Archrock Partners, L.P. (NASDAQ:APLP) today reported net loss

of $4.0 million, or $0.06 per diluted common unit, for

the third quarter of 2017, compared to net income of $5.3

million, or $0.08 per diluted common unit, for the second

quarter of 2017 and a net loss of $0.6 million, or $0.01 per

diluted common unit, for the third quarter of 2016.

EBITDA, as adjusted (as defined below), was $59.9

million for the third quarter of 2017, compared to $66.9

million for the second quarter of 2017 and $67.9

million for the third quarter of 2016.

Revenue was $140.2 million for the third quarter of

2017, compared to $138.3 million for the second quarter

of 2017 and $135.5 million for the third quarter of 2016.

Gross margin was $77.6 million, or 55% of revenue, in the third

quarter of 2017, compared to $84.3 million, or 61% of revenue, in

the second quarter of 2017 and $84.6 million, or 62% of revenue, in

the third quarter of 2016.

Selling, general and administrative expenses (“SG&A”)

were $20.7 million for the third quarter of 2017,

compared to $18.3 million for the second quarter of 2017

and $17.9 million in the third quarter of 2016.

Cash flows from operating activities were $38.4 million for the

third quarter of 2017, compared to $38.0 million for the second

quarter of 2017 and $64.8 million for the third quarter of

2016.

Distributable cash flow (as defined below) was $29.8

million for the third quarter of 2017, compared to $39.1

million for the second quarter of 2017 and $43.7

million for the third quarter of 2016. Distributable cash flow

coverage was 1.46x for the third quarter of 2017, compared to 2.04x

for the second quarter of 2017 and 2.50x for the third quarter of

2016.

“Archrock Partners' operating horsepower growth accelerated in

the third quarter,” said Brad Childers, Chairman, President and

Chief Executive Officer of Archrock Partners’ managing general

partner. “During the quarter, we grew operating horsepower by

50,000 horsepower and drove new orders at the highest quarterly

rate on record. Demand for our services has remained elevated,

setting the foundation for a strong 2018. Additionally, we

strengthened our capital position with the completion of a $60

million equity offering during the third quarter.”

“As we have stated, we expect gross margin percentage volatility

during this phase of the growth cycle,” continued Childers.

“Although gross margin percentage declined in the third quarter, we

expect sequential gross margin percentage improvement in the fourth

quarter. Increased lube oil expense, higher expenses due to

elevated start activities, and higher medical claims contributed to

higher costs in the third quarter.”

“With the industry's largest fleet of high demand large

horsepower units, Archrock Partners is positioned to capture

improving earnings from the long-term secular growth of U.S.

natural gas production as well as the current cyclical recovery in

our business. We continue to expect solid year-over-year growth in

year-end 2017 operating horsepower,” concluded Childers.

Net income, excluding the item listed in the following sentence,

for the third quarter of 2017 was $1.4 million, or $0.02 per

diluted common unit. The excluded item consisted of a non-cash

long-lived asset impairment of $5.4 million. Net income, excluding

the item listed in the following sentence, for the second quarter

of 2017 was $8.4 million, or $0.12 per diluted common unit. The

excluded item consisted of a non-cash long-lived asset impairment

of $3.1 million. Net income, excluding the items listed in the

following sentence, for the third quarter of 2016 was $9.3 million,

or $0.15 per diluted common unit. The excluded items consisted of a

non-cash long-lived asset impairment of $7.9 million as well as

restructuring charges of $1.9 million.

Conference Call

Details

Archrock, Inc. and Archrock Partners, L.P. will host a joint

conference call on Thursday, November 2, 2017, to discuss their

third quarter 2017 financial results. The call will begin at 11:00

a.m. Eastern Time.

To listen to the call via a live webcast, please visit

Archrock’s website at www.archrock.com. The call will also be

available by dialing 1-888-771-4371 in the United States and Canada

or +1-847-585-4405 for international calls. Please call

approximately 15 minutes prior to the scheduled start time and

reference Archrock conference call number 4578 3017.

A replay of the conference call will be available on Archrock’s

website for approximately seven days. Also, a replay may be

accessed for approximately seven days by dialing 1-888-843-7419 in

the United States and Canada, or +1-630-652-3042 for international

calls. The access code is 4578 3017#.

EBITDA, as adjusted, a non-GAAP measure, is defined as net

income (loss) excluding income taxes, interest expense,

depreciation and amortization expense, long-lived asset impairment,

restructuring charges, expensed acquisition costs, debt

extinguishment costs, non-cash SG&A costs and other items. A

reconciliation of EBITDA, as adjusted, to net income (loss), the

most directly comparable GAAP measure, appears below.

