- Diluted Earnings Per Common Share $0.93

- Total Assets $23.8 Billion and Total Deposits $21.0 Billion

at Quarter End

- Net Income $40.4 Million

- Net Interest Margin 2.18%

- Board of Directors Declares Dividend of $0.70 Per Common

Share

Bank of Hawai‘i Corporation (NYSE: BOH) today reported diluted

earnings per common share of $0.93 for the third quarter of 2024,

compared with diluted earnings per common share of $0.81 in the

linked quarter and $1.17 in the same period last year. Net income

for the third quarter of 2024 was $40.4 million, up 18.4% from the

linked quarter and down 15.8% from the same period last year. The

return on average common equity for the third quarter of 2024 was

11.50% compared with 10.41% during the linked quarter and 15.38%

during the same period last year.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20241028191210/en/

“For the third quarter 2024, we are pleased to report improved

net interest income and noninterest income, alongside controlled

expenses and steady loan and deposit performance. Credit remained

excellent,” said Peter Ho, Chairman and CEO.

Financial Highlights

Net interest income for the third quarter of 2024 was $117.6

million, an increase of 2.4% from the linked quarter and a decrease

of 2.7% as compared to the same period last year. The increase from

the previous quarter was primarily due to increases in the average

balance and yield on our earning assets, partially offset by

increases in the average balance and cost of our interest-bearing

liabilities. The decrease from same period last year was primarily

due to decreases in the average balance of our earnings assets and

higher funding costs, partially offset by higher earning asset

yields and lower average balance of our interest-bearing

liabilities.

Net interest margin was 2.18% in the third quarter of 2024, an

increase of 3 basis points from the linked quarter and an increase

of 5 basis points from the same period last year. The increase from

the linked quarter was primarily due to higher earning asset

yields, partially offset by higher funding costs. The increase from

the same period last year was primarily due to higher earning asset

yields and lower average balance of our earning assets, partially

offset by higher funding costs.

The average yield on loans and leases was 4.82% in the third

quarter of 2024, up 6 basis points from the linked quarter and up

48 basis points from the same period last year. The average yield

on total earning assets was 4.06% in the third quarter of 2024, up

7 basis points from the linked quarter and up 34 basis points from

the same period last year. The average cost of interest-bearing

deposits was 2.52% in the third quarter of 2024, up 6 basis points

from the linked quarter and up 57 basis points from the same period

last year. The average cost of total deposits, including

noninterest-bearing deposits, was 1.87%, up 6 basis points from the

linked quarter and up 47 basis points from the same period last

year. The changes in yields and rates over the linked quarter and

year over year period reflected deposit mix shift and

repricing.

Noninterest income was $45.1 million in the third quarter of

2024, an increase of 7.2% from the linked quarter and a decrease of

10.4% from the same period in 2023. Noninterest income in the third

quarter of 2023 included a $14.7 million gain from the early

termination of private repurchase agreements, partially offset by a

$4.6 million net loss related to investment securities sales and a

negative $0.8 million adjustment related to a change in the Visa

Class B conversion ratio. Adjusted for these items, noninterest

income increased by 9.9% from adjusted noninterest income in the

same period in 2023. The increase from the same period last year

was primarily due to increases in trust and asset management

income, and fees, exchange, and other service charges.

Noninterest expense was $107.1 million in the third quarter of

2024, a decrease of 2.0% from the linked quarter and an increase of

1.4% from the same period last year. Noninterest expense in the

second quarter of 2024 included an industry-wide FDIC Special

Assessment of $2.6 million, separation expenses of $0.8 million and

$0.6 million of other expenses that are not expected to recur in

2024. Noninterest expense in the third quarter of 2023 included

separation expenses of $2.1 million and extraordinary expenses

related to the Maui wildfires of $0.4 million. Adjusted for these

items, noninterest expense increased by 1.7% from adjusted

noninterest expense in the linked quarter and increased by 3.9%

from adjusted noninterest expense in the same period last year.

The effective tax rate for the third quarter of 2024 was 23.33%

compared with 24.77% during the linked quarter and 24.76% during

the same period last year. The lower effective tax rate in the

third quarter of 2024 as compared to the linked quarter was mainly

due to a decrease in discrete items and an increase in tax exempt

income. The lower effective tax rate in the third quarter of 2024

as compared to the same period last year was primarily due to an

increase in tax benefits from low-income housing investments and an

increase in tax exempt income.

Asset Quality

The Company’s overall asset quality remained strong during the

third quarter of 2024. Provision for credit losses for the third

quarter of 2024 was $3.0 million compared with $2.4 million in the

linked quarter and $2.0 million in the same period last year.

Total non-performing assets were $19.8 million at September 30,

2024, up $4.6 million from June 30, 2024 and up $8.3 million from

September 30, 2023. Non-performing assets as a percentage of total

loans and leases and foreclosed real estate were 0.14% at the end

of the quarter, an increase of 3 basis points from the linked

quarter and an increase of 6 basis points from the same period last

year.

Net loan and lease charge-offs during the third quarter of 2024

were $3.8 million or 11 basis points annualized of total average

loans and leases outstanding and comprised of gross charge-offs of

$5.3 million partially offset by gross recoveries of $1.5 million.

Compared to the linked quarter, net loan and lease charge-offs

increased by $0.4 million or 1 basis point annualized on total

average loans and leases outstanding. Compared to the same period

last year, net loan and lease charge-offs increased by $1.8 million

or 5 basis points annualized on total average loans and leases

outstanding.

The allowance for credit losses on loans and leases was $147.3

million at September 30, 2024, a decrease of $0.1 million from June

30, 2024 and an increase of $2.1 million from September 30, 2023.

The ratio of the allowance for credit losses to total loans and

leases outstanding was 1.06% at the end of the quarter, down 1

basis point from the linked quarter and up 2 basis points from the

same period last year.

Balance Sheet

Total assets were $23.8 billion at September 30, 2024, an

increase of 2.1% from June 30, 2024 and an increase of 1.1% from

September 30, 2023. The increase from the prior periods was

primarily due to an increase in federal funds sold.

The investment securities portfolio was $7.3 billion at

September 30, 2024, an increase of 2.1% from June 30, 2024 and a

decrease of 2.9% from September 30, 2023. This linked quarter

increase was primarily due to the purchases of $236.1 million of

floating rate investment securities partially offset by cashflows

from the portfolio. The decrease from the same period last year was

primarily due to the sale of $159.1 million of investment

securities in the third quarter of 2023 and cashflows from the

portfolio, partially offset by the above-mentioned purchase of

investment securities in the third quarter of 2024. The investment

portfolio remains largely comprised of securities issued by U.S.

government agencies and U.S. government-sponsored enterprises.

Total loans and leases were $13.9 billion at September 30, 2024,

an increase of 0.6% from June 30, 2024 and flat from September 30,

2023. Total commercial loans were $5.9 billion at September 30,

2024, an increase of 2.0% from June 30, 2024 and an increase of

4.4% from September 30, 2023. The increase from the linked quarter

was primarily due to an increase in commercial mortgage portfolio.

The increase from the same period last year was primarily due to

increases in commercial mortgage, construction and commercial and

industrial portfolios. Total consumer loans were $8.0 billion at

September 30, 2024, a decrease of 0.3% from the linked quarter and

a decrease of 3.1% from the same period last year. The decrease

from the linked quarter was primarily due to decreases in our home

equity and automobile portfolios, partially offset by an increase

in residential mortgage portfolio. The decrease from the same

period last year was primarily due to decreases in our residential

mortgage, home equity and automobile portfolios.

Total deposits were $21.0 billion at September 30, 2024, an

increase of 2.8% from June 30, 2024 and an increase of 0.8% from

September 30, 2023. Noninterest-bearing deposits made up 25.8% of

total deposit balances at September 30, 2024, down from 26.3% at

June 30, 2024 and down from 27.3% at September 30, 2023. Average

total deposits were $20.5 billion for the third quarter of 2024, up

0.6% from $20.4 billion in the linked quarter and flat from the

same period last year. Insured and uninsured but collateralized

deposits represented 58% of total deposit balances at September 30,

2024, down from 59% at June 30, 2024 and flat from September 30,

2023. At the end of the quarter, our readily available liquidity of

$10.6 billion exceeded total uninsured and uncollateralized

deposits of $8.8 billion.

