UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT

REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): September 12, 2023

ARES ACQUISITION CORPORATION

(Exact Name of Registrant as Specified in Charter)

|

|

|

|

|

| Cayman Islands |

|

001-39972 |

|

98-1538872 |

| (State or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

|

| 245 Park Avenue, 44th Floor

New York, New York 10167 |

| (Address of Principal Executive Offices) (Zip Code) |

(310) 201-4100

(Registrant’s Telephone Number, Including Area Code)

Not Applicable

(Former

Name or Former Address, if Changed Since Last Report)

Check the

appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☒ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act

(17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e 4(c)) |

Securities registered pursuant

to Section 12(b) of the Act:

|

|

|

|

|

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange

on which registered |

| Units, each consisting of one Class A Ordinary Share, $0.0001 par value per share, and one-fifth of one redeemable warrant |

|

AAC.U |

|

New York Stock Exchange |

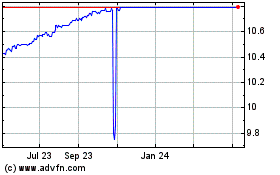

| Class A Ordinary Shares included as part of the units |

|

AAC |

|

New York Stock Exchange |

| Redeemable warrants included as part of the units, each whole warrant exercisable for one Class A Ordinary Share at an exercise price of $11.50 |

|

AAC WS |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the

Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 1.01. |

Entry into a Material Definitive Agreement. |

Second Amendment to Business Combination Agreement

On September 12, 2023, Ares Acquisition Corporation, a Cayman Islands exempted company (which intends to domesticate as a Delaware

corporation prior to the closing of the Business Combination) (“AAC”), and X-Energy Reactor Company, LLC, a Delaware limited liability company

(“X-energy”), entered into the Second Amendment to Business Combination Agreement (the “Second Amendment”), which amends the previously announced Business Combination

Agreement, dated as of December 5, 2022 (as amended by the First Amendment to Business Combination Agreement, dated as of June 11, 2023, and the Second Amendment, the “Business Combination Agreement”), by and among AAC, X-energy and, solely for purposes of Section 1.01(f), Section 6.25 and Article IX of the Business Combination Agreement, certain other parties thereto. The transactions contemplated by the

Business Combination Agreement are referred to as the “Business Combination.” Capitalized terms used but not otherwise defined in this Current Report on Form 8-K have the meanings given to

them in the Business Combination Agreement.

Pursuant to the Second Amendment, AAC and X-energy

have agreed to, among other things, amend the definition of “Base Purchase Price” to decrease the pre-transaction equity value given to X-energy from

$1,800,000,000 to $1,050,000,000.

The foregoing description of the Second Amendment does not purport to be complete and is qualified in

its entirety by reference to the full text of the Second Amendment, a copy of which is included as Exhibit 2.1 to, and the terms of which are incorporated by reference in, this Current Report on Form 8-K.

Preferred Stock PIPE Financing

Concurrently with the execution of the Second Amendment, AAC entered into a subscription agreement (the “Preferred Stock Subscription

Agreement”) with AAC Holdings II LP (“AAC Holdings II”), a Delaware limited liability company that is affiliated with AAC’s sponsor, Ares Acquisition Holdings LP, a Cayman Islands exempted limited partnership. Pursuant

to the Preferred Stock Subscription Agreement, AAC Holdings II agreed to subscribe for and purchase, and AAC agreed to issue and sell to AAC Holdings II, on the Closing Date, an aggregate of 50,000 shares of Series A Convertible Preferred Stock (the

“Series A Convertible Preferred Stock”) for an aggregate purchase price of $50,000,000 (the “Preferred Stock PIPE Financing”).

The closing of the Preferred Stock PIPE Financing is contingent upon, among other things, all conditions precedent to the closing of the

transactions contemplated by the Preferred Stock Subscription Agreement having been satisfied or waived, and the closing of the Business Combination occurring substantially concurrently with the closing of the transactions contemplated by the

Preferred Stock Subscription Agreement. The Preferred Stock Subscription Agreement provides that AAC will grant AAC Holdings II in the Preferred Stock PIPE Financing certain customary registration rights.

The foregoing description of the Preferred Stock Subscription Agreement and the Preferred Stock PIPE Financing is subject to and

qualified in its entirety by reference to the full text of the Preferred Stock Subscription Agreement, a copy of which is attached as Exhibit 10.1 to, and the terms of which are incorporated by reference in, this Current Report on Form 8-K.

Letter Agreement

On September 12, 2023, in connection with the Preferred Stock PIPE Financing, AAC entered into a letter agreement (the “Letter

Agreement”) with X-energy and Ghaffarian Enterprises, LLC (the “Guarantor”), pursuant to which the Guarantor agreed, in connection with the consummation of the Business Combination,

to contribute or cause to be contributed to X-energy an amount in cash (the “Contribution Amount”), which is currently anticipated to be approximately $30,000,000. X-energy intends to use the Contribution Amount, along with cash on the balance sheet, to repay certain loans, accrued and unpaid interest and related fees pursuant to that certain credit agreement, dated

July 28, 2020, as amended and restated, between X-Energy LLC, a wholly-owned subsidiary of X-energy, and Pershing LLC, an affiliate of Bank of New York Mellon. As

consideration for such contribution, the Guarantor or its designees will be entitled to receive a number of shares of Series A Convertible Preferred Stock determined by dividing (x) the Contribution Amount, by (y) $1,000 per share, subject to

the terms of the Letter Agreement.

The foregoing description of the Letter Agreement is subject to and qualified in its

entirety by reference to the full text of the Letter Agreement, a copy of which is attached as Exhibit 10.2 to, and the terms of which are incorporated by reference in, this Current Report on Form 8-K.

| Item 3.02. |

Unregistered Sales of Equity Securities. |

The disclosure set forth above in Item 1.01 of this Current Report on Form 8-K with respect

to the issuance of shares of Series A Convertible Preferred Stock in the Preferred Stock PIPE Financing, and pursuant to the Letter Agreement, will not be registered under the Securities Act of 1933, as amended (the “Securities

Act”), and will be issued in reliance on the exemption from registration requirements thereof provided by Section 4(a)(2) of the Securities Act and/or Regulation D promulgated thereunder as a transaction by an issuer not

involving a public offering.

| Item 7.01. |

Regulation FD Disclosure. |

On September 13, 2023, AAC and X-energy issued a joint press release announcing their entry into

the Second Amendment and AAC’s entry into the Preferred Stock Subscription Agreement and the Letter Agreement in connection with the Preferred Stock PIPE Financing. The press release is furnished as Exhibit 99.1 and incorporated by reference

into this Item 7.01.

Furnished herewith as Exhibit 99.2 hereto and incorporated by reference herein is the investor presentation dated

September 13, 2023 (the “Investor Presentation”), which will be used by AAC, from time to time, with respect to the previously announced Business Combination involving AAC

and X-energy. The information contained in the Investor Presentation is illustrative summary information that should be considered in the context of AAC’s filings with the U.S. Securities and

Exchange Commission (the “SEC”) and other public announcements that AAC may make by press release or otherwise from time to time.

The information referenced under Item 7.01 (including Exhibits 99.1 and 99.2 referenced in Item 9.01 below) of this Current Report on Form 8-K is being “furnished” under “Item 7.01. Regulation FD Disclosure” and, as such, shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act

of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section. The information set forth in this Current Report on Form 8-K (including Exhibits 99.1 and

99.2 referenced in Item 9.01 below) shall not be incorporated by reference into any registration statement, report or other document filed by the Company pursuant to the Securities Act, or the Exchange Act, except as shall be expressly set forth by

specific reference in such filing.

