(Alliance News) - The following is a summary of top news stories Monday.

----------

COMPANIES

----------

Anglo-Dutch consumer goods firm Unilever said the unification of its legal structure under a single parent company, Unilever PLC, is expected to complete over the weekend of November 21 and 22. The company added that the expected last day of trading in Unilever NV shares, including Unilever NV shares in New York, will be November 20. Unilever NV has set September 21 as its extraordinary general meeting date for securing investor approval for the unification proposal. Unilever PLC shareholder meetings will take place on October 12. Unilever intends to undertake a cross-border merger between Unilever PLC and Unilever NV. Under the merger, Unilever NV shareholders will receive one new Unilever PLC share in exchange for each Unilever NV share held. The company will remain listed in London, Amsterdam, and New York, and the legal restructuring will not affect its operations, staffing levels or the manufacture and supply of products in both countries. However, the group will be incorporated in the UK alone, with one class of shares and one market capitalisation.

----------

Public transport operators Go-Ahead Group and FirstGroup both noted the UK Department of Transport announcing a funding round of GBP218.4 million on Saturday. The funding package - which is under the Covid-19 Bus Service Support Grant Restart - will last for eight weeks, after which weekly funding of up to GBP27.3 million will be made available "until a time when the funding is no longer needed". In addition, the UK government has announced plans to publish a National Bus Strategy, setting out plans for supporting continued bus services across the country. The government is also looking for ways that ensure that the bus sector can operate independently and become viable. Aberdeen-based FirstGroup welcomed the funding, and also noted Scotland's announcements that it would spend an additional GBP68 million to extended to November 8 the similar funding scheme it has in place for its bus operators.

----------

ContourGlobal posted a much higher interim profit thanks to its Mexican assets buy in late 2019 as well as a foreign exchange and fair value gain. The power generation firm reported a USD101.6 million pretax profit for the six months ended June 30, more than four times its USD23.2 million interim profit the year before. Revenue climbed 10% to USD680.2 million from USD617.4 million as a result of its Mexican combined heat and power plant assets acquisition completed November 2019. On top of which, ContourGlobal swung to a USD55.5 million gain on foreign exchange and change in fair value of derivatives from an USD8.8 million loss the prior year. The company maintained its annual guidance for adjusted earnings before interest, tax, depreciation, and amortisation of between USD710 million and USD745 million. This compares to its 2019 adjusted Ebitda of USD702.7 million.

----------

Saudi Arabian Oil said Sunday net profit for the second quarter plunged a massive 73% due to sharply lower oil prices as the coronavirus crisis undercuts global demand. The company, known as Saudi Aramco, posted a net profit of USD6.6 billion for the three months to June 30, compared to USD24.7 billion in the same period of 2019. "Strong headwinds from reduced demand and lower oil prices are reflected in our second-quarter results," Chief Executive Officer Amin Nasser said in a statement. Aramco's net profit for the first half of the year also dived, by 50% to USD23.2 billion, compared to USD46.9 billion over the same period last year. Aramco's profits were also impacted by losses posted by Saudi Basic Industries, the petrochemicals firm that it acquired for USD69 billion in a deal agreed in 2019 and completed in June this year. Nasser voiced optimism over what he called a "partial recovery in the energy market" amid an easing of virus restrictions in some countries.

----------

MARKETS

----------

London shares were higher, shrugging off concerns over Congress's inability to reach an agreement over a new US stimulus package and US-China tensions. Oil was higher following upbeat comments from Saudi Aramco over the outlook for the world energy market. US stock market futures were pointed to a flat to higher open.

----------

FTSE 100: up 0.2% at 6,043.29

FTSE 250: up 0.4% at 17,698.77

AIM ALL-SHARE: up 0.1% at 934.10

GBP: flat at USD1.3058 (USD1.3050)

EUR: down at USD1.1759 (USD1.1789)

GOLD: flat at USD2,032.80 per ounce (USD2,032.40)

OIL (Brent): up at USD44.90 a barrel (USD44.60)

(changes since previous London equities close)

----------

ECONOMICS AND GENERAL

----------

UK Prime Minister Boris Johnson is facing widespread calls to boost coronavirus testing and tracing in order to safely reopen schools to all pupils without imposing further restrictions on businesses or social lives. Johnson said it is the "national priority" to get children back in class in England next month, but he has been warned by scientific advisers that "trade-offs" may be necessary to keep transmission down. Teachers, scientists, opposition politicians and the children's commissioner for England Anne Longfield have all called for improvements to testing before pupils return. Longfield welcomed Johnson's commitment to make children the priority after previously accusing ministers of treating them as "an afterthought". But she said regular testing of pupils and teachers, perhaps as frequently as weekly, could be needed even if they do not exhibit symptoms to keep transmission rates down.

