- Second quarter organic revenue growth

of 1.4 percent, with 1.9 percent organic growth in Identification

Solutions and 0.6 percent organic growth in Workplace Safety.

- Non-GAAP earnings from continuing

operations* growth of 12.5 percent to $15.0 million during the

quarter ended January 31, 2015 compared to $13.4 million in the

second quarter of last year.

- Non-GAAP earnings from continuing

operations per diluted Class A Nonvoting Common Share* growth of

16.0 percent to $0.29 during the quarter ended January 31, 2015

compared to $0.25 in the same quarter of the prior year. The

current quarter was positively impacted by a lower income tax rate

due to the extension of certain U.S. tax provisions that were

passed by Congress in late December.

Brady Corporation (NYSE: BRC) (“Brady” or “Company”), a world

leader in identification solutions, today reported its financial

results for its fiscal 2015 second quarter ended January 31,

2015.

Quarter Ended January 31, 2015 Financial Results:

Sales for the quarter ended January 31, 2015 decreased 2.9

percent to $282.6 million compared to $291.2 million in the second

quarter of fiscal 2014. Total organic sales increased 1.4 percent

and foreign currency translation decreased sales by 4.3 percent. By

segment, organic sales increased 1.9 percent in Identification

Solutions and 0.6 percent in Workplace Safety.

Earnings from continuing operations for the quarter ended

January 31, 2015 were $11.6 million compared to $10.5 million in

the prior year quarter. Non-GAAP net earnings from continuing

operations* for the current quarter were $15.0 million compared to

$13.4 million in the same quarter last year.

Net earnings from continuing operations per Class A Nonvoting

Common Share were $0.23 for the quarter ended January 31, 2015

compared to $0.20 in the same quarter last year. Non-GAAP earnings

from continuing operations per diluted Class A Nonvoting Common

Share* were $0.29 in the second quarter of fiscal 2015 compared to

$0.25 per share in the second quarter of fiscal 2014.

Six-Month Period Ended January 31, 2015 Financial

Results:

Sales for the six-month period ended January 31, 2015 decreased

1.0 percent to $592.9 million compared to $598.7 million in the

same period in fiscal 2014. Organic sales increased 1.9 percent and

the impact of foreign currency translation decreased sales by 2.9

percent. By segment, organic sales increased 2.1 percent in

Identification Solutions and 1.5 percent in Workplace Safety.

Earnings from continuing operations for the six-month period

ended January 31, 2015 were $27.1 million compared to $28.7 million

in the same period in fiscal 2014. Non-GAAP net earnings from

continuing operations* for the six-month period were $33.5 million

compared to $36.2 million in the same period in fiscal 2014.

Net earnings from continuing operations per Class A Nonvoting

Common share were $0.53 for the six-month period ended January 31,

2015 compared to $0.55 in the same period in fiscal 2014. Non-GAAP

earnings from continuing operations per diluted Class A Common

Share* were $0.65 in the six-month period ended January 31, 2015

compared to $0.69 in the same period in fiscal 2014.

Commentary:

“This marks the fourth consecutive quarter of organic sales

growth for Brady Corporation and the third consecutive quarter of

organic sales growth in our Workplace Safety business. Our gross

profit margin is also stabilizing as we near completion of our

facility consolidation activities. Our gross profit margin finished

at 48.9 percent, which is a 50 basis point improvement over the

first quarter of fiscal 2015,” said Brady President and Chief

Executive Officer, J. Michael Nauman. “Although our profitability

was impacted by costs related to the consolidation of our

manufacturing facilities, the level of incremental costs is

moderating and we expect completion of these activities by the end

of fiscal 2015. We are focused on executing business fundamentals

to drive organic sales growth and improve profitability while

investing in research and development and sales resources in

selected industries, as well as building an enhanced, scalable

digital platform that will generate value for Brady and its

customers.”

