Apollo Senior Floating Rate Fund Inc. (NYSE: AFT) and Apollo

Tactical Income Fund Inc. (NYSE: AIF) (AFT and AIF, together, the

“CEFs”) today announced that both CEFs received stockholder

approval of the necessary proposals related to their previously

announced mergers with and into MidCap Financial Investment

Corporation (NASDAQ: MFIC) at the AFT and AIF special meetings of

stockholders reconvened on June 21, 2024. Approximately 88% of

AFT’s common shares represented at its special meeting (excluding

votes abstained or withheld), or approximately 53% of AFT’s common

shares outstanding, voted in favor of the proposal, satisfying

AFT’s stockholder approval requirement. Approximately 87% of AIF’s

common shares represented at its special meeting (excluding votes

abstained or withheld), or approximately 53% of AIF’s common shares

outstanding, voted in favor of the proposal, satisfying AIF’s

stockholder approval requirement.

The final voting results are subject to

certification by the inspector of election of the AFT and AIF

special meetings of stockholders.

As previously announced, MFIC’s stockholders

approved the necessary proposal related to the mergers of the CEFs

with and into MFIC at a special meeting of stockholders held on May

28, 2024.

The mergers are currently expected to close in

late July, subject to satisfaction of customary closing conditions.

Following the closing of the mergers, the surviving entity will

continue to trade on the Nasdaq Global Select Market under the

ticker symbol “MFIC.”

Upon the closing of the mergers, stockholders of

AFT and AIF will receive a number of MFIC shares with a net asset

value (“NAV”) equal to the NAV of the shares they hold in each

respective CEF, with the applicable NAVs to be determined shortly

before closing. The NAVs per share for the CEFs used in determining

these amounts will be adjusted for the distribution of any

previously undistributed net investment income and capital gains

prior to closing.

Lazard served as financial advisor and Proskauer

Rose LLP as legal counsel to the special committee of MFIC. Keefe,

Bruyette & Woods Inc., A Stifel Company, served as financial

advisor and Dechert LLP as legal counsel to the special committees

of the CEFs. Simpson Thacher & Bartlett LLP served as legal

counsel to MFIC, AFT and AIF with respect to the mergers.

About MidCap Financial Investment

Corporation

MidCap Financial Investment Corporation (NASDAQ:

MFIC) is a closed-end, externally managed, diversified management

investment company that has elected to be treated as a business

development company (“BDC”) under the Investment Company Act of

1940 (the “1940 Act”). For tax purposes, MFIC has elected to be

treated as a regulated investment company (“RIC”) under Subchapter

M of the Internal Revenue Code of 1986, as amended (the “Code”).

MFIC is externally managed by Apollo Investment Management, L.P.

(the “MFIC Adviser”), an affiliate of Apollo Global Management,

Inc. and its consolidated subsidiaries (“Apollo”), a high-growth

global alternative asset manager. MFIC’s investment objective is to

generate current income and, to a lesser extent, long-term capital

appreciation. MFIC primarily invests in directly originated and

privately negotiated first lien senior secured loans to privately

held U.S. middle-market companies, which MFIC generally defines as

companies with less than $75 million in EBITDA, as may be adjusted

for market disruptions, mergers and acquisitions-related charges

and synergies, and other items. To a lesser extent, MFIC may invest

in other types of securities including, first lien unitranche,

second lien senior secured, unsecured, subordinated, and mezzanine

loans, and equities in both private and public middle market

companies. For more information, please visit

www.midcapfinancialic.com.

About Apollo Senior Floating Rate Fund

Inc.

Apollo Senior Floating Rate Fund Inc. (NYSE:

AFT) is registered under the 1940 Act as a diversified closed-end

management investment company. AFT’s investment objective is to

seek current income and preservation of capital by investing

primarily in senior, secured loans made to companies whose debt is

rated below investment grade and investments with similar economic

characteristics. Senior loans typically hold a first lien priority

and pay floating rates of interest, generally quoted as a spread

over a reference floating rate benchmark. Under normal market

conditions, AFT invests at least 80% of its managed assets (which

includes leverage) in floating rate senior loans and investments

with similar economic characteristics. Apollo Credit Management,

LLC, an affiliate of Apollo, serves as AFT’s investment adviser.

For tax purposes, AFT has elected to be treated as a RIC under the

Code. For more information, please visit

www.apollofunds.com/apollo-senior-floating-rate-fund.

About Apollo Tactical Income Fund

Inc.

Apollo Tactical Income Fund Inc. (NYSE: AIF) is

registered under the 1940 Act as a diversified closed-end

management investment company. AIF’s primary investment objective

is to seek current income with a secondary objective of

preservation of capital by investing in a portfolio of senior

loans, corporate bonds and other credit instruments of varying

maturities. AIF seeks to generate current income and preservation

of capital primarily by allocating assets among different types of

credit instruments based on absolute and relative value

considerations. Under normal market conditions, AIF invests at

least 80% of its managed assets (which includes leverage) in credit

instruments and investments with similar economic characteristics.

Apollo Credit Management, LLC, an affiliate of Apollo, serves as

AIF’s investment adviser. For tax purposes, AIF has elected to be

treated as a RIC under the Code. For more information, please visit

www.apollofunds.com/apollo-tactical-income-fund.

Forward-Looking Statements

Some of the statements in this press release

constitute forward-looking statements because they relate to future

events, future performance or financial condition. The

forward-looking statements may include statements as to: future

operating results of MFIC, AFT and AIF, and distribution

projections; business prospects of MFIC, AFT and AIF, and the

prospects of their portfolio companies, if applicable; and the

impact of the investments that MFIC, AFT and AIF expect to make. In

addition, words such as “anticipate,” “believe,” “expect,” “seek,”

“plan,” “should,” “estimate,” “project” and “intend” indicate

forward-looking statements, although not all forward-looking

statements include these words. The forward-looking statements

contained in this press release involve risks and uncertainties.

Certain factors could cause actual results and conditions to differ

materially from those projected, including those set forth in the

“Special Note Regarding Forward-Looking Statements” section in our

registration statement on Form N-14 (333-275640) previously filed

with the Securities and Exchange Commission (the “SEC”). MFIC, AFT

and AIF have based the forward-looking statements included in this

press release on information available to them on the date hereof,

and they assume no obligation to update any such forward-looking

statements. Although MFIC, AFT and AIF undertake no obligation to

revise or update any forward-looking statements, whether as a

result of new information, future events or otherwise, you are

advised to consult any additional disclosures that they may make

directly to you or through reports that MFIC, AFT, and/or AIF in

the future may file with the SEC, including annual reports on Form

10-K, annual reports on Form N-CSR, quarterly reports on Form 10-Q,

semi-annual reports on Form N-CSRS and current reports on Form

8-K.

Contact

Elizabeth BesenInvestor Relations Manager for

MFIC, AFT and AIF 212.822.0625ebesen@apollo.com

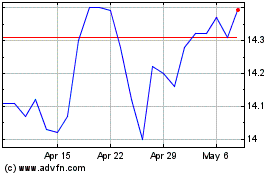

Apollo Tactical Income (NYSE:AIF)

Historical Stock Chart

From Nov 2024 to Dec 2024

Apollo Tactical Income (NYSE:AIF)

Historical Stock Chart

From Dec 2023 to Dec 2024