An

annual meeting of the shareholders of BlackRock ESG Capital Allocation Term Trust (“ECAT” or the “Trust”) will be held at [●], on [●],[●], 2023, at [●] [a.m./p.m.] (Eastern time), to consider and vote on

nominees for the Board of Trustees of the Trust (the “Board”), as discussed in the enclosed proxy statement. Your vote is extremely important because an activist hedge fund managed by Saba Capital Management, L.P. (“Saba”) has

notified the Trust of its intention to nominate four individuals for election to the Board at the meeting (the “Saba Hedge Fund Nominees”). We strongly urge you to spend some time reviewing the proposal in the accompanying proxy

statement and to vote as recommended by the Board.

The Board has unanimously approved the following nominees on behalf of the Trust (the “Board Nominees”) to serve as Trustees of the

Trust:

The Board believes the Board Nominees have the skills, qualifications and requisite experience in overseeing investment companies to act in

the best interests of ALL shareholders.

You have received the enclosed proxy statement because you were a shareholder of record of the

Trust on [●], 2023 (the “Record Date”).

If you are a

registered shareholder, you may vote your shares in person by ballot at the annual meeting. If you hold your shares of the Trust in a brokerage account or through a bank or other nominee, you will not be able to vote in person at the annual meeting

unless you have previously requested and obtained a “legal proxy” from your broker, bank or other nominee and present it at the annual meeting.

Even if you plan to attend the meeting, we request that you vote your shares by signing and dating the enclosed WHITE proxy card

and returning it in the enclosed postage-paid envelope or by voting via Internet or by telephone by following the instructions provided on the enclosed WHITE proxy card.

We encourage you to carefully review the enclosed materials, which explains the proposal in more detail. We

hope that you will respond today to ensure that your shares will be represented at the meeting. You may vote using one of the methods below by following the instructions on your WHITE proxy card or WHITE voting

instruction form(s):

If you do not vote using one of these methods, you may be called by Georgeson LLC, the Trust’s proxy solicitor, to vote your shares.

If you have any questions about the proposal to be voted on, please call Georgeson LLC toll free at 1-800-676-0281.

This proxy statement (this “Proxy Statement”) is furnished in connection with the

solicitation of proxies by the Board of Trustees (the “Board,” the members of which are referred to as “Board Members”) of BlackRock ESG Capital Allocation Term Trust (“ECAT” or the “Trust”). The proxies will

be voted at the annual meeting (the “meeting”) of shareholders of the Trust and at any and all adjournments, postponements or delays thereof. The meeting will be held at [●], on [●], [●], 2023, at [●] [a.m./p.m.]

(Eastern time). The meeting will be held for the purposes set forth in the accompanying Notice of Annual Meeting of Shareholders to held on [●], 2023.

Distribution to shareholders of this Proxy Statement and the accompanying materials, or the WHITE voting

instruction form for the Annual Meeting of Shareholders to be held on [●], 2023, will commence on or about [●], 2023.

Shareholders of record of the Trust as of the close of business on [●], 2023 (the “Record Date”) are entitled

to notice of and to vote at the Trust’s annual meeting of shareholders and at any and all adjournments, postponements or delays thereof. Shareholders of the Trust are entitled to one vote for each share held, with no shares having cumulative

voting rights. The quorum and voting requirements for the Trust are described in the section herein entitled “Vote Required and Manner of Voting Proxies.”

The Trust’s Amended and Restated Agreement and Declaration of Trust provides that it is subject to the Maryland Control

Share Acquisition Act (the “Control Share Act”) to the same extent as if it were a Maryland corporation registered under the 1940 Act as a closed-end investment company. Accordingly, under such

provision, any holder of “control shares” (as defined in the Control Share Act) as of the Record Date will not be entitled to vote those control shares at the meeting unless approved by shareholders in accordance with the Control Share

Act.

The number of common shares of beneficial interest of the Trust (“Common Shares”) outstanding as of the

close of business on the Record Date and the managed assets of the Trust on the Record Date are [●] Common Shares and $[●], respectively. “Managed assets” means the total assets of the Trust minus its accrued liabilities (other

than aggregate indebtedness constituting financial leverage). Except as set forth in Appendix F, to the knowledge of the Trust, as of [●], 2023, no person was the beneficial owner of more than five percent of a class of the Trust’s

outstanding shares.

Even if you plan to attend the meeting, please sign, date and return the enclosed WHITE

proxy card. If you vote by telephone or via the Internet, you will be asked to enter a unique code that has been assigned to you, which is printed on your proxy card or WHITE voting instruction form, as applicable. This code is

designed to confirm your identity, provide access to the voting website and confirm that your voting instructions are properly recorded.

All properly executed proxies received prior to the meeting will be voted at the meeting and at any and all adjournments,

postponements or delays thereof. On any matter coming before the meeting as to which a shareholder has specified a choice on that shareholder’s proxy, the shares will be voted accordingly. If a WHITE proxy card is properly

executed and returned and no choice is specified with respect to the proposal, the shares will be voted “FOR” Proposal 1. Shareholders who execute proxies or provide voting instructions by telephone or via the Internet may

revoke them with respect to the proposals at any time before a vote is taken on the proposal by filing with the Trust a written notice of revocation (addressed to the Secretary of the Trust at the principal executive offices of the Trust at

the New York address provided herein), by delivering a duly executed proxy bearing a later date, or by attending the meeting and voting in person by ballot, in all cases prior to the exercise of

the authority granted in the proxy card. Merely attending the meeting, however, will not revoke any previously executed proxy. If you hold shares through a bank, broker or other intermediary, please consult your bank, broker or intermediary

regarding your ability to revoke voting instructions after such instructions have been provided.

PLEASE DO NOT SEND

BACK ANY PROXY CARD YOU MAY RECEIVE FROM SABA, EVEN TO WITHHOLD VOTES ON THE SABA HEDGE FUND NOMINEES, AS THIS WILL CANCEL YOUR PRIOR VOTE FOR THE BOARD NOMINEES. ONLY YOUR LATEST DATED PROXY WILL COUNT AT THE MEETING.

If you are a record holder of the Trust’s shares and plan to attend the meeting in person, in order to gain admission you

must show valid photographic identification, such as your driver’s license or passport. If you hold your shares of the Trust through a bank, broker or other nominee, and plan to attend the meeting in person, in order to gain admission you must

show valid photographic identification, such as your driver’s license or passport, and satisfactory proof of ownership of shares in the Trust, such as your voting instruction form (or a copy thereof) or a letter from your bank, broker or other

nominee or a broker’s statement indicating ownership as of the Record Date. If you hold your shares of the Trust in a brokerage account or through a bank or other nominee, you will not be able to vote in person at the meeting unless you have

previously requested and obtained a “legal proxy” from your broker, bank or other nominee and present it at the meeting. Even if you plan to attend the meeting, please promptly follow the enclosed instructions to submit voting instructions

by telephone or via the Internet. Alternatively, you may submit voting instructions by signing and dating the WHITE proxy card and returning it in the accompanying postage-paid return envelope.

The Trust will furnish, without charge, a copy of its annual report and most recent semi-annual report succeeding the annual

report, if any, to a shareholder upon request. Such requests should be directed to the Trust at [●], or by calling toll free at

1-800-882-0052. Copies of annual and semi-annual reports of the Trust are also available on the EDGAR Database on the U.S.

Securities and Exchange Commission’s website at www.sec.gov.

BlackRock, Inc. (“BlackRock”) will

update performance and certain other data for the Trust on a monthly basis on its website in the “Closed-End Funds” section of http://www.blackrock.com as well as certain other material

information as necessary from time to time. Investors and others are advised to check the website for updated performance information and the release of other material information about the Trust. This reference to BlackRock’s website is

intended to allow investors public access to information regarding the Trust and does not, and is not intended to, incorporate BlackRock’s website into this Proxy Statement.

