as a benefit under the Severance Plan. He forfeited the PSU and RSU awards when he departed the company on November

13, 2022 since they were not outstanding for at least six months, which was required to receive retirement treatment of long-term incentive awards. |

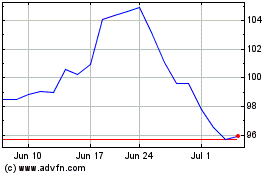

Cardinal Health (NYSE:CAH)

Historical Stock Chart

From Jun 2024 to Jul 2024

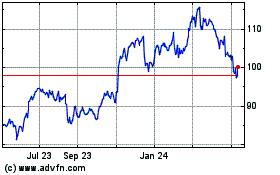

Cardinal Health (NYSE:CAH)

Historical Stock Chart

From Jul 2023 to Jul 2024