Additional Information and Where to Find It

In connection with the Business Combination, AAC filed a registration statement

on Form S-4 on January 25, 2023, (as amended by Amendment No. 1, Amendment No. 2, Amendment No. 3 and Amendment No. 4 thereto, filed on March 24, 2023,

June 12, 2023, July 3, 2023 and July 25, 2023, respectively, the “Registration Statement”) with the SEC, which includes a preliminary proxy statement/prospectus to be distributed to holders of AAC’s ordinary

shares in connection with AAC’s solicitation of proxies for the vote by AAC’s shareholders with respect to the Business Combination and other matters as described in the Registration Statement, as well as a prospectus relating to the offer

of securities to be issued to X-energy equity holders in connection with the Business Combination. After the Registration Statement has been declared effective, AAC will mail a copy of the

definitive proxy statement/prospectus, when available, to its shareholders. The Registration Statement includes information regarding the persons who may, under the SEC rules, be deemed participants in the solicitation of proxies to AAC’s

shareholders in connection with the Business Combination. AAC has filed and will file other documents regarding the Business Combination with the SEC. BEFORE MAKING ANY VOTING OR INVESTMENT DECISION, INVESTORS AND SECURITY HOLDERS OF AAC AND X-ENERGY ARE URGED TO READ THE REGISTRATION STATEMENT, THE PROXY STATEMENT/PROSPECTUS CONTAINED THEREIN, AND ALL OTHER RELEVANT DOCUMENTS FILED OR THAT WILL BE FILED WITH THE SEC IN

CONNECTION WITH THE BUSINESS COMBINATION AS THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE BUSINESS COMBINATION.

Investors and security holders will be able to obtain free copies of the Registration

Statement, the proxy statement/prospectus and all other relevant documents filed or that will be filed with the SEC by AAC through the website maintained by the SEC at www.sec.gov. In addition, the documents filed by AAC may be obtained free

of charge from AAC’s website at www.aresacquisitioncorporation.com or by written request to AAC at Ares Acquisition Corporation, 245 Park Avenue, 44th Floor, New York, NY 10167.

Forward-Looking Statements

This Current

Report contains certain forward-looking statements within the meaning of the federal securities laws with respect to the Business Combination and the Preferred Stock PIPE Financing, including statements regarding the benefits of the Business

Combination, the anticipated timing of the Business Combination and the Preferred Stock PIPE Financing, the markets in which X-energy operates

and X-energy’s projected future results. X-energy’s actual results may differ from its expectations, estimates and projections (which, in

part, are based on certain assumptions) and consequently, you should not rely on these forward-looking statements as predictions of future events. Words such as “expect,” “estimate,” “project,” “budget,”

“forecast,” “anticipate,” “intend,” “plan,” “may,” “will,” “could,” “should,” “believes,” “predicts,” “potential,” “continue,”

and similar expressions are intended to identify such forward-looking statements. Although these forward-looking statements are based on assumptions that X-energy and AAC believe are reasonable,

these assumptions may be incorrect. These forward-looking statements also involve significant risks and uncertainties that could cause the actual results to differ materially from the expected results. Factors that may cause such differences

include, but are not limited to: (1) the outcome of any legal proceedings that may be instituted in connection with any proposed business combination; (2) the inability to complete any proposed business combination or related transactions,

including the Preferred Stock PIPE Financing; (3) the inability to raise sufficient capital to fund our business plan, including limitations on the amount of capital raised in any proposed business combination as a result of redemptions or

otherwise; (4) the failure to obtain additional funding from the U.S. government or our ARDP partner for the ARDP; (5) unexpected increased project costs, increasing as a result of macroeconomic factors, such as inflation and rising

interest rates; (6) delays in obtaining, adverse conditions contained in, or the inability to obtain necessary regulatory approvals or complete regulatory reviews required to complete any business combination; (7) the risk that any

proposed business combination disrupts current plans and operations; (8) the inability to recognize the anticipated benefits of any proposed business combination, which may be affected by, among other things, competition, the ability of the

combined company to grow and manage growth profitably, maintain relationships with customers and suppliers and retain key employees; (9) costs related to the proposed business combination and the Preferred Stock PIPE Financing;

(10) changes in the applicable laws or regulations; (11) the possibility that X-energy may be adversely affected by other economic, business, and/or competitive factors; (12) the

persistent impact of the global COVID-19 pandemic; (13) economic uncertainty caused by the impacts of the conflict in Russia and Ukraine and rising levels of inflation and interest rates;

(14) the ability of X-energy to obtain regulatory approvals necessary for it to deploy its small modular reactors in the United States and abroad; (15) whether government funding for high

assay low enriched uranium for government or commercial uses will result in adequate supply on anticipated timelines to support X-energy’s business; (16) the impact and potential extended

duration of the current supply/demand imbalance in the market for low enriched uranium; (17) X-energy’s business with various governmental entities is subject to the policies, priorities,

regulations, mandates and funding levels of such governmental entities and may be negatively or positively impacted by any change thereto; (18) X-energy’s limited operating history makes it

difficult to evaluate its future prospects and the risks and challenges it may encounter; and (19) other risks and uncertainties separately provided to you and indicated from time to time described in filings and potential filings by X-energy, AAC or X-energy, Inc. with the SEC.

The foregoing list of factors is not exhaustive. These forward-looking statements are provided for illustrative purposes only and are not

intended to serve as, and must not be relied on by investors as, a guarantee, an assurance, a prediction or a definitive statement of fact or probability. You should carefully consider the foregoing factors and the other risks and uncertainties

described in the “Risk Factors” section of AAC’s Annual Report on Form 10-K, its subsequent Quarterly Reports on Form 10-Q, the

Registration Statement and the proxy statement/prospectus related to the transaction, and other documents filed (or to be filed) by AAC from time to time with the SEC. These filings identify and address other important risks and uncertainties that

could cause actual events and results to differ materially from those contained in the forward-looking statements. These risks and uncertainties may be amplified by the conflict between Russia and Ukraine, rising levels of inflation and interest

rates and the COVID-19 pandemic, which have caused significant economic uncertainty. Forward-looking statements speak only as of the date they are made.

Investors are cautioned not to put undue reliance on forward-looking statements, and X-energy and AAC assume no obligation and do not intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise, except as required by

securities and other applicable laws. Neither X-energy nor AAC gives any assurance that either X-energy or AAC, respectively, will achieve its

expectations.

No Offer or Solicitation

This Current Report is for informational purposes only and is neither an offer to purchase, nor a solicitation of an offer to sell, subscribe

for or buy, any securities or the solicitation of any vote in any jurisdiction pursuant to the Business Combination or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law.

No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act.

Participants

in the Solicitation

AAC and certain of its directors and executive officers may be deemed to be participants in the solicitation of

proxies from AAC’s shareholders, in favor of the approval of the proposed transaction. For information regarding AAC’s directors and executive officers, please see AAC’s Annual Report on

Form 10-K, its subsequent Quarterly Reports on Form 10-Q, and the other documents filed (or to be filed) by AAC from time to time with the SEC.