Please note that only one annual or semi-annual report or this Proxy Statement may be delivered to two or more shareholders of

the Trust who share an address, unless the Trust has received instructions to the contrary. To request a separate copy of an annual report or semi-annual report or this Proxy Statement, or for instructions on how to request a separate copy of these

documents or as to how to request a single copy if multiple copies of these documents are received, shareholders should contact the Trust at the Delaware address and phone number provided above.

|

|

Please vote now. Your vote is important.

To avoid the wasteful and unnecessary expense of further solicitation and no matter how large or small your

holdings may be, we urge you to vote your shares by signing and dating the enclosed WHITE proxy card and returning it promptly in the postage-paid envelope provided, or record your voting instructions by telephone or via the Internet. If you

submit a properly executed WHITE proxy card but do not indicate how you wish your shares to be voted, your shares will be voted “FOR” the election of the nominees named in this Proxy Statement. If your shares of the Trust are

held through a broker, you must provide voting instructions to your broker about how to vote your shares in order for your broker to vote your shares as you instruct at the meeting.

|

2

|

|

YOUR VOTE IS IMPORTANT.

PLEASE VOTE PROMPTLY BY SIGNING AND RETURNING THE

ENCLOSED WHITE PROXY CARD/VOTING INSTRUCTION FORM OR BY RECORDING YOUR

VOTING INSTRUCTIONS BY TELEPHONE OR VIA THE INTERNET, NO MATTER HOW

MANY SHARES YOU OWN.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR

THE ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON [●], 2023.

THE PROXY STATEMENT FOR THIS MEETING IS AVAILABLE AT:

[https://www.proxy-direct.com/blk-33352] |

3

|

| PROPOSAL 1—ELECTION OF TRUSTEE NOMINEES |

The purpose of Proposal 1 is to elect Board Members for the Trust.

The Board unanimously recommends a vote “FOR” the election of each of the Trust’s Class I

nominees: Cynthia L. Egan, Lorenzo A. Flores, Stayce D. Harris and Catherine A. Lynch, each of whom currently serves on the Board (collectively referred to as the “Board Nominees”).

Below are some of the many reasons why we believe a vote “FOR” the Board Nominees on the

WHITE proxy card is in the best interest of the Trust’s shareholders.

After careful and thorough

consideration, the Board, based on the recommendation of the Board’s Governance and Nominating Committee (the “Governance Committee”), unanimously concluded that the Board Nominees are the most qualified candidates, and therefore the

Board recommends that shareholders vote “FOR” the election of each Board Nominee to the Board. The Board Members believe that all of the Trust’s Board Members, including the Board Nominees, are the most qualified and experienced

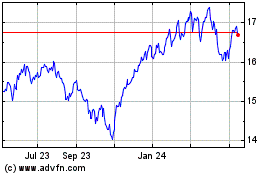

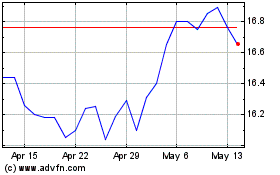

stewards to continue overseeing the Trust in pursuing its investment objectives for the benefit of all shareholders. The current Board Members have demonstrated their ability to consistently deliver value to shareholders. Under their leadership, the

Trust has generated strong returns on a market price basis over time (relative to its peers) as set out below, all while implementing value-creating and shareholder-friendly initiatives.

Excess Total Returns (%) on Market Price Relative to Peer Group Average1

(Periods ended April 30, 2023)

1 The Trust’s peer group is the

Morningstar Tactical Allocation category.

4

The current Board Members, 80% of whom are Independent Board Members (as defined

below), seek to ensure that the Trust operates in a responsible manner that protects and advances the interests of all shareholders, and not just the interests of a select few that are adverse to the interests of the Trust’s shareholders

and the Trust’s ability to pursue its investment objectives.

In contrast, an activist and opportunistic hedge fund,

through its investment adviser, Saba Capital Management, L.P., has indicated its intent to nominate the Saba Hedge Fund Nominees for election to the Board at the meeting, despite making no efforts whatsoever to engage with the Board or BlackRock on

Trust governance. The Governance Committee and the Board reviewed Saba’s notice of intent, including information provided by Saba regarding the qualifications of the Saba Hedge Fund Nominees, as compared with those of the Board Nominees. The

Board considered that the Board Nominees have extensive experience with registered closed-end funds generally, with funds that have an unconstrained approach to investing in public and private markets across

asset classes and environmental, social and governance focused funds, and specifically with the Trust, its investment objectives and strategies and service providers. The Board further considered that the Saba Hedge Fund Nominees:

| |

• |

|

have no experience with the Trust, its investment objectives and strategies, or service providers;

|

| |

• |

|

have little to no experience with closed-end funds in general, nor do

they have the extensive experience with investment company governance possessed by the Board Nominees; and |

| |

• |

|

have been handpicked and nominated by Saba, and, if elected, may seek to advance Saba’s short-term goals,

which the Board believes are not in the best interests of all of the Trust’s shareholders. |

In

addition, the Board noted that if elected, the Saba Hedge Fund Nominees would cause the elimination of all gender diversity on the Board based on the biographical information Saba provided to the Trust and the Board Nominees up for election.

The Board therefore recommends that you vote “FOR” the election of each Board Nominee using the WHITE proxy card.

To vote for the Board Nominees, please vote by telephone or via the Internet, as described in the proxy card, or date and sign the enclosed WHITE proxy card and return it promptly in the enclosed postage-paid envelope. PLEASE

DISCARD AND DO NOT SEND BACK ANY PROXY CARD YOU MAY RECEIVE FROM SABA, EVEN TO WITHHOLD VOTES ON THE SABA HEDGE FUND NOMINEES, AS THIS WILL CANCEL YOUR PRIOR VOTE FOR THE BOARD NOMINEES.

5

Nominees for the Trust. The Board consists of ten Board Members, eight of

whom are not “interested persons” of the Trust (as defined in the 1940 Act) (the “Independent Board Members”). The Trust divides its Board Members into three classes: Class I, Class II and Class III, and generally

only one class of Board Members stands for election each year.

The Class I Board Members are standing for election

this year. Each Class I Board Member elected at the meeting will serve until the later of the date of the Trust’s 2026 annual meeting or until his or her successor is elected and qualifies, or until his or her earlier death, resignation,

retirement or removal. Each of the Board Nominees has consented to being named in this Proxy Statement and to serve as a Board Member if elected.

Board Members’/Nominees’ Biographical Information. Each of the Board Nominees, as listed below, is

highly skilled and experienced.

Cynthia L. Egan

Lorenzo A. Flores

Stayce D. Harris

Catherine A. Lynch

Please refer to the below table which identifies the Board Nominees for election to the Board and sets forth certain

biographical information about the Board Members, including the Board Nominees. Please note that only the Class I Board Members are standing for election this year. Each Board Nominee was recommended by the Governance Committee of the Board and

nominated by the full Board for election by shareholders. R. Glenn Hubbard was selected to serve as the Chair of the Board, and W. Carl Kester was selected to serve as the Vice Chair of the Board. All of the

closed-end investment companies registered under the 1940 Act advised by BlackRock Advisors, LLC (the “Advisor”), including the Trust, are referred to collectively as the “BlackRock Closed-End Funds.” The BlackRock Closed-End Funds, together with certain other registered investment companies advised by the Advisor or its affiliates, are included in a

complex of funds referred to as the BlackRock Fixed-Income Complex.

|

|

|

|

|

|

|

|

|

|

|

|

Name, Address(1) and

Year of Birth |

|

Position(s) Held with Trust |

|

Term of

Office and

Length

of

Time

Served |

|

Principal

Occupation(s)

During Past Five

Years |

|

Number

of

BlackRock-

Advised

Registered

Investment

Companies

(“RICs”)

Consisting of

Investment

Portfolios

(“Portfolios”)

Overseen* |

|

Public

Company

and

Other

Investment

Company

Directorships

Held During

Past Five

Years** |

| Independent Board Members/Nominees† |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| R. Glenn Hubbard

