Black Stone Minerals, L.P. (NYSE: BSM) ("Black Stone Minerals,"

"Black Stone," or "the Company") today announces its financial and

operating results for the third quarter of 2024.

Financial and Operational Highlights

- Mineral and royalty production for the third quarter of 2024

equaled 35.3 MBoe/d; total production, including working-interest

volumes, was 37.4 MBoe/d for the quarter.

- Net income for the third quarter was $92.7 million, and

Adjusted EBITDA for the quarter totaled $86.4 million.

- Distributable cash flow was $78.6 million for the third

quarter.

- Black Stone announced a distribution of $0.375 per unit with

respect to the third quarter of 2024. Distribution coverage for all

units was approximately 1.00x.

- No debt was outstanding at the end of the third quarter; as of

November 1, 2024, total debt remained at zero with approximately

$42.8 million of cash on hand.

Management Commentary

Thomas L. Carter, Jr., Black Stone Minerals’ Chairman, Chief

Executive Officer and President, commented, “We are pleased to

announce another successful quarter with our distribution remaining

consistent at $0.375, despite headwinds from the volatile commodity

environment. During the quarter, we continued to advance our

active, targeted mineral acquisition program. In addition, we took

a lease on acreage that we expect to provide a solid foundation for

long-term development activity. We also amended our existing joint

exploration agreements with Aethon, which provide comfort on the

pace of future drilling plans and release acreage back to Black

Stone for other opportunities. We continue to focus on our organic

growth strategy across all our assets and to pursue opportunities

to partner with operators and promote development on our

acreage.”

Quarterly Financial and Operating Results

Production

Black Stone Minerals reported mineral and royalty volumes of

35.3 MBoe/d (74% natural gas) for the third quarter of 2024,

compared to 38.2 MBoe/d for the second quarter of 2024 and 40.3

MBoe/d for the third quarter of 2023.

Working-interest production was 2.1 MBoe/d in the third quarter

of 2024, 2.2 MBoe/d in the second quarter of 2024, and 2.3 MBoe/d

in the third quarter of 2023. The continued decline year over year

in working-interest volumes is consistent with the Company’s

decision to farm out its working-interest participation to

third-party capital providers.

Total reported production averaged 37.4 MBoe/d (94% mineral and

royalty, 75% natural gas) for the third quarter of 2024, compared

to 40.4 MBoe/d and 42.6 MBoe/d for the second quarter of 2024 and

the third quarter of 2023, respectively.

Realized Prices, Revenues, and Net Income

The Company’s average realized price per Boe, excluding the

effect of derivative settlements, was $29.40 for the third quarter

of 2024. This is a decrease of 2% from $30.01 per Boe in the second

quarter of 2024 and a 14% decrease from $34.30 in the third quarter

of 2023.

Black Stone reported oil and gas revenue of $101.0 million (63%

oil and condensate) for the third quarter of 2024, a decrease of 8%

from $110.4 million in the second quarter of 2024. Oil and gas

revenue in the third quarter of 2023 was $134.5 million.

The Company reported a gain on commodity derivative instruments

of $31.7 million for the third quarter of 2024, composed of a $10.9

million gain from realized settlements and a non-cash $20.8 million

unrealized gain due to the change in value of Black Stone’s

derivative positions during the quarter. Black Stone reported

losses of $5.5 million and $26.9 million on commodity derivative

instruments for the second quarter of 2024 and the third quarter of

2023, respectively.

Lease bonus and other income was $2.1 million for the third

quarter of 2024. Lease bonus and other income for the second

quarter of 2024 and the third quarter of 2023 was $4.8 million and

$2.2 million, respectively.

The Company reported net income of $92.7 million for the third

quarter of 2024, compared to net income of $68.3 million in the

preceding quarter. For the third quarter of 2023, the Company

reported net income of $62.1 million.

