Bio-Rad Laboratories, Inc. (NYSE: BIO and BIO.B), a global

leader in life science research and clinical diagnostics products,

today announced financial results for the second quarter ended June

30, 2024.

Second-quarter 2024 total net sales were $638.5 million, a

decrease of 6.3 percent compared to $681.1 million reported for the

second quarter of 2023. On a currency-neutral basis, quarterly

sales decreased 5.4 percent compared to the same period in

2023.

Life Science segment net sales for the second quarter were

$250.5 million, a decrease of 16.5 percent compared to the same

period in 2023. On a currency-neutral basis, Life Science segment

sales decreased by 15.9 percent compared to the same quarter in

2023. The currency-neutral year-over-year sales decrease was

broad-based and was primarily driven by ongoing weakness in the

biotech and biopharma end-markets.

Clinical Diagnostics segment net sales for the second quarter

were $387.9 million, an increase of 2.1 percent compared to the

same period in 2023. On a currency-neutral basis, net sales

increased 3.2 percent versus the same quarter last year. The

currency-neutral year-over-year sales increase was primarily driven

by an increased demand for quality control and blood typing

products.

Second-quarter gross margin was 55.6 percent compared to 53.2

percent during the second quarter of 2023.

Income from operations during the second quarter of 2024 was

$101.5 million versus $89.6 million during the same quarter last

year.

During the second quarter of 2024, the company recognized a

change in the fair market value of its investment in Sartorius AG,

which substantially contributed to a net loss of $2,165.5 million,

or $76.26 per share, on a diluted basis, versus a net loss of

$1,162.3 million, or $39.59 per share, on a diluted basis, reported

for the same period of 2023.

The effective tax rate for the second quarter of 2024 was 22.3

percent, compared to 22.5 percent for the same period in 2023. The

effective tax rate reported in these periods was primarily affected

by the accounting treatment of equity securities.

“Our second quarter results were in line with expectations for

topline revenue despite a challenging market environment,” said

Norman Schwartz, Bio-Rad’s President and Chief Executive Officer.

“We continue to experience constraints in biotech and biopharma

customer spending and, as a result, expect a more modest pace of

market recovery than originally anticipated. At the same time,

ongoing supply chain initiatives, core process improvements, and

cost control are positively impacting our margin profile. In

addition, as our life science business rebounds, we are well

positioned for further margin expansion.”

The non-GAAP financial measures discussed below exclude certain

items detailed later in this press release under the heading “Use

of Non-GAAP and Currency-Neutral Reporting.” A reconciliation

between historical GAAP operating results and non-GAAP operating

results is provided following the financial statements that are

part of this press release.

Non-GAAP gross margin was 56.4 percent for the second quarter of

2024 compared to 54.4 percent during the second quarter of

2023.

Non-GAAP income from operations during the second quarter of

2024 was $107.1 million versus $107.9 million during the comparable

prior-year period.

Non-GAAP net income for the second quarter of 2024 was $88.5

million, or $3.11 per share, on a diluted basis, compared to $88.5

million, or $3.00 per share, on a diluted basis, during the same

period in 2023.

The non-GAAP effective tax rate for the second quarter of 2024

was 23.4 percent, compared to 22.5 percent for the same period in

2023. The higher rate in 2024 was driven by geographical mix of

earnings.

GAAP Results

Q2 2024

Q2 2023

Revenue (millions)

$

638.5

$

681.1

Gross margin

55.6

%

53.2

%

Operating margin

15.9

%

13.2

%

Net loss (millions)

$

(2,165.5

)

$

(1,162.3

)

Loss per diluted share

$

(76.26

)

$

(39.59

)

Non-GAAP Results

Q2 2024

Q2 2023

Revenue (millions)

$

638.5

$

681.1

Gross margin

56.4

%

54.4

%

Operating margin

16.8

%

15.8

%

Net income (millions)

$

88.5

$

88.5

Income per diluted share

$

3.11

$

3.00

Updated Full-Year 2024 Financial Outlook

Bio-Rad is updating its financial outlook for the full year

2024. The company currently expects its non-GAAP revenue to decline

by approximately 2.5 to 4.0 percent on a currency-neutral basis

compared to its previous estimate of 1.0 to 2.5 percent revenue

growth. Bio-Rad also estimates a non-GAAP operating margin of about

12.0 to 13.0 percent versus the company’s prior estimate of

approximately 13.5 to 14.0 percent.