Distributable cash flow, a non-GAAP measure, is defined as net

income (loss) (a) plus depreciation and amortization expense,

long-lived asset impairment, restructuring charges, expensed

acquisition costs, non-cash SG&A costs, debt extinguishment

costs, and interest expense (b) less cash interest expense

(excluding amortization of deferred financing fees, amortization of

debt discount and non-cash transactions related to interest rate

swaps) and maintenance capital expenditures, and (c) excluding

gains or losses on asset sales and other items. Distributable cash

flow coverage is defined as distributable cash flow divided by

total distributions declared. A reconciliation of distributable

cash flow to cash flows from operating activities, the most

directly comparable GAAP measure, appears below.

Gross margin, a non-GAAP measure, is defined as total revenue

less cost of sales (excluding depreciation and amortization

expense). Gross margin percentage is defined as gross margin

divided by total revenue. A reconciliation of gross margin to net

income (loss), the most directly comparable GAAP measure, appears

below.

Net income (loss), excluding items, a non-GAAP measure, is

defined as net income (loss) plus long-lived asset impairment,

restructuring charges, expensed acquisition costs and debt

extinguishment costs. A reconciliation of net income (loss),

excluding items, to net income (loss), the most directly comparable

GAAP measure, appears below.

About Archrock Partners

Archrock Partners, L.P., a master limited partnership, is the

leading provider of natural gas contract compression services to

customers throughout the United States. Archrock, Inc. (NYSE:AROC)

owns an equity interest in Archrock Partners, including all of the

general partner interest. For more information, visit

www.archrock.com.

Forward-Looking Statements

All statements in this release (and oral statements made

regarding the subjects of this release) other than historical facts

are forward-looking statements within the meaning of Section 21E of

the Securities Exchange Act of 1934, as amended. These

forward-looking statements rely on a number of assumptions

concerning future events and are subject to a number of

uncertainties and factors, many of which are outside Archrock

Partners’ control, which could cause actual results to differ

materially from such statements. Forward-looking information

includes, but is not limited to: Archrock Partners’ financial and

operational strategies and ability to successfully effect those

strategies; Archrock Partners’ expectations regarding future

commodity prices, demand for natural gas and economic and market

conditions; Archrock Partners’ financial and operational outlook

and ability to fulfill that outlook, including as related to

increasing operating horsepower and gross margin percentage;

statements about Archrock Partners’ distributions; demand for

Archrock Partners’ services; and expectations regarding Archrock

Partners’ access to capital.

While Archrock Partners believes that the assumptions concerning

future events are reasonable, it cautions that there are inherent

difficulties in predicting certain important factors that could

impact the future performance or results of its business. Among the

factors that could cause results to differ materially from those

indicated by such forward-looking statements are: local, regional

and national economic conditions and the impact they may have on

Archrock Partners and its customers; changes in tax laws that

impact master limited partnerships; conditions in the oil and gas

industry, including a sustained decrease in the level of supply or

demand for oil or natural gas or a sustained decrease in the price

of oil or natural gas; changes in safety, health, environmental and

other regulations; the financial condition of Archrock Partners’

customers; the failure of any customer to perform its contractual

obligations; and the performance of Archrock, Inc.

These forward-looking statements are also affected by the risk

factors, forward-looking statements and challenges and

uncertainties described in Archrock Partners’ Annual Report on Form

10-K for the year ended December 31, 2016, and those set forth from

time to time in Archrock Partners’ filings with the Securities and

Exchange Commission, which are available at www.archrock.com.

Except as required by law, Archrock Partners expressly disclaims

any intention or obligation to revise or update any forward-looking

statements whether as a result of new information, future events or

otherwise.