Adjusted EBITDA and Distributable Cash Flow

Adjusted EBITDA for the third quarter of 2024 was $86.4 million,

which compares to $100.2 million in the second quarter of 2024 and

$130.0 million in the third quarter of 2023. Distributable cash

flow for the third quarter of 2024 was $78.6 million. For the

second quarter of 2024 and the third quarter of 2023, distributable

cash flow was $92.5 million and $124.4 million, respectively.

Financial Position and Activities

As of September 30, 2024, Black Stone Minerals had $21.0 million

in cash, with no amounts drawn under its credit facility. At the

beginning of November, the Company had approximately $42.8 million

in cash, and no debt was outstanding under the credit facility.

On November 1, 2024, Black Stone's borrowing base under the

credit facility was reaffirmed, and total commitments under the

credit facility were maintained at $375.0 million. Black Stone is

in compliance with all financial covenants associated with its

credit facility.

Third Quarter 2024 Distributions

As previously announced, the Board approved a cash distribution

of $0.375 for each common unit attributable to the third quarter of

2024. The quarterly distribution coverage ratio attributable to the

third quarter of 2024 was approximately 1.00x. The distribution

will be paid on November 15, 2024 to unitholders of record as of

the close of business on November 8, 2024.

Activity Update

Shelby Trough Development Update

A significant portion of Shelby Trough development in recent

years has been performed by Aethon Energy (“Aethon”) under the two

Joint Exploration Agreements (“JEAs”) between the Company and

Aethon. The JEAs outline Aethon’s development obligations and other

rights and obligations of each party related to our core mineral

positions in San Augustine and Angelina counties in East Texas.

In September 2024, the Partnership entered into letter

agreements with Aethon to amend the JEAs in San Augustine and

Angelina counties. In those agreements, the parties agreed to

revise the current program year drill schedules under each JEA, to

extend the respective program years by nine months, and to withdraw

the invocation of the time-out provisions. Aethon also released its

rights under 25,000 acres from the parties' area of mutual interest

defined in the original JEAs.

Acquisition Activity

Black Stone’s commercial strategy since 2021 has been focused on

attracting capital and securing drilling commitments in areas where

the Company already owns significant minerals. Management made the

decision to expand this growth strategy by adding to the Company’s

mineral portfolio through strategic, targeted efforts primarily in

the Gulf Coast region. In the third quarter of 2024 Black Stone

acquired additional (primarily non-producing) mineral, royalty, and

leasehold interests totaling $14.7 million and since September

2023, the Company has acquired a total of $79.8 million in mineral,

royalty, and leasehold interests. Black Stone’s commercial strategy

going forward includes the continuation of meaningful, targeted

mineral and royalty acquisitions to complement the Company's

existing positions.

Update to Hedge Position

Black Stone has commodity derivative contracts in place covering

portions of its anticipated production for 2024, 2025, and 2026.

The Company's hedge position as of November 1, 2024 is summarized

in the following tables:

Oil Hedge Position

Oil Swap

Oil Swap Price

MBbl

$/Bbl

4Q24

570

$71.45

1Q25

555

$71.22

2Q25

555

$71.22

3Q25

555

$71.22

4Q25

555

$71.22

1Q26

180

$66.29

2Q26

180

$66.29

3Q26

180

$66.29

4Q26

180

$66.29

Natural Gas Hedge Position

Gas Swap

Gas Swap Price

BBtu

$/MMbtu

4Q24

10,580

$3.55

1Q25

10,800

$3.36

2Q25

10,920

$3.36

3Q25

11,040

$3.45

4Q25

11,040

$3.45

1Q26

7,200

$3.52

2Q26

7,280

$3.52

3Q26

7,360

$3.52

4Q26

7,360

$3.52

More detailed information about the Company's existing hedging

program can be found in the Quarterly Report on Form 10-Q for the

third quarter of 2024, which is expected to be filed on or around

November 5, 2024.

Conference Call

Black Stone Minerals will host a conference call and webcast for

investors and analysts to discuss its results for the third quarter

of 2024 on Tuesday, November 5, 2024 at 9:00 a.m. Central Time.