“Along with our stabilizing gross profit margins, we are also

seeing benefits from our focus on controlling selling, general, and

administrative expenses, which should aid in continuing our trend

of improving financial results,” said Brady’s Chief Financial

Officer, Aaron Pearce. “As we look to the second half of fiscal

2015, we also anticipate free cash flow to improve as we

systematically reduce our inventory levels, moderate our capital

expenditures and increase profitability.”

Fiscal 2015 Guidance:

The Company anticipates low single-digit organic sales growth in

fiscal 2015, with organic sales growth in both the Identification

Solutions and Workplace Safety platforms. Brady also expects a

full-year income tax rate in the mid-to-upper 20 percent range,

approximately $15 million of restructuring charges, $40 million of

depreciation and amortization expense and capital expenditures of

approximately $35 million in fiscal 2015.

Earnings from continuing operations per diluted Class A

Nonvoting Common Share, exclusive of restructuring charges and

other non-routine charges guidance remains unchanged at $1.50 to

$1.70. However, due to the strengthening of the US dollar against

other major currencies, the Company anticipates that its full-year

fiscal 2015 results will finish at the low end of this range. This

guidance is based on current exchange rates.

A webcast regarding Brady’s fiscal 2015 second quarter financial

results will be available at www.bradycorp.com beginning at 9:30 a.m. Central

Time today.

Brady Corporation is an international manufacturer and marketer

of complete solutions that identify and protect people, products

and places. Brady’s products help customers increase safety,

security, productivity and performance and include high-performance

labels, signs, safety devices, printing systems and software.

Founded in 1914, the Company has a diverse customer base in

electronics, telecommunications, manufacturing, electrical,

construction, medical, aerospace and a variety of other industries.

Brady is headquartered in Milwaukee, Wisconsin and as of August 1,

2014, employed approximately 6,400 people in its worldwide

businesses. Brady’s fiscal 2014 sales were approximately $1.23

billion. Brady stock trades on the New York Stock Exchange under

the symbol BRC. More information is available on the Internet at

www.bradycorp.com.

* See accompanying notes for Non-GAAP measures.

In this news release, statements that are not reported financial

results or other historic information are “forward-looking

statements.” These forward-looking statements relate to, among

other things, the Company's future financial position, business

strategy, targets, projected sales, costs, earnings, capital

expenditures, debt levels and cash flows, and plans and objectives

of management for future operations.

The use of words such as “may,” “will,” “expect,” “intend,”

“estimate,” “anticipate,” “believe,” “should,” “project” or “plan”

or similar terminology are generally intended to identify

forward-looking statements. These forward-looking statements by

their nature address matters that are, to different degrees,

uncertain and are subject to risks, assumptions, and other factors,

some of which are beyond Brady's control, that could cause actual

results to differ materially from those expressed or implied by

such forward-looking statements. For Brady, uncertainties arise

from: implementation of the healthcare strategy; implementation of

the Workplace Safety strategy; future competition; risks associated

with restructuring plans; future financial performance of major

markets Brady serves, which include, without limitation,

telecommunications, hard disk drive, manufacturing, electrical,

construction, laboratory, education, governmental, public utility,

computer, healthcare and transportation; technology changes and

potential security violations to the Company's information

technology system; fluctuations in currency rates versus the U.S.

dollar; risks associated with international operations;

difficulties associated with exports; Brady's ability to develop

and successfully market new products; risks associated with

identifying, completing, and integrating acquisitions; changes in

the supply of, or price for, parts and components; increased price

pressure from suppliers and customers; Brady's ability to retain

significant contracts and customers; risk associated with loss of

key talent; risks associated with divestitures and businesses held

for sale; risks associated with obtaining governmental approvals

and maintaining regulatory compliance; risk associated with product

liability claims; environmental, health and safety compliance costs

and liabilities; potential write-offs of Brady's substantial

intangible assets; risks associated with our ownership structure;

unforeseen tax consequences; Brady's ability to maintain compliance

with its debt covenants; increase in our level of debt; and

numerous other matters of national, regional and global scale,

including those of a political, economic, business, competitive,

and regulatory nature contained from time to time in Brady's U.S.

