false

0000896622

0000896622

2024-07-22

2024-07-22

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

July 22, 2024

Date of Report (Date of earliest event reported)

AptarGroup, Inc.

(Exact name of registrant as specified in

its charter)

Delaware

(State or other jurisdiction of

incorporation) |

|

1-11846

(Commission File Number) |

|

36-3853103

(IRS Employer Identification No.) |

265 Exchange Drive, Suite 301, Crystal Lake, Illinois 60014

(Address of principal executive offices)

Registrant’s

telephone number, including area code: 815-477-0424

N/A

(Former name or former address, if changed

since last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant

to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of

the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common

Stock, $.01 par value |

|

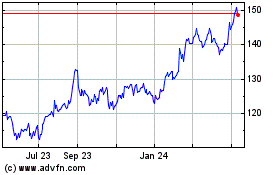

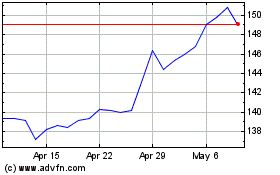

ATR |

|

New

York Stock Exchange |

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of

the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ¨

If an emerging growth

company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or

revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item

5.02. Departure of Directors

or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On July 22, 2024, Robert W. Kuhn, Executive Vice President, Chief

Financial Officer and Chief Accounting Officer of AptarGroup, Inc. (the “Company”), notified the Company that he will

retire as the Company’s Executive Vice President and Chief Financial Officer on December 31, 2024, following the expiration

of his employment agreement, and will retire as the Company’s principal accounting officer on July 31, 2024.

On July 25, 2024, the Company announced that Vanessa Kanu will

succeed Mr. Kuhn as Executive Vice President, Chief Financial Officer of the Company, effective January 1, 2025. Ms. Kanu, age 46, previously served

from September 2020 until March 2024 as Chief Financial Officer of TELUS International and from May 2019 until August 2020 as

Chief Financial Officer of Mitel Networks Corporation, where she spent 16 years in finance leadership roles. Prior to Mitel, Ms. Kanu spent over five years in the audit and business advisory

services practice of PricewaterhouseCoopers. Ms. Kanu also serves as a director of Manulife Financial Corporation.

On July 25, 2024, the Company announced that Daniel Ackerman,

age 51, Vice President, Corporate Controller of the Company since 2015, will become the Company’s Chief Accounting Officer,

effective August 1, 2024. In connection with this appointment, Mr. Ackerman will receive a restricted stock unit award under

the Company’s 2018 Equity Incentive Plan (the “2018 Plan”) with a grant date fair value of $750,000, which is

scheduled to vest on the third anniversary of the grant date, subject to Mr. Ackerman’s continued employment through such

date and such other terms and conditions as are set forth in the Company’s customary restricted stock unit award

agreement.

There is no arrangement or understanding between Ms. Kanu or Mr. Ackerman

and any other person pursuant to which either of them was appointed as an officer or director of the Company; there is no family relationship

between either of them and any of the Company’s directors or other executive officers; and neither Ms. Kanu nor Mr. Ackerman

is a party to any transactions of the type that would require disclosure under Item 404(a) of Regulation S-K.

Vanessa Kanu Employment Agreement

On July 24, 2024, the Company entered into an Employment Agreement

with Ms. Kanu (the “Employment Agreement”) that contemplates a start date as soon as practicable following the date Ms. Kanu’s

visa petition to work in the United States is approved, but in no event later than November 1, 2024 (such date, the “Effective

Date”). Upon the Effective Date, Ms. Kanu will serve as Executive Vice President, Finance and Chief Financial Officer (Designate),

reporting directly to the Company’s Chief Executive Officer and, effective January 1, 2025 or such other date as agreed to

by the parties, Ms. Kanu will serve as Executive Vice President, Chief Financial Officer of the Company. The Employment Agreement

provides for employment through December 31, 2027, unless terminated earlier. The Employment Agreement automatically extends for

one additional year each January 1st beginning on January 1, 2026, but may not be extended beyond December 31, 2042.

The Employment Agreement provides for an initial annual base salary

of $720,000, which amount may be increased (but not decreased) over the term of the Employment Agreement. The Employment Agreement also

provides that Ms. Kanu’s target annual performance incentive for 2025 will be set at 85% of her base salary, with the actual

amount paid determined based on the level of attainment of certain goals and objectives. Beginning in 2025, Ms. Kanu will also be

eligible to participate in the long-term incentive plan maintained for senior executive officers of the Company, with a target opportunity

for calendar year 2025 equal to 310% of her base salary. Ms. Kanu is also entitled to participate in the Company’s retirement

and executive benefit programs on the same basis as the Company’s other senior executives. In addition, the Company will (i) reimburse

Ms. Kanu for reasonable moving expenses incurred in connection with her relocation to the Company's corporate headquarters in accordance

with the Company's relocation practices for senior executive officers, (ii) reimburse Ms. Kanu for pre-approved temporary living

expenses (including food and lodging) for her and her family for a maximum of 60 consecutive days, (iii) reimburse Ms. Kanu

for expenses associated with her application for a U.S. O-1 visa and (iv) pay Ms. Kanu within 60 days of the Effective Date

an amount equal to one month of her base salary as a miscellaneous expense allowance.

The Employment Agreement also provides that the Company will make a

sign-on cash payment to Ms. Kanu in the amount of $300,000 (less applicable taxes and withholding) in a lump sum within 60 days of

the Effective Date, subject to her continued employment with the Company through the payment date (the “Sign-on Bonus”). The

Sign-On Bonus is subject to repayment if Ms. Kanu’s employment is terminated within 24 months following the Effective Date for

any reason other than by the Company without “cause” or by Ms. Kanu for “good reason” (each as defined in

the Employment Agreement). In addition, within 60 days of the Effective Date, subject to the approval of the Board of Directors of the

Company (the “Board”) (or a committee thereof) and Ms. Kanu’s continued employment with the Company through such

date, the Company will grant to Ms. Kanu a restricted stock unit award under the 2018 Plan with a grant date fair value equal to

$700,000, which will be scheduled to vest 100% on the three-year anniversary of the Effective Date, subject to Ms. Kanu’s continued

employment through such date and such other terms and conditions as are set forth in the Company’s customary restricted stock unit

award agreement.

If Ms. Kanu’s employment ends on account of death, Ms. Kanu’s

estate will receive one-half of the base salary that Ms. Kanu would have received until the second anniversary of her death. If her

employment ends due to the expiration of the Employment Agreement following a delivery by the Company of a notice of non-extension, Ms. Kanu

is entitled to receive an amount equal to one year's base salary and the medical and life insurance benefits she would have otherwise

received for a period of one year following the expiration date. If Ms. Kanu is terminated without “cause,” she is entitled

to receive an amount equal to the base salary she would have received had the employment period remained in effect until the date on which

it was then scheduled to end. In addition, if Ms. Kanu’s employment terminates for any reason other than by the Company for

“cause” during the third or fourth quarter of the Company’s fiscal year, she will also be entitled to a prorated annual

bonus based on actual performance for the year in which the termination occurs.