Black Stone recommends participants who do not anticipate asking

questions to listen to the call via the live broadcast available at

http://investor.blackstoneminerals.com. Analysts

and investors who wish to ask questions should dial (800) 343-4849

for domestic participants and (203) 518-9848 for international

participants, the conference ID for the call is BSMQ324. A

recording of the conference call will be available on Black Stone's

website.

About Black Stone Minerals, L.P.

Black Stone Minerals is one of the largest owners of oil and

natural gas mineral interests in the United States. The Company

owns mineral interests and royalty interests in 41 states in the

continental United States. Black Stone believes its large,

diversified asset base and long-lived, non-cost-bearing mineral and

royalty interests provide for stable to growing production and

reserves over time, allowing the majority of generated cash flow to

be distributed to unitholders.

Forward-Looking Statements

This news release includes forward-looking statements. All

statements, other than statements of historical facts, included in

this news release that address activities, events or developments

that the Company expects, believes or anticipates will or may occur

in the future are forward-looking statements. Terminology such as

“will,” “may,” “should,” “expect,” “anticipate,” “plan,” “project,”

“intend,” “estimate,” “believe,” “target,” “continue,” “potential,”

the negative of such terms, or other comparable terminology often

identify forward-looking statements. Except as required by law,

Black Stone Minerals undertakes no obligation and does not intend

to update these forward-looking statements to reflect events or

circumstances occurring after this news release. You are cautioned

not to place undue reliance on these forward-looking statements,

which speak only as of the date of this news release. All

forward-looking statements are qualified in their entirety by these

cautionary statements. These forward-looking statements involve

risks and uncertainties, many of which are beyond the control of

Black Stone Minerals, which may cause the Company’s actual results

to differ materially from those implied or expressed by the

forward-looking statements. Important factors that could cause

actual results to differ materially from those in the

forward-looking statements include, but are not limited to, those

summarized below:

- the Company’s ability to execute its business strategies;

- the volatility of realized oil and natural gas prices;

- the level of production on the Company’s properties;

- overall supply and demand for oil and natural gas, as well as

regional supply and demand factors, delays, or interruptions of

production;

- conservation measures and general concern about the

environmental impact of the production and use of fossil

fuels;

- the Company’s ability to replace its oil and natural gas

reserves;

- general economic, business, or industry conditions including

slowdowns, domestically and internationally, and volatility in the

securities, capital or credit markets;

- cybersecurity incidents, including data security breaches or

computer viruses;

- competition in the oil and natural gas industry;

- the availability or cost of rigs, equipment, raw materials,

supplies, oilfield services or personnel; and

- the level of drilling activity by the Company's operators,

particularly in areas such as the Shelby Trough where the Company

has concentrated acreage positions.

BLACK STONE MINERALS, L.P. AND

SUBSIDIARIES

CONSOLIDATED STATEMENTS OF

OPERATIONS

(Unaudited)

(In thousands, except per unit

amounts)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

REVENUE

Oil and condensate sales

$

63,999

$

85,724

$

209,112

$

208,184

Natural gas and natural gas liquids

sales

37,039

48,815

115,543

147,857

Lease bonus and other income

2,143

2,180

10,480

8,682

Revenue from contracts with customers

103,181

136,719

335,135

364,723

Gain (loss) on commodity derivative

instruments

31,675

(26,922

)

14,838

36,652

TOTAL REVENUE

134,856

109,797

349,973

401,375

OPERATING (INCOME) EXPENSE

Lease operating expense

2,422

2,615

7,433

8,149

Production costs and ad valorem taxes

12,369

16,441

38,876

41,952

Exploration expense

2,562

1,711

2,579

1,719

Depreciation, depletion, and

amortization

11,258

12,367

34,253

33,935

General and administrative

12,801

14,448

40,286

38,950

Accretion of asset retirement

obligations

324

254

962

749

(Gain) loss on sale of assets, net

—

(73

)

—

(73

)