1958 |

|

Chair of the Board and Trustee |

|

2024; from 2021 to present |

|

Dean, Columbia Business School from 2004 to 2019; Faculty member, Columbia Business School since 1988. |

|

70 RICs consisting of 100 Portfolios |

|

ADP (data and information services) from 2004 to 2020; Metropolitan Life Insurance Company (insurance); TotalEnergies SE (multi-energy) |

6

|

|

|

|

|

|

|

|

|

|

|

|

Name, Address(1) and

Year of Birth |

|

Position(s) Held with Trust |

|

Term of

Office and

Length

of

Time

Served |

|

Principal

Occupation(s)

During Past Five

Years |

|

Number

of

BlackRock-

Advised

Registered

Investment

Companies

(“RICs”)

Consisting of

Investment

Portfolios

(“Portfolios”)

Overseen* |

|

Public

Company

and

Other

Investment

Company

Directorships

Held During

Past Five

Years** |

| W. Carl Kester(3)

1951 |

|

Vice Chair of the Board and Trustee |

|

2024; from 2021 to present |

|

Baker Foundation Professor and George Fisher Baker Jr. Professor of Business Administration, Emeritus, Harvard Business School from 2008 to 2022; George Fisher Baker Jr. Professor of Business

Administration, Harvard Business School since 2008; Deputy Dean for Academic Affairs from 2006 to 2010; Chairman of the Finance Unit, from 2005 to 2006; Senior Associate Dean and Chairman of the MBA Program from 1999 to 2005; Member of the faculty

of Harvard Business School since 1981. |

|

72 RICs consisting of 102 Portfolios |

|

None |

7

|

|

|

|

|

|

|

|

|

|

|

|

Name, Address(1) and

Year of Birth |

|

Position(s) Held with Trust |

|

Term of

Office and

Length

of

Time

Served |

|

Principal

Occupation(s)

During Past Five

Years |

|

Number

of

BlackRock-

Advised

Registered

Investment

Companies

(“RICs”)

Consisting of

Investment

Portfolios

(“Portfolios”)

Overseen* |

|

Public

Company

and

Other

Investment

Company

Directorships

Held During

Past Five

Years** |

| Cynthia L. Egan(2)

1955 |

|

Trustee |

|

2023; from 2021 to present |

|

Advisor, U.S. Department of the Treasury from 2014 to 2015; President, Retirement Plan Services, for T. Rowe Price Group, Inc. from 2007 to 2012; executive positions within Fidelity Investments from 1989

to 2007. |

|

70 RICs consisting of 100 Portfolios |

|

Unum (insurance); The Hanover Insurance Group (Board Chair); Huntsman Corporation (Lead Independent Director and non-Executive Vice Chair of the Board) (chemical

products) |

8

|

|

|

|

|

|

|

|

|

|

|

|

Name, Address(1) and

Year of Birth |

|

Position(s) Held with Trust |

|

Term of

Office and

Length

of

Time

Served |

|

Principal

Occupation(s)

During Past Five

Years |

|

Number

of

BlackRock-

Advised

Registered

Investment

Companies

(“RICs”)

Consisting of

Investment

Portfolios

(“Portfolios”)

Overseen* |

|

Public

Company

and

Other

Investment

Company

Directorships

Held During

Past Five

Years** |

| Frank J. Fabozzi(3)

1948 |

|

Trustee |

|

2025; from 2021 to present |

|

Editor of The Journal of Portfolio Management since 1986; Professor of Finance, EDHEC Business School (France) from 2011 to 2022; Professor of Practice, Johns Hopkins University since 2021; Professor in

the Practice of Finance, Yale University School of Management from 1994 to 2011 and currently a Teaching Fellow in Yale’s Executive Programs; Visiting Professor, Rutgers University for the Spring 2019 semester; Visiting Professor, New York

University for the 2019 academic year; Adjunct Professor of Finance, Carnegie Mellon University for the Fall 2020 semester. |

|

72 RICs consisting of 102 Portfolios |

|

None |

|

|

|

|

|

|

| Lorenzo A. Flores(2)

1964 |

|

Trustee |

|

2023; from 2021 to present |

|

Vice Chairman, Kioxia, Inc. since 2019; Chief Financial Officer, Xilinx, Inc. from 2016 to 2019; Corporate Controller, Xilinx, Inc. from 2008 to 2016. |

|

70 RICs consisting of 100 Portfolios |

|

None |

9

|

|

|

|

|

|

|

|

|

|

|

|

Name, Address(1) and

Year of Birth |

|

Position(s) Held with Trust |

|

Term of

Office and

Length

of

Time

Served |

|

Principal

Occupation(s)

During Past Five

Years |

|

Number

of

BlackRock-

Advised

Registered

Investment

Companies

(“RICs”)

Consisting of

Investment

Portfolios

(“Portfolios”)

Overseen* |

|

Public

Company

and

Other

Investment

Company

Directorships

Held During

Past Five

Years** |

| Stayce D. Harris(2)

1959 |

|

Trustee |

|

2023; from 2021 to present |

|

Lieutenant General, Inspector General, Office of the Secretary of the United States Air Force from 2017 to 2019; Lieutenant General, Assistant Vice Chief of Staff and Director, Air Staff, United States

Air Force from 2016 to 2017; Major General, Commander, 22nd Air Force, AFRC, Dobbins Air Reserve Base, Georgia from 2014 to 2016; Pilot, United Airlines from 1990 to 2020. |

|

70 RICs consisting of 100 Portfolios |

|

KULR Technology Group, Inc. in 2021; The Boeing Company (airplane manufacturer) |

| J. Phillip Holloman

1955 |

|

Trustee |

|

2025; from 2021 to present |

|

President and Chief Operating Officer, Cintas Corporation from 2008 to 2018. |

|

70 RICs consisting of 100 Portfolios |

|

PulteGroup, Inc. (home construction); Rockwell Automation Inc. (industrial automation) |

10

|

|

|

|

|

|

|

|

|

|

|

|

Name, Address(1) and

Year of Birth |

|

Position(s) Held with Trust |

|

Term of

Office and

Length

of

Time

Served |

|

Principal

Occupation(s)

During Past Five

Years |

|

Number

of

BlackRock-

Advised

Registered

Investment

Companies

(“RICs”)

Consisting of

Investment

Portfolios

(“Portfolios”)

Overseen* |

|

Public

Company

and

Other

Investment

Company

Directorships

Held During

Past Five

Years** |

| Catherine A. Lynch(2)(3)

1961 |

|

Trustee |

|

2023; from 2021 to present |

|

Chief Executive Officer, Chief Investment Officer and various other positions, National Railroad Retirement Investment Trust from 2003 to 2016; Associate Vice President for Treasury Management, The George

Washington University from 1999 to 2003; Assistant Treasurer, Episcopal Church of America from 1995 to 1999. |

|

72 RICs consisting of 102 Portfolios |

|

PennyMac Mortgage Investment Trust |

11

|

|

|

|

|

|

|

|

|

|

|

|

Name, Address(1) and

Year of Birth |

|

Position(s) Held with Trust |

|

Term of

Office and

Length

of

Time

Served |

|

Principal

Occupation(s)

During Past Five

Years |

|

Number

of

BlackRock-

Advised

Registered

Investment

Companies

(“RICs”)

Consisting of

Investment

Portfolios

(“Portfolios”)

Overseen* |

|

Public

Company

and

Other

Investment

Company

Directorships

Held During

Past Five

Years** |

| Interested Board Members/Nominees†† |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Robert Fairbairn

1965 |

|

Trustee |

|

2025; from 2021 to present |

|

Vice Chairman of BlackRock, Inc. since 2019; Member of BlackRock’s Global Executive and Global Operating Committees; Co-Chair of BlackRock’s Human Capital

Committee; Senior Managing Director of BlackRock, Inc. from 2010 to 2019; oversaw BlackRock’s Strategic Partner Program and Strategic Product Management Group from 2012 to 2019; Member of the Board of Managers of BlackRock Investments, LLC from

