Current Report Filing (8-k)

August 06 2021 - 5:17PM

Edgar (US Regulatory)

0001411494

false

0001411494

2021-08-06

2021-08-06

0001411494

APO:ClassACommonStockMember

2021-08-06

2021-08-06

0001411494

us-gaap:SeriesAPreferredStockMember

2021-08-06

2021-08-06

0001411494

us-gaap:SeriesBPreferredStockMember

2021-08-06

2021-08-06

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date

of report (Date of earliest event reported): August 6, 2021

Apollo Global Management, Inc.

(Exact name of

registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

001-35107

|

|

20-8880053

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

9

West 57th Street, 43rd

Floor

New

York, New

York 10019

(Address of principal

executive offices) (Zip Code)

(212)

515-3200

(Registrant’s

Telephone Number, Including Area Code)

N/A

(Former Name or

Former Address, if Changed Since Last Report)

Check the appropriate box

below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following

provisions (see General Instruction A.2. below):

|

☐

|

Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant

to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant

to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title

of each class

|

|

Trading

Symbol(s)

|

|

Name

of each exchange

on

which registered

|

|

Class

A Common Stock

|

|

APO

|

|

New

York Stock Exchange

|

|

6.375%

Series A Preferred Stock

|

|

APO.PR

A

|

|

New

York Stock Exchange

|

|

6.375%

Series B Preferred Stock

|

|

APO.PR

B

|

|

New

York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934

(17 CFR §240.12b-2).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 8.01 Other Events

On August 6, 2021 Marc Rowan, Chief Executive Officer

and Director of Apollo Global Management, Inc. (the “Company”) and Director of Athene Holding Ltd. (“ATH”) informed

the Company that he has sold certain Class A common shares of ATH that he beneficially owns and that he intends to sell up to 1,000,000

Class A common shares of ATH in the aggregate (the “Aggregate ATH Shares”) prior to the closing of the merger of the Company

and ATH. Following such sales, Mr. Rowan will beneficially own approximately 681,075 Class A common shares of ATH. Mr. Rowan informed

the Company that the sales of the Aggregate ATH Shares are to generate liquidity to fund anticipated tax obligations arising from the

previously announced conversion of the Company’s capital structure to a single class of voting common stock, and that he does not

currently have any plan or intention to sell any additional Class A common shares of ATH (other than the Aggregate ATH Shares) or Class

A common stock of the Company.

In addition, on August 6, 2021 Mr. Rowan reported

a contribution of 1,500,000 shares of Class A common stock of the Company (the “Contributed APO Shares”) previously received

in connection with a September 2019 exchange of Apollo Operating Group units for shares of Class A common stock, to donor advised funds

in accordance with his previously disclosed intention to contribute certain shares of Class A common stock of the Company to a donor advised

fund or other charity over time. The Company has been informed that no more than 250,000 of the Contributed APO Shares are currently expected

to be sold by the donor advised funds and, from time to time, the donor advised funds may sell additional Contributed APO Shares to fund

additional future charitable contributions.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

Date: August 6, 2021

|

|

|

|

|

|

|

|

|

|

|

|

|

APOLLO GLOBAL MANAGEMENT, INC.

|

|

|

|

|

|

|

|

|

By:

|

|

/s/ John J. Suydam

|

|

|

|

Name:

|

|

John J. Suydam

|

|

|

|

Title:

|

|

Chief Legal Officer

|

|

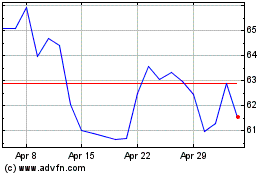

Apollo Global Management (NYSE:APO-A)

Historical Stock Chart

From Jun 2024 to Jul 2024

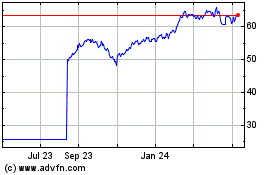

Apollo Global Management (NYSE:APO-A)

Historical Stock Chart

From Jul 2023 to Jul 2024