false

0001494582

0001494582

2024-07-23

2024-07-23

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 25, 2024 (July 23, 2024)

|

BOSTON OMAHA CORPORATION

|

|

(Exact name of registrant as specified in its Charter)

|

| |

|

Delaware

|

001-38113

|

27-0788438

|

|

(State or other jurisdiction of Incorporation)

|

(Commission File Number)

|

(IRS Employer Identification Number)

|

| |

| |

|

1601 Dodge Street, Suite 3300

Omaha, Nebraska 68102

(Address and telephone number of principal executive offices, including zip code)

|

|

(857) 256-0079

(Registrant's telephone number, including area code)

|

|

Not Applicable

(Former name or address, if changed since last report)

|

Securities registered under Section 12(b) of the Exchange Act:

|

Title of Class

|

Trading Symbol

|

Name of Exchange on Which Registered

|

|

Class A common stock,

$0.001 par value per share

|

BOC

|

The New York Stock Exchange

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of Registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934.

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 7.01

|

Regulation FD Disclosure

|

On July 25, 2024, Boston Omaha Corporation, a Delaware corporation (the “Company”), issued a press release regarding the Share Repurchase Program (defined below). A copy of the press release is furnished with this Current Report on Form 8-K as Exhibit 99.1 and incorporated by reference into Item 7.01.

The information in this Item 7.01, including Exhibit 99.1 attached hereto and incorporated by reference to this Item 7.01, shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section or Sections 11 and 12(a)(2) of the Securities Act of 1933, as amended and shall not be incorporated by reference into any filing with the SEC made by the Company, whether made before or after the date hereof, regardless of any general incorporation language in such filing. The information in this Item 7.01, including Exhibit 99.1 attached hereto and incorporated by reference into this Item 7.01, shall not be deemed an admission as to the materiality of any information in this Current Report on Form 8-K that is required to be disclosed solely to satisfy the requirements of Regulation FD.

On July 23, 2024, the Board of Directors (the “Board”) of the Company approved and authorized a share repurchase program (the “Share Repurchase Program”), pursuant to which the Company intends to repurchase up to $20 million of its Class A common stock, from time to time, in the open market, privately-negotiated transactions, or otherwise in compliance with Rule 10b-18 under the Securities Exchange Act of 1934. The Board also authorized the Company, in its discretion, to establish “Rule 10b5-1 trading plans” for these share repurchases. The Share Repurchase Program will go into effect on or about August 15, 2024, following the release of the Company’s quarterly report on Form 10-Q for the quarter ended June 30, 2024 and will terminate on September 30, 2025, unless earlier terminated in the discretion of the Board. The actual timing, number and value of shares repurchased under the Share Repurchase Program will depend on a number of factors, including constraints specified in applicable SEC regulations, price, general business and market conditions, and alternative investment opportunities. Pursuant to the Share Repurchase Program, the Company is not obligated to repurchase any specific number of shares of its Class A common stock and shall not repurchase more than 25% of the average daily volume of its stock over the previous 20 trading days.

|

Item 9.01

|

Financial Statements And Exhibits

|

|

(d)

|

Exhibits. The Exhibit Index set forth below is incorporated herein by reference.

|

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

BOSTON OMAHA CORPORATION

(Registrant)

|

|

| |

|

|

|

| |

|

|

|

| |

By:

|

/s/ Joshua P. Weisenburger

|

|

| |

|

Joshua P. Weisenburger,

|

|

| |

|

Chief Financial Officer

|

|

Date: July 25, 2024

Exhibit 99.1

Boston Omaha Corporation Announces Adoption of $20 Million Class A Common Stock Repurchase Program

Omaha, Nebraska (Business Wire)

July 25, 2024

Boston Omaha Corporation (NYSE: BOC) (the “Company”) announced today that its Board of Directors (the “Board”) approved a share repurchase program under which the Company can repurchase up to $20,000,000 of its Class A common stock through September 30, 2025 through open market purchases, privately-negotiated transactions, or otherwise in compliance with Rule 10b-18 under the Securities Exchange Act of 1934. The share repurchase program will go into effect on or about August 15, 2024, following the release of the Company’s quarterly report on Form 10-Q for the quarter ended June 30, 2024.