TOTAL OPERATING EXPENSE

41,736

47,763

124,389

125,381

INCOME (LOSS) FROM OPERATIONS

93,120

62,034

225,584

275,994

OTHER INCOME (EXPENSE)

Interest and investment income

344

511

1,476

1,041

Interest expense

(724

)

(621

)

(1,979

)

(2,080

)

Other income (expense)

(9

)

143

(101

)

(53

)

TOTAL OTHER EXPENSE

(389

)

33

(604

)

(1,092

)

NET INCOME (LOSS)

92,731

62,067

224,980

274,902

Distributions on Series B cumulative

convertible preferred units

(7,366

)

(5,250

)

(22,099

)

(15,750

)

NET INCOME (LOSS) ATTRIBUTABLE TO THE

GENERAL PARTNER AND COMMON UNITS

$

85,365

$

56,817

$

202,881

$

259,152

ALLOCATION OF NET INCOME (LOSS):

General partner interest

$

—

$

—

$

—

$

—

Common units

85,365

56,817

202,881

259,152

$

85,365

$

56,817

$

202,881

$

259,152

NET INCOME (LOSS) ATTRIBUTABLE TO LIMITED

PARTNERS PER COMMON UNIT:

Per common unit (basic)

$

0.41

$

0.27

$

0.96

$

1.23

Per common unit (diluted)

$

0.41

$

0.27

$

0.96

$

1.22

WEIGHTED AVERAGE COMMON UNITS

OUTSTANDING:

Weighted average common units outstanding

(basic)

210,687

209,982

210,680

209,963

Weighted average common units outstanding

(diluted)

210,687

209,982

210,680

224,932

The following table shows the Company’s production, revenues,

pricing, and expenses for the periods presented:

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

(Unaudited)

(Dollars in thousands, except

for realized prices and per Boe data)

Production:

Oil and condensate (MBbls)

875

1,092

2,751

2,731

Natural gas (MMcf)1

15,369

16,980

48,190

48,101

Equivalents (MBoe)

3,437

3,922

10,783

10,748

Equivalents/day (MBoe)

37.4

42.6

39.4

39.4

Realized prices, without derivatives:

Oil and condensate ($/Bbl)

$

73.15

$

78.50

$

76.01

$

76.23

Natural gas ($/Mcf)1

2.41

2.87

2.40

3.07

Equivalents ($/Boe)

$

29.40

$

34.30

$

30.11

$

33.13

Revenue:

Oil and condensate sales

$

63,999

$

85,724

$

209,112

$

208,184

Natural gas and natural gas liquids

sales1

37,039

48,815

115,543

147,857

Lease bonus and other income

2,143

2,180

10,480

8,682

Revenue from contracts with customers

103,181

136,719

335,135

364,723

Gain (loss) on commodity derivative

instruments

31,675

(26,922

)

14,838

36,652

Total revenue

$

134,856

$

109,797

$

349,973

$

401,375

Operating expenses:

Lease operating expense

$

2,422

$

2,615

$

7,433

$

8,149

Production costs and ad valorem taxes

12,369

16,441

38,876

41,952

Exploration expense

2,562

1,711

2,579

1,719

Depreciation, depletion, and

amortization

11,258

12,367

34,253

33,935

General and administrative

12,801

14,448

40,286

38,950

Other expense:

Interest expense

724

621

1,979

2,080

Per Boe:

Lease operating expense (per

working-interest Boe)

$

12.75

$

12.16

$

12.51

$

12.25

Production costs and ad valorem taxes

3.60

4.19

3.61

3.90

Depreciation, depletion, and

amortization

3.28

3.15

3.18

3.16

General and administrative

3.72

3.68

3.74

3.62

1

As a mineral-and-royalty-interest owner,

Black Stone Minerals is often provided insufficient and

inconsistent data on natural gas liquid ("NGL") volumes by its

operators. As a result, the Company is unable to reliably determine

the total volumes of NGLs associated with the production of natural

gas on its acreage. Accordingly, no NGL volumes are included in

reported production; however, revenue attributable to NGLs is

included in natural gas revenue and the calculation of realized

prices for natural gas.