| ARCHROCK PARTNERS, L.P. |

| UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS |

| (In thousands, except per unit

amounts) |

|

|

| |

Three Months Ended |

| |

September 30, |

|

June 30, |

|

September 30, |

| |

2017 |

|

2017 |

|

2016 |

| Revenue |

$ |

140,191 |

|

|

$ |

138,255 |

|

|

$ |

135,478 |

|

| |

|

|

|

|

|

| Costs and

expenses: |

|

|

|

|

|

| Cost of

sales (excluding depreciation and amortization expense) —

affiliates |

62,584 |

|

|

53,995 |

|

|

50,854 |

|

|

Depreciation and amortization |

35,787 |

|

|

36,275 |

|

|

38,087 |

|

|

Long-lived asset impairment |

5,368 |

|

|

3,081 |

|

|

7,909 |

|

|

Restructuring charges |

— |

|

|

— |

|

|

1,946 |

|

| Selling,

general and administrative — affiliates |

20,711 |

|

|

18,303 |

|

|

17,917 |

|

| Interest

expense |

21,839 |

|

|

21,299 |

|

|

20,034 |

|

| Other

income, net |

(2,793 |

) |

|

(933 |

) |

|

(890 |

) |

| Total

costs and expenses |

143,496 |

|

|

132,020 |

|

|

135,857 |

|

| Income (loss) before

income taxes |

(3,305 |

) |

|

6,235 |

|

|

(379 |

) |

| Provision for income

taxes |

708 |

|

|

960 |

|

|

188 |

|

| Net

income (loss) |

$ |

(4,013 |

) |

|

$ |

5,275 |

|

|

$ |

(567 |

) |

| |

|

|

|

|

|

| General partner

interest in net income (loss) |

$ |

(82 |

) |

|

$ |

105 |

|

|

$ |

(11 |

) |

| |

|

|

|

|

|

| Common unitholder

interest in net income (loss) |

$ |

(3,931 |

) |

|

$ |

5,170 |

|

|

$ |

(556 |

) |

| |

|

|

|

|

|

| Weighted average common

units outstanding used in income (loss) per common unit (1): |

|

|

|

|

|

| Basic and

diluted |

68,101 |

|

|

65,399 |

|

|

59,837 |

|

| |

|

|

|

|

|

| Income (loss) per

common unit (1): |

|

|

|

|

|

|

Basic and diluted |

$ |

(0.06 |

) |

|

$ |

0.08 |

|

|

$ |

(0.01 |

) |

(1) Basic and diluted income (loss) per

common unit is computed using the two-class method. Under the

two-class method, basic and diluted income (loss) per common unit

is determined by dividing income (loss) allocated to the common

units after deducting the amounts allocated to our general partner

(including distributions to our general partner on its incentive

distribution rights) and participating securities (unvested phantom

units with nonforfeitable tandem distribution equivalent rights to

receive cash distributions), by the weighted average number of

outstanding common units excluding the weighted average number of

outstanding participating securities during the period.

| ARCHROCK PARTNERS, L.P. |

| UNAUDITED SUPPLEMENTAL

INFORMATION |

| (In thousands, except per unit amounts,

percentages and ratios) |

|

|

| |

Three Months Ended |

| |

September 30, |

|

June 30, |

|

September 30, |

| |

2017 |

|

2017 |

|

2016 |

| Revenue |

$ |

140,191 |

|

|

$ |

138,255 |

|

|

$ |

135,478 |

|

| |

|

|

|

|

|

| Gross margin (1) |

$ |

77,607 |

|

|

$ |

84,260 |

|

|

$ |

84,624 |

|

| Gross margin

percentage |

55 |

% |

|

61 |

% |

|

62 |

% |

| |

|

|

|

|

|

| EBITDA, as adjusted

(1) |

$ |

59,885 |

|

|

$ |

66,927 |

|

|

$ |

67,920 |

|

| % of

revenue |

43 |

% |

|

48 |

% |

|

50 |

% |

| |

|

|

|

|

|

| Capital

expenditures |

$ |

44,327 |

|

|

$ |

57,522 |

|

|

$ |

17,626 |

|

| Less: Proceeds from

sale of property, plant and equipment |

(12,254 |

) |

|

(875 |

) |

|

(4,514 |

) |

| Net capital

expenditures |

$ |

32,073 |

|

|

$ |

56,647 |

|

|

$ |

13,112 |

|

| |

|

|

|

|

|

| Cash flows from

operating activities |

$ |

38,414 |

|

|

$ |

38,043 |

|

|

$ |

64,813 |

|

| Distributable cash flow

(2) |

$ |

29,809 |

|

|

$ |

39,081 |

|

|

$ |

43,703 |

|

| |

|

|

|

|

|

| Distributions declared

for the period per common unit |

$ |

0.2850 |

|

|

$ |

0.2850 |

|

|

$ |

0.2850 |

|

| Distributions declared

to all unitholders for the period |

$ |

20,459 |

|

|

$ |

19,121 |

|

|

$ |

17,513 |

|

| Distributable cash flow

coverage (3) |

|

1.46 |

x |

|

|

2.04 |

x |

|

|

2.50 |

x |

| |

|

|

|

|

|

| |

September 30, |

|

June 30, |

|

September 30, |

| |

2017 |

|

2017 |

|

2016 |

| Debt (4) |

$ |

1,317,447 |

|

|

$ |

1,377,152 |

|

|

$ |

1,370,382 |

|

| Total partners’