2011 to 2018; Global Head of BlackRock’s Retail and iShares® businesses from 2012 to 2016. |

|

98 RICs consisting of 266 Portfolios |

|

None |

12

|

|

|

|

|

|

|

|

|

|

|

|

Name, Address(1) and

Year of Birth |

|

Position(s) Held with Trust |

|

Term of

Office and

Length

of

Time

Served |

|

Principal

Occupation(s)

During Past Five

Years |

|

Number

of

BlackRock-

Advised

Registered

Investment

Companies

(“RICs”)

Consisting of

Investment

Portfolios

(“Portfolios”)

Overseen* |

|

Public

Company

and

Other

Investment

Company

Directorships

Held During

Past Five

Years** |

| John M. Perlowski(3)

1964 |

|

Trustee, President and Chief Executive Officer |

|

2024; Trustee, President and Chief Executive Officer from 2021 to present |

|

Managing Director of BlackRock, Inc. since 2009; Head of BlackRock Global Accounting and Product Services since 2009; Advisory Director of Family Resource Network (charitable foundation) since

2009. |

|

100 RICs consisting of 268 Portfolios |

|

None |

| * |

For purposes of this chart, “RICs” refers to investment companies registered under the 1940 Act and

“Portfolios” refers to the investment programs of the BlackRock-advised funds. The BlackRock Fixed-Income Complex is comprised of 72 RICs consisting of 102 Portfolios. |

| ** |

Directorships disclosed under this column do not include directorships disclosed under the column

“Principal Occupation(s) During Past Five Years.” |

| † |

Each Independent Board Member will serve until his or her successor is elected and qualifies, or until his or

her earlier death, resignation, retirement or removal, or until December 31 of the year in which he or she turns 75. The maximum age limitation may be waived as to any Board Member by action of a majority of the Board upon a finding of good

cause therefor. |

| †† |

Messrs. Fairbairn and Perlowski are both “interested persons,” as defined in the 1940 Act, of the

Trust based on their positions with BlackRock, Inc. and its affiliates. Messrs. Fairbairn and Perlowski are also board members of the BlackRock Multi-Asset Complex. Interested Board Members serve until their resignation, removal or death, or until

December 31 of the year in which they turn 72. The maximum age limitation may be waived as to any Board Member by action of a majority of the Board Members upon a finding of good cause therefor. |

| (1) |

The address of each Board Member and Board Nominee is c/o BlackRock, Inc., 50 Hudson Yards, New York, NY

10001. |

| (2) |

Class I Board Member and Board Nominee. |

| (3) |

Dr. Fabozzi, Dr. Kester, Ms. Lynch and Mr. Perlowski are also trustees of the BlackRock

Credit Strategies Fund and BlackRock Private Investments Fund. |

The Independent Board Members have

adopted a statement of policy that describes the experiences, qualifications, skills and attributes that are necessary and desirable for potential Independent Board Member candidates (the “Statement of Policy”). The Board believes that

each Independent Board Member satisfied, at the time he or she was initially elected or appointed as a Board Member, and continues to satisfy, the standards contemplated by the Statement of Policy as well as the standards set forth in the

Trust’s By-laws. Furthermore, in determining that a particular Board Member was and continues to be qualified to serve as a Board Member, the Board has considered a variety of criteria, none of which, in

isolation, was controlling. The Board believes that, collectively, the Board Members/Nominees have balanced and diverse experiences, skills, attributes and qualifications, which allows the Board to operate effectively in governing the Trust and

protecting the interests of shareholders. Among the attributes common to all Board Members/Nominees is their ability to review critically, evaluate, question and discuss information provided to them, to interact effectively with the Trust’s

investment adviser, other service providers, counsel and independent auditors, and to exercise effective business judgment in the performance of their duties as Board Members. Each Board Member’s/Nominee’s ability to perform his or her

duties effectively is evidenced by his

13

or her educational background or professional training; business, consulting, public service or academic positions; experience from service as a board member of the Trust or the other funds in

the BlackRock fund complexes (and any predecessor funds), other investment funds, public companies, or not-for-profit entities or other organizations; ongoing commitment

and participation in Board and committee meetings, as well as their leadership of standing and other committees throughout the years; or other relevant life experiences.

The table below discusses some of the experiences, qualifications and skills of the Board Members, including the Board

Nominees, that support the conclusion that they should serve (or continue to serve) on the Board.

|

|

|

|

Board Members/Nominees |

|

Experience, Qualifications and Skills

|

|

|

| R. Glenn Hubbard |

|

R. Glenn Hubbard has served in numerous roles in the field of economics, including as the Chairman of the U.S. Council of Economic Advisers of the President of the United States. Dr. Hubbard has served as the Dean of

Columbia Business School, as a member of the Columbia Faculty and as a Visiting Professor at the John F. Kennedy School of Government at Harvard University, the Harvard Business School and the University of Chicago. Dr. Hubbard’s

experience as an adviser to the President of the United States adds a dimension of balance to the Trust’s governance and provides perspective on economic issues. Dr. Hubbard’s service on the boards of ADP and Metropolitan Life

Insurance Company provides the Board with the benefit of his experience with the management practices of other financial companies. Dr. Hubbard’s long-standing service on the boards of directors/trustees of the closed-end funds in the BlackRock Fixed-Income Complex also provides him with a specific understanding of the Trust, its operations, and the business and regulatory issues facing the Trust. Dr. Hubbard’s

independence from the Trust and the Advisor enhances his service as Chair of the Board, Chair of the Executive Committee and a member of the Governance Committee, the Compliance Committee and the Performance Oversight Committee. |

|

|

| W. Carl Kester |

|

The Board benefits from W. Carl Kester’s experiences as a professor and author in finance, and his experience as the George Fisher Baker Jr. Professor of Business Administration at Harvard Business School and as Deputy Dean

of Academic Affairs at Harvard Business School from 2006 through 2010 adds to the Board a wealth of expertise in corporate finance and corporate governance. Dr. Kester has authored and edited numerous books and research papers on both subject

matters, including co-editing a leading volume of finance case studies used worldwide. Dr. Kester’s long-standing service on the boards of directors/trustees of the

closed-end funds in the BlackRock Fixed-Income Complex also provides him with a specific understanding of the Trust, its operations, and the business and regulatory issues facing the Trust.

Dr. Kester’s independence from the Trust and the Advisor enhances his service as a Vice Chair of the Board, Chair of the Governance Committee and a member of the Executive Committee, the Compliance Committee and the Performance Oversight

Committee. |

|

|

| Cynthia L. Egan* |

|

Cynthia L. Egan brings to the Board a broad and diverse knowledge of investment companies and the retirement industry as a result of her many years of experience as President, Retirement Plan Services, for T. Rowe Price Group,

Inc. and her various senior operating officer positions at Fidelity Investments, including her service as Executive Vice President of FMR Co., President of Fidelity Institutional Services Company and President of the Fidelity Charitable Gift Fund.