Additional information regarding the interests of those participants and other persons who may be deemed participants in the Business Combination may be obtained by reading the registration statement and the proxy statement/prospectus and other

relevant documents filed with the SEC when they become available. Free copies of these documents may be obtained as described in the preceding paragraph.

| Item 9.01. |

Financial Statements and Exhibits. |

(d) Exhibits

|

|

|

| Exhibit

Number |

|

Description |

|

|

| 2.1 |

|

Second Amendment to Business Combination Agreement, dated as of September 12, 2023, by and between Ares Acquisition

Corporation and X-Energy Reactor Company, LLC. |

|

|

| 10.1 |

|

Preferred Stock Subscription Agreement, dated as of September 12, 2023, by and between Ares Acquisition Corporation

and AAC Holdings II LP. |

|

|

| 10.2 |

|

Letter Agreement, dated as of September 12, 2023, by and among Ares Acquisition Corporation, X-Energy Reactor Company, LLC and Ghaffarian Enterprises, LLC. |

|

|

| 99.1 |

|

Press Release, dated as of September 13, 2023. |

|

|

| 99.2 |

|

Investor Presentation, dated as of September 13, 2023. |

|

|

| 104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed

on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

ARES ACQUISITION CORPORATION |

| Dated: September 13, 2023 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By: |

|

/s/ David B. Kaplan |

|

|

|

|

Name: |

|

David B. Kaplan |

|

|

|

|

Title: |

|

Chief Executive Officer and Co-Chairman |

Exhibit 2.1

SECOND AMENDMENT TO BUSINESS COMBINATION AGREEMENT

This SECOND AMENDMENT (this “Amendment”), dated as of September 12, 2023 to the Business Combination Agreement, dated as

of December 5, 2022 (as amended by the First Amendment to Business Combination Agreement, dated as of June 11, 2023, the “Agreement”), by and among Ares Acquisition Corporation, a Cayman Islands exempted company (the

“Purchaser”), X-Energy Reactor Company, LLC, a Delaware limited liability company (the “Company”), and, solely for purposes of Section 1.01(f), Section 6.25 and

Article IX of the Agreement, each of The Kamal S. Ghaffarian Revocable Trust, IBX Company Opportunity Fund 1, LP, a Delaware limited partnership, IBX Company Opportunity Fund 2, LP, a Delaware limited partnership, IBX Opportunity GP, Inc., a

Delaware corporation, GM Enterprises LLC, a Delaware limited liability company, and X-Energy Management, LLC, a Delaware limited liability company (collectively, the “Additional Parties”), is

entered into by and between the Purchaser and the Company. The Purchaser and the Company are sometimes referred to individually as a “Party” and collectively as the “Parties.” Capitalized terms used and not

otherwise defined herein shall have the meanings assigned to such terms in the Agreement.

RECITALS:

WHEREAS, the Purchaser, the Company and the Additional Parties entered into the Agreement on December 5, 2022;

WHEREAS, the Purchaser and the Company entered into the First Amendment to Business Combination Agreement on June 11, 2023, which

amended certain terms of the Agreement;

WHEREAS, Section 9.10 of the Agreement provides that the Agreement may be amended,

supplemented or modified only by execution of a written instrument signed by the Purchaser (which in the case of the Purchaser, shall require the approval of the Special Committee), the Company and, solely with respect to any amendment, supplement

or modification of Section 1.01(f) of the Agreement or any provision of Article IX of the Agreement, the Additional Parties;

WHEREAS, the Parties wish to make certain amendments to the Agreement, which do not amend, supplement or modify Section 1.01(f) or

Article IX of the Agreement, as set forth in this Amendment;

WHEREAS, the board of directors of the Purchaser and the Special

Committee have: (a) determined that it is advisable and in the best interests of the Purchaser and the Purchaser Shareholders for the Purchaser to enter into this Amendment; (b) authorized and approved the execution and delivery of this

Amendment and the transactions contemplated by this Amendment on the terms and subject to the conditions of this Amendment and (c) reaffirmed their respective recommendations of the approval of the Agreement, as amended by this Amendment, and

the transactions contemplated by the Agreement to the shareholders of the Purchaser;

WHEREAS, the board of directors of the

Company has: (a) determined that it is advisable and in the best interests of the Company and the members of the Company to enter into this Amendment and (b) authorized and approved the execution and delivery of this Amendment and the

transactions contemplated by this Amendment on the terms and subject to the conditions of this Amendment; and

WHEREAS, concurrently with the execution of this Amendment, the Company has delivered

to Purchaser the irrevocable affirmative written consent of the Requisite Members, in the form attached as Exhibit A, adopting and approving this Amendment pursuant to the terms and in accordance with and satisfaction of the conditions of the

Company’s Organizational Documents and applicable Law.

NOW THEREFORE, the Parties agree as follows:

Section 1.1 Definitions. Except as otherwise indicated, capitalized terms used but not defined in this Amendment have the meanings

given to them in the Agreement.

Section 1.2 Amendments.

(a) The defined term “Ares Commitment Letter” in Article X of the Agreement is amended and restated in its entirety

to read as follows:

“Ares Commitment Letter” means the letter dated December 5, 2022, among AAC

Holdings II LP, the Purchaser and the Company, as amended on June 11, 2023, and as may be further amended or supplemented from time to time, or superseded by definitive documentation among AAC Holdings II LP, a Delaware limited partnership, the

Purchaser and the Company, including any Alternative Securities Subscription Agreement (as defined in such December 5, 2022 letter).

(b) The defined term “Base Purchase Price” in Article X of the Agreement is amended and restated in its entirety to

read as follows:

“Base Purchase Price” means an amount equal to $1,050,000,000.

Section 1.3 No Other Amendments. All other provisions of the Agreement shall, subject to the amendments expressly set forth in

Section 1.2 of this Amendment, continue unmodified, in full force and effect and constitute legal and binding obligations of the Parties in accordance with their terms. This Amendment is limited precisely as written and

shall not be deemed to be an amendment to any other term or condition of the Agreement or any of the documents referred to in the Agreement. This Amendment forms an integral and inseparable part of the Agreement.

Section 1.4 References. Each reference to “this Agreement,” “hereof,” “herein,”

“hereunder,” “hereby” and each other similar reference contained in the Agreement shall, effective from the date of this Amendment, refer to the Agreement as amended by this Amendment. Notwithstanding the foregoing, references to

the date of the Agreement and references in the Agreement, as amended by this Amendment, to “Signing Date,” “the date hereof,” “the date of this Agreement” and other similar references shall in all instances continue to

refer to December 5, 2022, and references to the date of this Amendment and “as of the date of this Amendment” shall refer to September 12, 2023.

2

Section 1.5 Effect of Amendment. This Amendment shall form a part of the

Agreement for all purposes, and each Party and the Additional Parties shall be bound by this Amendment. This Amendment shall be deemed to be in full force and effect from and after the execution of this Amendment by the Parties.

Section 1.6 Incorporation by Reference. Each of the provisions of Section 9.02 (Notices), Section 9.03 (Binding Effect;

Assignment), Section 9.04 (Third Parties), Section 9.05 (Governing Law), Section 9.06 (Jurisdiction), Section 9.07 (WAIVER OF JURY TRIAL), Section 9.08 (Specific Performance), Section 9.09 (Severability),

Section 9.10 (Amendment; Waiver), Section 9.12 (Interpretation), Section 9.13 (Counterparts), Section 9.15 (Waiver of Claims Against Trust) and Section 9.16 (Non-Recourse) of the

Agreement are incorporated by reference into this Amendment and shall apply mutatis mutandis to this Amendment.

Section 1.7

Further Assurances. The Parties shall further cooperate with each other and use their respective reasonable best efforts to take or cause to be taken all actions, and do or cause to be done all things, necessary, proper or advisable on their

part under this Amendment and applicable Laws to consummate the Transactions as soon as reasonably practicable.