After a “change in control” (as defined in the Employment

Agreement), if Ms. Kanu’s employment is terminated by the Company or its successor other than for “cause,” disability

or death, or if Ms. Kanu terminates her employment for “good reason,” in each case, within two years following the change

in control, Ms. Kanu is entitled to receive a lump-sum payment equal to (i) two times her highest annualized salary during the

12 month period preceding the termination and (ii) two times the average of the annual performance incentives in respect of the three

years immediately preceding the year in which the change in control occurs, plus a prorated annual performance incentive equal to an amount

at least equal to the average of the annual performance incentives in respect of the three years immediately preceding the year in which

the change in control occurs, as well as the continuation of medical, disability and life insurance benefits for two years and a payment

in respect of any accrued but unused vacation pay.

The Employment Agreement also contains certain noncompetition and nonsolicitation

covenants prohibiting Ms. Kanu from, among other things, becoming employed by a competitor of the Company for a period of one or

two years following termination (depending on the nature of the termination).

The foregoing description of the Employment Agreement is qualified

in its entirety by reference to the full text of the Employment Agreement, a copy of which is attached hereto as Exhibit 10.1 and

is incorporated herein by reference.

In order to facilitate a transition of responsibilities following Mr. Kuhn’s

over 15 years of service as the Company’s Executive Vice President and Chief Financial Officer, the Company and Mr. Kuhn entered

into a one-year transition and advisor agreement entitling Mr. Kuhn to a monthly advisory fee of $10,000 for each month of service

as an advisor.

Item 7.01

Regulation FD Disclosures

On July 25, 2024, the Company issued press releases regarding the matters described in Item 5.02 of this report, which are furnished as

Exhibits 99.1 and 99.2 to this report.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

AptarGroup, Inc. |

| |

|

| Date: July 25, 2024 |

By: |

/s/ Kimberly Y. Chainey |

| |

|

Kimberly Y. Chainey |

| |

|

Executive Vice President, Chief Legal Officer and

Corporate Secretary |

Exhibit 10.1

EMPLOYMENT AGREEMENT

THIS EMPLOYMENT AGREEMENT (the “Agreement”)

between AptarGroup, Inc., a Delaware corporation (the “Company”), and Vanessa Kanu (the “Executive”)

is entered into as of July 24, 2024. In consideration of the covenants contained herein, the parties agree as follows:

1. Employment.

The Company shall employ the Executive, and the Executive agrees to be employed by the Company, upon the terms and subject to the

conditions set forth herein for the period beginning as soon as practicable following the date the Executive’s United States visa

petition is approved, but in no event later than November 1, 2024 (such date, the “Effective Date”), subject to Section 12

below. The employment term shall continue until December 31, 2027, unless earlier terminated pursuant to Section 4 hereof;

provided, however, that such term shall automatically be extended as of each January 1st commencing January 1, 2026, for one

additional year unless either the Company or the Executive shall have terminated this automatic extension provision by written notice

to the other party at least 30 days prior to the automatic extension date; provided, however, that in no event shall such term extend

beyond December 31, 2042. The term of employment in effect from time to time hereunder is hereinafter called the "Employment

Period."

2. Position

and Duties. Upon the Effective Date, the Executive shall serve as Executive Vice President, Finance and Chief Financial Officer (Designate),

reporting directly to the Chief Executive Officer of the Company (the "Company CEO") and, effective January 1, 2025 or

such other date as agreed to by the parties, the Executive shall serve as Chief Financial Officer of the Company, and shall have the

normal duties, responsibilities and authority of an executive serving in such position, subject to the direction of the Company CEO.

During the Employment Period, the Executive shall have the title of Executive Vice President and shall report to the Company CEO. During

the Employment Period, the Executive shall devote her best efforts and her full business time to the business and affairs of the Company

and its subsidiaries.

3. Compensation

and Benefits. The Executive shall be entitled to the following compensation and benefits under this Agreement:

| (a) | The Company shall pay the Executive a salary during the Employment

Period, in monthly installments, initially at the rate of $720,000 per annum. The Management

Development and Compensation Committee of the Board of Directors of the Company (the "Management

Development and Compensation Committee") may, in its sole discretion increase (but not

decrease) such salary from time to time. |

| (b) | During the Employment Period, Executive shall be eligible to participate

in the annual cash incentive program (the "Short-Term Incentive Plan"), with a

target opportunity determined by the Management Development & Compensation Committee

for each year of participation, provided that the 2025 target opportunity shall equal 85%

of Executive's base salary. The actual amount of the annual bonus earned by and payable to

Executive for any year or portion of a year, as applicable, shall be determined upon the

satisfaction of goals and objectives established by the Management Development &

Compensation Committee, and shall be subject to such other terms and conditions of the Short-Term

Incentive Plan (“STI”) as in effect from time to time. Each cash bonus paid under

the STI plan shall be paid to Executive no later than March 15th of the calendar year

following the calendar year in which the bonus is earned. |

| (c) | Beginning in calendar year 2025, during the Employment Period, Executive

shall be eligible to participate in the long-term incentive plan maintained for senior executive

officers of the Company (the "LTI Plan"), with a LTI Plan target opportunity determined

by the Management Development & Compensation Committee for each year of participation.

For calendar year 2025, the Executive’s LTI Plan target opportunity shall equal 310%

of the Executive's base salary. The LTI Plan awards granted to Executive shall be delivered

through vehicles and designs that are generally consistent with those awarded to the Company's

other senior executive officers in each year. |

| (d) | The Company shall reimburse the Executive for all reasonable expenses

incurred by her in the course of performing her duties under this Agreement which are consistent

with the Company's policies in effect from time to time. |

| (e) | During the Employment Period, the Executive shall be entitled to participate

in the Company's executive benefit programs on the same basis as other executives of the

Company having the same level of responsibility. Programs consist of those benefits (including

insurance, vacation in line with Aptar North America policy and/or other benefits) for which

substantially all of the executives of the Company are from time to time generally eligible,

as determined from time to time by the Board of Directors of the Company (the "Board")

or the Management Development & Compensation Committee. |

| (f) | In addition to participation in the Company's executive benefit programs

pursuant to Section 3(e), the Executive shall be entitled during the Employment Period

to: |

| (i) | supplemental term life insurance coverage in an amount equal to the

Executive's annual salary, but only if and so long as such additional coverage is available

at reasonable cost from the insurer providing term life insurance coverage under the executive

benefit programs or a comparable insurer acceptable to the Company; provided, that if such

supplemental life insurance coverage is not available and if the Employment Period ends on

account of the Executive's death, the Company shall pay to the Executive's estate (or such

person or persons as the Executive may designate in a written instrument signed by her and

delivered to the Company prior to her death) (1) a lump sum amount equal to the excess

of (A) the amount of the Executive's annual salary then in effect over (B) the

amount of term life insurance coverage provided to the Executive by the Company and (2) all

unpaid, incurred expenses pursuant to Section 3(d) above; and |

| (ii) | supplementary long-term disability coverage in an amount which will

increase maximum covered annual compensation to 66 2/3% of the Executive's annual salary;

but only if and so long as supplementary coverage is available at standard rates from the

insurer providing long- term disability coverage under the executive benefit program or a

comparable insurer acceptable to the Company. |

| (g) | The Company shall assist the Executive in her relocation to the Company

and shall (i) reimburse Executive for reasonable moving expenses incurred in connection

with relocation to the Company's corporate headquarters in accordance with the Company's

relocation practices for senior executive officers, (ii) reimburse the Executive for

pre-approved temporary living expenses (including food and lodging) for the Executive and

her family for a maximum of 60 consecutive days, (iii) reimburse the Executive for expenses

associated with the Executive’s application for a U.S. O-1 visa, and (iv) pay

the Executive within 60 days of the Effective Date an amount equal to one month of Executive's

base salary as a miscellaneous expense allowance (the items referred to in clauses (i), (ii),