Ms. Egan has also served as an advisor to the U.S. Department of Treasury as an expert in domestic retirement security. Ms. Egan began her professional career at the Board of Governors of the Federal Reserve and the Federal Reserve Bank of

New York. Ms. Egan is also a director of UNUM Corporation, a publicly traded insurance company providing personal risk reinsurance, and of The Hanover Group, a public property casualty insurance company. Ms. Egan’s independence from

the Trust and the Advisor enhances her service as Chair of the Compliance Committee, and a member of the Governance Committee and the Performance Oversight Committee. |

14

|

|

|

|

Board Members/Nominees |

|

Experience, Qualifications and Skills

|

| Frank J. Fabozzi |

|

Frank J. Fabozzi has served for over 25 years on the boards of registered investment companies. Dr. Fabozzi holds the designations of Chartered Financial Analyst and Certified Public Accountant. Dr. Fabozzi was inducted

into the Fixed Income Analysts Society’s Hall of Fame and is the 2007 recipient of the C. Stewart Sheppard Award and the 2015 recipient of the James R. Vertin Award, both given by the CFA Institute. The Board benefits from

Dr. Fabozzi’s experiences as a professor and author in the field of finance. Dr. Fabozzi’s experience as a professor at various institutions, including EDHEC Business School, Yale, MIT, and Princeton, as well as

Dr. Fabozzi’s experience as a Professor in the Practice of Finance and Becton Fellow at the Yale University School of Management and as editor of the Journal of Portfolio Management demonstrates his wealth of expertise in the investment

management and structured finance areas. Dr. Fabozzi has authored and edited numerous books and research papers on topics in investment management and financial econometrics, and his writings have focused on fixed income securities and

portfolio management, many of which are considered standard references in the investment management industry. Dr. Fabozzi’s long-standing service on the boards of directors/trustees of the closed-end

funds in the BlackRock Fixed-Income Complex also provides him with a specific understanding of the Trust, its operations and the business and regulatory issues facing the Trust. Moreover, Dr. Fabozzi’s knowledge of financial and accounting

matters qualifies him to serve as a member of the Audit Committee. Dr. Fabozzi’s independence from the Trust and the Advisor enhances his service as Chair of the Performance Oversight Committee. |

|

|

| Lorenzo A. Flores* |

|

The Board benefits from Lorenzo A. Flores’s many years of business, leadership and financial experience in his roles at various public and private companies. In particular, Mr. Flores’s service as Chief Financial

Officer and Corporate Controller of Xilinx, Inc. and Vice Chairman of Kioxia, Inc. and his long experience in the technology industry allow him to provide insight to into financial, business and technology trends. Mr. Flores’s knowledge of

financial and accounting matters qualifies him to serve as a member of the Audit Committee. Mr. Flores’s independence from the Trust and the Advisor enhances his service as a member of the Performance Oversight Committee. |

|

|

| Stayce D. Harris* |

|

The Board benefits from Stayce D. Harris’s leadership and governance experience gained during her extensive military career, including as a three-star Lieutenant General of the United States Air Force. In her most recent

role, Ms. Harris reported to the Secretary and Chief of Staff of the Air Force on matters concerning Air Force effectiveness, efficiency and the military discipline of active duty, Air Force Reserve and Air National Guard forces.

Ms. Harris’s experience on governance matters includes oversight of inspection policy and the inspection and evaluation system for all Air Force nuclear and conventional forces; oversight of Air Force counterintelligence operations and

service on the Air Force Intelligence Oversight Panel; investigation of fraud, waste and abuse; and oversight of criminal investigations and complaints resolution programs. Ms. Harris is also a director of The Boeing Company.

Ms. Harris’s independence from the Trust and the Advisor enhances her service as a member of the Compliance Committee and the Performance Oversight Committee. |

|

|

| J. Phillip Holloman |

|

The Board benefits from J. Phillip Holloman’s many years of business and leadership experience as an executive, director and advisory board member of various public and private companies. In particular,

Mr. Holloman’s service as President and Chief Operating Officer of Cintas Corporation and director of PulteGroup, Inc. and Rockwell Automation Inc. allows him to provide insight into business trends and conditions. Mr. Holloman’s

knowledge of financial and accounting matters qualifies him to serve as a member of the Audit Committee. Mr. Holloman’s independence from the Trust and the Advisor enhances his service as a member of the Governance Committee and the

Performance Oversight Committee. |

15

|

|

|

|

Board Members/Nominees |

|

Experience, Qualifications and Skills

|

| Catherine A. Lynch* |

|

Catherine A. Lynch, who served as the Chief Executive Officer and Chief Investment Officer of the National Railroad Retirement Investment Trust, benefits the Board by providing business leadership and experience and a diverse

knowledge of pensions and endowments. Ms. Lynch is also a trustee of PennyMac Mortgage Investment Trust, a specialty finance company that invests primarily in mortgage-related assets. Ms. Lynch also holds the designation of Chartered

Financial Analyst. Ms. Lynch’s knowledge of financial and accounting matters qualifies her to serve as Chair of the Audit Committee. Ms. Lynch’s independence from the Trust and the Advisor enhances her service as a member of the

Governance Committee and the Performance Oversight Committee. |

|

|

| Robert Fairbairn |

|

Robert Fairbairn has more than 25 years of experience with BlackRock, Inc. and over 30 years of experience in finance and asset management. In particular, Mr. Fairbairn’s positions as Vice Chairman of BlackRock, Inc.,

Member of BlackRock’s Global Executive and Global Operating Committees and Co-Chair of BlackRock’s Human Capital Committee provide the Board with a wealth of practical business knowledge and

leadership. In addition, Mr. Fairbairn has global investment management and oversight experience through his former positions as Global Head of BlackRock’s Retail and iShares® businesses, Head of BlackRock’s Global Client Group,

Chairman of BlackRock’s international businesses and his previous oversight over BlackRock’s Strategic Partner Program and Strategic Product Management Group. Mr. Fairbairn also serves as a board member for the funds in the BlackRock

Multi-Asset Complex. |

|

|

| John M. Perlowski |

|

John M. Perlowski’s experience as Managing Director of BlackRock, Inc. since 2009, as the Head of BlackRock Global Accounting and Product Services since 2009, and as President and Chief Executive Officer of the Trust

provides him with a strong understanding of the Trust, their operations, and the business and regulatory issues facing the Trust. Mr. Perlowski’s prior position as Managing Director and Chief Operating Officer of the Global Product Group

at Goldman Sachs Asset Management, and his former service as Treasurer and Senior Vice President of the Goldman Sachs Mutual Funds and as Director of the Goldman Sachs Offshore Funds provides the Board with the benefit of his experience with the

management practices of other financial companies. Mr. Perlowski also serves as a board member for the funds in the BlackRock Multi-Asset Complex. Mr. Perlowski’s experience with BlackRock enhances his service as a member of the

Executive Committee. |

| * |

Class I Board Member and Board Nominee. |

Board Leadership Structure and Oversight

The Board consists of ten Board Members, eight of whom are Independent Board Members. The registered investment companies

advised by the Advisor or its affiliates (the “BlackRock-advised Funds”) are organized into the BlackRock Multi-Asset Complex, the BlackRock Fixed-Income Complex, and the iShares Complex (each, a “BlackRock Fund Complex”). The

Trust is included in the BlackRock Fund Complex referred to as the BlackRock Fixed-Income Complex. The Board Members also oversee as board members the operations of the other open-end and closed-end registered investment companies included in the BlackRock Fixed-Income Complex.

The Board has overall responsibility for the oversight of the Trust. The Chair of the Board and the Chief Executive Officer

are different people. Not only is the Chair an Independent Board Member, but also the Chair of each Board committee (each, a “Committee”) is an Independent Board Member. The Board has five standing Committees: an Audit Committee, a

Governance Committee, a Compliance Committee, a Performance Oversight Committee and an Executive Committee. The Board has also established an ad hoc Discount Sub-Committee.

16

The Board currently oversees the Trust’s usage of leverage, including the

Trust’s incurrence, refinancing and maintenance of leverage and, to the extent necessary or appropriate, authorizes or approves the execution of documentation in respect thereto. The Executive Committee has authority to make any such

authorizations or approvals that are required between regular meetings of the Board.

The Trust does not have a

compensation committee because its executive officers, other than the Trust’s Chief Compliance Officer (“CCO”), do not receive any direct compensation from the Trust and the CCO’s compensation is comprehensively reviewed by the

Board. The role of the Chair of the Board is to preside over all meetings of the Board and to act as a liaison with service providers, officers, attorneys, and other Board Members between meetings. The Chair of each Committee performs a similar role

with respect to such Committee. The Chair of the Board or Chair of a Committee may also perform such other functions as may be delegated by the Board or the Committees from time to time. The Independent Board Members meet regularly outside the

presence of the Trust’s management, in executive sessions or with other service providers to the Trust. The Board has regular meetings five times a year, including a meeting to consider the approval of the Trust’s investment management

agreement and, if necessary, may hold special meetings before its next regular meeting. Each Committee meets regularly to conduct the oversight functions delegated to that Committee by the Board and reports its findings to the Board. The Board and

each standing Committee conduct annual assessments of their oversight function and structure. The Board has determined that the Board’s leadership structure is appropriate because it allows the Board to exercise independent judgment over

management and to allocate areas of responsibility among Committees and the Board to enhance oversight.