[Remainder of Page Left

Intentionally Blank; Signature Page Follows]

3

IN WITNESS WHEREOF, each of the undersigned has executed this Amendment as of the date first

written above.

|

|

|

| PURCHASER: |

|

| ARES ACQUISITION CORPORATION |

|

|

| By: |

|

/s/ David B. Kaplan |

| Name: David B. Kaplan |

| Its: Chief Executive Officer |

[Signature Page to Second Amendment to the Business Combination Agreement]

|

|

|

| COMPANY: |

|

| X-ENERGY REACTOR COMPANY, LLC |

|

|

| By: |

|

/s/ J. Clay Sell |

| Name: J. Clay Sell |

| Its: Chief Executive Officer |

[Signature Page to Second Amendment to the Business Combination Agreement]

Exhibit 10.1

EXECUTION VERSION

PREFERRED STOCK SUBSCRIPTION AGREEMENT

September 12, 2023

Ares Acquisition

Corporation

245 Park Avenue, 44th Floor

New York, NY 10167

Ladies and Gentlemen:

This

Subscription Agreement (this “Subscription Agreement”) is being entered into as of the date set forth on the signature page to this Subscription Agreement, by and between Ares Acquisition Corporation, a Cayman Islands exempted

company, which shall be domesticated as a Delaware corporation prior to the closing of the Transaction (as defined in this Subscription Agreement) (together with any successor thereto, including after the Domestication (as defined in this

Subscription Agreement), “SPAC”), and AAC Holdings II LP, a Delaware limited partnership (the “Investor”), in connection with the Business Combination Agreement, dated as of December 5, 2022 (as amended by the

First Amendment to the Business Combination Agreement, dated as of June 11, 2023, and as may be further amended, supplemented or otherwise modified from time to time, the “Business Combination Agreement”), by and among SPAC,

X-Energy Reactor Company, LLC, a Delaware limited liability company (the “X-energy”), and the other parties thereto. Pursuant to and on the terms and subject to the conditions set forth in the Business Combination Agreement, among

other things, the combined company will be organized in an umbrella partnership C corporation structure, in which substantially all of the assets and the business of the combined company will be held by X-energy (the transactions contemplated by the

Business Combination Agreement, the “Transaction”). In connection with the Transaction and following the Domestication, but prior to the closing of the Transaction, SPAC is seeking commitments from interested investors to purchase

shares of SPAC’s Series A Convertible Preferred Stock, par value $0.0001 per share (the “Preferred Stock”) (after giving effect to the Domestication) and convertible into shares of SPAC’s common stock, par value $0.0001

per share (collectively the “Underlying Common Shares” and, together with the shares of Preferred Stock, the “Securities”), in a private placement for a purchase price of $1,000.00 per share (the “Per Share

Purchase Price”). Capitalized terms used and not otherwise defined in this Subscription Agreement have the meanings given to them in the Business Combination Agreement and Annex A to this Subscription Agreement, as applicable.

Prior to the closing of the Transaction (and as more fully described in the Business Combination Agreement), SPAC will

domesticate as a Delaware corporation in accordance with Section 388 of the General Corporation Law of the State of Delaware and de-register as a Cayman Islands exempted company in accordance with Section 206 of the Companies Act (As

Revised) of the Cayman Islands (the “Domestication”). The aggregate purchase price to be paid by the Investor for the subscribed Shares (as set forth on the signature page to this Subscription Agreement) is referred to in this

Subscription Agreement as the “Subscription Amount.”

In consideration of the foregoing and the mutual

representations, warranties and covenants, and subject to the conditions, set forth in this Subscription Agreement, and intending to be legally bound under this Subscription Agreement, each of the Investor and SPAC acknowledges and agrees as

follows:

1. Subscription.

a. The Investor irrevocably subscribes for and agrees to purchase from SPAC the number of shares of Preferred Stock set forth

on the signature page of this Subscription Agreement (the “Shares”) on the terms and subject to the conditions provided for in this Subscription Agreement. The

Confidential

Investor acknowledges and agrees that SPAC reserves the right to accept or reject the Investor’s subscription for the Shares for any reason or for no reason, in whole or in part, at any time

prior to its acceptance. The Investor’s subscriptions shall be deemed to be accepted by SPAC only when this Subscription Agreement is signed by a duly authorized person by or on behalf of SPAC. SPAC may do so in counterpart form. Investor

acknowledges and agrees that, as a result of the Domestication, the Shares that will be purchased by the Investor and issued by SPAC pursuant to this Subscription Agreement shall be shares of convertible preferred stock in a Delaware corporation

(and not, for the avoidance of doubt, convertible preferred shares in a Cayman Islands exempted company).

2.

Closing. The closing of the sale of the Shares contemplated under this Subscription Agreement (the “Closing”) is contingent upon the substantially concurrent consummation of the Transaction. The Closing shall occur on the

date of, and substantially concurrently with and conditioned upon the effectiveness of, the Transaction. Upon (a) satisfaction or waiver of the conditions set forth in this Section 2 and in Section 3 below and

(b) delivery of written notice from (or on behalf of) SPAC to the Investor (the “Closing Notice”), that SPAC reasonably expects all conditions to the closing of the Transaction to be satisfied or waived on a date that is not

less than five business days from the date on which the Closing Notice is delivered to the Investor, the Investor shall deliver to SPAC at least three business days prior to the closing date specified in the Closing Notice (the “Closing

Date”): (i) the Subscription Amount by wire transfer of United States dollars in immediately available funds to the account(s) specified by SPAC in the Closing Notice; and (ii) any other information that is reasonably requested by

SPAC in order to issue the Investor’s Shares. Without limiting the generality of the foregoing, such information shall include the legal name of the person in whose name such Shares are to be issued and a duly executed Internal Revenue Service

Form W-9 or Form W-8, as applicable. Subject to the Investor’s compliance with such requirements, on the Closing Date, SPAC shall deliver to Investor the shares of Preferred Stock, free and clear of any liens, encumbrances or other restrictions

(other than those arising under this Subscription Agreement or applicable securities laws), in the name of the Investor on SPAC’s share register. If the Closing does not occur within ten business days following the Closing Date specified

in the Closing Notice, SPAC shall promptly (but not later than one business day) return the Subscription Amount in full to the Investor. For purposes of this Subscription Agreement, “business day” shall mean a day other than a

Saturday, Sunday or other day on which commercial banks in New York, New York are authorized or required by law to close.

3. Closing Conditions.

a. The parties’ obligation to consummate the purchase and sale of the Shares pursuant to this Subscription Agreement is

subject to the following conditions:

(i) no suspension of the offering or sale of SPAC’s common

stock, par value $0.0001 per share (the “Class A Common Stock”), after giving effect to the Domestication, shall have been initiated or, to SPAC’s knowledge, threatened by the U.S. Securities and Exchange Commission (the

“SEC”);

(ii) no applicable governmental authority shall have enacted, issued,

promulgated, enforced or entered any judgment, order, law, rule or regulation (whether temporary, preliminary or permanent) which is then in effect and has the effect of making the consummation of the transactions contemplated under this

Subscription Agreement illegal or otherwise restraining or prohibiting consummation of the transactions contemplated under this Subscription Agreement; and

(iii) all conditions precedent to the closing of the Transaction contained in the Business Combination

Agreement shall have been satisfied (as determined by the parties

2

Confidential

to the Business Combination Agreement and other than those conditions under the Business Combination Agreement which, by their nature, are to be fulfilled at the closing of the Transaction,

including to the extent that any such condition is dependent upon the consummation of the purchase and sale of the Shares pursuant to this Subscription Agreement) or waived and the closing of the Transaction shall be scheduled to occur concurrently

with or on the same date as the Closing Date.

b. SPAC’s obligation to consummate the issuance and sale of the Shares

pursuant to this Subscription Agreement shall be subject to the following conditions:

(i) all

representations and warranties of the Investor contained in this Subscription Agreement are true and correct in all material respects on the Closing Date;

(ii) consummation of the Closing shall constitute a reaffirmation by the Investor of each of the

representations and warranties of the Investor contained in this Subscription Agreement as of the Closing Date; and

(iii) all obligations, covenants and agreements of the Investor required to be performed by it at or prior to

the Closing Date shall have been performed in all material respects.

