Pay-TV Surge Boosts Televisa Profit - Analyst Blog

October 30 2012 - 8:30AM

Zacks

Driven by strong growth of its

pay-TV services, Grupo Televisa S.A.B. (TV)

handily beats the Zacks Consensus Estimates in the third quarter of

2012. Quarterly consolidated net income was approximately $222

million, up by a considerable 41.5% year over year. The annualized

upsurge primarily resulted from an increase in the top line and a

significant reduction of financing costs. Third-quarter earnings

per Global Depository Shares were 39 cents, well above the Zacks

Consensus Estimate of 33 cents.

Quarterly consolidated net revenue

of around $1,347 million was an improvement of 8.7% over the

prior-year quarter and exactly in line with the Zacks Consensus

Estimate. Except the Other business segment, all the remaining four

business segments of Grupo Televisa witnessed considerable sales

growth.

Quarterly gross margin was 58.3%

compared with 56.7% in the year-ago quarter. Third-quarter

consolidated operating income was $377.4 million, up 8.6% over the

prior-year quarter. Quarterly operating margin was 28% compared

with 28.1% in the year-ago quarter.

Capital expenditure, during the

reported quarter, was $228.2 million. At the end of the third

quarter of 2012, Televisa had a little over $1,675 million in cash

and marketable securities compared with $1,549.9 million at the end

of 2011. At the end of the reported quarter, Televisa had $4,113.9

million of outstanding debt on its balance sheet compared with

$4,059.1 million at the end of 2011. At the end of the previous

quarter, debt-to-capitalization ratio was around 0.45 compared with

0.49 at the end of 2011.

Content

Segment

Quarterly total revenue was $648

million, up 4.4% year over year. Operating profit was $328 million,

up 5.6% year over year. Quarterly operating margin was 50.6%

compared with 50% in the year-ago quarter. Royalty from Univision

was $62 million, up 6.5% year over year.

Within this segment, Advertising

revenue was $474.9 million, up 1% year over year. Network

Subscription revenue was $63.8 million, up 22.2% year over year.

Licensing and Syndication revenue was $109.3 million, up 11.3% year

over year.

Publishing

Segment

Quarterly revenue was $64.3

million, up 16.7% year over year. Operating profit was $9.6

million, up 1% year over year. Quarterly operating margin was 14.9%

compared with 15.1% in the year-ago quarter.

Sky Segment

Quarterly revenue came in at $288.9

million, up 18.9% year over year. Operating profit was $133

million, up 17.6% year over year. Quarterly operating margin was

46% compared with 46.5% in the year-ago quarter.

Cable and Telecom

Segment

Quarterly revenue was $301.9

million, up 14.6% year over year. Operating profit was $111

million, up 19% year over year. Quarterly operating margin came in

at 36.8% compared with 35.4% in the year-ago quarter.

Other Businesses

Segment

Quarterly revenue was $71.4

million, down 4.4% year over year. Operating income was $0.9

million compared with an operating loss of $0.5 million in the

year-ago quarter. Quarterly operating margin was 1.3% compared with

a negative 0.7% in the year-ago quarter.

Subscriber

Statistics

As of September 30, 2012, Televisa

had 2,263,631 Video subscribers; 1,249,377 Internet Broadband

subscribers; and 729,982 Telephony subscribers, which together

constitutes 4,242,990 revenue generating units (RGU) in the Cable

and Telecom segment. As of September 30, 2012, Televisa had

4,883,388 net active Satellite TV subscribers including 161,484

commercial subscribers. These figures were up 27.7% and 3.8% year

over year, respectively. In the reported quarter, Sky segment

generated a record-high 332,693 net active subscribers.

Our

Recommendation

Televisa is on the verge of

entering into the lucrative Mexican wireless market through its

partnership with Grupo Iusacell. Mexican wireless market is highly

monopolistic. Telcel, a unit of America Movil SAB

(AMX), controls over 70% of the market, Telefonica

SA (TEF) controls more than 22%, and Iusacell controls

hardly 5% of market share. Undoubtedly, a foothold in the lucrative

wireless market will make Televisa a highly integrated broadcasting

and telecom operator in Mexico.

We maintain our long-term Neutral

recommendation on Televisa. Currently, it holds a short-term Zacks

#3 Rank (Hold) on the stock.

AMER MOVIL-ADR (AMX): Free Stock Analysis Report

TELEFONICA S.A. (TEF): Free Stock Analysis Report

GRUPO TELEVISA (TV): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

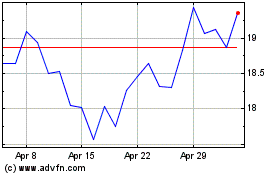

America Movil SAB de CV (NYSE:AMX)

Historical Stock Chart

From May 2024 to Jun 2024

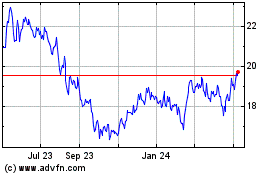

America Movil SAB de CV (NYSE:AMX)

Historical Stock Chart

From Jun 2023 to Jun 2024