Non-GAAP Financial Measures

Adjusted EBITDA and Distributable cash flow are supplemental

non-GAAP financial measures used by Black Stone's management and

external users of the Company's financial statements such as

investors, research analysts, and others, to assess the financial

performance of its assets and ability to sustain distributions over

the long term without regard to financing methods, capital

structure, or historical cost basis.

The Company defines Adjusted EBITDA as net income (loss) before

interest expense, income taxes, and depreciation, depletion, and

amortization adjusted for impairment of oil and natural gas

properties, if any, accretion of asset retirement obligations,

unrealized gains and losses on commodity derivative instruments,

non-cash equity-based compensation, and gains and losses on sales

of assets, if any. Black Stone defines Distributable cash flow as

Adjusted EBITDA plus or minus amounts for certain non-cash

operating activities, cash interest expense, distributions to

preferred unitholders, and restructuring charges, if any.

Adjusted EBITDA and Distributable cash flow should not be

considered an alternative to, or more meaningful than, net income

(loss), income (loss) from operations, cash flows from operating

activities, or any other measure of financial performance presented

in accordance with generally accepted accounting principles

("GAAP") in the United States as measures of the Company's

financial performance.

Adjusted EBITDA and Distributable cash flow have important

limitations as analytical tools because they exclude some but not

all items that affect net income (loss), the most directly

comparable U.S. GAAP financial measure. The Company's computation

of Adjusted EBITDA and Distributable cash flow may differ from

computations of similarly titled measures of other companies.

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

(Unaudited)

(In thousands, except per unit

amounts)

Net income (loss)

$

92,731

$

62,067

$

224,980

$

274,902

Adjustments to reconcile to Adjusted

EBITDA:

Depreciation, depletion, and

amortization

11,258

12,367

34,253

33,935

Interest expense

724

621

1,979

2,080

Income tax expense (benefit)

39

(109

)

225

177

Accretion of asset retirement

obligations

324

254

962

749

Equity–based compensation

2,177

3,777

6,765

8,412

Unrealized (gain) loss on commodity

derivative instruments

(20,811

)

51,111

21,642

29,006

(Gain) loss on sale of assets, net

—

(73

)

—

(73

)

Adjusted EBITDA

86,442

130,015

290,806

349,188

Adjustments to reconcile to Distributable

cash flow:

Change in deferred revenue

(1

)

(1

)

(3

)

(8

)

Cash interest expense

(453

)

(359

)

(1,172

)

(1,305

)

Preferred unit distributions

(7,366

)

(5,250

)

(22,099

)

(15,750

)

Distributable cash flow

$

78,622

$

124,405

$

267,532

$

332,125

Total units outstanding1

210,695

209,991

Distributable cash flow per unit

$

0.373

$

0.592

1

The distribution attributable to the three

months ended September 30, 2024 is estimated using 210,694,933

common units as of November 1, 2024; the exact amount of the

distribution attributable to the three months ended September 30,

2024 will be determined based on units outstanding as of the record

date of November 8, 2024. Distributions attributable to the three

months ended September 30, 2023 were calculated using 209,991,049

common units as of the record date of November 9, 2023.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241104018248/en/

Black Stone Minerals, L.P. Contact Taylor DeWalch Senior

Vice President, Chief Financial Officer, and Treasurer Telephone:

(713) 445-3200 investorrelations@blackstoneminerals.com

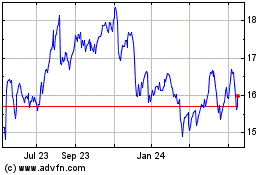

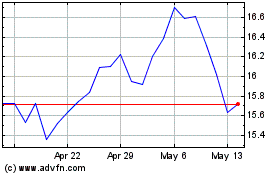

Black Stone Minerals (NYSE:BSM)

Historical Stock Chart

From Nov 2024 to Dec 2024

Black Stone Minerals (NYSE:BSM)

Historical Stock Chart

From Dec 2023 to Dec 2024