c. The Investor’s obligation to consummate the

purchase of the Shares pursuant to this Subscription Agreement shall be subject to the following conditions:

(i) all representations and warranties of SPAC contained in this Subscription Agreement shall be true and

correct in all material respects (other than representations and warranties that are qualified as to materiality or Material Adverse Effect (as defined in this Subscription Agreement), which representations and warranties shall be true in all

respects) on the Closing Date;

(ii) consummation of the Closing shall constitute a reaffirmation by SPAC

of each of the representations and warranties of SPAC contained in this Subscription Agreement on the Closing Date;

(iii) all obligations, covenants and agreements of SPAC required by this Subscription Agreement to be performed

by it at or prior to the Closing Date shall have been performed in all material respects;

(iv) SPAC shall

have adopted and filed the certificate of designation (the “Certificate of Designation”) governing the Preferred Stock, and on the terms set forth on Annex A, with the Secretary of State of the Delaware on the Closing Date;

and

(v) the Class A Common Stock of SPAC, after giving effect to the Domestication, shall be

conditionally approved for listing upon the Closing on the NYSE, subject only to official notice of issuance thereof, and, to the knowledge of SPAC, the Company will meet all applicable NYSE listing standards relating thereto immediately following

Closing.

4. Further Assurances. At or prior to the Closing Date, the parties shall execute and deliver, or cause

to be executed and delivered, such additional documents and take such additional actions as the

3

Confidential

parties reasonably may deem to be practical and necessary in order to consummate the subscription as contemplated by this Subscription Agreement.

5. SPAC Representations and Warranties. SPAC represents and warrants to the Investor that:

a. SPAC is an exempted company, duly organized, validly existing and in good standing under the laws of the Cayman Islands.

SPAC has all (corporate or otherwise) power and authority to own, lease and operate its properties and conduct its business as presently conducted and to enter into, deliver and perform its obligations under this Subscription Agreement. As of the

Closing Date, following the Domestication, SPAC will be duly incorporated, validly existing as a corporation and in good standing under the laws of the State of Delaware.

b. As of the Closing Date, the Shares will be duly authorized and, when issued and delivered to the Investor against full

payment therefor in accordance with the terms of this Subscription Agreement, the Shares: (i) will be validly issued, fully paid and non-assessable; and (ii) will not have been issued in violation of or subject to any preemptive or similar

rights created under SPAC’s certificate of incorporation (as adopted on the Closing Date) or under the General Corporation Law of the State of Delaware.

c. The Underlying Common Shares have been duly authorized and, when converted from the Shares in accordance with the terms of

the organizational documents of SPAC, will be validly issued, fully paid, and non-assessable and will not have been issued in violation of or subject to any preemptive or similar rights created under SPAC’s organizational documents (including

the Certificate of Designation) or applicable law or any other agreement or contract.

d. This Subscription Agreement has

been duly authorized, executed and delivered by SPAC. Assuming that this Subscription Agreement constitutes the valid and binding agreement of the Investor, this Subscription Agreement is enforceable against SPAC in accordance with its terms, except

as may be limited or otherwise affected by (i) bankruptcy, insolvency, fraudulent conveyance, reorganization, moratorium or other laws relating to or affecting the rights of creditors generally, or (ii) principles of equity, whether

considered at law or equity.

e. The issuance and sale of the Shares and the compliance by SPAC with all of the provisions

of this Subscription Agreement and the consummation of the transactions contemplated in this Subscription Agreement will not conflict with or result in a breach or violation of any of the terms or provisions of, or constitute a default under, or

result in the creation or imposition of any lien, charge or encumbrance upon any of the property or assets of SPAC or any of its subsidiaries pursuant to the terms of: (i) any indenture, mortgage, deed of trust, loan agreement, lease, license

or other agreement or instrument to which SPAC or any of its subsidiaries is a party or by which SPAC or any of its subsidiaries is bound or to which any of the property or assets of SPAC is subject that would reasonably be expected to have a

material adverse effect on the business, financial condition or results of operations of SPAC and its subsidiaries, taken as a whole (a “Material Adverse Effect”) or materially affect the validity of the Shares or the legal

authority of SPAC to timely comply in all material respects with the terms of this Subscription Agreement; (ii) result in any violation of the provisions of the organizational documents of SPAC after giving effect to the Domestication; or

(iii) result in any violation of any statute or any judgment, order, rule or regulation of any court or governmental agency or body, domestic or foreign, having jurisdiction over SPAC or any of its properties that would reasonably be expected

to have a Material Adverse Effect or materially affect the validity of the Shares or the legal authority of SPAC to comply in all material respects with this Subscription Agreement.

4

Confidential

f. As of their respective dates, all reports (the “SEC

Reports”) required to be filed by SPAC with the SEC complied in all material respects with the applicable requirements of the Securities Act of 1933, as amended (the “Securities Act”) and the Securities Exchange Act of

1934, as amended (the “Exchange Act”), and the rules and regulations of the SEC promulgated thereunder. When filed, none of the SEC Reports contained any untrue statement of a material fact or omitted to state a material fact

required to be stated therein or necessary in order to make the statements therein, in the light of the circumstances under which they were made, not misleading.

g. Assuming the accuracy of the Investor’s representations and warranties set forth in Section 6, no

registration under the Securities Act is required for the offer and sale of the Shares by SPAC to the Investor. The Shares: (i) were not offered by any form of general solicitation or general advertising, including methods described in

Section 502(c) of Regulation D under the Securities Act; and (ii) are not being offered in a manner involving a public offering under, or in a distribution in violation of, the Securities Act, or any state securities laws.

h. As of the date of this Subscription Agreement, the issued and outstanding Class A ordinary shares, par value $0.0001

per share, of SPAC (the “Common Shares”) are registered pursuant to Section 12(b) of the Exchange Act and are listed for trading on the New York Stock Exchange (the “NYSE”) under the symbol “AAC” (it

being understood that the trading symbol will be changed in connection with the Transaction). Except as disclosed in SPAC’s filings with the SEC, as of the date of this Subscription Agreement, there is no suit, action, proceeding or

investigation pending or, to the knowledge of SPAC, threatened against SPAC by NYSE or the SEC, respectively, to prohibit or terminate the listing of SPAC’s Common Shares or, when issued, the shares of Class A Common Stock (after giving

effect to the Domestication) on the NYSE or to deregister the Common Shares under the Exchange Act or, when registered and issued in connection with the Domestication, the shares of Class A Common Stock under the Exchange Act. SPAC has taken no

action that is designed to, or would reasonably be expected to result in, termination of the registration of the Common Shares under the Exchange Act, other than in connection with the Domestication and subsequent registration under the Exchange Act

of the shares of Class A Common Stock.

i. Other than the Placement Agents, SPAC has not engaged any broker, finder,

commission agent, placement agent or arranger in connection with the sale of the Shares, and SPAC is not under any obligation to pay any broker’s fees or commission in connection with the sale of the Shares other than to the Placement Agents.