capital |

528,789 |

|

|

486,703 |

|

|

478,200 |

|

(1) Management believes EBITDA, as

adjusted, and gross margin provide useful information to investors

because these non-GAAP measures, when viewed with our GAAP results

and accompanying reconciliations, provide a more complete

understanding of our performance than GAAP results

alone. Management uses these non-GAAP measures as supplemental

measures to review current period operating performance,

comparability measures and performance measures for period to

period comparisons.(2) Management uses distributable cash

flow, a non-GAAP measure, as a supplemental performance and

liquidity measure. Using this metric, management can quickly

compute the coverage ratio of estimated cash flows to planned cash

distributions.(3) Defined as distributable cash flow for the

period divided by distributions declared to all unitholders for the

period.(4) Carrying values are shown net of unamortized debt

discounts and unamortized deferred financing costs.

| ARCHROCK PARTNERS, L.P. |

| UNAUDITED SUPPLEMENTAL

INFORMATION |

| (In thousands, except per unit

amounts) |

|

|

| |

Three Months Ended |

| |

September 30, |

|

June 30, |

|

September 30, |

| |

2017 |

|

2017 |

|

2016 |

| Reconciliation of GAAP

to Non-GAAP Financial Information: |

|

|

|

|

|

| |

|

|

|

|

|

| Net

income (loss) |

$ |

(4,013 |

) |

|

$ |

5,275 |

|

|

$ |

(567 |

) |

|

Depreciation and amortization |

35,787 |

|

|

36,275 |

|

|

38,087 |

|

|

Long-lived asset impairment |

5,368 |

|

|

3,081 |

|

|

7,909 |

|

|

Restructuring charges |

— |

|

|

— |

|

|

1,946 |

|

| Selling,

general and administrative — affiliates |

20,711 |

|

|

18,303 |

|

|

17,917 |

|

| Interest

expense |

21,839 |

|

|

21,299 |

|

|

20,034 |

|

| Other

income, net |

(2,793 |

) |

|

(933 |

) |

|

(890 |

) |

| Provision

for income taxes |

708 |

|

|

960 |

|

|

188 |

|

| Gross

margin (1) |

77,607 |

|

|

84,260 |

|

|

84,624 |

|

| Non-cash

selling, general and administrative — affiliates |

196 |

|

|

37 |

|

|

323 |

|

| Less:

Selling, general and administrative — affiliates |

(20,711 |

) |

|

(18,303 |

) |

|

(17,917 |

) |

| Less:

Other income, net |

2,793 |

|

|

933 |

|

|

890 |

|

| EBITDA,

as adjusted (1) |

59,885 |

|

|

66,927 |

|

|

67,920 |

|

| Less:

Provision for income taxes |

(708 |

) |

|

(960 |

) |

|

(188 |

) |

| Less:

Gain on sale of property, plant and equipment (in Other income,

net) |

(2,759 |

) |

|

(907 |

) |

|

(795 |

) |

| Less:

Cash interest expense |

(19,262 |

) |

|

(19,659 |

) |

|

(18,449 |

) |

| Less:

Maintenance capital expenditures |

(7,347 |

) |

|

(6,320 |

) |

|

(4,785 |

) |

|

Distributable cash flow (2) |

$ |

29,809 |

|

|

$ |

39,081 |

|

|

$ |

43,703 |

|

|

|

|

|

|

|

|

| Cash

flows from operating activities |

$ |

38,414 |

|

|

$ |

38,043 |

|

|

$ |

64,813 |

|

| Provision

for doubtful accounts |

(1,346 |

) |

|

(663 |

) |

|

(705 |

) |

|

Restructuring charges |

— |

|

|

— |

|

|

1,946 |

|

| Deferred

income tax provision |

(686 |

) |

|

(930 |

) |

|

(188 |

) |

| Payments

for settlement of interest rate swaps that include financing

elements |

(364 |

) |

|

(460 |

) |

|

(754 |

) |

|

Maintenance capital expenditures |

(7,347 |

) |

|

(6,320 |

) |

|

(4,785 |

) |

| Change in

assets and liabilities |

1,138 |

|

|

9,411 |

|

|

(16,624 |

) |

|

Distributable cash flow (2) |

$ |

29,809 |

|

|

$ |

39,081 |

|

|

$ |

43,703 |

|

|

|

|

|

|

|

|

| Net

income (loss) |

$ |

(4,013 |

) |

|

$ |

5,275 |

|

|

$ |

(567 |

) |

|

Items: |

|

|

|

|

|

|

Long-lived asset impairment |

5,368 |

|

|

3,081 |

|

|

7,909 |

|

|

Restructuring charges |

— |

|

|

— |

|

|

1,946 |

|

| Net

income, excluding items |

$ |

1,355 |

|

|

$ |

8,356 |

|

|

$ |

9,288 |

|

|

|

|

|

|

|

|

| Diluted

income (loss) per common unit |

$ |

(0.06 |

) |

|

$ |

0.08 |

|

|

$ |

(0.01 |

) |

|

Adjustment for items per common unit |

0.08 |

|

|

0.04 |

|

|

0.16 |

|

| Diluted

income per common unit, excluding items (1) |

$ |

0.02 |

|

|

$ |

0.12 |

|

|

$ |

0.15 |

|

(1) Management believes EBITDA, as

adjusted, diluted income per common unit, excluding items, and

gross margin provide useful information to investors because these

non-GAAP measures, when viewed with our GAAP results and

accompanying reconciliations, provide a more complete understanding

of our performance than GAAP results alone. Management uses

these non-GAAP measures as supplemental measures to review current

period operating performance, comparability measures and

performance measures for period-to-period

comparisons.(2) Management uses distributable cash flow, a

non-GAAP measure, as a supplemental performance and liquidity

measure. Using this metric, management can quickly compute the

coverage ratio of estimated cash flows to planned cash

distributions.

| ARCHROCK PARTNERS, L.P. |

| UNAUDITED SUPPLEMENTAL

INFORMATION |

| (In thousands, except

percentages) |

| |

| |

Three Months Ended |

| |

September 30, |

|

June 30, |

|

September 30, |

| |

2017 |

|

2017 |

|

2016 |

| |

|

|

|

|

|

| Total available

horsepower (at period end) (1) (2) |

3,296 |

|

|

3,281 |

|

|

3,221 |

|

| |

|

|

|

|

|

| Total operating

horsepower (at period end) (1) (3) |

2,910 |

|

|

2,860 |

|

|

2,762 |

|

| |

|

|

|

|

|

| Average operating

horsepower |

2,890 |

|

|

2,843 |

|

|

2,751 |

|

| |

|

|

|

|

|

| Horsepower

Utilization: |

|

|

|

|

|

| Spot (at

period end) |

88 |

% |

|

87 |

% |

|

86 |

% |

|

Average |

88 |

% |

|

87 |

% |

|

84 |

% |

| |

|

|

|

|

|

| Total available

contract operations horsepower of Archrock, Inc. and Archrock

Partners (at period end) (2) |

3,866 |

|

|

3,827 |

|

|

3,984 |

|

| |

|

|

|

|

|

| Total operating

contract operations horsepower of Archrock, Inc. and Archrock

Partners (at period end) (3) |

3,204 |

|

|

3,118 |

|

|

3,153 |

|

(1) Includes compressor units comprising

approximately 28,000, 23,000 and 6,000 horsepower leased from

Archrock as of September 30, 2017, June 30, 2017 and

September 30, 2016, respectively. Excludes compressor units

comprising approximately 33,000, 6,000 and 100 horsepower leased to

Archrock as of September 30, 2017, June 30, 2017 and September

30, 2016, respectively. (2) Defined as idle and operating

horsepower. New compressor units completed by a third party

manufacturer that have been delivered to us are included in the

fleet.(3) Defined as horsepower that is operating under

contract and horsepower that is idle but under contract and

generating revenue such as standby revenue.

For information,

contact:

David Skipper, 281-836-8155

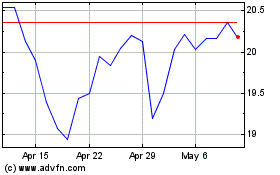

Archrock (NYSE:AROC)

Historical Stock Chart

From Jun 2024 to Jul 2024

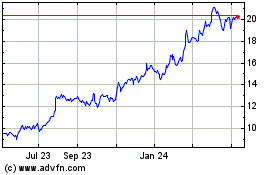

Archrock (NYSE:AROC)

Historical Stock Chart

From Jul 2023 to Jul 2024