ALLETE, Inc. (NYSE:ALE) today reported first quarter 2015

earnings of 85 cents per share on net income of $39.9 million and

operating revenue of $320.0 million, compared to first quarter 2014

earnings of 80 cents per share on net income of $33.5 million and

operating revenue of $296.5 million. Included in this year’s

quarterly results were transaction fees of $3.0 million after-tax,

or six cents per share, related to the acquisition of U.S. Water

Services. The first quarter of 2014 included transaction fees of

$1.4 million after-tax, or three cents per share, for the ALLETE

Clean Energy acquisition of three wind facilities.

“These strong financial results continue the earnings momentum

we have had over the past few years,” said ALLETE Chairman,

President and CEO Al Hodnik. “Looking forward, we believe our

recent acquisitions of U.S. Water Services and by ALLETE Clean

Energy will complement our core regulated utility, balance exposure

to business cycles and changing demand, and provide long-term

earnings growth.”

ALLETE’s Regulated Operations segment, which includes

Minnesota Power, Superior Water, Light and Power and the company’s

investment in the American Transmission Co., recorded net income of

$41.4 million, an increase of $7.5 million over the first quarter

of 2014. Total regulated utility sales increased 7.4 percent from

the first quarter a year ago, primarily due to the commencement of

the Minnkota Power sales agreement in June of 2014. Increases in

cost recovery rider revenue and production tax credits were

partially offset by increased depreciation and interest

expense.

The Investments and Other segment, which includes the

newly-acquired U.S. Water Services, ALLETE Clean Energy and BNI

Coal, recorded a net loss of $1.5 million, which included the $3.0

million after-tax U.S. Water Services transaction fees. Net income

at ALLETE Clean Energy increased from last year due to a full

quarter of operations in 2015 from acquisitions it made last year.

Last year’s results also included the aforementioned ACE

transaction fees of $1.4 million after-tax.

First quarter 2015 earnings also included 11 cents of dilution

due to additional shares of common stock outstanding as of

March 31, 2015. The additional shares were primarily used to

finance construction and acquisition activity.

Financial results were in line with Company expectations, and

ALLETE’s full-year earnings guidance range of $3.00 to $3.20 per

share, excluding transaction fees, remains unchanged. More details

about earnings guidance for the year will be discussed in our

conference call scheduled for today.

ALLETE Chairman, Chief Executive Officer and President Alan R.

Hodnik and Chief Financial Officer Steven Q. DeVinck will present

an overview of results and discuss other factors affecting

performance during a conference call beginning today at 10 a.m.

Eastern time.

Interested parties may listen to the conference live by calling

(877) 303-5852, or by accessing the webcast on ALLETE’s Web site,

www.allete.com. A replay of the call

will be available through May 9, 2015 by dialing (855) 859-2056,

pass code 22647307. The webcast will be accessible for one year at

www.allete.com.

ALLETE is an energy company headquartered in Duluth, Minn. In

addition to its electric utilities, Minnesota Power and Superior

Water, Light and Power of Wisconsin, ALLETE owns BNI Coal in

Center, N.D., ALLETE Clean Energy, based in Duluth, U.S. Water

Services headquartered in St. Michael, Minn. and has an eight

percent equity interest in the American Transmission Co. More

information about ALLETE is available at www.allete.com.

The statements contained in this release and statements that

ALLETE may make orally in connection with this release that are not

historical facts, are forward-looking statements. Actual results

may differ materially from those projected in the forward-looking

statements. These forward-looking statements involve risks and

uncertainties and investors are directed to the risks discussed in

documents filed by ALLETE with the Securities and Exchange

Commission.

ALLETE's press releases and other communications may include

certain non-Generally Accepted Accounting Principles (GAAP)

financial measures. A "non-GAAP financial measure" is defined as a

numerical measure of a company's financial performance, financial

position or cash flows that excludes (or includes) amounts that are

included in (or excluded from) the most directly comparable measure

calculated and presented in accordance with GAAP in the company's

financial statements

Non-GAAP financial measures utilized by the Company include

presentations of earnings (loss) per share. ALLETE's management

believes that these non-GAAP financial measures provide useful

information to investors by removing the effect of variances in

GAAP reported results of operations that are not indicative of

changes in the fundamental earnings power of the Company's

operations. Management believes that the presentation of the

non-GAAP financial measures is appropriate and enables investors

and analysts to more accurately compare the company's ongoing

financial performance over the periods presented.