6. Investor Representations and Warranties. The Investor represents and warrants to SPAC that:

a. The Investor (i) is validly existing and in good standing under the laws of its jurisdiction of formation or

incorporation and (ii) has the requisite power and authority to enter into and perform its obligations under this Subscription Agreement.

b. This Subscription Agreement has been duly authorized, executed and delivered by the Investor, and assuming the due

authorization, execution and delivery of the same by SPAC, this Subscription Agreement shall constitute the valid and legally binding obligation of the Investor, enforceable against the Investor in accordance with its terms, except as such

enforceability may be limited by bankruptcy, insolvency, reorganization, moratorium and similar laws affecting creditors generally and by the availability of equitable remedies.

c. The execution, delivery and performance of this Subscription Agreement, the purchase of the Shares, the compliance by the

Investor with all of the provisions of this Subscription

5

Confidential

Agreement and the consummation of the transactions contemplated in this Subscription Agreement will not conflict with or result in a breach or violation of any of the terms or provisions of, or

constitute a default under, or result in the creation or imposition of any lien, charge or encumbrance upon any of the property or assets of the Investor pursuant to the terms of (i) any indenture, mortgage, deed of trust, loan agreement,

lease, license or other agreement or instrument to which the Investor is a party or by which the Investor is bound or to which any of the property or assets of the Investor is subject; (ii) the organizational documents of the Investor; or

(iii) any statute or any judgment, order, rule or regulation of any court or governmental agency or body, domestic or foreign, having jurisdiction over the Investor or any of its properties that in the case of clauses (i) and (iii), would

reasonably be expected to have a material adverse effect on the Investor’s ability to consummate the transactions contemplated in this Subscription Agreement, including the purchase of the Shares.

d. The Investor, or each of the funds managed by or affiliated with the Investor for which the Investor is acting as nominee,

as applicable, is: (i) a “qualified institutional buyer” (as defined in Rule 144A under the Securities Act), or an institutional “accredited investor” (within the meaning of Rule 501(a) (1), (2), (3) or (7) under

the Securities Act), in each case, satisfying the applicable requirements set forth on Schedule A; (ii) acquiring the Shares only for his, her or its own account and not for the account of others, or if the Investor is subscribing

for the Shares as a fiduciary or agent for one or more investor accounts, the Investor has full investment discretion with respect to each such account, and the full power and authority to make the acknowledgements, representations, warranties and

agreements in this Subscription Agreement on behalf of each owner of each such account; and (iii) not acquiring the Shares with a view to, or for offer or sale in connection with, any distribution thereof in violation of the Securities Act (and

shall provide the requested information set forth on Schedule A). The Investor is not an entity formed for the specific purpose of acquiring the Shares. The Investor understands that the offering meets the exemptions from filing under

FINRA Rule 5123(b)(1)(C) or (J). The Investor has completed Schedule A following the signature page hereto and the information contained therein is accurate and complete.

e. The Investor, or each of the funds managed by or affiliated with the Investor for which the Investor is acting as nominee,

as applicable: (i) is an institutional account as defined in FINRA Rule 4512(c); (ii) is a sophisticated investor, experienced in investing in private equity transactions and capable of evaluating investment risks independently, both in

general and with regard to all transactions and investment strategies involving a security or securities; and (iii) has exercised independent judgment in evaluating our participation in the purchase of the Shares. Accordingly, we understand

that the offering meets (i) the exemptions from filing under FINRA Rule 5123(b)(1)(A) and (ii) the institutional customer exemption under FINRA Rule 2111(b).

f. The Investor acknowledges and agrees that the Shares are being offered in a transaction not involving any public offering

within the meaning of the Securities Act and that the Securities have not been registered under the Securities Act and that SPAC is not required to register the Securities except as set forth in Section 8 of this Subscription Agreement.

The Investor acknowledges and agrees that the Securities may not be offered, resold, transferred, pledged or otherwise disposed of by the Investor absent an effective registration statement under the Securities Act except: (i) to SPAC or a

subsidiary thereof; (ii) to non-U.S. persons pursuant to offers and sales that occur outside the United States within the meaning of Regulation S under the Securities Act; or (iii) pursuant to another applicable exemption from the

registration requirements of the Securities Act. With respect to any transactions falling within clauses (i) and (iii) of the preceding sentence, any such transaction must also be in accordance with any applicable securities laws of the

states and other jurisdictions of the United States, and any book entry records or certificates representing the Securities shall contain a restrictive legend to such effect. The Investor acknowledges and agrees that: (i) the Securities will be

subject to transfer restrictions; (ii) as a result of these transfer restrictions, the Investor may not be able to readily offer, resell, transfer, pledge or otherwise dispose of the Securities; and (iii) as a consequence, Investor may be

required to bear the financial risk of

6

Confidential

an investment in the Securities for an indefinite period of time. The Investor acknowledges and agrees that the Shares delivered at Closing will not be eligible for offer, resale, transfer,

pledge or disposition pursuant to Rule 144 promulgated under the Securities Act until at least one year from the date that SPAC files a Current Report on Form 8-K following the Closing Date that includes the “Form 10” information required

under applicable SEC rules and regulations. The Investor shall not engage in hedging transactions with regard to the Securities unless in compliance with the Securities Act. The Investor acknowledges and agrees that it has been advised to consult

legal counsel and tax and accounting advisors prior to making any offer, resale, transfer, pledge or disposition of any of the Securities.

g. The Investor acknowledges and agrees that the Investor is purchasing the Securities directly from SPAC. The Investor further

acknowledges that there have been no representations, warranties, covenants and agreements made to the Investor by or on behalf of SPAC, X-energy, any of their respective affiliates or any control persons, officers, directors, employees, partners,

agents or representatives of any of the foregoing or any other person or entity, expressly or by implication. Investor explicitly disclaims reliance on any of the foregoing other than those representations, warranties, covenants and agreements of

SPAC expressly set forth in Section 5 of this Subscription Agreement.

h. The Investor’s acquisition and

holding of the Securities will not constitute or result in a non-exempt prohibited transaction under Section 406 of the Employee Retirement Income Security Act of 1974, as amended, Section 4975 of the Internal Revenue Code of 1986, as

amended, or any applicable similar law.

i. The Investor acknowledges and agrees that the Investor has received, reviewed

and understood such financials and other information as the Investor deems necessary in order to make an investment decision with respect to the Securities, including, with respect to SPAC, the Transaction and the business of X-energy and its

subsidiaries. Without limiting the generality of the foregoing, the Investor acknowledges that he, she or it has reviewed SPAC’s SEC Reports. The Investor acknowledges and agrees that the Investor and the Investor’s professional

advisor(s), if any, have had the full opportunity to ask such questions, receive such answers and obtain such information as the Investor and such Investor’s professional advisor(s), if any, have deemed necessary to make an investment decision

with respect to the Securities. The Investor has received, reviewed and understood the materials made available to it in connection with the Transaction, including the terms of the Preferred Stock attached to this Subscription Agreement as Annex

A, has made its own assessment and has satisfied itself concerning the relevant tax and other economic considerations relevant to its investment in the Securities. The Investor acknowledges that as part of the Transaction, SPAC has filed a

registration statement under the Securities Act, including a preliminary prospectus and proxy statement, which contains additional information about the Transaction, X-energy and SPAC. The Investor further acknowledges that the information provided

to it is preliminary and subject to change, and that any changes to such information, including, without limitation, any changes based on updated information or changes in terms of the Transaction, shall in no way affect the Investor’s

obligation to purchase the Securities hereunder. The Investor acknowledges that the Investor has not relied on such registration statement and preliminary prospectus in making any investment decision. The Investor acknowledges that SPAC and X-energy

offered to make certain non-public information available to the Investor subject to customary trading restrictions and non-disclosure requirements.

j. The Investor acknowledges that certain information provided to it was based on forecasts, and such forecasts were prepared

based on assumptions and estimates that are inherently uncertain and are subject to a wide variety of significant business, economic and competitive risks and uncertainties that could cause actual results to differ materially from those contained in

the forecasts. The Investor acknowledges that such information and forecasts were prepared without the participation of the Placement Agents and that the Placement Agents do not assume responsibility for independent verification of, or the accuracy

or completeness of, such information or forecasts.