(iii) and (iv), the "Relocation Benefits"). In addition, with respect to the

Relocation Benefits, the Company shall pay to the Executive an additional amount (the "Relocation

Benefit Gross-Up") equivalent to any taxes paid by the Executive with respect to such

Relocation Benefits and the payment of the Relocation Benefit Gross-Up. Payment of the Relocation

Benefit Gross-Up shall be made on or as soon as practicable following the day on which the

required tax is remitted by or on behalf of Executive (but not later than the end of the

taxable year following the year in which such tax is remitted). |

| (h) | Sign-On Compensation. The Company shall: |

| (i) | pay to the Executive in a lump sum within sixty (60) days of the

Effective Date, subject to the Executive’s continued employment with the Company through

such date, a cash payment in the amount of $300,000 (less applicable taxes and withholding);

provided, that if Executive’s employment terminates for any reason other than by the

Company without Cause or by the Executive for Good Reason, in each case, within twenty-four

(24) months following the Effective Date, Executive shall repay such amount to the Company

within sixty (60) days following such termination of employment; and |

| (ii) | subject to the approval of the Board (or a committee thereof), grant

to the Executive within sixty (60) days of the Effective Date, subject to the Executive’s

continued employment with the Company through such date, a restricted stock unit award under

the Company’s 2018 Equity Incentive Plan with a grant date fair value equal to $700,000,

with the number of shares of Company common stock subject to such award to be determined

based on the Company’s standard methodology, and which shall vest 100% on the three-year

anniversary of the Effective Date, subject to Executive’s continued employment through

such date and such other terms and conditions as are set forth in the Company’s customary

restricted stock unit award agreement. |

4. Termination

of Employment.

| (a) | The Employment Period shall end upon the first to occur of: (i) the

expiration of the term of this Agreement pursuant to Section 1 hereof; (ii) termination

of the Executive's employment by the Company on account of the Executive having become unable

(as determined by the Board in good faith) to regularly perform her duties hereunder by reason

of illness or incapacity for a period of more than six consecutive months ("Termination

for Disability"); (iii) termination of the Executive's employment by the Company

for Cause ("Termination for Cause"); (iv) termination of the executive's employment

by the Company other than a Termination for Disability or a Termination for Cause ("Termination

Without Cause"); (v) the Executive's death; or (vi) termination of the Executive's

employment by the Executive for any reason following written notice to the Company at least

90 days prior to the date of such termination ("Termination by the Executive").

All references in this Agreement to the Executive’s termination of employment and to

the end of the Employment Period shall mean a "separation from service" within

the meaning of Section 409A of the Code. |

| (b) | For

purposes of this Agreement, "Cause" shall mean (i) the commission of a felony

involving moral turpitude, (ii) the commission of a fraud, (iii) the commission

of any material act involving dishonesty with respect to the Company or any of its subsidiaries

or affiliates, (iv) gross negligence or willful misconduct with respect to the Company

or any of its subsidiaries or affiliates, (v) breach of any provision of Section 5

or Section 6 hereof or (vi) any other breach of this Agreement which is material

and which is not cured within 30 days following written notice thereof to the Executive by

the Company. |

| (c) | If

the Employment Period ends for any reason set forth in Section 4(a), except as otherwise

provided in this Section 4, the Executive shall cease to have any rights to salary,

bonus (if any) or benefits hereunder, other than (i) any unpaid salary accrued through

the date of such termination, (ii) any bonus payable based on actual performance, but

only if such termination occurs during the third or fourth quarter of the Company's fiscal

year, such bonus to be prorated and paid in accordance with Company policy (with such prorated

bonus paid no later than the March 15th immediately following the end of the fiscal

year in which such prorated bonus was earned), (iii) any accrued vacation pay to the

extent not theretofore paid, (iv) any unpaid expenses which shall have been incurred

as of the date of such termination and (v) to the extent provided in any benefit plan

in which the Executive has participated, any plan benefits which by their terms extend beyond

termination of the Executive's employment. Notwithstanding the foregoing, if the Employment

Period ends on account of a Termination for Cause, the Executive shall not be entitled to

any unpaid bonus accrued through the date of such termination. |

| (d) | If

the Employment Period ends on account of Termination for Disability, in addition to the amounts

described in Section 4(c) hereof, the Executive shall receive the disability benefits

to which she is entitled under any disability benefit plan in which the Executive has participated

as an employee of the Company. |

| (e) | If

the Employment Period ends on account of the Executive's death, the Company shall pay to

the Executive's estate (or such person or persons as the Executive may designate in a written

instrument signed by her and delivered to the Company prior to her death), in addition to

the amount payable pursuant to Section 3(f)(i), amounts equal to one-half of the amounts

the Executive would have received as salary (based on the Executive's salary then in effect)

had the Employment Period remained in effect until the second anniversary of the date of

the Executive's death, at the times such amounts would have been paid. |

| (f) | If

the Employment Period ends on account of Termination without Cause, in addition to the amounts

described in Section 4(c) hereof, the Company shall, subject to Section 4(k) hereof,

pay to the Executive amounts equal to the amounts the Executive would have received as salary

(based on the Executive's salary then in effect) had the Employment Period remained in effect

until the date on which (without any extension thereof, or, if previously extended, without

any further extension thereof) it was then scheduled to end, at the times such amounts would

have been paid, less any payments to which the Executive shall be entitled during such salary

continuation period under any disability benefit plan in which the Executive has participated

as an employee of the Company; provided, however, that in the event of the Executive's death

during the salary continuation period, the Company shall pay to the Executive's estate (or

such person or persons as the Executive may designate in a written instrument signed by her

and delivered to the Company prior to her death) amounts during the remainder of the salary

continuation period equal to one-half of the amounts which would have been paid to the Executive

but for her death. It is expressly understood that the Company's payment obligations under

this Section 4(f) shall cease in the event the Executive shall breach any provision

of Section 5 or Section 6 hereof. |

| (g) | Notwithstanding

the foregoing provisions of this Section 4, in the event of a Change in Control (as

defined in Appendix A hereto), the employment of the Executive hereunder shall not be terminated

by the Company or any successor to the Company within two years following such Change in

