Earnings Preview: Leap Wireless - Analyst Blog

November 05 2012 - 11:20AM

Zacks

Leap Wireless International

Inc. (LEAP) is slated to release its third-quarter 2012

financial results on Wednesday, November 7, before the opening

bell. The Zacks Consensus Estimate for the quarter is pegged at a

loss of 76 cents, representing an annualized growth of 15.32%.

With respect to earnings surprises,

Leap Wireless has underperformed the Zacks Consensus Estimate in

three of the last four quarters with an average of negative

10.32%.

Second Quarter

Recap

On August 6, Time Warner reported

its second-quarter 2012 financial results. GAAP net loss, in the

second quarter of 2012, was $41.6 million or a loss of $0.54 per

share compared with $65.2 million or $0.85 per share in the

prior-year quarter. Quarterly earnings per share of a loss of $0.54

were higher than the Zacks Consensus Estimate of a loss of

$0.52.

Quarterly total revenue was $786.8

million, up 3.5% year over year, but well below the Zacks Consensus

Estimate of $839 million. In the second quarter of 2012, operating

loss was $31.6 million compared with $12.3 million in the

prior-year quarter. Quarterly adjusted OIBDA was $190.8 million, up

18.8% year over year.

Agreement of Estimate

Revisions

In the last 30 days, out of the

total 19 estimates, three were revised upward while two moved in

the opposite direction for the third quarter of 2012. However, for

the fourth quarter of 2012, out of the total 18 estimates, only one

upward revision was witnessed, while three moved downward over the

same time frame.

For 2012, out of the total 18

estimates, two were revised upward while three witnessed downward

revisions, over the past one month. The upward estimate revision

continues for 2013, where out of the 19 estimates, four were

revised upward, while one moved in the opposite direction over the

same period.

Magnitude of Estimate

Revisions

Over the last 30 days, the current

Zacks Consensus Estimate has remained unchanged for the third

quarter of 2012 while it decreased by a penny to a loss of $1.22

for the fourth quarter of 2012. Alike the fourth quarter, the

current Zacks Consensus Estimate also fell by a penny for 2012 over

the last 30 days, while the estimate decreased by 4 cents to $3.07

for 2013 over the same time frame.

Our

Recommendation

Leap Wireless remains one of the

low-cost prepaid wireless service providers in the U.S, and offers

a range of cheap service plans including its popular Muve Music

service thus enabling the company to attract young customers. The

company is focusing on upgrading its existing customers by selling

Android-based smartphones, which in turn, will not only drive the

company’s top-line sales but also contribute to customer retention

as well as customer additions.

However, the major concern for Leap

Wireless is the growing competition in the U.S. low-cost prepaid

wireless phone market. Traditionally, the company competes with the

likes of MetroPCS Communications Inc. (PCS), Boost

Mobile, the prepaid subsidiary of Sprint Nextel

Corp. (S) and Tracfone – the prepaid subsidiary of

America Movil S.A.B. (AMX). Recently, the two

largest nationwide carriers, viz., Verizon Communications

Inc. (VZ) and AT&T Inc. (T) entered

the wireless prepaid phone market after the growth rate of

lucrative postpaid wireless market subdued.

We maintain our long-term Neutral

recommendation on Leap Wireless International Inc. (LEAP).

Currently, the company retains a Zacks #3 Rank, implying a

short-term Hold rating.

AMER MOVIL-ADR (AMX): Free Stock Analysis Report

LEAP WIRELESS (LEAP): Free Stock Analysis Report

METROPCS COMMUN (PCS): Free Stock Analysis Report

SPRINT NEXTEL (S): Free Stock Analysis Report

AT&T INC (T): Free Stock Analysis Report

VERIZON COMM (VZ): Free Stock Analysis Report

To read this article on Zacks.com click here.

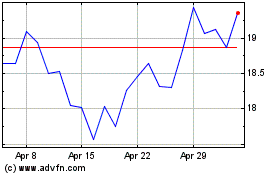

America Movil SAB de CV (NYSE:AMX)

Historical Stock Chart

From May 2024 to Jun 2024

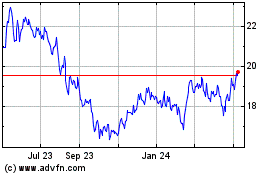

America Movil SAB de CV (NYSE:AMX)

Historical Stock Chart

From Jun 2023 to Jun 2024