7

Confidential

k. The Investor became aware of this offering of the Securities solely by

means of direct contact between the Investor and SPAC, X-energy or a representative of SPAC or X-energy. Investor acknowledges that the Securities were offered to the Investor solely by direct contact between the Investor and SPAC, X-energy or a

representative of SPAC or X-energy. The Investor did not become aware of this offering of the Securities, nor were the Securities offered to the Investor, by any other means. The Investor acknowledges that the Securities: (i) were not offered

by any form of general solicitation or general advertising; and (ii) are not being offered in a manner involving a public offering under, or in a distribution in violation of, the Securities Act, or any state securities laws. The Investor

acknowledges that it is not relying upon, and has not relied and disclaims reliance upon, any statement, representation or warranty made by any person, firm or corporation (including, without limitation, SPAC, X-energy, the Placement Agents (as

defined in this Subscription Agreement), any of their respective affiliates or any control persons, officers, directors, employees, partners, agents or representatives of any of the foregoing), other than the representations and warranties of SPAC

contained in Section 5 of this Subscription Agreement, in making its investment or decision to invest in SPAC. Neither the Investor, nor any of its directors, officers, employees, agents, stockholders or partners has either directly or

indirectly, including through a broker or finder, (i) to its knowledge, engaged in any general solicitation, or (ii) published any advertisement in connection with the offering of the Securities.

l. The Investor acknowledges that it is aware that there are substantial risks incident to the purchase and ownership of the

Shares, including those set forth in SPAC’s SEC Reports. The Investor is able to fend for itself in the transactions contemplated in this Subscription Agreement and has such knowledge and experience in financial and business matters as to be

capable of evaluating the merits and risks of an investment in the Securities; and has the ability to bear the economic risks of its prospective investment and can afford the complete loss of such investment. The Investor has sought such accounting,

legal and tax advice as the Investor has considered necessary to make an informed investment decision. Investor acknowledges and agrees that it has made its own assessment and has satisfied itself concerning relevant tax and other economic

considerations relative to its purchase of the Shares. The Investor will not look to Moelis & Company LLC, Citigroup Global Markets Inc., UBS Securities LLC or any of their respective affiliates, in their capacity as placement agents

(collectively, the “Placement Agents”), for all or part of any such loss or losses the Investor may suffer. Investor represents that: (i) it is able to sustain a complete loss on its investment in the Securities; (ii) has

no need for liquidity with respect to its investment in the Securities; and (iii) has no reason to anticipate any change in circumstances, financial or otherwise, which may cause or require any sale or distribution of all or any part of the

Securities.

m. Alone, or together with any professional advisor(s), the Investor acknowledges that it has adequately

analyzed and fully considered the risks of an investment in the Securities and determined that the Securities are a suitable investment for the Investor. Investor represents that it is able at this time and in the foreseeable future to bear the

economic risk of a total loss of the Investor’s investment in SPAC. The Investor acknowledges specifically that a possibility of total loss exists.

n. In making its decision to purchase the Shares, the Investor has relied solely upon independent investigation made by the

Investor. Without limiting the generality of the foregoing, the Investor has not relied (and disclaims reliance) on any statements or other information provided by or on behalf of any Placement Agent or any of their respective affiliates or any

control persons, officers, directors, employees, partners, agents or representatives of any of the foregoing concerning SPAC, X-energy, the Transaction, the Business Combination Agreement, this Subscription Agreement or the transactions contemplated

under this Subscription Agreement or the Business Combination Agreement, the Securities or the offer and sale of the Securities.

o. The Investor acknowledges and agrees that the Placement Agents and their respective directors, officers, employees,

representatives and controlling persons: (i) have not provided the

8

Confidential

Investor with any information or advice with respect to the Securities; (ii) have not made or make any representation, express or implied as to SPAC, X-energy, X-energy’s credit

quality, the Securities or the Investor’s purchase of the Shares; (iii) have not acted as the Investor’s financial advisor or fiduciary in connection with the issue and purchase of Shares; (iv) may have acquired, or during the

term of the Securities may acquire, non-public information with respect to X-energy, which, subject to the requirements of applicable law, the Investor agrees need not be provided to it; (v) may have existing or future business relationships

with SPAC and X-energy (including, but not limited to, lending, depository, risk management, advisory and banking relationships); (vi) will pursue actions and take steps that it deems or they deem necessary or appropriate to protect its or

their interests arising therefrom without regard to the consequences for a holder of Securities, and that certain of these actions may have material and adverse consequences for a holder of Securities.

p. The Investor acknowledges and agrees that it has not relied on the Placement Agents in connection with its determination as

to the legality of its acquisition of the Shares or as to the other matters referred to in this Subscription Agreement and the Investor has not relied on any investigation that the Placement Agents, any of their affiliates or any person acting on

their behalf have conducted with respect to the Securities, SPAC or X-energy. The Investor further acknowledges that it has not relied on any information contained in any research reports prepared by the Placement Agents or any of their respective

affiliates.

q. The Investor acknowledges and agrees that no federal or state agency has passed upon or endorsed the merits

of the offering of the Securities or made any findings or determination as to the fairness of this investment.

r. The

Investor, if not an individual, has been duly formed or incorporated and is validly existing and is in good standing under the laws of its jurisdiction of formation or incorporation, with power and authority to enter into, deliver and perform its

obligations under this Subscription Agreement.

s. The execution, delivery and performance by the Investor of this

Subscription Agreement is within the Investor’s powers, has been duly authorized and will not constitute or result in a breach or default under or conflict with any order, ruling or regulation of any court or other tribunal or of any

governmental commission or agency, or any agreement or other undertaking, to which the Investor is a party or by which the Investor is bound, and, if the Investor is not an individual, will not violate any provisions of the Investor’s

organizational documents, including, without limitation, its incorporation or formation papers, bylaws, indenture of trust or partnership or operating agreement, as may be applicable. The signature on this Subscription Agreement is genuine. If the

Investor is an individual, the signatory has legal competence and Investor has the capacity to execute this Subscription Agreement. If the Investor is not an individual, the signatory has been duly authorized to execute this Subscription Agreement,

and, assuming that this Subscription Agreement constitutes the valid and binding obligation of SPAC, this Subscription Agreement constitutes a legal, valid and binding obligation of the Investor, enforceable against the Investor in accordance with

its terms except as may be limited or otherwise affected by (i) bankruptcy, insolvency, fraudulent conveyance, reorganization, moratorium or other laws relating to or affecting the rights of creditors generally, and (ii) principles of

equity, whether considered at law or equity.

t. The Investor is not: (i) a person or entity named on the List of

Specially Designated Nationals and Blocked Persons administered by the U.S. Treasury Department’s Office of Foreign Assets Control (“OFAC”) or in any Executive Order issued by the President of the United States and

administered by OFAC (“OFAC List”), or a person or entity prohibited by any OFAC sanctions program; (ii) owned, directly or indirectly, or controlled by, or acting on behalf of, one or more persons that are named on the OFAC

List; (iii) organized, incorporated, established, located, resident or born in, or a citizen, national or the government, including any political subdivision, agency or instrumentality thereof, of, Cuba, Iran, North

9

Confidential

Korea, Syria, the Crimea region of Ukraine, the so-called Donetsk People’s Republic, the so-called Luhansk People Republic or any other country or territory embargoed or subject to

substantial trade restrictions by the United States; (iv) a Designated National as defined in the Cuban Assets Control Regulations, 31 C.F.R. Part 515; or (v) a non-U.S. shell bank or providing banking services indirectly to a

non-U.S. shell bank (each of the foregoing, a “Prohibited Investor”). If requested, the Investor agrees to provide law enforcement agencies such records as required by applicable law, provided that the Investor is permitted to

do so under applicable law. If the Investor is a financial institution subject to the Bank Secrecy Act (31 U.S.C. Section 5311 et seq.) (the “BSA”), as amended by the USA PATRIOT Act of 2001 (the “PATRIOT