Control unless the Executive receives written notice of such termination from the Company

or such successor at least 30 days prior to the date of such termination. In addition, the

Executive agrees that she shall not terminate her employment hereunder, other than for Good

Reason, within one year following a Change in Control unless the Company or any successor

to the Company receives written notice of such termination from the Executive at least six

months prior to the date of such termination. In the event of a termination of employment

by the Company or its successor other than a Termination for Cause, a Termination for Disability

or due to the Executive's death (in which case the provisions of Section 4(c), 4(d) or

4(e), as the case may be, shall apply), within two years following a Change in Control, or

in the event that the Executive terminates her employment hereunder for Good Reason (as defined

in Section 4(h) hereof) within two years following a Change in Control: |

| (i) | the Company shall, subject to Section 4(k) hereof, pay

to the Executive within 30 days following the date of termination, in addition to the amounts

and benefits described in Sections 4(c)(i), (iii) and (iv) hereof: (A) a cash

amount equal to the sum of (i) the Executive's annual bonus in an amount at least equal

to the average of the annual bonuses paid or payable, including by reason of any deferral,

to the Executive by the Company and its affiliated companies in respect of the three fiscal

years of the Company immediately preceding the fiscal year in which the Change in Control

occurs, multiplied by a fraction, the numerator of which is the number of days in the fiscal

year in which the Change in Control occurs through the date of termination and the denominator

of which is 365 or 366, as applicable, and (ii) any accrued vacation pay to the extent

not theretofore paid; plus (B) a lump-sum cash amount in an amount equal to (i) two

(2) times the Executive's highest annual base salary from the Company and its affiliated

companies in effect during the 12-month period prior to the date of termination, plus (ii) two

(2) times the average of the annual bonuses paid or payable, including by reason

of any deferral, to the Executive by the Company and its affiliated companies in respect

of the three fiscal years of the Company immediately preceding the fiscal year in which the

Change in Control occurs; provided, however, that any amount paid pursuant to this Section 4(g)(i)(B) shall

be paid in lieu of any other amount of severance relating to salary or bonus continuation

to be received by the Executive upon termination of employment of the Executive under Section 4(f) of

this Agreement or under any severance plan, policy or arrangement of the Company; |

| (ii) | for a period of two (2) years commencing on the date of termination,

the Company shall continue to keep in full force and effect all policies of medical, disability

and life insurance with respect to the Executive and her dependents with the same level of

coverage, upon the same terms and otherwise to the same extent as such policies shall have

been in effect immediately prior to the date of termination or, if more favorable to the

Executive, as provided generally with respect to other peer executives of the Company, and

the Company and the Executive shall share the costs of the continuation of such insurance

coverage in the same proportion as such costs were shared immediately prior to the date of

termination, with the Company-paid portion of the insurance premiums to be paid directly

to Executive on a monthly basis, provided that the Executive converts the life insurance

policy into an individual policy within the time period required by the life insurance carrier;

and |

| (iii) | the Company shall pay to the Executive any compensation previously

deferred by the Executive (together with any interest and earnings thereon) in accordance

with the terms of the plans pursuant to which such compensation was deferred. |

| (h) | For

purposes of this Agreement “Good Reason” shall mean, without the written consent

of the Executive, any one or more of the following: (i) the Company reduces the amount

of the Executive’s (x) base salary or (y) the aggregate cash bonus opportunity

and long-term incentive opportunity (it being understood that the Board shall have discretion

to set the Company’s and the Executive’s personal performance targets to which

the cash bonus and long-term incentive opportunities will be tied and to change the form

of long-term incentive awards); (ii) the Company adversely changes the Executive’s

reporting responsibilities, titles or office as in effect as of the date hereof or reduces

her position, authority, duties, responsibilities or status, in a manner that is materially

inconsistent with the positions, authority, duties, responsibilities or status, which the

Executive then holds (for the avoidance of doubt, Executive shall be deemed to have an adverse

change in Executive’s position, authorities, duties, responsibilities or status, in

the event the Executive ceases to have public company reporting responsibilities as a result

of the Company ceasing to be publicly-traded following a Change in Control); (iii) any

successor to the Company in any merger, consolidation or transfer of assets, as described

in Section 12, does not expressly assume any material obligation of the Company to the

Executive under any agreement or plan pursuant to which the Executive receives benefits or

rights; or (iv) the Company changes the Executive’s place of work to a location

more than sixty (60) miles from the Executive’s present place of work; provided, however,

that the occurrence of any such condition shall not constitute Good Reason unless (A) the

Executive provides written notice to the Company of the existence of such condition not later

than 60 days after the Executive knows or reasonably should know of the existence of such

condition, (B) the Company shall have failed to remedy such condition within 30 days

after receipt of such notice and (C) the Executive resigns due to the existence of such

condition within 60 days after the expiration of the remedial period described in clause

(B) hereof in which such condition remains unremedied. Notwithstanding anything to the

contrary, the “Good Reason” definition set forth herein shall override any definition

in an equity award agreement for any equity awards granted after the date hereof to the extent

the definition herein contains more favorable provisions. |

| (i) | Notwithstanding

anything in this Agreement to the contrary, in the event it shall be determined that any

payment or distribution by the Company or its affiliated companies to or for the benefit

of the Executive (whether paid or payable or distributed or distributable pursuant to the

terms of this Agreement or otherwise, but determined without regard to any adjustment required

under this Section 4(i) (in the aggregate, the "Total Payments") would

be subject to the excise tax imposed by Section 4999 of the Code (the "Excise Tax"),

and if it is determined that (A) the amount remaining, after the Total Payments are

reduced by an amount equal to all applicable federal and state taxes (computed at the highest

applicable marginal rate), including the Excise Tax, is less than (B) the amount remaining,

after taking into account all applicable federal and state taxes (computed at the highest

applicable marginal rate), after payment or distribution to or for the benefit of the Executive

of the maximum amount that may be paid or distributed to or for the benefit of the Executive

without resulting in the imposition of the Excise Tax, then the Total Payments shall be reduced

so that the Total Payments are one dollar ($1) less than such maximum amount. In the event

that the Total Payments shall be reduced pursuant to this Section 4(i), then such reduced

payment shall be determined by reducing the Total Payments otherwise payable to the Executive

in the following order: (i) by reducing the payments due under Section 4(g)(i);

(ii) by reducing any cash payments not subject to Section 409A of the Code; (iii) by

eliminating the acceleration of vesting of any stock options (and if there is more than one

option award so outstanding, then the acceleration of the vesting of the stock option with

the highest exercise price shall be reduced first and so on); and (iv) by reducing the

payments of any restricted stock, restricted stock units, performance awards or similar equity-based

awards that have been awarded to the Executive by the Company (and if there be more than

one such award held by the Executive, by reducing the awards in the reverse order of the

date of their award, with the oldest award reduced first and the most- recently awarded reduced

last). |

| (j) | If

the Executive's employment terminates at the expiration of the term of this Agreement following

a delivery by the Company of a notice of non-extension as contemplated by Section 1

of this Agreement, then the Executive shall, subject to Section 4(k) hereof, be

entitled to receive the amounts the Executive would have received as salary (based on the