Capital and Dividends

The Company’s capital levels increased quarter over quarter and

remain well above regulatory well-capitalized minimums.

The Tier 1 Capital Ratio was 14.05% at September 30, 2024

compared with 13.96% at June 30, 2024 and 12.53% at September 30,

2023. The Tier 1 Leverage Ratio was 8.38% at September 30, 2024, up

1 basis point from 8.37% at June 30, 2024 and up 116 basis points

from 7.22% at September 30, 2023. The increases from the linked

quarter were due to retained earnings growth and partially offset

by increases in risk-weighted assets and average total assets. The

increases from the same period last year were primarily due to the

issuance of $165.0 million of Fixed Rate Non-Cumulative Perpetual

Preferred Stock, Series B, at a rate of 8.00% in the second quarter

of 2024.

No shares of common stock were repurchased under the share

repurchase program in the third quarter of 2024. Total remaining

buyback authority under the share repurchase program was $126.0

million at September 30, 2024.

The Company’s Board of Directors declared a quarterly cash

dividend of $0.70 per share on the Company’s outstanding common

shares. The dividend will be payable on December 13, 2024 to

shareholders of record at the close of business on November 29,

2024.

On October 4, 2024, the Company announced that the Board of

Directors declared a quarterly dividend payment of $10.94 per

share, equivalent to $0.2735 per depositary share, of Fixed Rate

Non-Cumulative Perpetual Preferred Stock, Series A, and a quarterly

dividend payment of $20.00 per share, equivalent to $0.5000 per

depositary share, of Fixed Rate Non-Cumulative Perpetual Preferred

Stock, Series B. The depositary shares representing the Series A

Preferred Stock and Series B Preferred Stock are traded on the NYSE

under the symbol “BOH.PRA” and “BOH.PRB”, respectively. The

dividends on the Series A Preferred Stock and Series B Preferred

Stock will be payable on November 1, 2024 to shareholders of record

of the preferred stock as of the close of business on October 17,

2024.

Conference Call

Information

The Company will review its third quarter financial results

today at 8:00 a.m. Hawai‘i Time (2:00 p.m. Eastern Time). The live

call, including a slide presentation, will be accessible on the

investor relations link of Bank of Hawai‘i Corporation's website,

www.boh.com. The webcast can be accessed via the link:

https://register.vevent.com/register/BIe5723fafb08d499d83a299d646fa683d.

A replay of the conference call will be available for one year

beginning approximately 11:00 a.m. Hawai‘i Time on Monday, October

28, 2024. The replay will be available on the Company's website,

www.boh.com.

Investor Announcements

Investors and others should note that the Company intends to

announce financial and other information to the Company’s investors

using the Company’s investor relations website at

https://ir.boh.com, social media channels, press releases, SEC

filings and public conference calls and webcasts, all for purposes

of complying with the Company’s disclosure obligations under

Regulation FD. Accordingly, investors should monitor these

channels, as information is updated, and new information is

posted.

Forward-Looking

Statements

This news release, and other statements made by the Company in

connection with it may contain "forward-looking statements" (as

defined in the Private Securities Litigation Reform Act of 1995)

that involve risks and uncertainties that could cause results to be

materially different from expectations. Forecasts of our financial

results and condition, expectations for our operations and business

prospects, and our assumptions used in those forecasts and

expectations are examples of certain of these forward-looking

statements. Do not unduly rely on forward-looking statements.

Actual results might differ significantly from our forecasts and

expectations because of a variety of factors. More information

about these factors is contained in Bank of Hawai‘i Corporation's

Annual Report on Form 10-K for the year ended December 31, 2023 and

its Form 10-Q for fiscal quarters ended March 31, 2024 and June 30,

2024, which were filed with the U.S. Securities and Exchange

Commission. These forward-looking statements are not guarantees of

future performance and speak only as of the date made, and, except

as required by law, the Company undertakes no obligation to update

or revise any forward-looking statements to reflect subsequent

events, new information or future circumstances.

Bank of Hawai‘i Corporation is an independent regional financial

services company serving businesses, consumers, and governments in

Hawai‘i and the West Pacific. The Company’s principal subsidiary,

Bank of Hawai‘i, was founded in 1897. For more information about

Bank of Hawai‘i Corporation, see the Company’s website,

www.boh.com. Bank of Hawai‘i Corporation is a trade name of Bank of

Hawaii Corporation.

Bank of Hawai‘i Corporation and Subsidiaries

Financial Highlights

Table 1

Three Months Ended Nine Months Ended September

30, June 30, September 30, September 30,

(dollars in thousands, except per share amounts)