The Board decided

to separate the roles of Chief Executive Officer from the Chair because it believes that having an independent Chair:

| |

• |

|

increases the independent oversight of the Trust and enhances the Board’s objective evaluation of the

Chief Executive Officer; |

| |

• |

|

allows the Chief Executive Officer to focus on the Trust’s operations instead of Board administration;

|

| |

• |

|

provides greater opportunities for direct and independent communication between shareholders and the Board;

and |

| |

• |

|

provides independent spokespersons for the Trust. |

The Board has engaged the Advisor to manage the Trust on a

day-to-day basis. The Board is responsible for overseeing the Advisor, other service providers, the operations of the Trust and associated risks in accordance with the

provisions of the 1940 Act, state law, other applicable laws, the Trust’s charter, and the Trust’s investment objectives and strategies. The Board reviews, on an ongoing basis, the Trust’s performance, operations, and investment

strategies and techniques. The Board also conducts reviews of the Advisor and its role in running the operations of the Trust.

Day-to-day risk management with respect to the

Trust is the responsibility of the Advisor or other service providers (depending on the nature of the risk), subject to the supervision of the Advisor. The Trust is subject to a number of risks, including investment, compliance, operational and

valuation risks, among others. While there are a number of risk management functions performed by the Advisor or other service providers, as applicable, it is not possible to eliminate all of the risks applicable to the Trust. Risk oversight is part

of the Board’s general oversight of the Trust and is addressed as part of various Board and Committee activities. The Board, directly or through Committees, also reviews reports from, among others, management, the independent registered public

accounting firm for the Trust, the Advisor, and internal auditors for the Advisor or its affiliates, as appropriate, regarding risks faced by the Trust and management’s or the service providers’ risk functions. The Committee system

facilitates the timely and efficient consideration of matters by the Board Members and facilitates effective oversight of compliance with legal and regulatory requirements and of the Trust’s activities and associated risks. The Board has

approved the appointment of a Chief Compliance Officer, who oversees the implementation and testing of the Trust’s compliance program and reports regularly to the Board regarding compliance matters for the Trust and its service providers. The

Independent Board Members have engaged independent legal counsel to assist them in performing their oversight responsibilities.

17

Compensation. Information relating to compensation paid to the Board

Members for the Trust’s most recent fiscal year is set forth in Appendix A.

Equity Securities Owned by

Board Members and Board Nominees. Information relating to the amount of equity securities owned by Board Members/Nominees in the Trust as of [●] is set forth in Appendix B.

Attendance of Board Members at Annual Shareholders’ Meetings. It is the policy of the Trust to encourage Board

Members to attend the annual shareholders’ meeting. All of the Board Members in office at the time attended last year’s annual shareholders’ meeting.

Board Meetings. During the calendar year 2022, the Board met seven times. Additionally, during the fiscal year ended

December 31, 2022, the Board met seven times. No incumbent Board Member attended less than 75% of the aggregate number of meetings of the Board and of each Committee on which the Board Member served during the Trust’s most recently

completed full fiscal year.

Committees of the Board. Information relating to the various standing Committees of

the Board, as well as an ad hoc Sub-Committee, is set forth in Appendix C.

Delinquent Section 16(a) Reports. Section 16(a) of the Securities Exchange Act of 1934 (the

“Exchange Act”) and the rules thereunder require the Trust’s Board Members, executive officers, persons who own, either directly or indirectly, more than ten percent of a registered class of the Trust’s equity securities, the

Advisor and certain officers of the Advisor (the “Section 16 insiders”), including in some cases former Section 16 insiders for a period of up to 6 months, to file reports on holdings of, and transactions in, Trust shares with

the Securities and Exchange Commission (the “SEC”). Based solely on a review of copies of such reports furnished to the Trust during the Trust’s most recent fiscal year and representations from these Section 16 insiders, or

former Section 16 insiders, as applicable, with respect to the Trust’s most recent fiscal year, the Trust believes that its Section 16 insiders met all such applicable SEC filing requirements for the Trust’s most recently

concluded fiscal year, except for any late filings disclosed in previous proxy statements and certain inadvertent late filings. There was one inadvertent late Form 4 filed in November 2022 for Mr. Perlowski.

Executive Officers of the Trust. Information about the executive officers of the Trust, including their year of birth

and their principal occupations during the past five years, is set forth in Appendix D.

|

|

For the reasons discussed above, the Board recommends that you vote

“FOR” the election of each Board Nominee to the Board using the WHITE proxy card. |

PLEASE DISCARD AND DO NOT SEND BACK ANY PROXY CARD YOU MAY RECEIVE FROM SABA, EVEN TO WITHHOLD VOTES ON THE SABA HEDGE FUND NOMINEES,

AS THIS WILL CANCEL YOUR PRIOR VOTE FOR THE NOMINEES RECOMMENDED BY THE BOARD.

18

|

| VOTE REQUIRED AND MANNER OF VOTING PROXIES |

A quorum of shareholders is required to take action at the meeting. The holders of a majority

of the shares entitled to vote on any matter at a shareholder meeting present in person or by proxy shall constitute a quorum for purposes of conducting business on such matter.

The Trust expects that broker-dealer firms holding shares of the Trust in “street name” for their customers will not

be permitted by NYSE rules to vote on the election of Trustees on behalf of their customers and beneficial owners in the absence of voting instructions from their customers and beneficial owners. Accordingly, the Trust does not expect to receive any

“broker non-votes.” Broker non-votes occur when shares are held by brokers or nominees for which proxies have been returned but (a) voting instructions

have not been received from the beneficial owners or persons entitled to vote, (b) the broker or nominee does not have discretionary voting power or elects not to exercise discretion on a particular matter and (c) the shares are present at

the meeting. We urge you to instruct your broker or other nominee to vote your shares for the WHITE proxy card so that your votes may be counted.

The affirmative vote of a majority of the shares outstanding and entitled to vote is necessary to elect each of the respective

Board Nominees under Proposal 1. Abstentions and broker non-votes, if any, will be counted as represented at the meeting and will have the same effect as a vote against Proposal 1.

Votes cast by proxy or in person at the meeting will be tabulated by the inspectors of election appointed for the meeting. The

inspectors of election will determine whether or not a quorum is present at the meeting. The inspectors of election will treat abstentions and broker non-votes, if any, as present for purposes of determining a

quorum.

If you hold your shares directly (not through a broker-dealer, bank or other financial institution) and if you

return a signed and dated WHITE proxy card that does not specify how you wish to vote on a proposal, your shares will be voted “FOR” the Board Nominees in Proposal 1.

If you hold shares of the Trust through a bank, broker, other financial institution or intermediary (called a service agent),

the service agent may be the record holder of your shares. At the meeting, a service agent will vote shares for which it receives instructions from its customers in accordance with those instructions. A properly executed proxy card or other

authorization by a shareholder that does not specify how the shareholder’s shares should be voted on a proposal may be deemed to authorize a service provider to vote such shares in favor of Proposal 1. Depending on its policies, applicable law

or contractual or other restrictions, a service agent may be permitted to vote shares with respect to which it has not received specific voting instructions from its customers. In those cases, the service agent may, but is not required to, vote such

shares in the same proportion as those shares for which the service agent has received voting instructions. This practice is commonly referred to as “echo voting.”

If you beneficially own shares that are held in “street name” through a broker-dealer or that are held of record by

a service agent, and if you do not give specific voting instructions for your shares, they may not be voted at all. Therefore, you are strongly encouraged to give your broker-dealer or service agent specific instructions as to how you want your

shares to be voted.

|

| INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

The Board Members, including a majority of the Independent Board Members, of the Trust have

selected Deloitte & Touche LLP (“D&T”) as the independent registered public accounting firm for the Trust.