Executive's salary then in effect) at the times such amounts would otherwise have been paid,

and the medical and life insurance benefits the Executive and her dependents otherwise would

have received, had the Employment Period remained in effect for one year following the date

of such termination. It is expressly understood that the Company's payment obligations under

this Section 4(j) shall cease in the event the Executive shall breach any provision

of Section 5 or Section 6 hereof. |

| (k) | Notwithstanding

any other provision of this Agreement, if on the date that the Employment Period ends, (i) the

Company is a publicly traded corporation and (ii) the Company determines that the Executive

is a "specified employee," as defined in Section 409A of the Code, then to

the extent that any amount payable under this Agreement (A) is payable as a result of

the Executive's separation from service, (B) constitutes the payment of nonqualified

deferred compensation within the meaning of Section 409A of the Code and (C) under

the terms of this Agreement would be payable prior to the six-month anniversary of the date

on which the Employment Period ends, such payment shall be delayed until the earlier of (1) the

six-month anniversary of the date on which the Employment Period ends and (2) the death

of the Executive. Further, to the extent any payments made or contemplated hereunder constitute

nonqualified deferred compensation within the meaning of Section 409A, then each such

payment which is conditioned upon Executive’s execution of a release and which is to

be paid or provided during a designated period that begins in one taxable year and ends in

a second taxable year, shall be paid or provided in the later of the two taxable years. Notwithstanding

the requirement of Section 4(g)(i) hereof that payments to the Executive thereunder

be made in a lump sum, if a Change in Control within the meaning of this Agreement does not

constitute a "change in control event" within the meaning of Section 409A

of the Code, the amounts payable pursuant to Section 4(g)(i) hereof shall be paid

to the Executive, but with respect to the timing thereof, such payments shall be made in

the installments, and during the period, described in Section 4(f) hereof. Each

amount payable under this Agreement as a result of the separation of the Executive's service

shall constitute a "separately identified amount" within the meaning of Treasury

Regulation§ l.409A-2(b)(2). This Agreement shall be interpreted and construed in a manner

that avoids the imposition of taxes and other penalties under Section 409A of the Code

("409A Penalties"). In the event the terms of this Agreement would subject the

Executive to 409A Penalties, the Company and the Executive shall cooperate diligently to

amend the terms of this Agreement to avoid such 409A Penalties, to the extent possible. Any

reimbursement (including any advancement) payable to the Executive pursuant to this Agreement

shall be conditioned on the submission by the Executive of all expense reports reasonably

required by the Company under any applicable expense reimbursement policy, and shall be paid

to the Executive within 30 days following receipt of such expense reports (or invoices),

but in no event later than the last day of the calendar year following the calendar year

in which the Executive incurred the reimbursable expense. Any amount of expenses eligible

for reimbursement, or in- kind benefit provided, during a calendar year shall not affect the

amount of expenses eligible for reimbursement, or in-kind benefit to be provided, during

any other calendar year. The right to any reimbursement or in-kind benefit pursuant to this

Agreement shall not be subject to liquidation or exchange for any other benefit. Notwithstanding

the foregoing, under no circumstances shall the Company be responsible for any taxes, penalties,

interest or other losses or expenses incurred by the Executive due to any failure to comply

with Section 409A of the Code. |

| (l) | Executive's execution and non-revocation of a complete and general

release of any and all of her potential, legally-releasable claims (other than for benefits

and payments described in this Agreement or any other vested benefits with the Company and/or

its affiliates) against the Company, any of its affiliated companies, and their respective

successors and any officers, employees, agents, directors, attorneys, insurers, underwriters,

and assignees of the Company or its affiliates and/or successors, is an express condition

of Executive's right to receive termination payments and benefits under this Agreement. Executive

shall be required to execute within 45 days after Executive's termination of employment a

customary general waiver and release agreement which documents the release required under

this Section 4(l). |

5. Confidential

Information. The Executive acknowledges that the information, observations and data obtained by her while employed by the Company

pursuant to this Agreement, as well as those obtained by her while employed by the Company or any of its subsidiaries or affiliates or

any predecessor thereof prior to the date of this Agreement, concerning the business or affairs of the Company or any of its subsidiaries

or affiliates or any predecessor thereof ("Confidential Information") are the property of the Company or such subsidiary or

affiliate. Therefore, the Executive agrees that she shall not disclose to any unauthorized person or use for her own account any Confidential

Information without the prior written consent of the Company CEO unless and except to the extent that such Confidential Information becomes

generally known to and available for use by the public other than as a result of the Executive's acts or omissions to act. The Executive

shall deliver to the Company at the termination of the Employment Period, or at any other time the Company may request, all memoranda,

notes, plans, records, reports, computer tapes and software and other documents and data (and copies thereof) relating to the Confidential

Information or the business of the Company or any of its subsidiaries or affiliates which she may then possess or have under her control.

The Executive understands that nothing contained in this Agreement limits Executive's ability to report possible violations of law or

regulation to, or file a charge or complaint with, the Securities and Exchange Commission, the Equal Employment Opportunity Commission,

the National Labor Relations Board, the Occupational Safety and Health Administration, the Department of Justice, the Congress, any Inspector

General, or any other federal, state or local governmental agency or commission ("Government Agencies"). The Executive further

understands that this Agreement does not limit Executive's ability to communicate with any Government Agencies or otherwise participate

in any investigation or proceeding that may be conducted by any Government Agency, including providing documents or other information,

without notice to the Company. Nothing in this Agreement shall limit Executive’s ability under applicable U.S. Federal law to (i) disclose

in confidence trade secrets to federal, state, and local government officials, or to an attorney, for the sole purpose of reporting or

investigating a suspected violation of law or (ii) disclose trade secrets in a document filed in a lawsuit or other proceeding,

but only if the filing is made under seal and protected from public disclosure.

6. Noncompetition

and Nonsolicitation.

| (a) | The Executive acknowledges that in the course of her employment with

the Company pursuant to this Agreement she will become familiar with trade secrets and customer

lists and other confidential information concerning the Company and its subsidiaries and

affiliates and predecessors thereof and that her services will be of special, unique and

extraordinary value to the Company. |

| (b) | The Executive agrees that during the Employment Period and for one

year thereafter in the case of either Termination for Good Reason following a Change in Control

or Termination without Cause, or for two years thereafter in the case of termination of employment

for any other reason (the ''Noncompetition Period"), she shall not in any manner, directly

or indirectly, through any person, firm or corporation, alone or as a member of a partnership

or as an officer, director, stockholder, investor or employee of or in any other corporation

or enterprise or otherwise, engage or be engaged, or assist any other person, firm corporation

or enterprise in engaging or being engaged, in any business then actively being conducted

by the Company in any geographic area in which the Company is conducting such business (whether

through manufacturing or production, calling on customers or prospective customers, or otherwise).