2024

2024

2023

2024

2023

For the Period: Operating

Results Net Interest Income

$

117,618

$

114,846

$

120,937

$

346,402

$

381,240

Provision for Credit Losses

3,000

2,400

2,000

7,400

6,500

Total Noninterest Income

45,110

42,087

50,334

129,482

134,326

Total Noninterest Expense

107,092

109,226

105,601

322,177

321,556

Pre-Provision Net Revenue

55,636

47,707

65,670

153,707

194,010

Net Income

40,358

34,083

47,903

110,832

140,806

Net Income Available to Common Shareholders 1

36,922

32,114

45,934

103,458

134,899

Basic Earnings Per Common Share

0.94

0.81

1.17

2.62

3.44

Diluted Earnings Per Common Share

0.93

0.81

1.17

2.61

3.42

Dividends Declared Per Common Share

0.70

0.70

0.70

2.10

2.10

Performance Ratios Return on Average Assets

0.69

%

0.59

%

0.78

%

0.64

%

0.78

%

Return on Average Shareholders' Equity

9.90

9.53

13.92

9.92

13.91

Return on Average Common Equity

11.50

10.41

15.38

11.04

15.37

Efficiency Ratio 2

65.81

69.60

61.66

67.70

62.37

Net Interest Margin 3

2.18

2.15

2.13

2.15

2.27

Dividend Payout Ratio 4

74.47

86.42

59.83

80.15

61.05

Average Shareholders' Equity to Average Assets

6.95

6.22

5.60

6.42

5.61

Average Balances Average Loans and Leases

$

13,809,977

$

13,831,797

$

13,903,214

$

13,836,760

$

13,833,164

Average Assets

23,338,529

23,145,107

24,387,421

23,255,372

24,124,360

Average Deposits

20,484,391

20,358,393

20,492,082

20,462,222

20,314,079

Average Shareholders' Equity

1,621,936

1,438,476

1,365,143

1,492,645

1,353,815

Per Share of Common Stock Book Value

$

33.22

$

31.91

$

29.78

$

33.22

$

29.78

Tangible Book Value

32.43

31.12

28.99

32.43

28.99

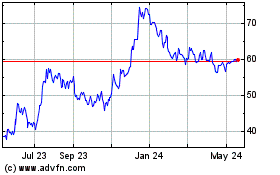

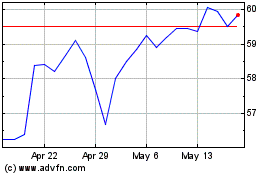

Market Value Closing

62.77

57.21

49.69

62.77

49.69

High

70.44

62.53

58.63

73.73

81.73

Low

55.75

54.50

39.02

54.50

30.83

September 30, June 30, December 31,

September 30,

2024

2024

2023

2023

As of Period End: Balance

Sheet Totals Loans and Leases

$

13,918,583

$

13,831,266

$

13,965,026

$

13,919,491

Total Assets

23,799,174

23,300,768

23,733,296

23,549,785

Total Deposits

20,978,322

20,408,502

21,055,045

20,802,309

Other Debt

558,297

560,136

560,190

560,217

Total Shareholders' Equity

1,665,474

1,612,849

1,414,242

1,363,840

Asset Quality Non-Performing Assets

$

19,781

$

15,179

$

11,747

$

11,519

Allowance for Credit Losses - Loans and Leases

147,331

147,477

146,403

145,263

Allowance to Loans and Leases Outstanding 5

1.06

%

1.07

%

1.05

%

1.04

%

Capital Ratios 6 Common Equity Tier 1 Capital Ratio 7

11.66

%

11.56

%

11.33

%

11.29

%

Tier 1 Capital Ratio 7

14.05

13.96

12.56

12.53

Total Capital Ratio 7

15.11

15.02

13.60

13.56

Tier 1 Leverage Ratio

8.38

8.37

7.51

7.22

Total Shareholders' Equity to Total Assets

7.00

6.92

5.96

5.79

Tangible Common Equity to Tangible Assets 8

5.42

5.31

5.07

4.90

Tangible Common Equity to Risk-Weighted Assets 7, 8

9.17

8.80

8.45

8.10

Non-Financial Data Full-Time Equivalent Employees

1,854

1,910

1,899

1,919

Branches

50

50

51

51

ATMs

317

317

318

320

1 Due to rounding, the amounts presented in this table may

not tie to other amounts presented elsewhere in this report. 2

Efficiency ratio is defined as noninterest expense divided by total

revenue (net interest income and total noninterest income). 3 Net

interest margin is defined as net interest income, on a

taxable-equivalent basis, as a percentage of average earning

assets. 4 Dividend payout ratio is defined as dividends declared

per common share divided by basic earnings per common share. 5 The

numerator comprises the Allowance for Credit Losses - Loans and

Leases. 6 Regulatory capital ratios as of September 30, 2024 are

preliminary. 7 Regulatory capital ratios for June 30, 2024 have

been updated to reflect final reported ratios. 8 Tangible common

equity to tangible assets and tangible common equity to

risk-weighted assets are Non-GAAP financial measures. Tangible

common equity is defined by the Company as common shareholders'

equity minus goodwill. See Table 2 "Reconciliation of Non-GAAP

Financial Measures".

Bank of Hawai‘i Corporation and

Subsidiaries Reconciliation of Non-GAAP Financial

Measures Table 2 September 30, June 30,

December 31, September 30, (dollars in thousands)

2024

2024

2023

2023

Total Shareholders' Equity

$

1,665,474

$

1,612,849

$

1,414,242

$

1,363,840

Less: Preferred Stock

345,000

345,000

180,000

180,000

Goodwill

31,517

31,517

31,517

31,517

Tangible Common Equity

$

1,288,957

$

1,236,332

$

1,202,725

$

1,152,323

Total Assets

$

23,799,174

$

23,300,768

$

23,733,296

$

23,549,785

Less: Goodwill

31,517

31,517

31,517

31,517

Tangible Assets

$

23,767,657

$

23,269,251

$

23,701,779

$

23,518,268

Risk-Weighted Assets, determined in accordance with

prescribed regulatory requirements 1, 2

$

14,054,698

$

14,051,627

$

14,226,780

$

14,222,825

Total Shareholders' Equity to Total Assets

7.00

%

6.92

%

5.96

%

5.79

%

Tangible Common Equity to Tangible Assets (Non-GAAP)

5.42

%

5.31

%

5.07

%

4.90

%

Tier 1 Capital Ratio 1, 2

14.05

%

13.96

%

12.56

%

12.53

%

Tangible Common Equity to Risk-Weighted Assets (Non-GAAP) 1, 2

9.17

%

8.80

%

8.45

%

8.10

%

1 Regulatory capital ratios as of September 30, 2024 are

preliminary. 2 Regulatory capital ratios for June 30, 2024 have

been updated to reflect final reported ratios.

Bank of

Hawai‘i Corporation and Subsidiaries Consolidated Statements

of Income Table 3 Three Months Ended Nine

Months Ended September 30, June 30, September

30, September 30, (dollars in thousands, except per

share amounts)

2024

2024

2023

2024

2023

Interest Income Interest and Fees on Loans and Leases

$

166,286

$

163,208

$

151,245

$

488,830

$

432,287

Income on Investment Securities Available-for-Sale

23,257

21,468

23,552

66,482

70,746

Held-to-Maturity

21,107

21,595

22,838

64,838

70,161

Deposits

29

25

18

84

63

Funds Sold

8,951

6,114

12,828

21,192

22,589

Other

1,018

1,120

1,464

3,108

4,182

Total Interest Income

220,648

213,530

211,945

644,534

600,028

Interest Expense Deposits

96,067

91,542

72,153

276,665

163,726

Securities Sold Under Agreements to Repurchase

993

1,180

4,034

3,616

14,847

Funds Purchased

-

44

-

44

888

Short-Term Borrowings

-

-

-

-

5,713

Other Debt

5,970

5,918

14,821

17,807

33,614

Total Interest Expense

103,030

98,684

91,008

298,132

218,788

Net Interest Income

117,618

114,846

120,937

346,402

381,240

Provision for Credit Losses

3,000

2,400

2,000

7,400

6,500

Net Interest Income After Provision for Credit Losses

114,618

112,446

118,937

339,002

374,740

Noninterest Income Fees, Exchange, and Other Service Charges

14,945

13,769

13,824

42,837

41,782

Trust and Asset Management

11,916

12,223

10,548

35,328

32,453

Service Charges on Deposit Accounts

8,075

7,730

7,843

23,752

23,167

Bank-Owned Life Insurance

3,533

3,396

2,749

10,285

8,467

Annuity and Insurance

1,460

1,583

1,156

4,089

3,465

Mortgage Banking

1,188

1,028

1,059

3,167

3,239

Investment Securities Losses, Net

(1,103

)

(1,601

)

(6,734

)

(4,201

)

(9,836

)

Other

5,096

3,959

19,889

14,225

31,589

Total Noninterest Income

45,110

42,087

50,334

129,482

134,326

Noninterest Expense Salaries and Benefits

58,626

57,033

58,825

173,874

180,088

Net Occupancy

10,806

10,559

10,327

31,821

30,190

Net Equipment

10,120

10,355

9,477

30,578

30,425

Professional Fees

4,725

4,929

3,846

14,331

12,380

Data Processing

4,712

4,745

4,706

14,227

13,888

FDIC Insurance

3,355

7,170

3,361

14,139

9,768

Other

14,748

14,435

15,059

43,207

44,817

Total Noninterest Expense

107,092

109,226

105,601

322,177

321,556

Income Before Provision for Income Taxes

52,636

45,307

63,670

146,307

187,510

Provision for Income Taxes

12,278

11,224

15,767

35,475

46,704

Net Income

$

40,358

$

34,083

$

47,903

$

110,832

$

140,806

Preferred Stock Dividends

3,436

1,969

1,969

7,375

5,908

Net Income Available to Common Shareholders

$

36,922

$

32,114

$

45,934

$

103,457

$

134,898

Basic Earnings Per Common Share

$

0.94

$

0.81

$

1.17

$

2.62

$

3.44

Diluted Earnings Per Common Share

$

0.93

$

0.81

$

1.17

$

2.61

$

3.42

Dividends Declared Per Common Share

$

0.70

$

0.70

$

0.70

$

2.10

$

2.10

Basic Weighted Average Common Shares

39,488,187

39,450,551

39,274,626

39,429,815

39,264,450

Diluted Weighted Average Common Shares

39,736,492

39,618,705

39,420,531

39,654,705

39,392,433

Bank of Hawai‘i Corporation and Subsidiaries

Consolidated Statements of Comprehensive Income Table

4 Three Months Ended Nine Months Ended

September 30, June 30, September 30,

September 30, (dollars in thousands)

2024

2024

2023

2024

2023

Net Income

$

40,358

$

34,083

$

47,903

$

110,832

$

140,806

Other Comprehensive Income (Loss), Net of Tax: Net Unrealized Gains

(Losses) on Investment Securities

38,833

9,052

(18,264

)

60,823

(7,205

)

Defined Benefit Plans

168

168

84

505

252

Other Comprehensive Income (Loss)

39,001

9,220

(18,180

)

61,328

(6,953

)