Increase to 2023 Share Repurchase Program

Authorization

On July 29, 2024, Bio-Rad's board of directors authorized

increasing the amount available under the company's 2023 Share

Repurchase Program to allow the company to repurchase up to an

additional $500 million of the company’s outstanding common stock.

As of July 31, 2024, a total of approximately $578 million is

available for repurchases under the 2023 Share Repurchase

Program.

Repurchases under the 2023 Share Repurchase Program may be made

at management's discretion from time to time on the open market,

through trading plans in accordance with Rule 10b5-1 under the

Securities Exchange Act of 1934, as amended, or through privately

negotiated transactions. The 2023 Share Repurchase Program has no

time limit and may be suspended for periods or discontinued at any

time.

Conference Call and Webcast

Management will discuss the company’s second quarter 2024

results and financial outlook in a conference call scheduled for 2

PM Pacific Time (5 PM Eastern Time) on August 1, 2024. To

participate, dial 800-343-4849 within the U.S., or (+1)

203-518-9856 from outside the U.S., and provide access code:

BIORAD.

A live webcast of the conference call will also be available in

the "Investor Relations" section of the company’s website under

"Events & Presentations" at investors.bio-rad.com. A replay of

the webcast will be available for up to a year.

Use of Non-GAAP and Currency-Neutral Reporting

In addition to the financial measures prepared in accordance

with generally accepted accounting principles (GAAP), we use

certain non-GAAP financial measures, including non-GAAP net income

and non-GAAP EPS, which exclude amortization of acquisition-related

intangible assets, certain acquisition-related expenses and

benefits, restructuring charges, asset impairment charges, gains

and losses from change in fair market value of equity securities

and loan receivable, gains and losses on equity-method investments,

and significant legal-related charges or benefits and associated

legal costs. Non-GAAP net income and non-GAAP EPS also exclude

certain other gains and losses that are either isolated or cannot

be expected to occur again with any predictability, tax

provisions/benefits related to the previous items, and significant

discrete tax events. We exclude the above items because they are

outside of our normal operations and/or, in certain cases, are

difficult to forecast accurately for future periods.

We utilize a number of different financial measures, both GAAP

and non-GAAP, in analyzing and assessing the overall performance of

our business, in making operating decisions, forecasting and

planning for future periods, and determining payments under

compensation programs. We consider the use of the non-GAAP measures

to be helpful in assessing the performance of the ongoing operation

of our business. We believe that disclosing non-GAAP financial

measures provides useful supplemental data that, while not a

substitute for financial measures prepared in accordance with GAAP,

allows for greater transparency in the review of our financial and

operational performance. We also believe that disclosing non-GAAP

financial measures provides useful information to investors and

others in understanding and evaluating our operating results and

future prospects in the same manner as management and in comparing

financial results across accounting periods and to those of peer

companies. More specifically, management adjusts for the excluded

items for the following reasons:

Amortization of purchased intangible assets: we do not acquire

businesses and assets on a predictable cycle. The amount of

purchase price allocated to purchased intangible assets and the

term of amortization can vary significantly and are unique to each

acquisition or purchase. We believe that excluding amortization of

purchased intangible assets allows the users of our financial

statements to better review and understand the historic and current

results of our operations, and also facilitates comparisons to peer

companies.

Acquisition-related expenses and benefits: we incur expenses or

benefits with respect to certain items associated with our

acquisitions, such as transaction costs, professional fees for

assistance with the transaction; valuation or integration costs;

changes in the fair value of contingent consideration, gain or loss

on settlement of pre-existing relationships with the acquired

entity; or adjustments to purchase price. We exclude such expenses

or benefits as they are related to acquisitions and have no direct

correlation to the operation of our on-going business.

Restructuring, impairment charges, and gains and losses from

change in fair market value of equity securities and loan

receivable, and gains and losses on equity-method investments: we

incur restructuring and impairment charges on individual or groups

of employed assets and charges and benefits arising from gains and

losses from change in fair market value of equity securities and

loan receivable, and gains and losses (including impairments) on

equity-method investments, which arise from unforeseen

circumstances and/or often occur outside of the ordinary course of

our on-going business. Although these events are reflected in our

GAAP financials, these unique transactions may limit the

comparability of our on-going operations with prior and future

periods.

