Lehman Commodities Unit Creditors Fire Back At Ad Hoc Group

July 16 2010 - 5:13PM

Dow Jones News

Creditors of a Lehman Brothers Holding Inc. (LEHMQ) commodities

subsidiary became the latest to weigh in on whether the remnants of

the investment bank should be treated like one giant pool of assets

or smaller pieces to be divvied up among its subsidiaries.

In a bankruptcy court filing Thursday, the trustee representing

a group of creditors in Lehman Brothers Commodity Services said

arguments by the ad hoc creditors--a group that includes about a

dozen hedge funds, pension funds and investment firms--"appear to

be made on behalf of a few individual LBHI bondholders that are

merely grabbing for a higher recovery for LBHI creditors at the

expense of subsidiary creditors."

The creditors are arguing against an objection filed last month

by an ad hoc group of bondholders of the Lehman parent company,

claiming they aren't being treated fairly under the company's

bankruptcy plan. Lehman's plan involves agreements with many of the

parent company's subsidiaries, and the ad-hoc group has said that's

at the expense of it and other holders of the holding company's

debt.

The commodities creditors are represented by Bank of New York

Mellon (BK), which serves as the trustee for holders of $700

million in bonds issued by a Georgia company, Main Street Natural

Gas, Inc. The bonds were issued as part of a complex deal that

called for Lehman Brothers Commodity Services to supply natural gas

to various municipalities for 30 years in exchange for an upfront

payment from Main Street.

But the holding company shut off the taps to the gas following

its September 2008 bankruptcy filing and the Main Street

bondholders, owed $700 million, are stuck with other creditors,

waiting to see how much they can recover under Lehman's bankruptcy

plan.

In the court filing, the creditors of the commodity business say

the ad hoc bondholders' objection has merit in one respect: its

call for more information. "Without additional information, it

appears that the plan gives too much value to LBHI creditors" at

the expense of holders of claims against the commodity subsidiary,

the filing says.

The commodities unit's creditors are requesting information so

they can "have adequate time to digest and analyze it" and to

decide whether the plan is fair. The filing says that with some

changes in the plan, recoveries for holders of the commodities

subsidiary "could drastically improve."

While it supports more information disclosure, the group said it

doesn't support what it calls the ad hoc group's "premature call

for an intensive, trial-oriented protocol."

In April, the holding company unveiled details of its plan to

pay back creditors some of the estimated $1 trillion in claims

filed against Lehman, the largest bankruptcy case in the nation's

history.

The plan includes a number of intercompany settlements and

actually constitutes 23 distinct Chapter 11 plans applying to each

of the Lehman units in bankruptcy. Allowed claims against a

particular debtor will be paid from the assets of that debtor, with

recoveries for unsecured creditors ranging from about 10 cents on

the dollar to 44 cents.

For example, unsecured creditors of Lehman's commodities

business will recover about 26 cents to 27 cents on the dollar

while recoveries for general unsecured creditors of its holding

company can expect recoveries on their claims of 10.4% to

14.7%.

That's a problem, according to the holding company's

bondholders. They argue that creditors of the parent company stand

to fare better if the various Lehman units are treated as a single

company, or substantively consolidated, for purposes of the Chapter

11 distribution.

-By Joseph Checkler, Dow Jones Newswires; 212-416-2152;

joseph.checkler@dowjones.com

(Patrick Fitzgerald contributed to this article.)

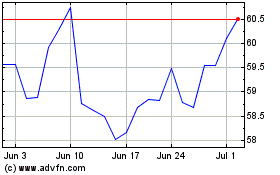

Bank of New York Mellon (NYSE:BK)

Historical Stock Chart

From Apr 2024 to May 2024

Bank of New York Mellon (NYSE:BK)

Historical Stock Chart

From May 2023 to May 2024