Comprehensive Income

$

79,359

$

43,303

$

29,723

$

172,160

$

133,853

Bank of Hawai‘i Corporation and Subsidiaries

Consolidated Statements of Condition Table 5

September 30, June 30, December 31,

September 30, (dollars in thousands, except share amounts)

2024

2024

2023

2023

Assets Interest-Bearing Deposits in Other Banks

$

8,287

$

3,259

$

2,761

$

4,676

Funds Sold

992,854

624,089

690,112

386,086

Investment Securities Available-for-Sale

2,550,324

2,298,092

2,408,933

2,387,324

Held-to-Maturity (Fair Value of $4,072,596; $4,002,122; $4,253,637;

and $4,104,469)

4,710,245

4,812,954

4,997,335

5,088,013

Loans Held for Sale

5,048

2,664

3,124

1,450

Loans and Leases

13,918,583

13,831,266

13,965,026

13,919,491

Allowance for Credit Losses

(147,331

)

(147,477

)

(146,403

)

(145,263

)

Net Loans and Leases

13,771,252

13,683,789

13,818,623

13,774,228

Total Earning Assets

22,038,010

21,424,847

21,920,888

21,641,777

Cash and Due from Banks

271,622

297,990

308,071

261,464

Premises and Equipment, Net

191,899

192,319

194,855

196,094

Operating Lease Right-of-Use Assets

81,736

84,757

86,110

86,896

Accrued Interest Receivable

66,534

67,554

66,525

65,541

Foreclosed Real Estate

2,667

2,672

2,098

1,040

Mortgage Servicing Rights

19,571

19,954

20,880

21,273

Goodwill

31,517

31,517

31,517

31,517

Bank-Owned Life Insurance

475,263

470,708

462,894

458,260

Other Assets

620,355

708,450

639,458

785,923

Total Assets

$

23,799,174

$

23,300,768

$

23,733,296

$

23,549,785

Liabilities Deposits Noninterest-Bearing Demand

$

5,412,048

$

5,371,593

$

6,058,554

$

5,687,442

Interest-Bearing Demand

3,734,601

3,928,295

3,749,717

3,925,469

Savings

8,663,147

8,207,902

8,189,472

8,530,384

Time

3,168,526

2,900,712

3,057,302

2,659,014

Total Deposits

20,978,322

20,408,502

21,055,045

20,802,309

Securities Sold Under Agreements to Repurchase

100,490

100,490

150,490

150,490

Other Debt

558,297

560,136

560,190

560,217

Operating Lease Liabilities

90,356

93,364

94,693

95,453

Retirement Benefits Payable

22,870

23,142

23,673

26,074

Accrued Interest Payable

40,434

37,278

41,023

33,434

Taxes Payable

1,722

5,289

7,636

6,965

Other Liabilities

341,209

459,718

386,304

511,003

Total Liabilities

22,133,700

21,687,919

22,319,054

22,185,945

Shareholders' Equity Preferred Stock (Series A, $.01 par

value; authorized 180,000 shares issued and outstanding)

180,000

180,000

180,000

180,000

Preferred Stock (Series B, $.01 par value; authorized 165,000

shares issued and outstanding)

165,000

165,000

-

-

Common Stock ($.01 par value; authorized 500,000,000 shares; issued

/ outstanding: September 30, 2024 - 58,765,907 / 39,748,304; June

30, 2024 - 58,765,907 / 39,729,941; December 31, 2023 - 58,755,465

/ 39,753,138; and September 30, 2023 - 58,767,820 / 39,748,700)

585

585

583

583

Capital Surplus

643,620

639,841

636,422

632,425

Accumulated Other Comprehensive Loss

(335,360

)

(374,361

)

(396,688

)

(441,611

)

Retained Earnings

2,127,585

2,119,140

2,107,569

2,108,702

Treasury Stock, at Cost (Shares: September 30, 2024 - 19,017,603;

June 30, 2024 - 19,035,966; December 31, 2023 - 19,002,327; and

September 30, 2023 - 19,019,120)

(1,115,956

)

(1,117,356

)

(1,113,644

)

(1,116,259

)

Total Shareholders' Equity

1,665,474

1,612,849

1,414,242

1,363,840

Total Liabilities and Shareholders' Equity

$

23,799,174

$

23,300,768

$

23,733,296

$

23,549,785

Bank of Hawai‘i Corporation and Subsidiaries

Consolidated Statements of Shareholders' Equity Table

6 Accumulated Preferred Preferred

Other Shares Preferred Shares

Preferred Common Comprehensive Series A

Series A Series B Series B Shares

Common Capital Income Retained

Treasury (dollars in thousands, except share amounts)

Outstanding Stock Outstanding Stock

Outstanding Stock Surplus (Loss)

Earnings Stock Total Balance as of December

31, 2023

180,000

$

180,000

-

$

-

39,753,138

$

583

$

636,422

$

(396,688

)

$

2,107,569

$

(1,113,644

)

$

1,414,242

Net Income

-

-

-

-

-

-

-

-

110,832

-

110,832

Other Comprehensive Income

-

-

-

-

-

-

-

61,328

-

-

61,328

Share-Based Compensation

-

-

-

-

-

-

11,051

-

-

-

11,051

Preferred Stock Issued, Net

-

-

165,000

165,000

-

-

(4,386

)

-

-

-

160,614

Common Stock Issued under Purchase and Equity Compensation Plans

-

-

-

-

78,753

2

533

-

768

2,829

4,132

Common Stock Repurchased

-

-

-

-

(83,587

)

-

-

-

-

(5,141

)

(5,141

)

Cash Dividends Declared Common Stock ($2.10 per share)

-

-

-

-

-

-

-

-

(84,209

)

-

(84,209

)

Cash Dividends Declared Preferred Stock

-

-

-

-

-

-

-

-

(7,375

)

-

(7,375

)

Balance as of September 30, 2024

180,000

$

180,000

165,000

$

165,000

39,748,304

$

585

$

643,620

$

(335,360

)

$

2,127,585

$

(1,115,956

)

$

1,665,474

Balance as of December 31, 2022

180,000

$

180,000

-

$

-

39,835,750

$

582

$

620,578

$

(434,658

)

$

2,055,912

$

(1,105,419

)

$

1,316,995

Net Income

-

-

-

-

-

-

-

-

140,806

-

140,806

Other Comprehensive Loss

-

-

-

-

-

-

-

(6,953

)

-

-

(6,953

)

Share-Based Compensation

-

-

-

-

-

-

11,979

-

-

-

11,979

Common Stock Issued under Purchase and Equity Compensation Plans

-

-

-

-

121,040

1

(132

)

-

1,716

3,216

4,801

Common Stock Repurchased

-

-

-

-

(208,090

)

-

-

-

-

(14,056

)

(14,056

)

Cash Dividends Declared Common Stock ($2.10 per share)

-

-

-

-

-

-

-

-

(83,824

)

-

(83,824

)

Cash Dividends Declared Preferred Stock

-

-

-

-

-

-

-

-

(5,908

)

-

(5,908

)

Balance as of September 30, 2023

180,000

$

180,000

-

$

-

39,748,700

$

583

$

632,425

$

(441,611

)

$

2,108,702

$

(1,116,259

)

$

1,363,840

Bank of Hawai‘i Corporation and Subsidiaries

Average Balances and Interest Rates - Taxable-Equivalent Basis

1 Table 7a Three Months Ended Three Months

Ended Three Months Ended September 30, 2024

June 30, 2024 September 30, 2023 Average

Income / Yield / Average Income /

Yield / Average Income / Yield /

(dollars in millions)