Significant litigation charges or benefits and legal costs: we

may incur charges or benefits as well as legal costs in connection

with litigation and other contingencies unrelated to our core

operations. We exclude these charges or benefits, when significant,

as well as legal costs associated with significant legal matters,

because we do not believe they are reflective of on-going business

and operating results.

Income tax expense: we estimate the tax effect of the excluded

items identified above to determine a non-GAAP annual effective tax

rate applied to the pretax amount in order to calculate the

non-GAAP provision for income taxes. We also adjust for items for

which the nature and/or tax jurisdiction requires the application

of a specific tax rate or treatment.

From time to time in the future, there may be other items

excluded if we believe that doing so is consistent with the goal of

providing useful information to investors and management.

Percentage sales growth in currency neutral amounts are

calculated by translating prior period sales in each local currency

using the current period’s monthly average foreign exchange rates

for that currency and comparing that to current period sales.

There are limitations in using non-GAAP financial measures

because the non-GAAP financial measures are not prepared in

accordance with generally accepted accounting principles and may be

different from non-GAAP financial measures used by other companies.

The non-GAAP financial measures are limited in value because they

exclude certain items that may have a material impact on our

reported financial results. The presentation of this additional

information is not meant to be considered in isolation or as a

substitute for the directly comparable financial measures prepared

in accordance with GAAP in the United States. Investors should

review the reconciliation of the non-GAAP financial measures to

their most directly comparable GAAP financial measures as provided

in the tables accompanying this press release.

We do not provide a reconciliation of our non-GAAP financial

expectations to expectations for the most comparable GAAP measure

because the amount and timing of many future charges that impact

these measures (such as amortization of future acquisition-related

intangible assets, future acquisition-related expenses and

benefits, future restructuring charges, future asset impairment

charges, future valuation changes of equity-owned securities,

future gains and losses on equity-method investments or future

legal charges or benefits), which could be material, are variable,

uncertain, or out of our control and therefore cannot be reasonably

predicted without unreasonable effort, if at all.

BIO-RAD is a trademark of Bio-Rad Laboratories, Inc. in certain

jurisdictions.

About Bio-Rad

Bio-Rad Laboratories, Inc. (NYSE: BIO and BIO.B) is a leader in

developing, manufacturing, and marketing a broad range of products

for the life science research and clinical diagnostics markets.

Based in Hercules, California, Bio-Rad operates a global network of

research, development, manufacturing, and sales operations with

approximately 8,000 employees and $2.7 billion in revenues in 2023.

Our customers include universities, research institutions,

hospitals, food safety and environmental quality laboratories, and

biopharmaceutical companies. Together, we develop innovative,

high-quality products that advance science and save lives. To learn

more, visit bio-rad.com.

Forward-Looking Statements

This release may be deemed to contain certain forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995. These forward-looking statements include,

without limitation, statements we make regarding estimated future

financial performance or results; being well positioned for further

margin expansion as our life science business rebounds; continuing

to experience constraints in biotech and biopharma customer

spending and, as a result, expecting a more modest pace of market

recovery than originally anticipated; and for the full-year 2024:

expecting non-GAAP revenue to decline by approximately 2.5 to 4.0

percent on a currency-neutral basis compared to its previous

estimate of 1.0 to 2.5 percent revenue growth, and estimating a

non-GAAP operating margin of about 12.0 to 13.0 percent versus the

company’s prior estimate of approximately 13.5 to 14.0 percent.

Forward-looking statements generally can be identified by the use

of forward-looking terminology such as, "expect,” "estimate,"

"continue," "believe," "anticipate," “target,” "will," "project,"