Securities and Exchange Commission filings, including, but not

limited to, those factors listed in the “Risk Factors” section

within Item 1A of Part I of Brady’s Form 10-K for the year ended

July 31, 2014.

These uncertainties may cause Brady's actual future results to

be materially different than those expressed in its forward-looking

statements. Brady does not undertake to update its forward-looking

statements except as required by law.

BRADY CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF EARNINGS (Unaudited; Dollars in

thousands, except per share data) Three months ended January

31, Six months ended January 31, 2015 2014 2015 2014 Net

sales $ 282,628 $ 291,194 $ 592,868 $ 598,724 Cost of products sold

144,425 148,658 304,503

298,341 Gross margin 138,203 142,536 288,365 300,383

Operating expenses: Research and development 8,948 8,440 18,579

17,027 Selling, general and administrative 107,565 111,426 216,846

224,159 Restructuring charges 4,879 4,324

9,157 11,163 Total operating

expenses 121,392 124,190 244,582 252,349 Operating income

16,811 18,346 43,783 48,034 Other income and (expense):

Investment and other income 211 255 535 1,017 Interest expense

(3,000 ) (3,676 ) (5,891 ) (7,397 )

Earnings from continuing operations before income taxes

14,022 14,925 38,427 41,654 Income tax expense 2,438

4,408 11,344 13,002

Earnings from continuing operations $ 11,584 $ 10,517

$ 27,083 $ 28,652 Earnings (loss) from discontinued

operations, net of income taxes — 5,907

(1,915 ) 11,701 Net earnings $ 11,584

$ 16,424 $ 25,168 $ 40,353

Earnings from continuing operations per Class A Nonvoting Common

Share: Basic $ 0.23 $ 0.20 $ 0.53 $ 0.55 Diluted $ 0.23 $ 0.20 $

0.53 $ 0.55 Earnings from continuing operations per Class B

Voting Common Share: Basic $ 0.23 $ 0.20 $ 0.51 $ 0.53 Diluted $

0.23 $ 0.20 $ 0.51 $ 0.53 Earnings (loss) from discontinued

operations per Class A Nonvoting Common Share: Basic $ — $ 0.11 $

(0.04 ) $ 0.22 Diluted $ — $ 0.11 $ (0.04 ) $ 0.22 Earnings

(loss) from discontinued operations per Class B Voting Common

Share: Basic $ — $ 0.11 $ (0.03 ) $ 0.23 Diluted $ — $ 0.11 $ (0.04

) $ 0.22 Net earnings per Class A Nonvoting Common Share:

Basic $ 0.23 $ 0.31 $ 0.49 $ 0.77 Diluted $ 0.23 $ 0.31 $ 0.49 $

0.77 Dividends $ 0.20 $ 0.195 $ 0.40 $ 0.39 Net earnings per

Class B Voting Common Share: Basic $ 0.23 $ 0.31 $ 0.48 $ 0.76

Diluted $ 0.23 $ 0.31 $ 0.47 $ 0.75 Dividends $ 0.20 $ 0.195 $

0.383 $ 0.373 Weighted average common shares outstanding (in

thousands): Basic 51,272 52,208 51,262 52,140 Diluted 51,348 52,494

51,330 52,457 BRADY CORPORATION AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS (Unaudited; Dollars in thousands)

January 31, 2015 July 31, 2014

ASSETS

Current assets:

Cash and cash equivalents

$ 93,299 $ 81,834 Accounts receivable—net 151,426 177,648

Inventories: Finished products 70,974 73,096 Work-in-process 19,315

17,689 Raw materials and supplies 26,649

22,490 Total inventories 116,938 113,275 Assets held for

sale — 49,542 Prepaid expenses and other current assets

43,953 41,543

Total current assets

405,616 463,842

Other assets: Goodwill 478,991 515,004 Other

intangible assets 81,526 91,014 Deferred income taxes 19,293 27,320

Other 20,775 22,314

Property, plant and equipment: Cost:

Land 5,924 7,875 Buildings and improvements 97,729 101,866

Machinery and equipment 283,773 288,409 Construction in progress

8,508 12,500 395,934 410,650 Less

accumulated depreciation 266,680 276,479

Property, plant and equipment—net 129,254

134,171

Total $ 1,135,455 $

1,253,665

LIABILITIES AND

STOCKHOLDERS’ INVESTMENT

Current liabilities: Notes payable $ 90,850 $ 61,422

Accounts payable 74,154 88,099 Wages and amounts withheld from

employees 32,535 38,064 Liabilities held for sale — 10,640 Taxes,

other than income taxes 5,928 7,994 Accrued income taxes 1,549

7,893 Other current liabilities 32,935 35,319 Current maturities on

long-term debt 42,514 42,514

Total

current liabilities 280,465 291,945

Long-term obligations,

less current maturities 143,778 159,296

Other

liabilities 65,652 69,348

Total

liabilities 489,895 520,589

Stockholders’ investment:

Common stock: Class A nonvoting common stock—Issued 51,261,487 and

51,261,487 shares, respectively and outstanding 47,748,984 and

47,704,196 shares, respectively 513 513 Class B voting common

stock—Issued and outstanding, 3,538,628 shares 35 35 Additional

paid-in capital 312,819 311,811 Earnings retained in the business

456,777 452,057 Treasury stock—3,512,503 and 3,477,291 shares,

respectively of Class A nonvoting

common stock, at cost

(94,089 ) (93,337 ) Accumulated other comprehensive (loss) income

(27,569 ) 64,156 Other (2,926 ) (2,159 )

Total

stockholders’ investment 645,560 733,076

Total $ 1,135,455 $ 1,253,665

BRADY CORPORATION AND SUBSIDIARIES CONSOLIDATED STATEMENTS

OF CASH FLOWS (Unaudited; Dollars in thousands) Six months

ended January 31, 2015 2014 Operating activities: Net earnings $

25,168 $ 40,353 Adjustments to reconcile net income to net cash

provided by operating activities: Depreciation and amortization

20,066 22,342 Non-cash portion of stock-based compensation expense

2,471 4,377 Non-cash portion of restructuring charges 896 97 Loss

on sale of business, net 426 — Deferred income taxes (781 ) (2,402

) Changes in operating assets and liabilities (net of effects of

business acquisitions/divestitures): Accounts receivable 10,918

(1,418 ) Inventories (10,840 ) (8,754 ) Prepaid expenses and other

assets (3,053 ) (3,505 ) Accounts payable and accrued liabilities

(15,423 ) (7,263 ) Income taxes (5,918 ) (2,050 ) Net

cash provided by operating activities 23,930 41,777

Investing activities: Purchases of property, plant and equipment

(17,808 ) (17,607 ) Sale of business, net of cash retained 6,111 —

Other 4,173 89 Net cash used in

investing activities (7,524 ) (17,518 ) Financing

activities: Payment of dividends (20,449 ) (20,370 ) Proceeds from

issuance of common stock 847 10,894 Proceeds from borrowing on

notes payable 47,818 3,187 Repayment of borrowing on notes payable

(18,390 ) (30,000 ) Income tax on the exercise of stock options and

deferred compensation distributions, and other (3,830 )

(984 ) Net cash provided by (used in) financing activities

5,996 (37,273 ) Effect of exchange rate changes on cash

(10,937 ) 1,072 Net increase (decrease) in cash and cash

equivalents 11,465 (11,942 ) Cash and cash equivalents, beginning

of period 81,834 91,058 Cash and

cash equivalents, end of period $ 93,299 $ 79,116

Supplemental disclosures: Cash paid during the period for:

Interest $ 6,146 $ 7,283 Income taxes, net of refunds 15,727 14,083

BRADY CORPORATION AND

SUBSIDIARIES SEGMENT INFORMATION (Unaudited; Dollars in

thousands) Three Months Ended January 31, Six Months Ended

January 31, 2015 2014 2015 2014

SALES TO EXTERNAL CUSTOMERS

ID Solutions $ 192,065 $ 194,732 $ 404,162 $ 404,278 Workplace

Safety 90,563 96,462 188,706

194,446 Total $ 282,628 $ 291,194

$ 592,868 $ 598,724

SALES

INFORMATION ID Solutions

Organic

1.9 % 2.5 % 2.1 % 2.9 % Currency (3.3 )% (0.5 )% (2.1 )% (0.4 )%

Acquisitions — % 13.8 % — % 19.8 %

Total (1.4 )% 15.8 % — % 22.3 %

Workplace Safety Organic 0.6 % (6.8 )% 1.5 % (8.4 )%

Currency (6.7 )% (0.9 )% (4.5 )% (0.8 )% Acquisitions — %

— % — % — % Total (6.1 )% (7.7

)% (3.0 )% (9.2 )%

Total Company Organic 1.4 %

(1.1 )% 1.9 % (1.6 )% Currency (4.3 )% (0.6 )% (2.9 )% (0.5 )%

Acquisitions — % 8.5 % — % 12.0 % Total

(2.9 )% 6.8 % (1.0 )% 9.9 %

SEGMENT PROFIT ID Solutions $ 35,719 $ 37,526 $ 79,186 $

88,493 Workplace Safety 12,776 14,668

28,315 33,042 Total $

48,495 $ 52,194 $ 107,501 $

121,535

SEGMENT PROFIT AS A PERCENT OF SALES ID

Solutions 18.6 % 19.3 % 19.6 % 21.9 % Workplace Safety 14.1

% 15.2 % 15.0 % 17.0 % Total 17.2 %

17.9 % 18.1 % 20.3 % Three

Months Ended January 31, Six Months Ended January 31, 2015 2014

2015 2014 Total segment profit $ 48,495 $ 52,194 $ 107,501 $

121,535 Unallocated amounts: Administrative costs (26,805 ) (29,524

) (54,561 ) (62,338 ) Restructuring charges (4,879 ) (4,324 )

(9,157 ) (11,163 ) Investment and other income 211 255 535 1,017

Interest expense (3,000 ) (3,676 ) (5,891 )

(7,397 ) Earnings from continuing operations before income

taxes $ 14,022 $ 14,925 $ 38,427 $ 41,654

GAAP to

NON-GAAP MEASURES (Unaudited; Dollars in Thousands, Except Per

Share Amounts) In accordance with the U.S. Securities

and Exchange Commission’s Regulation G, the following provides

definitions of the non-GAAP measures used in the earnings release

and the reconciliation to the most closely related GAAP measure.

Earnings from Continuing Operations Before Income

Taxes Excluding Certain Items: Brady is presenting the Non-GAAP

measure "Earnings from Continuing Operations Before Income Taxes

Excluding Certain Items." This is not a calculation based upon

GAAP. The amounts included in this Non-GAAP measure are derived

from amounts included in the Consolidated Financial Statements and

supporting footnote disclosures. We do not view these items to be

part of our sustainable results. We believe this profit measure

provides an important perspective of underlying business trends and

results and provides a more comparable measure from year to year.

The table below provides a reconciliation of Earnings from

Continuing Operations Before Income Taxes to Earnings from

Continuing Operations Before Income Taxes Excluding Certain Items:

Three Months Ended January 31, Six Months Ended

January 31, 2015 2014 2015 2014

Earnings from Continuing

Operations Before Income Taxes (GAAP measure) $ 14,022 $ 14,925

$ 38,427 $ 41,654 Restructuring charges 4,879 4,324 9,157 11,163

Earnings from Continuing Operations

Before Income Taxes Excluding Certain Items (non-GAAP

measure)