Balance Expense 2 Rate

Balance Expense 2 Rate Balance

Expense 2 Rate Earning Assets Interest-Bearing

Deposits in Other Banks

$

4.0

$

0.0

2.89

%

$

4.3

$

0.0

2.40

%

$

2.9

$

0.0

2.40

%

Funds Sold

663.8

9.0

5.28

455.8

6.1

5.31

944.8

12.8

5.31

Investment Securities Available-for-Sale Taxable

2,430.0

23.0

3.80

2,308.3

21.5

3.73

2,605.4

23.5

3.60

Non-Taxable

11.8

0.2

6.63

1.6

0.0

2.01

3.5

0.0

3.21

Held-to-Maturity Taxable

4,735.5

21.0

1.77

4,837.2

21.4

1.77

5,118.6

22.7

1.77

Non-Taxable

34.4

0.2

2.10

34.6

0.2

2.10

35.0

0.2

2.10

Total Investment Securities

7,211.7

44.4

2.46

7,181.7

43.1

2.40

7,762.5

46.4

2.39

Loans Held for Sale

3.8

0.1

6.13

1.4

0.0

6.30

3.8

0.1

6.28

Loans and Leases 3 Commercial and Industrial

1,658.1

22.6

5.43

1,683.2

22.3

5.34

1,515.0

18.9

4.96

Paycheck Protection Program

7.2

0.0

1.42

9.5

0.1

2.24

13.1

0.0

1.32

Commercial Mortgage

3,744.6

52.0

5.51

3,723.6

51.6

5.57

3,792.6

51.1

5.35

Construction

357.3

7.1

7.95

321.3

6.3

7.85

241.9

3.7

6.09

Commercial Lease Financing

59.6

0.4

2.58

59.3

0.3

2.28

62.6

0.3

1.84

Residential Mortgage

4,593.7

46.4

4.03

4,595.2

45.6

3.97

4,715.3

42.8

3.62

Home Equity

2,206.9

22.4

4.04

2,231.7

21.8

3.92

2,283.5

20.1

3.49

Automobile

795.7

9.4

4.72

813.5

9.1

4.52

868.0

8.2

3.75

Other 4

386.9

6.9

7.13

394.5

6.8

6.95

411.2

6.5

6.24

Total Loans and Leases

13,810.0

167.2

4.82

13,831.8

163.9

4.76

13,903.2

151.6

4.34

Other

63.2

0.9

6.43

62.5

1.2

7.18

91.6

1.5

6.40

Total Earning Assets

21,756.5

221.7

4.06

21,537.5

214.3

3.99

22,708.8

212.4

3.72

Cash and Due from Banks

258.8

233.4

289.8

Other Assets

1,323.2

1,374.2

1,388.8

Total Assets

$

23,338.5

$

23,145.1

$

24,387.4

Interest-Bearing Liabilities Interest-Bearing

Deposits Demand

$

3,775.6

8.9

0.94

$

3,788.5

8.8

0.94

$

3,929.7

6.6

0.67

Savings

8,402.9

55.7

2.63

8,259.2

52.0

2.53

7,952.6

39.1

1.95

Time

3,008.7

31.5

4.17

2,935.9

30.7

4.20

2,767.8

26.5

3.79

Total Interest-Bearing Deposits

15,187.2

96.1

2.52

14,983.6

91.5

2.46

14,650.1

72.2

1.95

Funds Purchased

0.0

0.0

5.40

3.2

0.0

5.37

-

-

-

Short-Term Borrowings

0.0

0.0

5.40

0.0

0.0

5.40

-

-

-

Securities Sold Under Agreements to Repurchase

100.5

1.0

3.87

121.9

1.2

3.83

528.5

4.0

2.99

Other Debt

560.1

5.9

4.24

560.2

6.0

4.25

1,365.7

14.8

4.31

Total Interest-Bearing Liabilities

15,847.8

103.0

2.59

15,668.9

98.7

2.53

16,544.3

91.0

2.18

Net Interest Income

$

118.7

$

115.6

$

121.4

Interest Rate Spread

1.47

%

1.46

%

1.54

%

Net Interest Margin

2.18

%

2.15

%

2.13

%

Noninterest-Bearing Demand Deposits

5,297.2

5,374.8

5,842.0

Other Liabilities

571.6

662.9

636.0

Shareholders' Equity

1,621.9

1,438.5

1,365.1

Total Liabilities and Shareholders' Equity

$

23,338.5

$

23,145.1

$

24,387.4

1 Due to rounding, the amounts presented in this table may

not tie to other amounts presented elsewhere in this report. 2

Interest income includes taxable-equivalent basis adjustments,

based upon a federal statutory tax rate of 21%, of $1.0 million,

$774 thousand, and $437 thousand for the three months ended

September 30, 2024, June 30, 2024, and September 30, 2023,

respectively. 3 Non-performing loans and leases are included in the

respective average loan and lease balances. Income, if any, on such

loans and leases is recognized on a cash basis. 4 Comprised of

other consumer revolving credit, installment, and consumer lease

financing.

Bank of Hawai‘i Corporation and

Subsidiaries Average Balances and Interest Rates -

Taxable-Equivalent Basis 1 Table 7b Nine Months

Ended Nine Months Ended September 30, 2024

September 30, 2023 Average Income / Yield

/ Average Income / Yield / (dollars in

millions)

Balance Expense 2 Rate

Balance Expense 2 Rate Earning Assets

Interest-Bearing Deposits in Other Banks

$

4.3

$

0.1

2.59

%

$

3.2

$

0.1

2.60

%

Funds Sold

525.7

21.2

5.30

582.7

22.6

5.11

Investment Securities Available-for-Sale Taxable

2,373.1

66.4

3.73

2,721.5

70.6

3.46

Non-Taxable

5.0

0.2

5.59

7.6

0.2

4.22

Held-to-Maturity Taxable

4,832.9

64.4

1.78

5,227.8

69.7

1.78

Non-Taxable

34.6

0.5

2.10

35.2

0.6

2.10

Total Investment Securities

7,245.6

131.5

2.42

7,992.1

141.1

2.36

Loans Held for Sale

2.5

0.1

6.16

2.7

0.1

5.82

Loans and Leases 3 Commercial and Industrial

1,664.5

67.0

5.38

1,461.2

52.7

4.82

Paycheck Protection Program

9.1

0.1

1.70

14.8

0.2

1.70

Commercial Mortgage

3,728.3

153.9

5.52

3,781.7

145.6

5.15

Construction

329.0

19.0

7.71

256.2

11.1

5.81

Commercial Lease Financing

59.1

1.0

2.25

64.9

0.5

1.11

Residential Mortgage

4,613.0

137.0

3.96

4,695.4

123.8

3.51

Home Equity

2,229.5

65.3

3.91

2,265.2

57.3

3.38

Automobile

813.3

27.5

4.51

873.0

23.2

3.55

Other 4

391.0

20.2

6.91

420.8

19.0

6.04

Total Loans and Leases

13,836.8

491.0

4.74

13,833.2

433.4

4.19

Other

62.6

3.1

6.61

84.6

4.1

6.59

Total Earning Assets

21,677.5

647.0

3.98

22,498.5

601.4

3.57

Cash and Due from Banks

244.4

308.4

Other Assets

1,333.5

1,317.5

Total Assets

$

23,255.4

$

24,124.4

Interest-Bearing Liabilities Interest-Bearing

Deposits Demand

$

3,776.1

25.4

0.90

$

4,060.0

19.3

0.64

Savings

8,264.9

157.1

2.54

7,876.1

86.3

1.46

Time

3,008.6

94.2

4.18

2,288.2

58.1

3.40

Total Interest-Bearing Deposits

15,049.6

276.7

2.46

14,224.3

163.7

1.54

Funds Purchased

1.1

0.0

5.37

24.8

0.9

4.72

Short-Term Borrowings

0.0

0.0

5.40

152.4

5.7

4.94

Securities Sold Under Agreements to Repurchase

124.2

3.6

3.82

659.1

14.8

2.97

Other Debt

560.2

17.8

4.25

1,043.6

33.7

4.31

Total Interest-Bearing Liabilities

15,735.1

298.1

2.53

16,104.2

218.8

1.81

Net Interest Income

$

348.8

$

382.6

Interest Rate Spread

1.45

%

1.76

%

Net Interest Margin

2.15

%

2.27

%

Noninterest-Bearing Demand Deposits

5,412.6

6,089.8

Other Liabilities

615.1

576.6

Shareholders' Equity

1,492.6

1,353.8

Total Liabilities and Shareholders' Equity

$

23,255.4

$

24,124.4

1 Due to rounding, the amounts presented in this table may

not tie to other amounts presented elsewhere in this report. 2

Interest income includes taxable-equivalent basis adjustments,

based upon a federal statutory tax rate of 21%, of $2.5 million and

$1.4 million for the nine months ended September 30, 2024 and

September 30, 2023, respectively. 3 Non-performing loans and leases

are included in the respective average loan and lease balances.