"assume," "may," "intend," or similar expressions or the negative

of those terms or expressions, although not all forward-looking

statements contain these words. Such statements involve risks and

uncertainties, which could cause actual results to vary materially

from those expressed in or indicated by the forward-looking

statements. These risks and uncertainties include reductions in

government funding or capital spending of our customers, global

economic and geopolitical conditions, the uncertain pace of the

biopharma sector’s recovery, the challenging macroeconomic

environment in China, supply chain issues, international legal and

regulatory risks, our ability to develop and market new or improved

products, our ability to compete effectively, foreign currency

exchange fluctuations, product quality and liability issues, our

ability to integrate acquired companies, products or technologies

into our company successfully, changes in the healthcare industry,

and natural disasters and other catastrophic events beyond our

control. For further information regarding the Company's risks and

uncertainties, please refer to the "Risk Factors" and "Management’s

Discussion and Analysis of Financial Condition and Results of

Operations" in the Company's public reports filed with the

Securities and Exchange Commission (the "SEC"), including the

Company's Annual Report on Form 10-K for the fiscal year ended

December 31, 2023, and its Quarterly Report on Form 10-Q for the

quarter ended June 30, 2024 to be filed with the SEC. The Company

cautions you not to place undue reliance on forward-looking

statements, which reflect an analysis only and speak only as of the

date hereof. Bio-Rad Laboratories, Inc. disclaims any obligation to

update these forward-looking statements.

Bio-Rad Laboratories, Inc. Condensed Consolidated

Statements of Income (Loss) (In thousands, except per share

data) (Unaudited)

Three Months Ended

Six Months Ended

June 30,

June 30,

2024

2023

2024

2023

Net sales

$

638,476

$

681,110

$

1,249,296

$

1,357,954

Cost of goods sold

283,357

318,627

568,211

633,054

Gross profit

355,119

362,483

681,085

724,900

Selling, general and administrative expense

194,719

207,824

409,602

433,377

Research and development expense

58,904

65,042

125,279

139,993

Income from operations

101,496

89,617

146,204

151,530

Interest expense

12,264

12,343

24,541

24,680

Foreign currency exchange gains, net

(1,699

)

(1,253

)

(3,653

)

(3,600

)

Losses from change in fair market value of equity securities and

loan receivable

2,895,355

1,595,442

2,473,178

1,612,967

Other income, net

(18,143

)

(16,488

)

(52,659

)

(66,919

)

Loss before income taxes

(2,786,281

)

(1,500,427

)

(2,295,203

)

(1,415,598

)

Benefit from income taxes

620,795

338,176

513,633

322,309

Net loss

$

(2,165,486

)

$

(1,162,251

)

$

(1,781,570

)

$

(1,093,289

)

Basic and diluted loss per share: Net loss per share

$

(76.26

)

$

(39.59

)

$

(62.61

)

$

(37.09

)

Weighted average common shares

28,395

29,355

28,457

29,475

Note:

As a result of the net loss for the three and six months ended June

30, 2024 and 2023, all potentially issuable common shares have been

excluded from the diluted shares used in the computation of

earnings per share as their effect was anti-dilutive.

Bio-Rad

Laboratories, Inc. Condensed Consolidated Balance Sheets

(In thousands)

June 30,

December 31,

2024

2023

(Unaudited)

Current assets: Cash and cash equivalents

$

406,913

$

403,815

Short-term investments

1,214,753

1,208,887

Accounts receivable, net

445,506

489,017

Inventories, net

803,693

780,517

Other current assets

185,389

166,094

Total current assets

3,056,254

3,048,330

Property, plant and equipment, net

533,767

529,007

Operating lease right-of-use assets

181,473

194,730

Goodwill, net

412,116

413,569

Purchased intangibles, net

307,093

320,514

Other investments

5,099,554

7,698,070

Other assets

98,189

94,850

Total assets

$

9,688,446

$

12,299,070

Current liabilities: Accounts payable, accrued payroll and

employee benefits

$

259,153

$

284,554

Current maturities of long-term debt

483

486

Income and other taxes payable

35,896

35,759

Other current liabilities

191,429

202,000

Total current liabilities

486,961

522,799

Long-term debt, net of current maturities

1,199,724

1,199,052

Other long-term liabilities

1,222,974

1,836,086

Total liabilities

2,909,659

3,557,937

Total stockholders' equity

6,778,787

8,741,133

Total liabilities and stockholders' equity

$

9,688,446

$

12,299,070

Bio-Rad Laboratories, Inc. Condensed Consolidated

Statements of Cash Flows (In thousands) (Unaudited)

Six Months Ended

June 30,

2024

2023

Cash flows from operating activities: Cash received from

customers

$

1,265,453

$

1,360,206

Cash paid to suppliers and employees

(1,084,925

)

(1,173,285

)

Interest paid, net

(23,301

)

(23,535

)

Income tax payments, net

(52,172

)

(31,556

)