“We believe our Class A common stock to be an attractive investment when, as we believe is currently the case, it trades at a meaningful discount to our view of the Company's intrinsic value and prospects. With the adoption of a repurchase program, we add to our capital allocation options the ability to opportunistically repurchase shares alongside our ability to continue investing in our businesses. We will continue to allocate capital to what we believe is its best and highest use in order to grow long-term value on a per share basis,” said Adam Peterson, Chairman and Chief Executive Officer.

The Board also authorized the Company, in its discretion, to establish “Rule 10b5-1 trading plans” for these share repurchases. Rule 10b5-1 trading plans allow companies to repurchase shares at times when they might otherwise be prevented from doing so by securities laws or because of self-imposed trading blackout periods.

The actual timing, number and value of shares repurchased under the stock repurchase program will depend on a number of factors, including constraints specified in applicable SEC regulations, price, general business and market conditions, and alternative investment opportunities. The share buyback program does not obligate the Company to acquire any specific number of shares in any period, and may be expanded, extended, modified or discontinued at any time.

About Boston Omaha Corporation

Boston Omaha Corporation is a public holding company with four majority owned businesses engaged in outdoor advertising, broadband telecommunications services, surety insurance and asset management. For more information, please visit www.bostonomaha.com.

Forward-Looking Statements

This press release contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements other than statements of historical fact are “forward-looking statements” for purposes of this press release on Form 8-K, including statements concerning the Company’s plans to consummate the share repurchase program; the timing and ability of the Company to repurchase additional shares of Class A common stock, if any, under the share repurchase program; fluctuations in the trading volume and market price of shares of the Company’s Class A common stock, our expectations regarding future growth, general business and market conditions and management’s determination of alternative needs and uses of the Company’s cash resources, all of which may affect the Company’s long-term performance and repurchases under the share repurchase program; and any statements or assumptions underlying any of the foregoing. In some cases, forward-looking statements can be identified by the use of terminology such as “may,” “will,” “expects,” “plans,” “anticipates,” “estimates,” or the negative thereof or other comparable terminology. Although the Company believes that the expectations reflected in the forward-looking statements contained herein are reasonable, such expectations or any of the forward-looking statements may prove to be incorrect and actual results could differ materially from those projected or assumed in the forward-looking statements. Important factors discussed under the caption “Risk Factors” in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023, and its other filings with the Securities and Exchange Commission could cause actual results to differ materially from those indicated by the forward-looking statements made in this press release. Any such forward-looking statements represent management’s estimates as of the date of this press release. While the Company may elect to update such forward-looking statements at some point in the future, it disclaims any obligation to do so, except as required by law, even if subsequent events cause its views to change.

Boston Omaha Corporation

Josh Weisenburger, 402-210-2633

contact@bostonomaha.com

v3.24.2

Document And Entity Information

|

Jul. 23, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

BOSTON OMAHA CORPORATION

|

| Document, Type |

8-K

|

| Document, Period End Date |

Jul. 23, 2024

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

001-38113

|

| Entity, Tax Identification Number |

27-0788438

|

| Entity, Address, Address Line One |

1601 Dodge Street, Suite 3300

|

| Entity, Address, City or Town |

Omaha

|

| Entity, Address, State or Province |

NE

|

| Entity, Address, Postal Zip Code |

68102

|

| City Area Code |

857

|

| Local Phone Number |

256-0079

|

| Title of 12(b) Security |

Class A common stock

|

| Trading Symbol |

BOC

|

| Security Exchange Name |

NYSE

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001494582

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

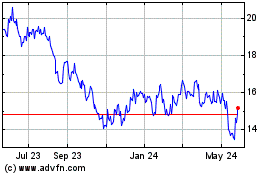

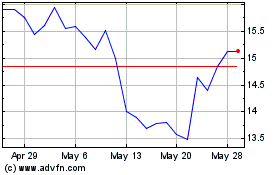

Boston Omaha (NYSE:BOC)

Historical Stock Chart

From Jun 2024 to Jul 2024

Boston Omaha (NYSE:BOC)

Historical Stock Chart

From Jul 2023 to Jul 2024