Income, if any, on such loans and leases is recognized on a cash

basis. 4 Comprised of other consumer revolving credit, installment,

and consumer lease financing.

Bank of Hawai‘i Corporation

and Subsidiaries Analysis of Change in Net Interest Income -

Taxable-Equivalent Basis Table 8a Three Months Ended

September 30, 2024 Compared to June 30, 2024 (dollars in

millions)

Volume 1 Rate 1 Total Change in

Interest Income: Interest-Bearing Deposits in Other Banks

$

(0.0

)

$

0.0

$

0.0

Funds Sold

3.0

(0.0

)

2.9

Investment Securities Available-for-Sale Taxable

1.2

0.3

1.5

Non-Taxable

0.1

0.1

0.2

Held-to-Maturity Taxable

(0.4

)

0.1

(0.4

)

Non-Taxable

(0.0

)

(0.0

)

(0.0

)

Total Investment Securities

0.9

0.4

1.3

Loans Held for Sale

0.0

(0.0

)

0.0

Loans and Leases Commercial and Industrial

(0.2

)

0.5

0.3

Paycheck Protection Program

(0.1

)

(0.0

)

(0.1

)

Commercial Mortgage

0.5

(0.1

)

0.4

Construction

0.8

(0.0

)

0.8

Commercial Lease Financing

0.1

0.0

0.1

Residential Mortgage

(0.0

)

0.8

0.8

Home Equity

(0.2

)

0.8

0.6

Automobile

(0.2

)

0.5

0.3

Other 2

(0.1

)

0.2

0.1

Total Loans and Leases

0.6

2.8

3.3

Other

(0.0

)

(0.3

)

(0.3

)

Total Change in Interest Income

4.5

2.9

7.4

Change in Interest Expense: Interest-Bearing Deposits Demand

0.1

0.0

0.1

Savings

1.1

2.6

3.7

Time

1.0

(0.2

)

0.9

Total Interest-Bearing Deposits

2.2

2.4

4.6

Funds Purchased

(0.0

)

0.0

(0.0

)

Short-Term Borrowings

(0.0

)

-

(0.0

)

Securities Sold Under Agreements to Repurchase

(0.2

)

0.0

(0.2

)

Other Debt

0.0

(0.1

)

(0.0

)

Total Change in Interest Expense

1.9

2.4

4.3

Change in Net Interest Income

$

2.5

$

0.5

$

3.0

1 The change in interest income and expense not solely due

to changes in volume or rate has been allocated on a pro-rata basis

to the volume and rate columns. 2 Comprised of other consumer

revolving credit, installment, and consumer lease financing.

Bank of Hawai‘i Corporation and Subsidiaries Analysis of

Change in Net Interest Income - Taxable-Equivalent Basis

Table 8b Three Months Ended September 30, 2024

Compared to September 30, 2023 (dollars in millions)

Volume 1 Rate 1 Total Change in Interest

Income: Interest-Bearing Deposits in Other Banks

$

0.0

$

0.0

$

0.0

Funds Sold

(3.8

)

0.0

(3.8

)

Investment Securities Available-for-Sale Taxable

(1.7

)

1.2

(0.5

)

Non-Taxable

0.1

0.1

0.2

Held-to-Maturity Taxable

(1.7

)

(0.0

)

(1.7

)

Non-Taxable

(0.0

)

(0.0

)

(0.0

)

Total Investment Securities

(3.3

)

1.3

(2.0

)

Loans Held for Sale

0.0

(0.0

)

(0.0

)

Loans and Leases Commercial and Industrial

1.8

1.9

3.7

Paycheck Protection Program

(0.0

)

0.0

(0.0

)

Commercial Mortgage

(0.6

)

1.5

0.9

Construction

2.1

1.3

3.4

Commercial Lease Financing

0.0

0.1

0.1

Residential Mortgage

(1.1

)

4.7

3.6

Home Equity

(0.7

)

3.0

2.3

Automobile

(0.7

)

1.9

1.2

Other 2

(0.5

)

0.9

0.4

Total Loans and Leases

0.3

15.3

15.6

Other

(0.5

)

0.0

(0.5

)

Total Change in Interest Income

(7.3

)

16.6

9.3

Change in Interest Expense: Interest-Bearing Deposits Demand

(0.3

)

2.6

2.3

Savings

2.3

14.3

16.6

Time

2.4

2.6

5.0

Total Interest-Bearing Deposits

4.4

19.5

23.9

Securities Sold Under Agreements to Repurchase

(4.0

)

1.0

(3.0

)

Other Debt

(8.7

)

(0.2

)

(8.9

)

Total Change in Interest Expense

(8.3

)

20.3

12.0

Change in Net Interest Income

$

1.0

$

(3.7

)

$

(2.7

)

1 The change in interest income and expense not solely due

to changes in volume or rate has been allocated on a pro-rata basis

to the volume and rate columns. 2 Comprised of other consumer

revolving credit, installment, and consumer lease financing.

Bank of Hawai‘i Corporation and Subsidiaries Analysis of

Change in Net Interest Income - Taxable-Equivalent Basis

Table 8c Nine Months Ended September 30, 2024

Compared to September 30, 2023 (dollars in millions)

Volume 1 Rate 1 Total Change in Interest

Income: Interest-Bearing Deposits in Other Banks

$

0.0

$

(0.0

)

$

0.0

Funds Sold

(2.2

)

0.8

(1.4

)

Investment Securities Available-for-Sale Taxable

(9.4

)

5.2

(4.2

)

Non-Taxable

(0.1

)

0.1

-

Held-to-Maturity Taxable

(5.2

)

(0.1

)

(5.3

)

Non-Taxable

(0.0

)

(0.1

)

(0.1

)

Total Investment Securities

(14.7

)

5.1

(9.6

)

Loans Held for Sale

(0.0

)

0.0

-

Loans and Leases Commercial and Industrial

7.8

6.5

14.3

Paycheck Protection Program

(0.1

)

(0.0

)

(0.1

)

Commercial Mortgage

(2.1

)

10.4

8.3

Construction

3.6

4.3

7.9

Commercial Lease Financing

(0.0

)

0.5

0.5

Residential Mortgage

(2.2

)

15.4

13.2

Home Equity

(0.9

)

8.9

8.0

Automobile

(1.6

)

5.9

4.3

Other 2

(1.4

)

2.6

1.2

Total Loans and Leases

3.1

54.5

57.6

Other

(1.1

)

0.1

(1.0

)

Total Change in Interest Income

(14.9

)

60.5

45.6

Change in Interest Expense: Interest-Bearing Deposits Demand

(1.4

)

7.5

6.1

Savings

4.5

66.3

70.8

Time

20.8

15.3

36.1

Total Interest-Bearing Deposits

23.9

89.1

113.0

Funds Purchased

(1.0

)

0.1

(0.9

)

Short-Term Borrowings

(6.2

)

0.5

(5.7

)

Securities Sold Under Agreements to Repurchase

(14.6

)

3.4

(11.2

)

Other Debt

(15.4

)

(0.5

)

(15.9

)

Total Change in Interest Expense

(13.3

)

92.6

79.3

Change in Net Interest Income

$

(1.6

)

$

(32.1

)

$

(33.7

)

1 The change in interest income and expense not solely due

to changes in volume or rate has been allocated on a pro-rata basis

to the volume and rate columns. 2 Comprised of other consumer

revolving credit, installment, and consumer lease financing.