Other operating activities

62,383

64,355

Net cash provided by operating activities

167,438

196,185

Cash flows from investing activities: Payments for purchases

of marketable securities and investments

(654,541

)

(341,522

)

Proceeds from sales and maturities of marketable securities and

investments

662,886

369,358

Other investing activities

(82,365

)

(70,325

)

Net cash used in investing activities

(74,020

)

(42,489

)

Cash flows from financing activities: Payments on long-term

borrowings

(236

)

(231

)

Other financing activities

(96,330

)

(198,198

)

Net cash used in financing activities

(96,566

)

(198,429

)

Effect of foreign exchange rate changes on cash

6,494

670

Net increase (decrease) in cash, cash equivalents and

restricted cash

3,346

(44,063

)

Cash, cash equivalents and restricted cash at beginning of period

404,369

434,544

Cash, cash equivalents and restricted cash at end of period

$

407,715

$

390,481

Reconciliation of net loss to net cash provided by

operating activities: Net loss

$

(1,781,570

)

$

(1,093,289

)

Adjustments to reconcile net loss to net cash provided by operating

activities: Depreciation and amortization

73,502

71,446

Reduction in the carrying amount of right-of-use assets

20,904

19,872

Losses from change in fair market value of equity securities and

loan receivable

2,473,178

1,612,966

Changes in working capital

(71,637

)

(56,568

)

Other

(546,939

)

(358,242

)

Net cash provided by operating activities

$

167,438

$

196,185

Bio-Rad Laboratories, Inc.

Reconciliation of GAAP financial measures to non-GAAP financial

measures (In thousands, except per share data) (Unaudited)

In addition to the financial measures prepared in accordance

with generally accepted accounting principles (GAAP), we use

certain non-GAAP financial measures, including non-GAAP net income

and non-GAAP diluted income per share (non-GAAP EPS), which exclude

amortization of acquisition-related intangible assets; certain

acquisition-related expenses and benefits; restructuring charges;

asset impairment charges; gains and losses from change in fair

market value of equity securities and loan receivable; gains and

losses on equity-method investments; and significant legal-related

charges or benefits and associated legal costs. Non-GAAP net income

and non-GAAP EPS also exclude certain other gains and losses that

are either isolated or cannot be expected to occur again with any

predictability, tax provisions/benefits related to the previous

items, and significant discrete tax events. We exclude the above

items because they are outside of our normal operations and/or, in

certain cases, are difficult to forecast accurately for future

periods.

We utilize a number of different financial measures, both GAAP

and non-GAAP, in analyzing and assessing the overall performance of

our business, in making operating decisions, forecasting and

planning for future periods, and determining payments under

compensation programs. We consider the use of the non-GAAP measures

to be helpful in assessing the performance of the ongoing operation

of our business. We believe that disclosing non-GAAP financial

measures provides useful supplemental data that, while not a

substitute for financial measures prepared in accordance with GAAP,

allows for greater transparency in the review of our financial and

operational performance. We also believe that disclosing non-GAAP

financial measures provides useful information to investors and

others in understanding and evaluating our operating results and

future prospects in the same manner as management and in comparing

financial results across accounting periods and to those of peer

companies.

Three Months Ended Three Months Ended Six Months

Ended Six Months Ended June 30, % of

June 30, % of June 30, % of June

30, % of

2024

revenue

2023

revenue

2024

revenue

2023

revenue GAAP cost of goods sold

$

283,357

$

318,627

$

568,211

$

633,054

Amortization of purchased intangibles

(4,444

)

(4,336

)

(8,892

)

(8,624

)

Restructuring benefits (costs)

(643

)

(3,377

)

(1,161

)

(3,707

)

Non-GAAP cost of goods sold

$

278,270

$

310,914

$

558,158

$

620,723

GAAP gross profit

$

355,119

55.6%

$

362,483

53.2%

$

681,085

54.5%

$

724,900

53.4%

Amortization of purchased intangibles

4,444

4,336

8,892

8,624

Restructuring (benefits) costs

643

3,377

1,161

3,707

Non-GAAP gross profit

$

360,206

56.4%

$

370,196

54.4%

$

691,138

55.3%

$

737,231

54.3%

GAAP selling, general and administrative expense

$

194,719

$

207,824

$

409,602

$

433,377

Amortization of purchased intangibles

(817

)

(1,611

)

(1,861

)