Act”), and its implementing regulations (collectively, the “BSA/PATRIOT Act”), the Investor maintains policies and procedures reasonably designed to comply with applicable obligations under the BSA/PATRIOT Act. To the

extent required, it maintains policies and procedures reasonably designed to ensure compliance with OFAC-administered sanctions programs, including for the screening of its investors against the OFAC sanctions programs, including the OFAC List. To

the extent required by applicable law, the Investor maintains policies and procedures reasonably designed to ensure that the funds held by the Investor and used to purchase the Shares were legally derived and were not obtained, directly or

indirectly, from a Prohibited Investor.

u. No disclosure or offering document has been prepared by the Placement Agents

in connection with the offer and sale of the Securities.

v. No Placement Agent, nor any of its respective affiliates nor

any control persons, officers, directors, employees, partners, agents or representatives of any of the foregoing have made any independent investigation with respect to SPAC, X-energy or its subsidiaries or any of their respective businesses, or the

Securities or the accuracy, completeness or adequacy of any information supplied to the Investor by SPAC.

w. In connection

with the issue and purchase of the Shares, no Placement Agent has acted as the Investor’s financial advisor or fiduciary.

x. The Investor has or has commitments to have and, when required to deliver payment to SPAC pursuant to Section 2

above, will have, sufficient immediately available funds to pay the Subscription Amount and consummate the purchase and sale of the Shares pursuant to this Subscription Agreement.

y. As of the date of this Subscription Agreement, the Investor does not have, and during the 30 day period immediately prior to

the date of this Subscription Agreement, the Investor has not entered into, any “put equivalent position” as such term is defined in Rule 16a-1 under the Exchange Act or short sale positions with respect to the securities of SPAC.

z. The Investor is not currently (and at all times through Closing will refrain from being or becoming) a member of a

“group” (within the meaning of Section 13(d)(3) or Section 14(d)(2) of the Exchange Act or any successor provision) acting for the purpose of acquiring, holding, voting or disposing of equity securities of SPAC (within the

meaning of Rule 13d-5(b)(1) under the Exchange Act), other than a group consisting solely of the Investor and its affiliates.

aa. If the Investor is or is acting on behalf of (i) an employee benefit plan that is subject to Title I of the Employee

Retirement Income Security Act of 1974, as amended (“ERISA”), (ii) a plan, an individual retirement account or other arrangement that is subject to Section 4975 of the Internal Revenue Code of 1986, as amended (the

“Code”), (iii) an entity whose underlying assets are considered to include “plan assets” of any such plan, account or arrangement described in clauses (i) and (ii) (each, an “ERISA Plan”),

or (iv) an employee benefit plan that is a governmental plan (as defined in Section 3(32) of ERISA),

10

Confidential

a church plan (as defined in Section 3(33) of ERISA), a non-U.S. plan (as described in Section 4(b)(4) of ERISA) or other plan that is not subject to the foregoing clauses (i),

(ii) or (iii) but may be subject to provisions under any other federal, state, local, non-U.S. or other laws or regulations that are similar to such provisions of ERISA or the Code (collectively, “Similar Laws,” and

together with ERISA Plans, “Plans”), the Investor represents and warrants that (A) neither SPAC nor any of its affiliates has provided investment advice or has otherwise acted as the Plan’s fiduciary, with respect to its

decision to acquire and hold the Shares, and none of the parties to the Transaction is or shall at any time be the Plan’s fiduciary with respect to any decision in connection with the Investor’s investment in the Shares; and (B) its

purchase of the Shares will not result in a non-exempt prohibited transaction under Section 406 of ERISA or Section 4975 of the Code, or any applicable Similar Law.

7. Most Favored Nation. Except as relates to (a) Commercial Arrangements and (b) the letter agreement, dated

as of September 12, 2023, among SPAC, X-energy and Ghaffarian Enterprises, LLC (as in effect as of the date of this Subscription Agreement and without giving effect to any subsequent waivers or other modifications), if, prior to the Closing

Date or otherwise in connection with the consummation of the transactions contemplated by the Business Combination Agreement, SPAC issues or agrees to issue equity securities, or securities convertible into equity securities, of SPAC, and such newly

issued securities would have material terms that are more favorable (the “Favored Terms”) than the terms and/or conditions contained in this Subscription Agreement, then SPAC will provide the Investor with written notice thereof,

together with a copy of all documentation relating to the Favored Terms and, upon request of the Investor, any additional information related to the Favored Terms. SPAC will provide such notice to the Investor promptly (and in any event within two

business days) following (i) the entry into any definitive documentation related to the Favored Terms or (ii) if such issuances will be made pursuant to definitive documentation in existence on or prior to the date of this Subscription

Agreement, such time as SPAC becomes aware that such issuance on Favored Terms is reasonably likely to occur. In the event that the Investor determines that the Favored Terms as a whole are preferable to the terms and/or conditions contained in this

Subscription Agreement, the Investor will notify SPAC in writing within one business day following the Investor’s receipt of such notice from SPAC. Promptly after receipt of such written notice from the Investor, but in any event within one

business day, SPAC will amend and restate this Subscription Agreement to contain the Favored Terms in such manner as provides the Investor with substantially identical rights and privileges to those contained in the Favored Terms. Notwithstanding

the foregoing, the Investor shall not be entitled to receive the Favored Terms to the extent such terms are included in documentation related to a transaction (including, for the avoidance of doubt, a transaction involving the issuance of equity or

debt securities) entered into by SPAC or its subsidiaries with customers, strategic partners and/or other commercial counterparties relating to the design, manufacture, production and delivery of the small modular nuclear reactors and related

technology (the “Commercial Arrangements”).

8. Registration Rights.

a. Within 45 calendar days after the Closing Date (such deadline, the “Filing Deadline”), SPAC agrees that it

will file with the SEC (at its sole cost and expense) a registration statement registering the resale of the Underlying Common Shares (the “Registration Statement”). SPAC shall use its commercially reasonable efforts to have the

Registration Statement declared effective as soon as practicable after the filing thereof; but no later than the earlier of (i) 90 calendar days after the filing thereof (or 120 calendar days after the filing thereof if the SEC notifies SPAC

that it will “review” the Registration Statement) and (ii) ten business days after SPAC is notified (orally or in writing, whichever is earlier) by the SEC that the Registration Statement will not be “reviewed” or will not

be subject to further review. In connection with the foregoing, Investor shall not be required to execute any lock-up or similar agreement or otherwise be subject to any contractual restriction on the ability to transfer the Underlying Common

Shares. SPAC agrees to cause such Registration Statement, or another shelf registration statement that includes the Underlying Common Shares to be sold pursuant to this Subscription Agreement, to remain

11

Confidential

effective until the earliest of: (i) the second anniversary of the Closing; (ii) the date on which the Investor ceases to hold any Underlying Common Shares issued pursuant to this

Subscription Agreement; or (iii) on the first date on which the Investor is able to sell all of its Underlying Common Shares issued pursuant to this Subscription Agreement (or shares received in exchange therefor) under Rule 144 promulgated

under the Securities Act (“Rule 144”) within 90 days without the public information, volume or manner of sale limitations of such rule (such date, the “End Date”). Prior to the End Date, SPAC will use commercially

reasonable efforts to qualify the Underlying Common Shares for listing on the applicable stock exchange. Upon request, the Investor agrees to disclose its ownership to SPAC to assist it in making the determination with respect to Rule 144 described

in clause (iii) above. SPAC may amend the Registration Statement so as to convert the Registration Statement to a Registration Statement on Form S-3 at such time after SPAC becomes eligible to use such Form S-3. The Investor acknowledges and