Bank of Hawai‘i Corporation and Subsidiaries Salaries and

Benefits Table 9 Three Months Ended Nine

Months Ended September 30, June 30, September

30, September 30, (dollars in thousands)

2024

2024

2023

2024

2023

Salaries

$

38,993

$

38,662

$

39,426

$

115,686

$

116,005

Incentive Compensation

5,086

3,109

2,956

11,285

9,937

Retirement and Other Benefits

3,692

3,961

3,809

11,952

13,186

Medical, Dental, and Life Insurance

3,512

3,211

2,835

9,935

10,267

Share-Based Compensation

3,364

3,296

4,072

10,459

11,327

Payroll Taxes

2,839

3,070

2,921

10,639

12,079

Commission Expense

979

939

676

2,490

2,098

Separation Expense

161

785

2,130

1,428

5,189

Total Salaries and Benefits

$

58,626

$

57,033

$

58,825

$

173,874

$

180,088

Bank of Hawai‘i Corporation and Subsidiaries Loan

and Lease Portfolio Balances Table 10 September

30, June 30, March 31, December 31,

September 30, (dollars in thousands)

2024

2024

2024

2023

2023

Commercial Commercial Mortgage

$

3,868,566

$

3,741,140

$

3,715,032

$

3,749,016

$

3,784,339

Commercial and Industrial

1,675,347

1,691,441

1,669,482

1,652,699

1,569,572

Construction

319,150

315,571

323,069

304,463

251,507

Lease Financing

60,665

59,388

57,817

59,939

61,522

Paycheck Protection Program

6,346

7,997

10,177

11,369

12,529

Total Commercial

5,930,074

5,815,537

5,775,577

5,777,486

5,679,469

Consumer Residential Mortgage

4,622,677

4,595,586

4,616,900

4,684,171

4,699,140

Home Equity

2,195,844

2,221,073

2,240,946

2,264,827

2,285,974

Automobile

786,910

806,240

825,854

837,830

856,113

Other 1

383,078

392,830

394,560

400,712

398,795

Total Consumer

7,988,509

8,015,729

8,078,260

8,187,540

8,240,022

Total Loans and Leases

$

13,918,583

$

13,831,266

$

13,853,837

$

13,965,026

$

13,919,491

1 Comprised of other revolving credit, installment, and lease

financing.

Deposits September 30, June

30, March 31, December 31, September 30,

(dollars in thousands)

2024

2024

2024

2023

2023

Consumer

$

10,340,466

$

10,382,432

$

10,429,004

$

10,319,809

$

10,036,261

Commercial

8,356,239

7,995,618

8,323,330

8,601,224

8,564,536

Public and Other

2,281,617

2,030,452

1,924,252

2,134,012

2,201,512

Total Deposits

$

20,978,322

$

20,408,502

$

20,676,586

$

21,055,045

$

20,802,309

Average Deposits Three Months Ended

September 30, June 30, March 31, December

31, September 30, (dollars in thousands)

2024

2024

2024

2023

2023

Consumer

$

10,345,772

$

10,379,724

$

10,313,730

$

10,092,727

$

9,963,690

Commercial

8,207,310

8,188,685

8,334,540

8,581,426

8,288,891

Public and Other

1,931,309

1,789,984

1,895,370

2,029,917

2,239,501

Total Deposits

$

20,484,391

$

20,358,393

$

20,543,640

$

20,704,070

$

20,492,082

Bank of Hawai‘i Corporation and Subsidiaries

Non-Performing Assets and Accruing Loans and Leases Past Due 90

Days or More Table 11 September 30, June

30, March 31, December 31, September 30,

(dollars in thousands)

2024

2024

2024

2023

2023

Non-Performing Assets Non-Accrual Loans and Leases

Commercial Commercial and Industrial

$

6,218

$

3,681

$

13

$

39

$

43

Commercial Mortgage

2,680

2,601

2,714

2,884

2,996

Total Commercial

8,898

6,282

2,727

2,923

3,039

Consumer Residential Mortgage

4,269

2,998

3,199

2,935

3,706

Home Equity

3,947

3,227

3,240

3,791

3,734

Total Consumer

8,216

6,225

6,439

6,726

7,440

Total Non-Accrual Loans and Leases

17,114

12,507

9,166

9,649

10,479

Foreclosed Real Estate

2,667

2,672

2,672

2,098

1,040

Total Non-Performing Assets

$

19,781

$

15,179

$

11,838

$

11,747

$

11,519

Accruing Loans and Leases Past Due 90 Days or More

Consumer Residential Mortgage

$

4,421

$

4,524

$

3,378

$

3,814

$

3,519

Home Equity

1,980

2,025

1,580

1,734

2,172

Automobile

580

568

517

399

393

Other 1

554

733

872

648

643

Total Consumer

7,535

7,850

6,347

6,595

6,727

Total Accruing Loans and Leases Past Due 90 Days or More

$

7,535

$

7,850

$

6,347

$

6,595

$

6,727

Total Loans and Leases

$

13,918,583

$

13,831,266

$

13,853,837

$

13,965,026

$

13,919,491

Ratio of Non-Accrual Loans and Leases to Total Loans and

Leases

0.12

%

0.09

%

0.07

%

0.07

%

0.08

%

Ratio of Non-Performing Assets to Total Loans and Leases and

Foreclosed Real Estate

0.14

%

0.11

%

0.09

%

0.08

%

0.08

%

Ratio of Non-Performing Assets to Total Assets

0.08

%

0.07

%

0.05

%

0.05

%

0.05

%

Ratio of Commercial Non-Performing Assets to Total

Commercial Loans and Leases and Commercial Foreclosed Real Estate

0.15

%

0.11

%

0.05

%

0.05

%

0.05

%

Ratio of Consumer Non-Performing Assets to Total Consumer

Loans and Leases and Consumer Foreclosed Real Estate

0.14

%

0.11

%

0.11

%

0.11

%

0.10

%

Ratio of Non-Performing Assets and Accruing Loans and Leases

Past Due 90 Days or More to Total Loans and Leases and Foreclosed

Real Estate

0.20

%

0.17

%

0.13

%

0.13

%

0.13

%

Quarter to Quarter Changes in Non-Performing Assets

Balance at Beginning of Quarter

$

15,179

$

11,838

$

11,747

$

11,519

$

11,477

Additions

5,557

5,257

1,652

2,683

1,318

Reductions Payments

(734

)

(844

)

(921

)

(2,018

)

(1,017

)

Return to Accrual Status

(81

)

(1,018

)

(617

)

(437

)

(259

)

Charge-offs / Write-downs

(140

)

(54

)

(23

)

-

-

Total Reductions

(955

)

(1,916

)

(1,561

)

(2,455

)

(1,276

)

Balance at End of Quarter

$

19,781

$

15,179

$

11,838

$

11,747

$

11,519

1 Comprised of other revolving credit, installment, and

lease financing.

Bank of Hawai‘i Corporation and

Subsidiaries Reserve for Credit Losses Table 12

Three Months Ended Nine Months Ended September

30, June 30, September 30, September 30,

(dollars in thousands)

2024

2024

2023

2024

2023

Balance at Beginning of Period

$

151,155

$

152,148

$

151,702

$

152,429

$

151,247

Loans and Leases Charged-Off Commercial Commercial and

Industrial

(1,021

)

(875

)

(294

)

(2,256

)

(758

)

Consumer Residential Mortgage

-

(48

)

-

(48

)

(6

)

Home Equity

(125

)

(202

)

(13

)

(362

)

(68

)

Automobile

(1,651

)

(1,095

)

(1,353

)

(3,794

)

(4,309

)

Other 1

(2,539

)

(2,610

)

(1,957

)

(7,461

)

(6,296

)

Total Loans and Leases Charged-Off

(5,336

)

(4,830

)

(3,617

)

(13,921

)

(11,437

)

Recoveries on Loans and Leases Previously Charged-Off Commercial

Commercial and Industrial

66

263

72

445

225

Consumer Residential Mortgage

48

63

69

153

188

Home Equity

318

113

131

615

893

Automobile

552

481

721

1,559

2,170

Other 1

522

517

575

1,645

1,867

Total Recoveries on Loans and Leases Previously Charged-Off

1,506

1,437

1,568

4,417

5,343

Net Charged-Off - Loans and Leases

(3,830

)