A representative of D&T is expected to be present at the meeting. The representative of D&T will have the opportunity

to make a statement at the meeting if he or she desires to do so and is expected to be available to respond to appropriate questions.

The Trust’s Audit Committee has discussed with D&T the matters required to be discussed by the applicable

requirements of the Public Company Accounting Oversight Board (“PCAOB”) and the SEC.

The Trust’s Audit

Committee has received from D&T the written disclosures and the letter required by PCAOB Ethics and Independence Rule 3526, Communication with Audit Committees Concerning Independence, has

19

discussed D&T’s independence with D&T, and has considered the compatibility of non-audit services with the independence of the independent

registered public accounting firm.

The Trust’s Audit Committee also reviews and discusses the Trust’s financial

statements with Trust management and the independent registered public accounting firm. If any material concerns arise during the course of the audit and the preparation of the audited financial statements mailed to shareholders and included in the

Trust’s annual report to shareholders, the Audit Committee would be notified by Trust management or the independent registered public accounting firm. The Audit Committee received no such notifications for the Trust during its most recently

completed fiscal year. Following the Audit Committee’s review and discussion with the Trust’s independent registered public accounting firm, pursuant to authority delegated by the Board, the Audit Committee approved the Trust’s

audited financial statements for the Trust’s fiscal year ended December 31, 2022 for inclusion in the Trust’s annual report to shareholders.

Appendix E sets forth the fees billed by the Trust’s independent registered public accounting firm for the two

most recent fiscal years for all audit, non-audit, tax and all other services provided directly to the Trust. The fee information in Appendix E is presented under the following captions:

(a) Audit Fees—fees related to the audit and review of the financial

statements included in annual reports and registration statements, and other services that are normally provided in connection with statutory and regulatory filings or engagements, including out-of-pocket expenses.

(b) Audit-Related Fees—fees related to assurance and related services that are

reasonably associated with the performance of the audit or review of financial statements, but not reported under “Audit Fees,” including accounting consultations, agreed-upon procedure reports, attestation reports, comfort letters and

internal control reviews not required by regulators.

(c) Tax

Fees—fees associated with tax compliance and/or tax preparation, as applicable. Tax compliance and preparation include services such as the filing or amendment of federal, state or local income tax returns, and services relating to regulated

investment company qualification reviews, taxable income and tax distribution calculations. All of the fees included under “Tax Fees” in Appendix E relate solely to services provided for tax compliance and/or tax preparation, and

none of such fees relate to tax advice, tax planning or tax consulting.

(d) All Other Fees—fees for products and services provided to the Trust

other than those reported under “Audit Fees,” “Audit-Related Fees” and “Tax Fees.”

(e) Aggregate Non-Audit Fees for

Services Provided to the Trust and its Affiliated Service Providers Pre-Approved by the Audit Committee—the sum of the fees shown under “Audit-Related Fees,” “Tax Fees,” and “All

Other Fees” and fees paid by the Trust’s Affiliated Service Providers to the Trust’s independent registered public accounting firm.

The Trust’s Audit Committee is required to approve all audit engagement fees and terms for the Trust. The Trust’s

Audit Committee also is required to consider and approve (i) the provision by the Trust’s independent registered public accounting firm of any non-audit services to the Trust, and (ii) the

provision by the Trust’s independent registered public accounting firm of non-audit services to BlackRock and any entity controlling, controlled by or under common control with BlackRock that provides

ongoing services to the Trust (“Affiliated Service Providers”) to the extent that such approval (in the case of this clause (ii)) is required under applicable regulations of the SEC. See Appendix E to this Proxy Statement for

information about the fees paid by the Trust, the Advisor, and Affiliated Service Providers to the Trust’s independent registered public accounting firm.

The Audit Committee complies with applicable laws and regulations with regard to the

pre-approval of services. Audit, audit-related and tax compliance services provided to the Trust on an annual basis require specific pre-approval by the Trust’s

Audit Committee. As noted above, the Trust’s Audit Committee must also approve other non-audit services provided by the Trust’s independent registered public accounting firm to the Trust and to the

Trust’s Affiliated Service Providers that relate directly to the operations and financial reporting of the Trust. The Trust’s Audit Committee has implemented policies and procedures by which such services may be approved other than by the

full Audit Committee. Subject to such policies and procedures, including applicable dollar limitations, the Trust’s Audit Committee may pre-approve, without consideration on a specific case-by-case basis (“general pre-approval”), certain

20

permissible non-audit services that the Audit Committee believes are (a) consistent with the SEC’s auditor independence rules and

(b) routine and recurring services that will not impair the independence of the independent registered public accounting firm. Each service approved subject to general pre-approval is presented to the

Trust’s Audit Committee for ratification at the next regularly scheduled Board meeting.

For the Trust’s two

most recently completed fiscal years, there were no services rendered by D&T to the Trust for which the general pre-approval requirement was waived.

Fees for non-audit services provided to the Trust’s Affiliated Service Providers

for which pre-approval by the Trust’s Audit Committee was required for the calendar years ended December 31, 2022 and December 31, 2021 were $2,098,000 and $2,032,000, respectively. These fees

were paid in their entirety by BlackRock in connection with services provided to the Affiliated Service Providers of the Trust and of other BlackRock open-end and

closed-end funds primarily for a service organization controls review and secondarily, a subscription to the Deloitte Accounting Research Tool.

The Trust’s Audit Committee has considered the provision of non-audit services

that were rendered by D&T to the Trust’s Affiliated Service Providers that were not pre-approved (and did not require pre-approval) in connection with

determining such auditor’s independence. All services provided by D&T to the Trust and the Trust’s Affiliated Service Providers that required pre-approval were

pre-approved during the Trust’s most recently completed fiscal year.

The

Audit Committee of the Trust consists of the following Board Members:

|

| Catherine A. Lynch (Chair); |

| Frank J. Fabozzi; |

| Lorenzo A. Flores; and |

| J. Phillip Holloman. |

5% Beneficial Share Ownership

[As of [●], to the best of the Trust’s knowledge, the persons listed in Appendix F beneficially owned more

than 5% of the outstanding shares of the class of the Trust.]

Investment Advisor and Administrator

The Advisor provides investment advisory and administrative services to the Trust. The Advisor is responsible for the

management of the Trust’s portfolio and provides the necessary personnel, facilities, equipment and certain other services necessary to the operation of the Trust. The Advisor, located at 100 Bellevue Parkway, Wilmington, DE 19809, is a wholly

owned subsidiary of BlackRock.

Submission of Shareholder Proposals

A shareholder proposal intended to be presented at a future meeting of shareholders of the Trust must be received at the

offices of the Trust, 50 Hudson Yards, New York, NY 10001, in accordance with the timing requirements set forth below. Timely submission of a proposal does not guarantee that such proposal will be included in a proxy statement.

If a Trust shareholder intends to present a proposal at the 2024 annual meeting of the Trust’s shareholders and desires

to have the proposal included in the Trust’s proxy statement and form of proxy for that meeting pursuant to Rule 14a-8 under the Exchange Act, the shareholder must deliver the proposal to the offices of

the Trust by [●], [●], 2024. In the event the Trust moves the date of its 2024 annual shareholder meeting by more than 30 days from the anniversary of its 2023 annual shareholder meeting, shareholder submissions of proposals for

inclusion in the Trust’s proxy statement and proxy card for the 2024 annual shareholder meeting pursuant to Rule 14a-8 under the Exchange Act must be delivered to the Trust at a reasonable time before the

Trust begins to print and send its proxy materials in connection with the 2024 annual shareholder meeting.