Notwithstanding the foregoing, subsequent to the Employment Period the Executive may engage

or be engaged, or assist any other person, firm, corporation or enterprise in engaging or

being engaged, in any business activity which is not competitive with a business activity

being conducted by the Company at the time subsequent to the Employment Period that the Executive

first engages or assists in such business activity. |

| (c) | The Executive further agrees that during the Noncompetition Period

she shall not in any manner, directly or indirectly (i) induce or attempt to induce

any employee of the Company or of any of its subsidiaries or affiliates to terminate or abandon

his employment, or any customer of the Company or any of its subsidiaries or affiliates to

terminate or abandon its relationship, for any purpose whatsoever, or (ii) in connection

with any business to which Section 6(b) applies, call on, service, solicit or otherwise

do business with any then current or prospective customer of the Company or of any of its

subsidiaries or affiliates. |

| (d) | Nothing in this Section 6 shall prohibit the Executive from being

(i) a stockholder in a mutual fund or a diversified investment company or (ii) a

passive owner of not more than 2% of the outstanding stock of any class of a corporation

any securities of which are publicly traded, so long as the Executive has no active participation

in the business of such corporation. |

| (e) | If, at the time of enforcement of this Section 6, a court holds

that the restrictions stated herein are unreasonable under circumstances then existing, the

parties hereto agree that the maximum period, scope or geographical area reasonable under

such circumstances shall be substituted for the stated period, scope or area and that the

court shall be allowed to revise the restrictions contained herein to cover the maximum period,

scope and area permitted by law. |

7. Enforcement.

Because the services of the Executive are unique and the Executive has access to confidential information of the Company, the parties

hereto agree that the Company would be damaged irreparably in the event any provision of Section 5 or Section 6 hereof were

not performed in accordance with its terms or were otherwise breached and that money damages would be an inadequate remedy for any such

nonperformance or breach. Therefore, the Company or its successors or assigns shall be entitled, in addition to other rights and remedies

existing in their favor, to seek an injunction or injunctions to prevent any breach or threatened breach of any of such provisions and

to enforce such provisions specifically (without posting a bond or other security).

8. Survival.

Sections 5, 6, 7 and 16 hereof shall survive and continue in full force and effect in accordance with their respective terms, notwithstanding

any termination of the Employment Period.

9. Notices.

Any notice provided for in this Agreement shall be in writing and shall be either personally delivered, or sent by certified mail, return

receipt requested, postage prepaid, addressed (a) if to the Executive, to her last known address shown on the payroll records of

the Company, and to the Company, to AptarGroup, Inc., 265 Exchange Drive, Suite 301, Crystal Lake, Illinois 60014, attention:

Chief Executive Officer or (b) to such other address as either party shall have furnished to the other in accordance with this Section 9.

10. Severability.

Whenever possible, each provision of this Agreement shall be interpreted in such manner as to be effective and valid under applicable

law, but if any provision of this Agreement is held to be invalid, illegal or unenforceable in any respect under applicable law or rule in

any jurisdiction, such invalidity, illegality or unenforceability shall not affect any other provision or any other jurisdiction, but

this Agreement shall be reformed, construed and enforced in such jurisdiction as if such invalid, illegal or unenforceable provision

had never been contained herein.

11. Entire

Agreement. This Agreement constitutes the entire agreement and understanding between the parties with respect to the subject matter

hereof and supersedes and preempts any prior understandings, agreements or representations by or between the parties, written or oral,

which may have related in any manner to the subject matter hereof.

12. Successors

and Assigns. This Agreement shall inure to the benefit of and be enforceable by the Executive and her heirs, executors and personal

representatives, and the Company and its successors and assigns. Any successor or assignee of the Company shall assume the liabilities

of the Company hereunder. The Executive shall be required to obtain a visa to work in the United States. If by the Effective Date (as

defined in Section 1 above) the Executive is unable to obtain a U.S. O-1 visa or other visa that, in the Company’s

sole discretion, is sufficient to allow the Executive to work in the United States, then the Company shall assign Executive’s employment

to its Canadian affiliate and the Executive shall enter into a new employment agreement with such entity that has substantially similar

terms to this Agreement, subject to modifications to reflect employee benefits offered to employees in the applicable jurisdiction and

applicable law.

13. Governing

Law. This Agreement shall be governed by the internal laws (as opposed to the conflicts of law provisions) of the State of Illinois.

14. Amendment

and Waiver. The provisions of this Agreement may be amended or waived only with the prior written consent of the Company and the

Executive, and no course of conduct or failure or delay in enforcing the provisions of this Agreement shall affect the validity, binding

effect or enforceability of this Agreement.

15. Withholding.

All payments and benefits under this Agreement are subject to withholding of all applicable taxes.

16. Compensation

Subject to Recoupment. Notwithstanding any provisions in this Agreement or any other agreement or arrangement to the contrary, any

incentive-based compensation, equity-based compensation or compensation otherwise subject to clawback under applicable law, in each case,

paid or payable pursuant to the terms of this Agreement or any other agreement or arrangement with the Company, shall be subject to forfeiture,

recovery by the Company or other action pursuant to the AptarGroup, Inc. Policy on Recoupment of Forfeiture of Incentive Compensation,

as may be amended from time to time or any other clawback or recoupment policy which the Company may adopt from time to time, including

without limitation any such policy which the Company may be required to adopt under the Dodd-Frank Wall Street Reform and Consumer Protection

Act and implementing rules and regulations thereunder, or as otherwise required by law.

17. No

Conflict. Executive represents and warrants that Executive is not bound by any employment contract, restrictive covenant, or other

restriction preventing Executive from carrying out Executive’s responsibilities for the Company, or which is in any way inconsistent

with the terms of this Agreement. Executive further represents and warrants that Executive shall not disclose to the Company or induce

the Company to use any confidential or proprietary information or material belonging to any previous employer or others.

18. Acknowledgment.

The Company hereby advises Executive to consult with an attorney (chosen by Executive and at Executive’s cost) prior to signing

this Agreement, including with respect to the restrictive covenants contained in this Agreement. Executive has at least fourteen (14)

calendar days to review this Agreement before agreeing to its terms (although Executive may elect to voluntarily sign it before the end

of this review period).

