Brady Corporation Reaffirms Fiscal 2006 Guidance and Provides Preliminary Guidance for Fiscal 2007

June 05 2006 - 5:30PM

PR Newswire (US)

MILWAUKEE, June 5 /PRNewswire-FirstCall/ -- Brady Corporation

(NYSE:BRC), a world leader in identification solutions, today

announced preliminary guidance for its 2007 fiscal year which

starts on August 1, 2006. In fiscal 2007, Brady expects sales of

between $1.150 and $1.175 billion and net income of between $115

and $120 million. Diluted earnings per Class A share are expected

to be between $2.28 and $2.38 for fiscal 2007 which represents a 10

to 16 percent increase over current guidance for fiscal 2006

diluted earnings per share. Taking into account the recently

announced common stock offering and the anticipated increase in

share count, fiscal 2007 diluted earnings per Class A share are

expected to be between $2.18 and $2.27. The company today also

reaffirmed guidance for fiscal 2006, ending July 31, 2006, of sales

between $985 to $995 million and net income of $103 to $104 million

or $2.06 to $2.08 per share. "Our fiscal 2007 guidance reflects our

plans for continued growth, including a continued increase in

investment for new product development," said Brady President and

Chief Executive Officer Frank M. Jaehnert. "This guidance also

takes into account the increase in interest expenses for the

private placement announced in February 2006, and borrowing for our

recent acquisition of Tradex Converting AB." Brady Corporation is a

leading global manufacturer and marketer of identification

solutions and specialty products that identify and protect

premises, products and people. Its products include

high-performance labels and signs, safety devices, printing systems

and software, and precision die- cut materials. Founded in 1914,

Brady has more than 500,000 end-customers in electronics,

telecommunications, manufacturing, electrical, construction,

education, medical and a variety of other industries. Brady is

headquartered in Milwaukee and employs about 6,600 people in

operations in the United States, Europe, Asia/Pacific, Latin

America and Canada. Brady's fiscal 2005 sales were approximately

$816 million. More information is available on the Internet at

http://www.bradycorp.com/ . Brady believes that certain statements

in this news release are "forward- looking statements" within the

meaning of the Private Securities Litigation Reform Act of 1995.

All statements related to future, not past, events included in this

news release, including, without limitation, statements regarding

Brady's future financial position, business strategy, targets,

projected sales, costs, earnings, capital expenditures, debt levels

and cash flows, and plans and objectives of management for future

operations are forward-looking statements. When used in this news

release, words such as "may," "will," "expect," "intend,"

"estimate," "anticipate," "believe," "should," "project" or "plan"

or similar terminology are generally intended to identify

forward-looking statements. These forward-looking statements by

their nature address matters that are, to different degrees,

uncertain and are subject to risks, assumptions and other factors,

some of which are beyond Brady's control, that could cause actual

results to differ materially from those expressed or implied by

such forward-looking statements. For Brady, uncertainties arise

from the potential upsizing or downsizing and price parameters of

the proposed public offering; unanticipated issues associated with

the proposed public offering or the terms thereof; future financial

performance of major markets Brady serves, which include, without

limitation, telecommunications, manufacturing, electrical,

construction, laboratory, education, governmental, public utility,

computer, transportation; difficulties in making and integrating

acquisitions; risks associated with newly acquired businesses;

Brady's ability to retain significant contracts and customers;

future competition; Brady's ability to develop and successfully

market new products; changes in the supply of, or price for, parts

and components; increased price pressure from suppliers and

customers; interruptions to sources of supply; environmental,

health and safety compliance costs and liabilities; Brady's ability

to realize cost savings from operating initiatives; Brady's ability

to attract and retain key talent; difficulties associated with

exports; risks associated with international operations;

fluctuations in currency rates versus the US dollar; technology

changes; potential write-offs of Brady's substantial intangible

assets; risks associated with obtaining governmental approvals and

maintaining regulatory compliance for new and existing products;

business interruptions due to implementing business systems; and

numerous other matters of national, regional and global scale,

including those of a political, economic, business, competitive and

regulatory nature contained from time to time in Brady's U.S.

Securities and Exchange Commission filings, including, but not

limited to, those factors listed in the "Risk Factors" section

located in Item 1A of Part II of Brady's Quarterly Report on Form

10-Q for the period ended April 30, 2006. These uncertainties may

cause Brady's actual future results to be materially different than

those expressed in its forward-looking statements. Brady does not

undertake to update its forward-looking statements. DATASOURCE:

Brady Corporation CONTACT: Barbara Bolens of Brady Corporation,

+1-414-438-6940 Web site: http://www.bradycorp.com/ Company News

On-Call: http://www.prnewswire.com/comp/952350.html

Copyright

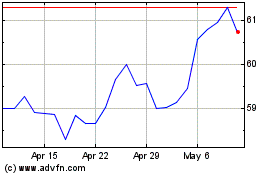

Brady (NYSE:BRC)

Historical Stock Chart

From Jun 2024 to Jul 2024

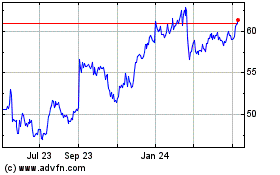

Brady (NYSE:BRC)

Historical Stock Chart

From Jul 2023 to Jul 2024