21

Shareholders who do not wish to submit a proposal for inclusion in the

Trust’s proxy statement and form of proxy for the 2024 annual shareholder meeting in accordance with Rule 14a-8 under the Exchange Act may submit a proposal for consideration at the 2024 annual

shareholder meeting in accordance with the By-laws of the Trust. The By-laws for the Trust require that advance notice be given to the Trust in the event a shareholder

desires to transact any business, including business from the floor, at an annual meeting of shareholders, including the nomination of Board Members. Notice of any such business or nomination for consideration at the 2024 annual shareholder meeting

must be in writing, comply with the requirements of the Trust’s By-laws and, assuming that the 2024 annual shareholder meeting is held within 25 days of [●], 2024, must be received by the Trust

between [●], [●], 2024 and [●], [●], 2024.

In order for a shareholder proposal made outside of

Rule 14a-8 under the Exchange Act to be considered “timely” within the meaning of Rule 14a-4(c) under the Exchange Act, such proposal must be received at the

Trust’s principal executive offices by [●], [●], 2024. In the event the Trust moves the date of its 2024 annual shareholder meeting by more than 25 days from the anniversary of its 2023 annual shareholder meeting, shareholders who

wish to submit a proposal or nomination for consideration at the 2024 annual shareholder meeting in accordance with the advance notice provisions of the By-laws of the Trust must deliver such proposal or

nomination not later than the close of business on the tenth day following the day on which the notice of the date of the meeting was mailed or such public disclosure of the meeting date was made, whichever comes first. If such proposals are not

“timely” within the meaning of Rule 14a-4(c), then proxies solicited by the Board for the 2024 annual shareholder meeting may confer discretionary authority to the Board to vote on such proposals.

Copies of the By-laws of the Trust are available on the EDGAR Database on the

SEC’s website at www.sec.gov. The Trust will also furnish, without charge, a copy of its By-laws to a shareholder upon request. Such requests should be directed to the Trust at [●], or

by calling toll free at 1-800-882-0052. For further information, please see Appendix C—Committees of the

Board—Governance Committee.

Written proposals (including nominations of Board Members) and notices should be sent to

the Secretary of the Trust, 50 Hudson Yards, New York, NY 10001.

Shareholder Communications

Shareholders who want to communicate with the Board or any individual Board Member should write to the attention of the

Secretary of the Trust, 50 Hudson Yards, New York, NY 10001. Shareholders may communicate with the Board electronically by sending an e-mail to closedendfundsbod@blackrock.com. The communication

should indicate that you are a Trust shareholder. If the communication is intended for a specific Board Member and so indicates, it will be sent only to that Board Member. If a communication does not indicate a specific Board Member, it will be sent

to the Chair of the Governance Committee and the outside counsel to the Independent Board Members for further distribution as deemed appropriate by such persons.

Additionally, shareholders with complaints or concerns regarding accounting matters may address letters to the CCO, 50 Hudson

Yards, New York, NY 10001. Shareholders who are uncomfortable submitting complaints to the CCO may address letters directly to the Chair of the Audit Committee of the Board that oversees the Trust. Such letters may be submitted on an anonymous

basis.

Expense of Proxy Solicitation

The cost of preparing, printing and mailing the enclosed proxy, accompanying notice and this Proxy Statement, and costs in

connection with the solicitation of proxies will be borne by the Trust. Additional out-of-pocket costs, such as legal expenses and auditor fees, incurred in connection

with the preparation of this Proxy Statement, also will be borne by the Trust. Although no precise estimate can be made at the present time, it is currently estimated that the aggregate amount to be spent in connection with the solicitation of

proxies by the Trust (excluding the salaries and fees of officers and employees) will be between $[●] and $[●]. To date, approximately $[●] has been spent on the solicitation. These estimates include fees for attorneys,

accountants, public relations or financial advisers, proxy solicitors, advertising, printing, transportation, litigation, and other costs incidental to the solicitation, but exclude costs normally expended for the election of Board Members in the

absence of a contest, and costs represented by salaries and wages of regular employees and officers.

Solicitation may be

made by mail, telephone, fax, e-mail or the Internet by officers or regular employees of the Advisor, or by dealers and their representatives. Brokerage houses, banks and other fiduciaries may be requested to

forward proxy solicitation material to their principals to obtain authorization for the execution of proxies. The Trust will reimburse brokerage firms, custodians, banks and fiduciaries for their expenses in forwarding this Proxy Statement and proxy

materials to the beneficial owners of the Trust’s shares. The Trust and BlackRock have retained Georgeson LLC (“Georgeson”), 1290 Avenue of the Americas, 9th Floor, New York, NY

10104, a proxy solicitation

22

firm, to assist in the distribution of proxy materials and the solicitation and tabulation of proxies. It is anticipated that Georgeson will be paid approximately $224,900 for such services

(including reimbursements of out-of-pocket expenses), which is included in the estimate above. Georgeson may solicit proxies personally and by mail, telephone, fax, e-mail or the Internet. Georgeson anticipates that approximately [●] of its employees will be involved in soliciting shareholders of the Trust.

If You Plan to Attend the Annual Meeting

Attendance at the annual meeting will be limited to the Trust’s shareholders as of the Record Date. Each

shareholder will be asked to present valid photographic identification, such as a valid driver’s license or passport. Shareholders holding shares in brokerage accounts or by a bank or other nominee will also be required to show

satisfactory proof of ownership of shares in the Trust, such as a voting instruction form (or a copy thereof) or a letter from the shareholder’s bank, broker or other nominee or a brokerage statement or account statement reflecting share

ownership as of the Record Date. Cameras, recording devices and other electronic devices will not be permitted at the annual meeting.

If you are a registered shareholder, you may vote your shares in person by ballot at the annual meeting. If you hold your

shares in a brokerage account or through a broker, bank or other nominee, you will not be able to vote in person at the annual meeting unless you have previously requested and obtained a “legal proxy” from your broker, bank or other

nominee and present it at the annual meeting.

Privacy Principles of the Trust

The Trust is committed to maintaining the privacy of its current and former shareholders and to safeguarding their non-public personal information. The following information is provided to help you understand what personal information the Trust collects, how the Trust protects that information and why, in certain cases, the

Trust may share such information with select parties.

If you are located in a jurisdiction where specific laws, rules or

regulations require the Trust to provide you with additional or different privacy-related rights beyond what is set forth above, then the Trust will comply with those specific laws, rules or regulations.

The Trust obtains or verifies personal non-public information from and about you from

different sources, including the following: (i) information the Trust receives from you or, if applicable, your financial intermediary, on applications, forms or other documents; (ii) information about your transactions with the Trust, its

affiliates or others; (iii) information the Trust receives from a consumer reporting agency; and (iv) information the Trust receives from visits to the Trust’s or its affiliates’ websites.

The Trust does not sell or disclose to non-affiliated third parties any non-public personal information about its current and former shareholders, except as permitted by law or as is necessary to respond to regulatory requests or to service shareholder accounts. These non-affiliated third parties are required to protect the confidentiality and security of this information and to use it only for its intended purpose.

The Trust may share information with its affiliates to service your account or to provide you with information about other

BlackRock products or services that may be of interest to you. In addition, the Trust restricts access to non-public personal information about its current and former shareholders to those BlackRock employees

with a legitimate business need for the information. The Trust maintains physical, electronic and procedural safeguards that are designed to protect the non-public personal information of its current and

former shareholders, including procedures relating to the proper storage and disposal of such information.

General

Management does not intend to present and does not have reason to believe that any other items of business will be presented

at the 2023 annual shareholder meeting. However, if other matters are properly presented to the meeting for a vote, the proxies will be voted by the persons named in the enclosed proxy upon such matters in accordance with their judgment of what is

in the best interests of the Trust.

23

Failure of a quorum to be present at any meeting may necessitate adjournment. The

Board, prior to any shareholder meeting being convened, may postpone such meeting from time to time to a date not more than 120 days after the original record date. The chair of any shareholder meeting may also adjourn such meeting from time to time

to reconvene at the same or some other place, and notice of any such adjourned meeting need not be given if the time and place by which shareholders may be deemed to be present in person and vote at such adjourned meeting are announced at the