[signature page follows]

IN WITNESS WHEREOF, the parties hereto have executed

this Agreement as of the date first written above.

| |

APTARGROUP, INC. |

| |

|

| |

By: |

/s/ Stephan B. Tanda |

| |

Name: |

Stephan B. Tanda |

| |

Title: |

President and Chief Executive Officer |

| |

EXECUTIVE: |

| |

|

| |

/s/ Vanessa Kanu |

| |

Vanessa Kanu |

Appendix A to

Employment Agreement

DEFINITION OF CHANGE IN CONTROL

"Change in Control" means:

(1) the

acquisition by any individual, entity or group (a "Person"), including any "person" within the meaning of Section 13(d)(3) or

14(d)(2) of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), of beneficial ownership within the meaning

of Rule 13d-3 promulgated under the Exchange Act, of more than 50% of either (i) the then outstanding shares of common stock

of the Company (the "Outstanding Company Common Stock") or (ii) the combined voting power of the then outstanding securities

of the Company entitled to vote generally in the election of directors (the "Outstanding Company Voting Securities"); provided,

however, that the following acquisitions shall not constitute a Change in Control: (A) any acquisition directly from the Company

(excluding any acquisition resulting from the exercise of a conversion or exchange privilege in respect of outstanding convertible or

exchangeable securities unless such outstanding convertible or exchangeable securities were acquired directly from the Company), (B) any

acquisition by the Company, (C) any acquisition by an employee benefit plan (or related trust) sponsored or maintained by the Company

or any corporation controlled by the Company or (D) any acquisition by any corporation pursuant to a reorganization, merger or consolidation

involving the Company, if, immediately after such reorganization, merger or consolidation, each of the conditions described in clauses

(i), (ii) and (iii) of subsection (3) of this Appendix A shall be satisfied; and provided further that, for purposes of

clause (B), if any Person (other than the Company or any employee benefit plan (or related trust) sponsored or maintained by the Company

or any corporation controlled by the Company) shall become the beneficial owner of more than 50% of the Outstanding Company Common Stock

or more than 50% of the Outstanding Company Voting Securities by reason of an acquisition by the Company and such Person shall, after

such acquisition by the Company, become the beneficial owner of any additional shares of the Outstanding Company Common Stock or any

additional Outstanding Company Voting Securities and such beneficial ownership is publicly announced, such additional beneficial ownership

shall constitute a Change in Control;

(2) individuals who, as of the date hereof,

constitute the Board (the "Incumbent Board") cease for any reason to constitute at least a majority of such Board;

provided, however, that any individual who becomes a director of the Company subsequent to the date hereof whose election, or

nomination for election by the Company's stockholders, was approved by the vote of at least a majority of the directors then

comprising the Incumbent Board shall be deemed to have been a member of the Incumbent Board; and provided further, that no

individual who was initially elected as a director of the Company as a result of an actual or threatened solicitation by a Person

other than the Board for the purpose of opposing a solicitation by any other Person with respect to the election or removal of

directors or any other actual or threatened solicitation of proxies or consents by or on behalf of any Person other than the Board

shall be deemed to have been a member of the Incumbent Board;

(3) consummation

of a reorganization, merger or consolidation unless, in any such case, immediately after such reorganization, merger or consolidation,

(i) 50% or more of the then outstanding shares of common stock of the corporation resulting from such reorganization, merger or

consolidation and 50% or more of the combined voting power of the then outstanding securities of such corporation entitled to vote generally

in the election of directors is then beneficially owned, directly or indirectly, by all or substantially all of the individuals or entities

who were the beneficial owners, respectively, of the Outstanding Company Common Stock and the Outstanding Company Voting Securities immediately

prior to such reorganization, merger or consolidation and in substantially the same proportions relative to each other as their ownership,

immediately prior to such reorganization, merger or consolidation, of the Outstanding Company Common Stock and the Outstanding Company

Voting Securities, as the case may be, (ii) no Person (other than the Company, any employee benefit plan (or related trust) sponsored

or maintained by the Company or the corporation resulting from such reorganization, merger or consolidation (or any corporation controlled

by the Company) and any Person which beneficially owned, immediately prior to such reorganization, merger or consolidation, directly

or indirectly, more than 50% of the Outstanding Company Common Stock or the Outstanding Company Voting Securities, as the case may be)

beneficially owns, directly or indirectly, more than 50% of the then outstanding shares of common stock of such corporation or more than

50% of the combined voting power of the then outstanding securities of such corporation entitled to vote generally in the election of

directors and (iii) at least a majority of the members of the board of directors of the corporation resulting from such reorganization,

merger or consolidation were members of the Incumbent Board at the time of the execution of the initial agreement or action of the Board

providing for such reorganization, merger or consolidation; or

(4) consummation

of (i) a plan of complete liquidation or dissolution of the Company or (ii) the sale or other disposition of all or substantially

all of the assets of the Company other than to a corporation with respect to which, immediately after such sale or other disposition,

(A) 50% or more of the then outstanding shares of common stock thereof and 50% or more of the combined voting power of the then

outstanding securities thereof entitled to vote generally in the election of directors is then beneficially owned, directly or indirectly,

by all or substantially all of the individuals and entities who were the beneficial owners, respectively, of the Outstanding

Company Common Stock and the Outstanding Company Voting Securities immediately prior to such sale or other disposition and in substantially

the same proportions relative to each other as their ownership, immediately prior to such sale or other disposition, of the Outstanding

Company Common Stock and the Outstanding Company Voting Securities, as the case may be, (B) no Person (other than the Company, any

employee benefit plan (or related trust) sponsored or maintained by the Company or such corporation (or any corporation controlled by

the Company) and any Person which beneficially owned, immediately prior to such sale or other disposition, directly or indirectly, more

than 50% of the Outstanding Company Common Stock or the Outstanding Company Voting Securities, as the case may be) beneficially owns,

directly or indirectly, more than 50% of the then outstanding shares of common stock thereof or more than 50% of the combined voting

power of the then outstanding securities thereof entitled to vote generally in the election of directors and (C) at least a majority

of the members of the board of directors thereof were members of the Incumbent Board at the time of the execution of the initial agreement

or action of the Board providing for such sale or other disposition.

Exhibit 99.1

Aptar CFO, Robert

(Bob) Kuhn, Has Decided to Step Down After 37 Years with the Company

Aptar Names Vanessa

Kanu, A Finance Veteran with Over 25 Years of Experience as Next CFO

Photo: (Left to right) Bob Kuhn, Executive Vice President and Chief

Financial Officer since 2008 has decided to retire at the end of 2024; Vanessa Kanu will become Executive Vice President and CFO

on January 1, 2025, and is expected to join the company early in the fourth quarter of 2024 as CFO designate.

Crystal Lake, Illinois, July 25, 2024 - AptarGroup, Inc.

(NYSE: ATR), a global leader in drug and consumer product dosing, dispensing and protection technologies, today announced that Bob

Kuhn, Executive Vice President and Chief Financial Officer (CFO) since 2008, has decided to retire at the end of this year.

Kuhn has spent 37 years with the company,16 of them as CFO, leading

Aptar’s global financial and information technology functions. Kuhn also led the internal M&A and integration teams for Aptar’s

largest acquisition – CSP Technologies, the active film technology company Aptar acquired in 2018. Kuhn has been responsible for

the division’s operations, which has had a CAGR of about 10% since it was acquired.

“Bob’s contributions to Aptar are immeasurable. He has

been a terrific business partner to me and his C-suite colleagues, and I have relied on his extensive knowledge of our business, sage

counsel and strategic thinking – all of which have contributed greatly to our overall success and the creation of shareholder value,”

said Stephan B. Tanda, President and CEO of Aptar.

Tanda added, “Saying Bob will be missed would be an extreme

understatement, we know this was a very difficult decision for him but respect his desire to spend more time with his growing family.

We wish him nothing but the best for his next set of adventures.”

Vanessa Kanu will become Executive Vice President and CFO on January 1,

2025, and is expected to join the company early in the fourth quarter of 2024 as CFO designate.