----------

China has sanctioned 11 Americans, including senators Marco Rubio and Ted Cruz, in retaliation for similar US moves against Chinese officials over Beijing's crackdown in Hong Kong. "China has decided to impose sanctions on some people that behaved badly on Hong Kong-related issues," foreign ministry spokesman Zhao Lijian said Monday, with Human Rights Watch director Kenneth Roth and National Endowment for Democracy president Carl Gershman also on the list. Washington had announced on Friday it was freezing the US assets of Hong Kong Chief Executive Carrie Lam and 10 other senior Chinese officials, in the toughest US action on Hong Kong since China imposed a sweeping new security law on the territory. It accused Lam and the other sanctioned officials of being "directly responsible for implementing Beijing's policies of suppression of freedom and democratic processes."

----------

China's consumer inflation edged up in July, official data showed Monday, partly because of rising food prices from flood-related disruptions and as the country recovers from the coronavirus outbreak. The consumer price index, a key gauge of retail inflation, had been pushed up over the past year by livestock prices after China's pig herds were ravaged by African swine fever, with the Covid-19 outbreak later hitting supply chains. Consumer inflation has been easing since January but ticked up again in recent months, with the CPI hitting 2.7% last month, according to the National Bureau of Statistics, slightly better than forecasts in a Bloomberg News poll of analysts. NBS senior statistician Dong Lijuan said Monday that food prices rose 13% from a year ago, nudging the CPI up – with pork prices climbing 86%. "With the gradual recovery of catering services, demand for pork continued to increase," said Dong, adding that this was accompanied by floods in many areas across the country, which hit the transportation of live pigs.

----------

Hong Kong pro-democracy media mogul Jimmy Lai was arrested under a new national security law Monday and police raided his newspaper offices in a deepening crackdown on dissent in the restless Chinese city. Lai was among seven arrested in an operation focused on his Next Media publishing group, the latest to target dissidents since Beijing imposed the sweeping law on Hong Kong at the end of June, sending a political chill through the semi-autonomous city. "They arrested him at his house at about 7am," Mark Simon, a close aide of Lai's, told AFP, adding that the six other colleagues had also been arrested. In a statement, police said seven people were detained on suspicion of colluding with foreign forces - one of the new national security offences - and fraud. Journalists working at Lai's Apple Daily newspaper took to Facebook to broadcast dramatic images of police officers conducting the raid.

----------

The US on Sunday reached the extraordinary milestone of five million coronavirus cases as President Donald Trump was accused of flouting the constitution by unilaterally extending a virus relief package. The US has been hammered by the Covid-19 pandemic, recording nearly 163,000 deaths - by far the highest of any country, ahead only of Brazil, which on Saturday became the second country to pass 100,000 deaths. In Washington, the new virus relief package - announced by Trump on Saturday after talks between Republican and Democrat lawmakers hit a wall - was "absurdly unconstitutional," senior Democrat Nancy Pelosi told CNN. Fellow Democrat and Senate minority leader Chuck Schumer, appearing on ABC, dismissed Trump's unilateral measures as "unworkable, weak and far too narrow." The four executive orders Trump signed Saturday at his golf club in Bedminster, New Jersey will, among other things, defer payroll taxes and provide some temporary unemployment benefits. The president was seen as keen to show himself taking decisive action ahead of a November 3 election that could see him ousted from office, with polls showing a large majority of voters unhappy with his handling of the crisis. On Sunday night, Trump blamed what he called Democratic stubbornness for his being forced to take executive action.

----------

Copyright 2020 Alliance News Limited. All Rights Reserved.

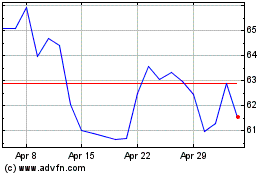

Apollo Global Management (NYSE:APO-A)

Historical Stock Chart

From Jun 2024 to Jul 2024

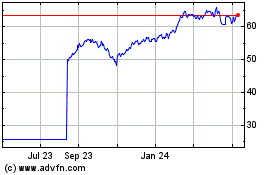

Apollo Global Management (NYSE:APO-A)

Historical Stock Chart

From Jul 2023 to Jul 2024