(3,302

)

Acquisition related benefits (costs)

-

800

-

-

Restructuring benefits (costs)

1,421

(6,328

)

(3,006

)

(15,316

)

Other non-recurring items (2)

(1,543

)

(1,995

)

(3,041

)

(3,917

)

Non-GAAP selling, general and administrative expense

$

193,780

$

198,690

$

401,694

$

410,842

GAAP research and development expense

$

58,904

$

65,042

$

125,279

$

139,993

Acquisition related benefits (costs)

(200

)

(400

)

(400

)

(400

)

Restructuring benefits (costs)

664

(1,080

)

(1,500

)

(5,315

)

Non-GAAP research and development expense

$

59,368

$

63,562

$

123,379

$

134,278

GAAP income from operations

$

101,496

15.9%

$

89,617

13.2%

$

146,204

11.7%

$

151,530

11.2%

Amortization of purchased intangibles

5,261

5,947

10,753

11,926

Acquisition related (benefits) costs

200

(400

)

400

400

Restructuring (benefits) costs

(1,442

)

10,785

5,667

24,338

Other non-recurring items (2)

1,543

1,995

3,041

3,917

Non-GAAP income from operations

$

107,058

16.8%

$

107,944

15.8%

$

166,065

13.3%

$

192,111

14.1%

GAAP (gains) losses from change in fair market value of

equity securities and loan receivable

$

2,895,355

$

1,595,442

$

2,473,178

$

1,612,967

Gains (losses) from change in fair market value of equity

securities and loan receivable

(2,895,355

)

(1,595,442

)

(2,473,178

)

(1,612,967

)

Non-GAAP (gains) losses from change in fair market value of

equity securities and loan receivable

$

-

$

-

$

-

$

-

GAAP other (income) expense, net

$

(18,143

)

$

(16,488

)

$

(52,659

)

$

(66,919

)

Gains (losses) on equity-method investments

(940

)

(851

)

(1,723

)

(1,846

)

Non-GAAP other (income) expense, net

$

(19,083

)

$

(17,339

)

$

(54,382

)

$

(68,765

)

GAAP loss before income taxes

$

(2,786,281

)

$

(1,500,427

)

$

(2,295,203

)

$

(1,415,598

)

Amortization of purchased intangibles

5,261

5,947

10,753

11,926

Acquisition related (benefits) costs

200

(400

)

400

400

Restructuring (benefits) costs

(1,442

)

10,785

5,667

24,338

(Gains) losses from change in fair market value of equity

securities and loan receivable

2,895,355

1,595,442

2,473,178

1,612,967

(Gains) losses on equity-method investments

940

851

1,723

1,846

Other non-recurring items (2)

1,543

1,995

3,041

3,917

Non-GAAP income before income taxes

$

115,576

$

114,193

$

199,559

$

239,796

GAAP benefit from income taxes

$

620,795

$

338,176

$

513,633

$

322,309

Income tax effect of non-GAAP adjustments (1)

(647,855

)

(363,858

)

(559,459

)

(374,234

)

Non-GAAP provision for income taxes

$

(27,060

)

$

(25,682

)

$

(45,826

)

$

(51,925

)

GAAP net loss

$

(2,165,486

)

-339.2%

$

(1,162,251

)

-170.6%

$

(1,781,570

)

-142.6%

$

(1,093,289

)

-80.5%

Amortization of purchased intangibles

5,261

5,947

10,753

11,926

Acquisition related (benefits) costs

200

(400

)

400

400

Restructuring (benefits) costs

(1,442

)

10,785

5,667

24,338

(Gains) losses from change in fair market value of equity

securities and loan receivable

2,895,355

1,595,442

2,473,178

1,612,967

(Gains) losses on equity-method investments

940

851

1,723

1,846

Other non-recurring items (2)

1,543

1,995

3,041

3,917

Income tax effect of non-GAAP adjustments (1)

(647,855

)

(363,858

)

(559,459

)

(374,234

)

Non-GAAP net income

$

88,516

13.9%

$

88,511

13.0%

$

153,733

12.3%

$

187,871

13.8%

GAAP diluted loss per share

$

(76.26

)

$

(39.59

)

$

(62.61

)

$

(37.09

)

Amortization of purchased intangibles

0.19

0.20

0.38

0.40

Acquisition related (benefits) costs

0.01

(0.01

)

