Televisa Back in Wireless Domain - Analyst Blog

June 19 2012 - 4:30AM

Zacks

Grupo Televisa

S.A. (TV), the largest media company in the Spanish

speaking world, is finally on the verge of entering into the

lucrative Mexican wireless market. Recently, the company won

conditional approval from the Mexican regulator CoFeCo (CFC) to

acquire 50% stake of Grupo Iusacell, a small wireless operator of

Mexico.

Yesterday, in a filing with the

Mexican stock exchange, Televisa declared that the company accepted

all the conditions imposed by CFC and thereby converted its $1.6

billion investment in the low-interest bearing notes of GSF Telecom

Holdings, the holding company of Grupo Iusacell, into 50% shares of

it.

CFC was initially reluctant about

this merger. The main concern of CFC was that although

Televisa-Iusacell venture will create a formidable player in the

highly concentrated Mexican wireless market, the merger will indeed

create a virtual monopoly in the Mexican TV market. WhileTelevisa

controls 70% share of the Mexican pay-TV and satellite TV market,

Grupo Iusacell is a part of Grupo Salinas, which also controls TV

Azteca, the second largest pay-TV operator in Mexico. In fact,

these two entities control approximately 100% of the Mexican TV

broadcasting market together.

To solve the monopolistic

concentration, CFC imposed several restrictive conditions on the

Televisa-Iusacell merger including (1) the deal will depend on the

success of the proposed government auction of the TV frequency. The

Mexican government wants at least a new TV broadcaster in addition

to incumbent Televisa and TV Azteca (2) both Televisa and TV Azteca

should refrain from forcing any TV advertiser to become a Iusacell

client (3) Televisa must offer new pay TV package that includes all

four of its free public channels for which the company currently

charges a fee to cable operators and (4) Televisa must offer the

sale of advertising time to all incumbent telecom operators.

The situation is just the opposite

in the wireless market. Here, Telcel, a unit of America

Movil S.A.B. (AMX), controls over 70% of the market,

Telefonica S.A. (TEF) controls more than 22%, and

Iusacell controls hardly 5% of market share. Interestingly,

Iusacell has an existing agreement with Telefonica for network

sharing in order to improve both the entities coverage and service

quality.

Televisa currently holds four

free-to-air broadcast channels, the largest of the two satellite TV

channels, and three cable units offering triple-play TV, phone and

Internet services. Undoubtedly, a foothold in the lucrative

wireless market will make it a complete and powerful telecom

operator in Mexico.

AMER MOVIL-ADR (AMX): Free Stock Analysis Report

TELEFONICA S.A. (TEF): Free Stock Analysis Report

GRUPO TELEVISA (TV): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

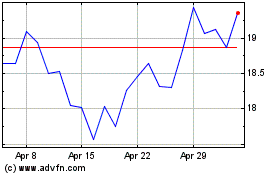

America Movil SAB de CV (NYSE:AMX)

Historical Stock Chart

From Jun 2024 to Jul 2024

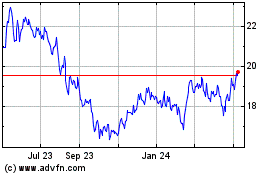

America Movil SAB de CV (NYSE:AMX)

Historical Stock Chart

From Jul 2023 to Jul 2024