Blackstone / GSO Closed-End Funds Declare Monthly Distributions

May 22 2015 - 8:45AM

Business Wire

GSO / Blackstone Debt Funds Management LLC, wholly-owned

subsidiary of GSO Capital Partners LP (‘‘GSO’’), announced the

declaration of monthly distributions for its three closed-end funds

(the “Funds”). GSO is one of the world’s largest credit-oriented

alternative asset managers, with a focus on delivering attractive

risk-adjusted returns and capital preservation for its clients.

The Funds’ monthly distributions are listed below. The following

dates apply to today’s distribution declarations for these

Funds:

Ex-Date: June 19, 2015 Record Date: June 23, 2015 Payable Date:

June 30, 2015 Ex-Date: July 22, 2015 Record Date: July 24,

2015 Payable Date: July 31, 2015 Ex-Date: August 20, 2015

Record Date: August 24, 2015 Payable Date: August 31, 2015

Ex-Date: September 21, 2015 Record Date: September 23, 2015 Payable

Date: September 30, 2015

Monthly Distribution Per Share Ticker Fund

Amount

Change fromPrevious

Month

BGB Strategic Credit Fund $ 0.105 - BGX Long-Short Credit Income

Fund $ 0.098 - BSL Senior Floating Rate Term Fund $ 0.090 -

The Funds seek to pay distributions at rates that reflect net

investment income actually earned and projected future income.

A portion of each distribution may be treated as paid from

sources other than net investment income, including but not limited

to short-term capital gain, long-term capital gain or return of

capital. The final determination of the source and tax

characteristics of these distributions will depend upon each Fund’s

investment experience during its fiscal year and will be made after

the Fund’s year end. Each Fund will send to investors a Form

1099-DIV for the calendar year that will define how to report these

distributions for federal income tax purposes.

About The Blackstone Group and GSO Capital Partners

Blackstone is one of the world’s leading investment firms.

Blackstone seeks to create positive economic impact and long-term

value for its investors, the companies it invests in, and the

communities in which it works. The firm does this by using

extraordinary people and flexible capital to help companies solve

problems. Blackstone’s asset management businesses, with over $300

billion in assets under management as of March 31, 2015, include

investment vehicles focused on private equity, real estate, public

debt and equity, non-investment grade credit, real assets and

secondary funds, all on a global basis. Blackstone also provides

various financial advisory services, including financial and

strategic advisory, restructuring and reorganization advisory and

fund placement services. Further information is available at

www.blackstone.com. Follow Blackstone on Twitter @Blackstone.

GSO is the global credit and distressed investment platform of

Blackstone. With approximately $75 billion of assets under

management as of March 31, 2015, GSO is one of the largest

alternative managers in the world focused on the leveraged-finance,

or non-investment grade related, marketplace. GSO seeks to generate

attractive risk-adjusted returns in its business by investing in a

broad array of strategies including mezzanine debt, distressed

investing, leveraged loans and other special-situation strategies.

Its funds are major providers of credit for small and middle-market

companies, and it also advances rescue financing to help distressed

companies.

Investors wishing to buy or sell shares need to place orders

through an intermediary or broker.

Contact the Funds at 1-877-299-1588 or visit the Funds’

website at www.blackstone-gso.com for additional

information.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20150522005094/en/

Blackstone Group and GSO Capital PartnersJane Lee,

877-876-1121

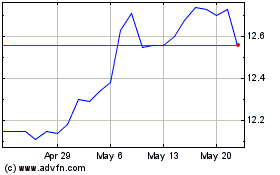

Blackstone Long Short Cr... (NYSE:BGX)

Historical Stock Chart

From Oct 2024 to Nov 2024

Blackstone Long Short Cr... (NYSE:BGX)

Historical Stock Chart

From Nov 2023 to Nov 2024