Current Report Filing (8-k)

September 12 2022 - 5:10PM

Edgar (US Regulatory)

0001477845

false

0001477845

2022-09-09

2022-09-09

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported):

September 9, 2022

ANNOVIS BIO, INC.

(Exact Name of Registrant as Specified in Charter)

| |

|

|

| Delaware |

001-39202 |

26-2540421 |

|

(State or Other Jurisdiction

of Incorporation) |

(Commission

File Number) |

(I.R.S. Employer

Identification No.) |

1055 Westlakes Drive, Suite 300

Berwyn, PA 19312

(Address of Principal Executive Offices, and

Zip Code)

(610) 727-3913

Registrant’s Telephone Number, Including

Area Code

Not

Applicable

(Former Name or Former Address, if Changed Since

Last Report)

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

Trading Symbol(s) |

Name

of each exchange on which

registered |

| Common Stock, par value $0.0001 per share |

ANVS |

New York Stock Exchange |

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2. below):

| |

¨ |

Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

¨ |

Pre-commencement communication pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communication pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company x

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period

for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

| Item 5.02 |

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers |

On August 29, 2022, Annovis Bio, Inc. (the “Company”)

previously reported on a Current Report on Form 8-K filed with the Securities and Exchange Commission (“SEC”), that

Jeffrey B. McGroarty, formerly Chief Financial Officer, Treasurer and Corporate Secretary of the Company, was stepping down from his role

to pursue other opportunities. As previously reported, Mr. McGroarty was succeeded as Chief Financial Officer of the Company by Henry

Hagopian III. Mr. McGroarty remained an employee of the Company through September 9, 2022 (the “Separation Date”).

In connection with Mr. McGroarty’s departure

from the Company, the Company and Mr. McGroarty have entered into a Separation Agreement and General Release (the “Separation

Agreement”), dated as of the Separation Date, pursuant to which the Company and Mr. McGroarty have agreed upon the terms of

Mr. McGroarty’s separation from the Company. Pursuant to the Separation Agreement, Mr. McGroarty has agreed to comply

with certain non-solicitation and cooperation provisions. The Separation Agreement also provides for a customary general release

of claims and the following severance benefits, as set forth in the Company’s Executive Severance Plan, a copy of which is filed

as Exhibit 10.3 to the Company’s Quarterly Report on Form 10-Q with the SEC on February 7, 2017 (the “Separation

Benefits”):

| |

• |

three (3) months of Mr. McGroarty’s base salary, less applicable taxes and withholding, payable in equal installments over a three (3) month period following the Separation Date; |

| |

• |

until the earlier of (i) three (3) month period following the Separation Date and (ii) the date on which Mr. McGroarty becomes eligible for group health benefits from another employer, the Company will reimburse Mr. McGroarty for the same portion of the monthly premium for Mr. McGroarty’s participation in the Company’s group health coverage; and |

| |

• |

the Company will amend all of Mr. McGroarty’s outstanding stock option agreements to extend the exercise period to two (2) years after the Separation Date. |

To be entitled to the

Separation Benefits, Mr. McGroarty must: (a) not revoke the Separation Agreement within the seven (7) day revocation period

following the date he signed the Separation Agreement; and (b) comply with his obligations under the Separation Agreement.

The foregoing summary

of the Separation Agreement is qualified in its entirety by the text of the Separation Agreement, a copy of which is attached hereto to

as Exhibit 10.1.

| Item 9.01 |

Financial Statements and Exhibits |

The Company hereby files or furnishes, as

applicable, the following exhibits:

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

ANNOVIS BIO, INC. |

| |

|

|

| Date: September 12, 2022 |

By: |

/s/ Maria Maccecchini |

| |

|

Name: Maria Maccecchini |

| |

|

Title: President and Chief Executive Officer |

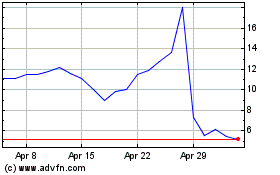

Annovis Bio (NYSE:ANVS)

Historical Stock Chart

From Jun 2024 to Jul 2024

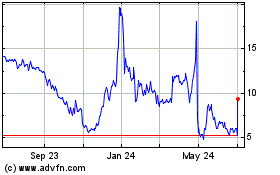

Annovis Bio (NYSE:ANVS)

Historical Stock Chart

From Jul 2023 to Jul 2024