Telefonica to Exit Chinese Assets - Analyst Blog

June 11 2012 - 9:30AM

Zacks

Spanish telecom giant Telefonica S.

A. (TEF) plans to sell almost half (4.56%) of its stake in

China's second largest mobile operator China

Unicom (CHU).

Telefonica will sell 1.1 billion shares for a total of €1.13

billion ($1.4 billion). The transaction, awaiting approval from

antitrust regulators, is expected to complete by the end of next

month. Following the sale, the company will retain a 5.01% stake in

China Unicom.

The divestiture is a part of the company’s efforts to increase

its financial flexibility. Telefonica operates with a high debt

level of €57.1 billion as of March 2012 versus €56.3 billion at the

end of 2011 and €55.6 billion at the end of 2010. In addition, the

company was compelled to plan such a move after Standard and Poor

downgraded its credit rating last month. The company is also facing

the threat of a Moody’s downgrade if its debt position does not

recover.

According to a Bloomberg report, Telefonica’s market share has

plunged about €50 billion over the last 18 months. Telefonica is

underperforming in its home market and woes are getting deeper with

the unresolved Euro-zone crisis. Additionally, Telefonica is

exposed to increased churn rates (customer switch) and lower

Spanish revenue due to the ongoing reduction in MTRs, which is the

fee that operators charge each other to connect calls.

Further, growing competition from France Telecom

S.A. (FTE), Vodafone Group Plc (VOD),

China Mobile Ltd. (CHL) and

America Movil S.A.B. de C.V. (AMX) added to its

concerns.

Apart from divesting its Chinese assets, Telefonica is taking

various efforts to reduce its debt. Late last month, the company

announced its intention to sell its stake in its German unit, O2

Germany, through public share offerings, for €9 billion.

Additionally, the company is looking to sell some assets in Latin

America through public offerings. Latin American operations include

the two largest markets Mexico and Brazil, which are healthy

contributors to the company’s revenue and earnings.

Besides, Telefonica is restructuring its Colombian business and

announced the sale of a 13.23% stake in satellite operator Hispasat

SA in February this year.

We believe this asset-light model would strengthen the company’s

balance sheet by trimming its debt. These would lead to a €1.5

billion debt reduction this year, which will be 2.35 times of OIBDA

compared with 2.63 times at the end of 2011. Such actions will also

help in winning back investor confidence and would uplift

shareholder returns in the future.

We are maintaining our long-term Neutral rating on Telefonica.

But for the short term (1–3 months), the stock retains a Zacks #4

(Sell) Rank.

AMER MOVIL-ADR (AMX): Free Stock Analysis Report

CHINA MOBLE-ADR (CHL): Free Stock Analysis Report

CHINA UNICOM (CHU): Free Stock Analysis Report

FRANCE TELE-ADR (FTE): Free Stock Analysis Report

TELEFONICA S.A. (TEF): Free Stock Analysis Report

VODAFONE GP PLC (VOD): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

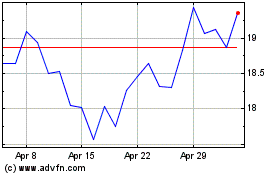

America Movil SAB de CV (NYSE:AMX)

Historical Stock Chart

From Jun 2024 to Jul 2024

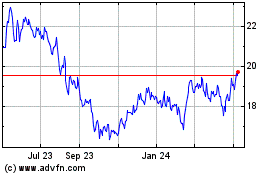

America Movil SAB de CV (NYSE:AMX)

Historical Stock Chart

From Jul 2023 to Jul 2024