ALLETE, Inc.

Consolidated Statement of

Income

Millions Except Per Share Amounts -

Unaudited

Three Months Ended March 31,

2015 2014 Operating Revenue

$ 320.0 $ 296.5

Operating

Expenses Fuel and Purchased Power 86.0 96.2 Transmission

Services 14.9 10.8 Cost of Sales 31.2 23.5 Operating and

Maintenance 79.7 74.3 Depreciation and Amortization 39.0 32.2 Taxes

Other than Income Taxes 12.8

11.2 Total Operating Expenses 263.6 248.2

Operating

Income 56.4 48.3

Other Income (Expense) Interest Expense (15.1 ) (12.8 )

Equity Earnings in ATC 3.9 5.1 Other 1.1

2.0 Total Other Expense (10.1 )

(5.7 )

Income Before Non-Controlling Interest and

Income Taxes 46.3 42.6

Income Tax Expense

6.2 8.8

Net Income

40.1 33.8 Less: Non-Controlling

Interest in Subsidiaries 0.2 0.3

Net Income Attributable to ALLETE $ 39.9

$ 33.5

Average Shares of Common Stock

Basic 46.9 41.4 Diluted 47.1

41.6

Basic Earnings Per Share of Common Stock $ 0.85

$ 0.81

Diluted Earnings Per Share of Common Stock $ 0.85 $

0.80

Dividends Per Share of Common Stock $ 0.505

$ 0.49

Consolidated Balance Sheet

Millions - Unaudited

Mar. 31, Dec. 31,

Mar. 31, Dec. 31, 2015

2014 2015 2014

Assets Liabilities and Shareholders’ Equity Cash and

Cash Equivalents $72.1 $145.8 Current Liabilities $402.0 $416.0

Other Current Assets 317.9 273.0 Long-Term Debt 1,253.8 1,272.8

Property, Plant and Equipment - Net 3,319.2 3,284.8 Deferred Income

Taxes 559.5 510.7 Regulatory Assets 358.0 357.3 Regulatory

Liabilities 101.2 94.2 Investment in ATC 122.3 121.1 Defined

Benefit Pension & Other 190.4 190.9 Other Investments 114.7

114.4 Other Non-Current Liabilities 302.3 265.0 Goodwill and

Intangibles - Net 214.3 4.8 Shareholders’ Equity 1,770.9 1,611.2

Other Non-Current Assets 61.6 59.6

Total Assets $4,580.1

$4,360.8

Total Liabilities and Shareholders’

Equity $4,580.1 $4,360.8

Three Months

Ended ALLETE, Inc. March 31, Income (Loss)

2015 2014 Millions Regulated

Operations $ 41.4 $ 33.9 Investments and Other (1.5 )

(0.4 ) Net Income Attributable to ALLETE $

39.9 $ 33.5

Diluted Earnings Per Share

$ 0.85 $ 0.80

Statistical

Data Corporate Common Stock High $

59.73 $ 52.73 Low $ 51.16 $ 47.96 Close $ 52.76 $ 52.42 Book Value

$ 36.28 $ 33.11

Kilowatt-hours Sold

Millions Regulated Utility Retail and Municipals

Residential 356 398 Commercial 384 395 Municipals 233 242

Industrial 1,950 1,816

Total Retail and Municipal 2,923 2,851 Other Power Suppliers

891 700 Total Regulated Utility

3,814 3,551 Non-regulated Energy Operations 30

34 Total Kilowatt-hours Sold

3,844 3,585

Regulated Utility

Revenue Millions Regulated Utility

Revenue Retail and Municipals Residential $ 35.0 $ 39.9 Commercial

33.6 35.1 Municipals 16.0 16.5 Industrial 114.7

111.6 Total Retail and Municipals 199.3

203.1 Other Power Suppliers 33.7 29.5 Other 29.8

31.6 Total Regulated Utility Revenue

$ 262.8 $ 264.2

ALLETE, Inc.Investor Contacts:Tim Thorp,

218-723-3953tthorp@allete.comorVince Meyer,

218-723-3952vmeyer@allete.com

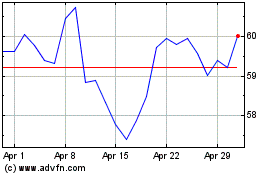

Allete (NYSE:ALE)

Historical Stock Chart

From May 2024 to Jun 2024

Allete (NYSE:ALE)

Historical Stock Chart

From Jun 2023 to Jun 2024