0.01

0.01

Restructuring (benefits) costs

(0.05

)

0.37

0.20

0.82

(Gains) losses from change in fair market value of equity

securities and loan receivable

101.88

54.10

86.84

54.46

(Gains) losses on equity-method investments

0.03

0.03

0.06

0.06

Other non-recurring items (2)

0.05

0.07

0.11

0.13

Income tax effect of non-GAAP adjustments (1)

(22.80

)

(12.35

)

(19.64

)

(12.63

)

Add back anti-dilutive shares

0.06

0.18

0.05

0.18

Non-GAAP diluted income per share

$

3.11

$

3.00

$

5.40

$

6.34

GAAP diluted weighted average shares used in per share

calculation

28,395

29,355

28,457

29,475

Shares included in non-GAAP net income per share, but excluded from

GAAP net loss per share as they would have been anti-dilutive

25

135

22

143

Non-GAAP diluted weighted average shares used in per share

calculation

28,420

29,490

28,479

29,618

Reconciliation of Net loss to adjusted EBITDA:

GAAP net loss

$

(2,165,486

)

-339.2%

$

(1,162,251

)

-170.6%

$

(1,781,570

)

-142.6%

$

(1,093,289

)

-80.5%

Interest expense

12,264

12,343

24,541

24,680

Benefit from income taxes

(620,795

)

(338,176

)

(513,633

)

(322,309

)

Depreciation and amortization

36,411

35,859

73,502

71,446

Foreign currency exchange gains, net

(1,699

)

(1,253

)

(3,653

)

(3,600

)

Other income, net

(18,143

)

(16,488

)

(52,659

)

(66,919

)

Losses from change in fair market value of equity securities and

loan receivable

2,895,355

1,595,442

2,473,178

1,612,967

Dividend from Sartorius AG

-

-

17,930

34,766

Acquisition related (benefits) costs

200

(400

)

400

400

Restructuring (benefits) costs

(1,442

)

10,785

5,667

24,338

Other non-recurring items (2)

1,543

1,995

3,041

3,917

Adjusted EBITDA

$

138,208

21.6%

$

137,856

20.2%

$

246,744

19.8%

$

286,397

21.1%

(1)

Excluded items identified in the

reconciliation schedule are tax effected by application of a

non-GAAP effective tax rate. The non-GAAP tax

provision is adjusted for items, the

nature of which and/or tax jurisdiction requires the application of

a specific tax rate or treatment.

(2)

Incremental costs to comply with the

European Union's In Vitro Diagnostics Regulation ("IVDR") for

previously approved products.

2024 Financial Outlook

Forecasted non-GAAP operating margin excludes 89 basis points

related to amortization of purchased intangibles. Forecasted

non-GAAP operating margin does not reflect future gains and charges

that are inherently difficult to predict and estimate due to their

unknown timing, effect and/or significance, such as foreign

currency fluctuations, future gains or losses associated with

certain legal matters, acquisitions and restructuring activities.

We do not provide a reconciliation of our non-GAAP financial

expectations to expectations for the most comparable GAAP measure

because the amount and timing of many future charges that impact

these measures (such as amortization of future acquisition-related

intangible assets, future acquisition-related expenses and

benefits, future restructuring charges, future asset impairment

charges, future valuation changes of equity-owned securities,

future gains and losses on equity-method investments or future

legal charges or benefits), which could be material, are variable,

uncertain, or out of our control and therefore cannot be reasonably

predicted without unreasonable effort, if at all.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240801492841/en/

Investor Contact: Edward Chung, Investor Relations

510-741-6104 ir@bio-rad.com

Media Contact: Anna Gralinska, Corporate Communications

510-741-6643 cc@bio-rad.com

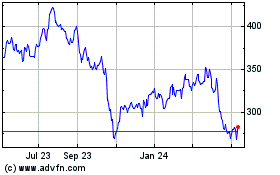

Bio Rad Laboratories (NYSE:BIO)

Historical Stock Chart

From Dec 2024 to Jan 2025

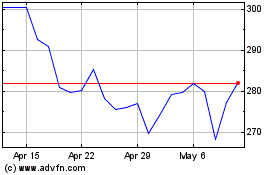

Bio Rad Laboratories (NYSE:BIO)

Historical Stock Chart

From Jan 2024 to Jan 2025