Kanu has over 25 years of experience with global multi-billion dollar

and publicly traded companies. Most recently she was CFO of TELUS International, a technology services firm with approximately $2.7B

in annual revenues operating in 32 countries. During her tenure at TELUS International, Kanu led the largest technology IPO in the history

of the Toronto Stock Exchange, helped with the acquisition and integration of several strategic acquisitions and together with the management

team initiated an extensive cost reduction effort.

Previously, she served as CFO of Mitel Networks Corporation, a global

technology firm providing business communications including premise-based and cloud-based software-as-a-service (SaaS) solutions with

more than $1B in annual revenues with operations in the Americas, Europe, Australia and Asia. Kanu also serves on the Board of Directors

of Manulife Financial Corporation, a global financial services institution with over $30B in annual revenues. At Aptar, Kanu will lead

the global finance organization, including planning, treasury, tax, financial reporting, financial operations and information technology.

“We are lucky to be able to welcome Vanessa to the Aptar team.

She brings with her tremendous experience in financial reporting, global operations and cost management that Aptar and our shareholders

will benefit from greatly,” said Tanda. “I look forward to working with Vanessa, she is an accomplished CFO and a dynamic

leader whose extensive experience will bolster our strong foundation.”

Kanu was an article trainee with PricewaterhouseCoopers and is both

a Chartered Accountant in Canada (CICA) as well as a Certified Public Accountant (CPA) in the United States. She holds a BSc in International

and Financial Economics from Hull University in the United Kingdom, with first class honours. In 2023, Kanu was named one of Canada’s

Best Executives by The Globe and Mail’s Report on Business magazine. In 2021, she was recognized as CFO of the Year, and

in 2017 Kanu was a recipient of the Top 40 under 40 Business Awards by the Ottawa Chamber of Commerce and Ottawa Business Journal.

About Aptar

Aptar is a global leader in the design and manufacturing of a broad

range of drug delivery, consumer product dispensing and active material science solutions and services. Aptar’s innovative solutions

and services serve a variety of end markets including pharmaceutical, beauty, personal care, home, food and beverage. Using insights,

proprietary design, engineering and science to create dispensing, dosing and protective technologies for many of the world’s leading

brands, Aptar in turn makes a meaningful difference in the lives, looks, health and homes of millions of patients and consumers around

the world. Aptar is headquartered in Crystal Lake, Illinois and has over 13,000 dedicated employees in 20 countries. For more information,

visit www.aptar.com.

This press release contains forward-looking statements. Expressions

or future or conditional verbs such as “will” are intended to identify such forward-looking statements. Forward-looking statements

are made pursuant to the safe harbor provisions of Section 27A of the Securities Act of 1933 and Section 21E of the Securities

Exchange Act of 1934 and are based on our beliefs as well as assumptions made by and information currently available to us. Accordingly,

our actual results or other events may differ materially from those expressed or implied in such forward-looking statements due to known

or unknown risks and uncertainties that exist in our operations and business environment. For additional information on these risks and

uncertainties, please see our filings with the Securities and Exchange Commission, including the discussion under “Risk Factors”

and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our Form 10-Ks

and Form 10-Qs. We undertake no obligation to update publicly any forward-looking statements, whether as a result of new information,

future events or otherwise, except as required by law.

# # #

| Investor Relations Contact: |

Media Contact: |

| |

| Mary Skafidas |

Katie Reardon |

| mary.skafidas@aptar.com |

katie.reardon@aptar.com |

| 815-479-5658 |

815-479-5671 |

Exhibit 99.2

Daniel Ackerman

Named Aptar’s Chief Accounting Officer

Crystal Lake, Illinois, July 25, 2024 - AptarGroup, Inc.

(NYSE: ATR), a global leader in drug and consumer product dosing, dispensing and protection technologies, today announced that

Daniel Ackerman has been named Chief Accounting Officer, effective August 1, 2024.

“Since joining Aptar over a decade ago, Dan has provided exemplary

leadership. He has built a strong team and taken on increasingly challenging responsibilities, most recently helping to lead our renewed

focus on cost management,” said Stephan B. Tanda President and CEO of Aptar. “Dan has become a trusted advisor, valued for

his integrity and demonstrated commitment to Aptar.”

Ackerman will continue to lead all corporate finance and accounting

functions, working closely with the segment finance teams as well as helping to set the company’s long-term financial planning strategy.

Ackerman joined Aptar in 2015 as Vice President, Corporate Controller.

His breadth of international experience includes living and working in Latin America and Asia in various finance positions at The Goodyear

Tire & Rubber Company. Prior to Goodyear, Ackerman worked at KPMG.

Ackerman is a Certified Public Accountant (CPA) and holds Bachelor

of Science degrees in Accounting and Finance from the University of Akron.

About Aptar

Aptar is a global leader in the design and manufacturing of a broad

range of drug delivery, consumer product dispensing and active material science solutions and services. Aptar’s innovative solutions

and services serve a variety of end markets including pharmaceutical, beauty, personal care, home, food and beverage. Using insights,

proprietary design, engineering and science to create dispensing, dosing and protective technologies for many of the world’s leading

brands, Aptar in turn makes a meaningful difference in the lives, looks, health and homes of millions of patients and consumers around

the world. Aptar is headquartered in Crystal Lake, Illinois and has over 13,000 dedicated employees in 20 countries. For more information,

visit www.aptar.com.

This press release contains forward-looking

statements. Expressions or future or conditional verbs such as “will” are intended to identify such forward-looking statements.

Forward-looking statements are made pursuant to the safe harbor provisions of Section 27A of the Securities Act of 1933 and Section 21E

of the Securities Exchange Act of 1934 and are based on our beliefs as well as assumptions made by and information currently available

to us. Accordingly, our actual results or other events may differ materially from those expressed or implied in such forward-looking statements

due to known or unknown risks and uncertainties that exist in our operations and business environment. For additional information on these

risks and uncertainties, please see our filings with the Securities and Exchange Commission, including the discussion under “Risk

Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our Form 10-Ks

and Form 10-Qs. We undertake no obligation to update publicly any forward-looking statements, whether as a result of new information,

future events or otherwise, except as required by law.

# # #

| Investor Relations Contact: |

Media Contact: |

| |

| Mary Skafidas |

Katie Reardon |

| mary.skafidas@aptar.com |

katie.reardon@aptar.com |

| 815-479-5658 |

815-479-5671 |

v3.24.2

Cover

|

Jul. 22, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jul. 22, 2024

|

| Entity File Number |

1-11846

|

| Entity Registrant Name |

AptarGroup, Inc.

|

| Entity Central Index Key |

0000896622

|

| Entity Tax Identification Number |

36-3853103

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

265 Exchange Drive

|

| Entity Address, Address Line Two |

Suite 301

|

| Entity Address, City or Town |

Crystal Lake

|

| Entity Address, State or Province |

IL

|

| Entity Address, Postal Zip Code |

60014

|

| City Area Code |

815

|

| Local Phone Number |

477-0424

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

Stock, $.01 par value

|

| Trading Symbol |

ATR

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |