AMX Unveils Argentina Investment - Analyst Blog

July 03 2012 - 12:09PM

Zacks

Mexican Telecom giant America Movil S.A. de

C.V.’s (AMX) subsidiary Claro has unveiled its plan to

invest $249 million in Argentina in 2012 to build additional cell

sites and extend its fiber-optic connections across the country.

The new investment is in addition to the previously declared $1

billion of investment in fiscal 2012.

"Cell site" is a term used to describe a site where antennas and

other communication related equipments are placed, usually on

towers to create a cell in the existing cellular networks. The

additional investment would enable the company to build 150 cell

sites in excess of its initial planning, which in turn would

increase the number of cell sites to be built during the year to

450.

Claro, the largest mobile operator in Argentina with a customer

base of almost 20 million, faces stiff competition from

Telecom Argentina SA (TEO) and Telefonica

SA (TEF). The Mexican company is extending its fiber-optic

cable network in different parts of Argentina to extend its retail

broadband access service which could partially offset its weak

landline business.

Argentina possesses one of the highest mobile ownership rates in

the world which stands at 142 mobile phones for every 100 residents

and handily beats its American counterparts Brazil and the U.S.

According to research firm IDC, the smartphone market is expected

to grow at a CAGR of 12.7% from 2012–2016, which could increase the

ownership rate even further.

To sustain this increasing adaptation of smartphone the company

has recently launched 4G services, which is the first of its kind

in Argentina and offers a speed of up to 5MB per second. It is

believed that to support the increased demand of data traffic from

smartphone users, the company is expanding its cell sites which

when completed will put the number of cell sites connected by

fiber-optic cable to more than 1400.

The current Zacks Consensus Estimates for America Movil is

pegged at $1.04 for the second quarter with a growth rate estimate

of (53.97%). For 2012 and 2013, the Zacks Consensus Estimates

stands at $2.22 and $2.08 with growth rate of (6.14%) and 4.67%,

respectively.

Recommendation

We, maintain our long-term Neutral recommendation for America

Movil S.A.B. de C.V. Currently, AMX has a Zacks #3 Rank, implying a

short-term Hold rating on the stock.

AMER MOVIL-ADR (AMX): Free Stock Analysis Report

TELEFONICA S.A. (TEF): Free Stock Analysis Report

TELECOM ARGENTI (TEO): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

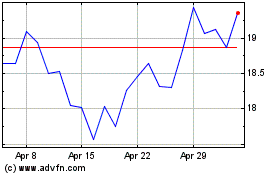

America Movil SAB de CV (NYSE:AMX)

Historical Stock Chart

From May 2024 to Jun 2024

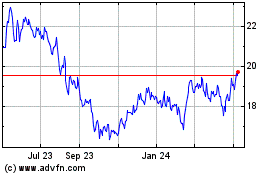

America Movil SAB de CV (NYSE:AMX)

Historical Stock Chart

From Jun 2023 to Jun 2024