Current Report Filing (8-k)

September 23 2020 - 4:43PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September

22, 2020

|

AMREP CORPORATION

|

|

(Exact name of registrant as specified in its charter)

|

|

Oklahoma

|

1-4702

|

59-0936128

|

|

(State or other jurisdiction of

|

(Commission File

|

(IRS Employer

|

|

incorporation)

|

Number)

|

Identification No.)

|

|

620 West Germantown Pike, Suite 175

Plymouth Meeting, PA

|

19462

|

|

(Address of principal executive offices)

|

(Zip Code)

|

Registrant's telephone number, including

area code: (610) 487-0905

|

|

|

(Former name or former address, if changed since last report)

|

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2. below):

|

|

¨

|

Written

communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

¨

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

¨

|

Pre-commencement

communication pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

¨

|

Pre-commencement

communication pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock $.10 par value

|

AXR

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange

Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 1.01 Entry into a Material Definitive Agreement.

On September 22, 2020, Lomas Encantadas

Development Company LLC (“LEDC”), a subsidiary of the Company, entered into a Development Loan Agreement with BOKF,

NA dba Bank of Albuquerque (“BOKF”). The Development Loan Agreement is evidenced by a Non-Revolving Line of Credit

Promissory Note and is secured by a Mortgage, Security Agreement and Financing Statement, between LEDC and BOKF with respect to

certain planned residential lots within the Lomas Encantadas subdivision located in Rio Rancho, New Mexico. Pursuant to a Guaranty

Agreement entered into by AMREP Southwest Inc. (“ASW”), a subsidiary of the Company, in favor of BOKF, ASW guaranteed

LEDC’s obligations under each of the above agreements.

|

|

o

|

Initial Available Principal: Pursuant to the loan documentation, BOKF agrees to lend up

to $2,400,000 to LEDC on a non-revolving line of credit basis to partially fund the development of certain planned residential

lots within the Lomas Encantadas subdivision.

|

|

|

o

|

Repayments: LEDC is required to make periodic principal repayments of borrowed funds not

previously repaid as follows: $1,144,000 on or before December 22, 2022, $572,000 on or before March 22, 2023, $572,000 on or before

June 22, 2023 and $112,000 on or before September 22, 2023. The outstanding principal amount of the loan may be prepaid at any

time without penalty.

|

|

|

o

|

Maturity Date: The loan is scheduled to mature in September 2023.

|

|

|

o

|

Interest Rate: Interest on the outstanding principal amount of the loan is payable monthly

at the annual rate equal to the London Interbank Offered Rate for a thirty-day interest period plus a spread of 3.0%, adjusted

monthly, subject to a minimum interest rate of 3.75%.

|

|

|

o

|

Lot Release Price: BOKF is required to release the lien of its mortgage on any lot upon

LEDC making a principal payment of $44,000.

|

LEDC and ASW made certain representations

and warranties in connection with this loan and are required to comply with various covenants, reporting requirements and other

customary requirements for similar loans. The loan documentation contains customary events of default for similar financing transactions,

including LEDC’s failure to make principal, interest or other payments when due; the failure of LEDC or ASW to observe or

perform their respective covenants under the loan documentation; the representations and warranties of LEDC or ASW being false; the

insolvency or bankruptcy of LEDC or ASW; and the failure of ASW to maintain a net worth of at least $32 million. Upon the

occurrence and during the continuance of an event of default, BOKF may declare the outstanding principal amount and all other obligations

under the loan immediately due and payable. LEDC incurred customary costs and expenses and paid certain fees to BOKF in connection

with the loan.

The foregoing description of the loan documentation

is a summary only and is qualified in all respects by the provisions of the loan documentation; copies of the Development Loan

Agreement, Non-Revolving Line of Credit Promissory Note, Mortgage, Security Agreement and Financing Statement, Guaranty Agreement

are attached hereto as Exhibits 10.1 through 10.4 and are incorporated herein by reference.

Item 2.03 Creation of a Direct Financial Obligation or an

Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The information in Item 1.01 of this Current

Report on Form 8-K is incorporated by reference into this Item 2.03.

Item 9.01 Financial

Statements and Exhibits.

(d) Exhibits.

|

Exhibit Number

|

Description

|

|

10.1

|

Development Loan Agreement, dated as of September 22, 2020, between BOKF, NA dba Bank of Albuquerque and Lomas Encantadas Development Company, LLC.

|

|

10.2

|

Non-Revolving Line of Credit Promissory Note, dated September 22, 2020, by Lomas Encantadas Development Company, LLC in favor of BOKF, NA dba Bank of Albuquerque.

|

|

10.3

|

Mortgage, Security Agreement and Financing Statement, dated as of September 22, 2020, between BOKF, NA dba Bank of Albuquerque and Lomas Encantadas Development Company, LLC.

|

|

10.4

|

Guaranty Agreement, dated as of September 22, 2020, made by AMREP Southwest Inc. for the benefit of BOKF, NA dba Bank of Albuquerque.

|

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

AMREP Corporation

|

|

|

|

|

|

Date: September 23, 2020

|

By:

|

/s/ Christopher

V. Vitale

|

|

|

|

Name: Christopher V. Vitale

|

|

|

|

Title: President and Chief Executive Officer

|

EXHIBIT INDEX

|

Exhibit Number

|

Description

|

|

10.1

|

Development Loan Agreement, dated as of September 22, 2020, between BOKF, NA dba Bank of Albuquerque and Lomas Encantadas Development Company, LLC.

|

|

10.2

|

Non-Revolving Line of Credit Promissory Note, dated September 22, 2020, by Lomas Encantadas Development Company, LLC in favor of BOKF, NA dba Bank of Albuquerque.

|

|

10.3

|

Mortgage, Security Agreement and Financing Statement, dated as of September 22, 2020, between BOKF, NA dba Bank of Albuquerque and Lomas Encantadas Development Company, LLC.

|

|

10.4

|

Guaranty Agreement, dated as of September 22, 2020, made by AMREP Southwest Inc. for the benefit of BOKF, NA dba Bank of Albuquerque.

|

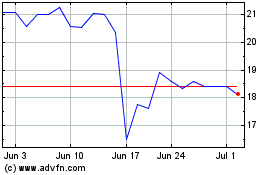

AMREP (NYSE:AXR)

Historical Stock Chart

From Oct 2024 to Nov 2024

AMREP (NYSE:AXR)

Historical Stock Chart

From Nov 2023 to Nov 2024