(3,393

)

(2,049

)

(9,504

)

(6,094

)

Provision for Credit Losses: Loans and Leases

3,684

3,206

1,945

10,432

6,918

Unfunded Commitments

(684

)

(806

)

55

(3,032

)

(418

)

Total Provision for Credit Losses

3,000

2,400

2,000

7,400

6,500

Balance at End of Period

$

150,325

$

151,155

$

151,653

$

150,325

$

151,653

Components Allowance for Credit Losses - Loans and

Leases

$

147,331

$

147,477

$

145,263

$

147,331

$

145,263

Reserve for Unfunded Commitments

2,994

3,678

6,390

2,994

6,390

Total Reserve for Credit Losses

$

150,325

$

151,155

$

151,653

$

150,325

$

151,653

Average Loans and Leases Outstanding

$

13,809,977

$

13,831,797

$

13,903,214

$

13,836,760

$

13,833,164

Ratio of Net Loans and Leases Charged-Off to Average Loans

and Leases Outstanding (annualized)

0.11

%

0.10

%

0.06

%

0.09

%

0.06

%

Ratio of Allowance for Credit Losses to Loans and Leases

Outstanding 2

1.06

%

1.07

%

1.04

%

1.06

%

1.04

%

1 Comprised of other revolving credit, installment, and

lease financing. 2 The numerator comprises the Allowance for Credit

Losses - Loans and Leases.

Bank of Hawai‘i Corporation

and Subsidiaries Business Segments Selected Financial

Information Table 13a Consumer Commercial

Treasury Consolidated (dollars in thousands)

Banking Banking and Other Total

Three Months Ended September 30, 2024 Net Interest Income

(Expense)

$

97,919

$

50,556

$

(30,857

)

$

117,618

Provision for Credit Losses

3,058

772

(830

)

3,000

Net Interest Income (Expense) After Provision for Credit Losses

94,861

49,784

(30,027

)

114,618

Noninterest Income

34,133

7,786

3,191

45,110

Noninterest Expense

(84,712

)

(18,825

)

(3,555

)

(107,092

)

Income (Loss) Before Income Taxes

44,282

38,745

(30,391

)

52,636

Provision for Income Taxes

(11,289

)

(9,816

)

8,827

(12,278

)

Net Income (Loss)

$

32,993

$

28,929

$

(21,564

)

$

40,358

Total Assets as of September 30, 2024

$

8,308,389

$

5,952,321

$

9,538,464

$

23,799,174

Three Months Ended September 30, 2023 1 Net Interest

Income (Expense)

$

98,984

$

52,066

$

(30,113

)

$

120,937

Provision for Credit Losses

1,974

74

(48

)

2,000

Net Interest Income (Expense) After Provision for Credit Losses

97,010

51,992

(30,065

)

118,937

Noninterest Income

31,027

8,483

10,824

50,334

Noninterest Expense

(81,377

)

(18,937

)

(5,287

)

(105,601

)

Income (Loss) Before Income Taxes

46,660

41,538

(24,528

)

63,670

Provision for Income Taxes

(12,073

)

(10,523

)

6,829

(15,767

)

Net Income (Loss)

$

34,587

$

31,015

$

(17,699

)

$

47,903

Total Assets as of September 30, 2023

$

8,584,796

$

5,719,577

$

9,245,412

$

23,549,785

1 Certain prior period information has been reclassified to

conform to current presentation.

Bank of Hawai‘i

Corporation and Subsidiaries Business Segments Selected

Financial Information Table 13b Consumer

Commercial Treasury Consolidated (dollars in

thousands)

Banking Banking and Other

Total Nine Months Ended September 30, 2024 Net

Interest Income (Expense)

$

293,118

$

152,934

$

(99,650

)

$

346,402

Provision for Credit Losses

8,218

1,239

(2,057

)

7,400

Net Interest Income (Expense) After Provision for Credit Losses

284,900

151,695

(97,593

)

339,002

Noninterest Income

99,768

21,278

8,436

129,482

Noninterest Expense

(254,428

)

(55,478

)

(12,271

)

(322,177

)

Income (Loss) Before Income Taxes

130,240

117,495

(101,428

)

146,307

Provision for Income Taxes

(33,154

)

(29,711

)

27,390

(35,475

)

Net Income (Loss)

$

97,086

$

87,784

$

(74,038

)

$

110,832

Total Assets as of September 30, 2024

$

8,308,389

$

5,952,321

$

9,538,464

$

23,799,174

Nine Months Ended September 30, 2023 1 Net Interest

Income (Expense)

$

293,681

$

159,864

$

(72,305

)

$

381,240

Provision for Credit Losses

6,035

59

406

6,500

Net Interest Income (Expense) After Provision for Credit Losses

287,646

159,805

(72,711

)

374,740

Noninterest Income

94,126

25,072

15,128

134,326

Noninterest Expense

(247,543

)

(58,528

)

(15,485

)

(321,556

)

Income (Loss) Before Income Taxes

134,229

126,349

(73,068

)

187,510

Provision for Income Taxes

(34,566

)

(31,345

)

19,207

(46,704

)

Net Income (Loss)

$

99,663

$

95,004

$

(53,861

)

$

140,806

Total Assets as of September 30, 2023

$

8,584,796

$

5,719,577

$

9,245,412

$

23,549,785

1 Certain prior period information has been reclassified to

conform to current presentation.

Bank of Hawai‘i

Corporation and Subsidiaries Selected Quarterly Financial

Data Table 14 Three Months Ended September

30, June 30, March 31, December 31,

September 30, (dollars in thousands, except per share

amounts)

2024

2024

2024

2023

2023

Quarterly Operating Results Interest Income Interest and

Fees on Loans and Leases

$

166,286

$

163,208

$

159,336

$

158,324

$

151,245

Income on Investment Securities Available-for-Sale

23,257

21,468

21,757

22,782

23,552

Held-to-Maturity

21,107

21,595

22,136

22,589

22,838

Deposits

29

25

30

23

18

Funds Sold

8,951

6,114

6,127

5,705

12,828

Other

1,018

1,120

970

924

1,464

Total Interest Income

220,648

213,530

210,356

210,347

211,945

Interest Expense Deposits

96,067

91,542

89,056

87,121

72,153

Securities Sold Under Agreements to Repurchase

993

1,180

1,443

1,459

4,034

Funds Purchased

-

44

-

-

-

Other Debt

5,970

5,918

5,919

5,982

14,821

Total Interest Expense

103,030

98,684

96,418

94,562

91,008

Net Interest Income

117,618

114,846

113,938

115,785

120,937

Provision for Credit Losses

3,000

2,400

2,000

2,500

2,000

Net Interest Income After Provision for Credit Losses

114,618

112,446

111,938

113,285

118,937

Noninterest Income Fees, Exchange, and Other Service Charges

14,945

13,769

14,123

13,774

13,824

Trust and Asset Management

11,916

12,223

11,189

11,144

10,548

Service Charges on Deposit Accounts

8,075

7,730

7,947

7,949

7,843

Bank-Owned Life Insurance

3,533

3,396

3,356

3,176

2,749

Annuity and Insurance

1,460

1,583

1,046

1,271

1,156

Mortgage Banking

1,188

1,028

951

1,016

1,059

Investment Securities Losses, Net

(1,103

)

(1,601

)

(1,497

)

(1,619

)

(6,734

)

Other

5,096

3,959

5,170

5,572

19,889

Total Noninterest Income

45,110

42,087

42,285

42,283

50,334

Noninterest Expense Salaries and Benefits

58,626

57,033

58,215

53,991

58,825

Net Occupancy

10,806

10,559

10,456

9,734

10,327

Net Equipment

10,120

10,355

10,103

9,826

9,477

Professional Fees

4,725

4,929

4,677

5,079

3,846

Data Processing

4,712

4,745

4,770

4,948

4,706

FDIC Insurance

3,355

7,170

3,614

18,545

3,361

Other

14,748

14,435

14,024

13,839

15,059

Total Noninterest Expense

107,092

109,226

105,859

115,962

105,601