$ 18,901 $ 19,249 $

47,584 $ 52,817 Income Taxes

on Continuing Operations Excluding Certain Items: Brady is

presenting the Non-GAAP measure "Income Taxes on Continuing

Operations Excluding Certain Items." This is not a calculation

based upon GAAP. The amounts included in this Non-GAAP measure are

derived from amounts included in the Consolidated Financial

Statements and supporting footnote disclosures. We do not view

these items to be part of our sustainable results. We believe this

measure provides an important perspective of underlying business

trends and results and provides a more comparable measure from year

to year. The table below provides a reconciliation of Income Taxes

on Continuing Operations to Income Taxes on Continuing Operations

Excluding Certain Items: Three Months Ended January

31, Six Months Ended January 31, 2015 2014 2015 2014

Income

Taxes on Continuing Operations (GAAP measure) $ 2,438 $ 4,408 $

11,344 $ 13,002 Restructuring charges 1,434 1,481 2,770 3,611

Income Taxes on Continuing Operations

Excluding Certain Items (non-GAAP measure)

$ 3,872 $ 5,889 $ 14,114

$ 16,613 Net Earnings from

Continuing Operations Excluding Certain Items: Brady is

presenting the Non-GAAP measure "Net Earnings from Continuing

Operations Excluding Certain Items." This is not a calculation

based upon GAAP. The amounts included in this Non-GAAP measure are

derived from amounts included in the Consolidated Financial

Statements and supporting footnote disclosures. We do not view

these items to be part of our sustainable results. We believe this

measure provides an important perspective of underlying business

trends and results and provides a more comparable measure from year

to year. The table below provides a reconciliation of Net Earnings

from Continuing Operations to Net Earnings from Continuing

Operations Excluding Certain Items: Three Months

Ended January 31, Six Months Ended January 31, 2015 2014 2015 2014

Net Earnings from Continuing Operations (GAAP measure) $

11,584 $ 10,517 $ 27,083 $ 28,652 Restructuring charges 3,445 2,843

6,387 7,552

Net Earnings from Continuing Operations

Excluding Certain Items (non-GAAP measure)

$ 15,029 $ 13,360 $

33,470 $ 36,204 Net Earnings

from Continuing Operations Per Diluted Class A Nonvoting Common

Share Excluding Certain Items: Brady is presenting the Non-GAAP

measure "Net Earnings from Continuing Operations Per Diluted Class

A Nonvoting Common Share Excluding Certain Items." This is not a

calculation based upon GAAP. The amounts included in this Non-GAAP

measure are derived from amounts included in the Consolidated

Financial Statements. We do not view these items to be part of our

sustainable results. We believe this measure provides an important

perspective of underlying business trends and results and provides

a more comparable measure from year to year. The table below

provides a reconciliation of Net Earnings from Continuing

Operations Per Diluted Class A Nonvoting Common Share to Net

Earnings from Continuing Operations Per Diluted Class A Nonvoting

Common Share Excluding Certain Items: Three Months

Ended January 31, Six Months Ended January 31, 2015 2014 2015 2014

Net Earnings from Continuing Operations

Per Diluted Class A Nonvoting Common Share (GAAP measure)

$ 0.23 $ 0.20 $ 0.53 $ 0.55 Restructuring charges 0.07 0.05 0.12

0.14

Net Earnings from Continuing Operations

Per Diluted Class A Nonvoting Common Share Excluding Certain Items

(non-GAAP measure)

$ 0.29 $ 0.25 $ 0.65

$ 0.69

Brady CorporationInvestor contact:Ann Thornton,

414-438-6887orMedia contact:Carole Herbstreit, 414-438-6882

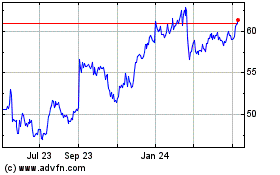

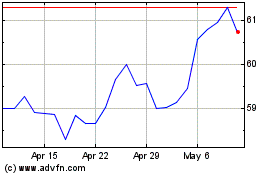

Brady (NYSE:BRC)

Historical Stock Chart

From Jun 2024 to Jul 2024

Brady (NYSE:BRC)

Historical Stock Chart

From Jul 2023 to Jul 2024