Full year earnings guidance is

reaffirmed

ALLETE, Inc. (NYSE:ALE) today reported second quarter 2014

earnings of 40 cents per share on net income of $16.8 million

compared to 35 cents per share on net income of $14.0 million

during the same period last year. Included in this quarter’s

results was a $2.5 million after-tax, or 6 cents per share,

non-recurring charge associated with a settlement agreement with

the Environmental Protection Agency (EPA).

Revenue for the second quarter of 2014 rose by 10.7 percent to

$260.7 million versus $235.6 million a year ago. This quarter’s

earnings per share included 2 cents per share of dilution due to an

increase in common shares year over year.

Net income at ALLETE’s Regulated Operations segment,

which includes Minnesota Power, Superior Water, Light and Power and

the company’s investment in the American Transmission Co., rose to

$17.5 million compared to $16.3 million in the same period of 2013,

despite the inclusion of the aforementioned non-recurring charge in

this quarter’s results. The net income increase was primarily due

to higher cost recovery revenue as a result of ongoing work on the

Boswell 4 environmental retrofit and Bison 4 wind energy projects.

Electric sales were similar to the second quarter of 2013, and

reflected continued strong demand from Minnesota Power’s industrial

customers.

The Investments and Other segment, which includes BNI

Coal, ALLETE Clean Energy, ALLETE Properties, and miscellaneous

corporate income and expense, reported a net loss of $0.7 million

for the quarter, an improvement of $1.6 million from the same

period in 2013. ALLETE Clean Energy posted a profit from its newly

acquired wind energy facilities in Minnesota, Iowa and Oregon.

Results at BNI Coal and ALLETE Properties were similar to the

second quarter of last year.

“Demand nominations we’ve just received indicate our taconite

customers will continue to operate at full demand levels through

the remainder of 2014,” said ALLETE Chairman, President and CEO Al

Hodnik. “We’re pleased to be on track with the earnings projections

we made earlier this year.” Hodnik said the 2014 full year earnings

guidance range remains unchanged at $2.75 to $2.95, excluding 3

cents per share of costs recorded in the first quarter associated

with an ALLETE Clean Energy acquisition, and this quarter’s

non-recurring 6 cents per share charge associated with the EPA

settlement.

The company will host a conference call and webcast at 10 a.m.

Eastern time today to discuss details of its quarterly performance.

Interested parties may listen live by calling (877) 303-5852, or by

accessing the webcast at www.allete.com. A replay of the call will

be available through August 3, 2014 by dialing (855) 859-2056, pass

code 72262344. The webcast will be accessible for one year at

www.allete.com.

ALLETE is an energy company headquartered in Duluth, Minn. In

addition to its electric utilities, Minnesota Power and Superior

Water, Light and Power of Wisconsin, ALLETE owns BNI Coal in

Center, N.D., ALLETE Clean Energy, based in Duluth, and has an

eight percent equity interest in the American Transmission Co. More

information about ALLETE is available at www.allete.com.

The statements contained in this release and statements that

ALLETE may make orally in connection with this release that are not

historical facts, are forward-looking statements. Actual results

may differ materially from those projected in the forward-looking

statements. These forward-looking statements involve risks and

uncertainties and investors are directed to the risks discussed in

documents filed by ALLETE with the Securities and Exchange

Commission.

ALLETE's press releases and other communications may include

certain non-Generally Accepted Accounting Principles (GAAP)

financial measures. A "non-GAAP financial measure" is defined as a

numerical measure of a company's financial performance, financial

position or cash flows that excludes (or includes) amounts that are

included in (or excluded from) the most directly comparable measure

calculated and presented in accordance with GAAP in the company's

financial statements

Non-GAAP financial measures utilized by the Company include

presentations of earnings (loss) per share. ALLETE's management

believes that these non-GAAP financial measures provide useful

information to investors by removing the effect of variances in

GAAP reported results of operations that are not indicative of

changes in the fundamental earnings power of the Company's

operations. Management believes that the presentation of the

non-GAAP financial measures is appropriate and enables investors

and analysts to more accurately compare the company's ongoing

financial performance over the periods presented.

ALLETE, Inc. Consolidated Statement of Income

Millions Except Per Share Amounts -

Unaudited

Quarter Ended Six

Months Ended June 30, June 30,

2014 2013

2014 2013

Operating Revenue $ 260.7

$ 235.6 $ 557.2 $ 499.4

Operating Expenses Fuel and Purchased Power

83.6 78.7 179.8 165.2 Operating and Maintenance 115.1 103.8 234.9

208.5 Depreciation 33.8

28.7 66.0

56.9 Total Operating Expenses 232.5 211.2 480.7 430.6

Operating Income 28.2

24.4 76.5

68.8

Other Income

(Expense) Interest Expense (13.5 ) (12.8 ) (26.3 ) (25.1 )

Equity Earnings in ATC 5.2 5.0 10.3 10.2 Other

1.9 1.5 3.9

4.2 Total Other Expense

(6.4 ) (6.3 )

(12.1 ) (10.7 )

Income Before

Non-Controlling Interest and Income Taxes 21.8 18.1 64.4 58.1

Income Tax Expense 4.9

4.1 13.7

11.6

Net Income

16.9 14.0

50.7 46.5 Less: Non-Controlling

Interest in Subsidiaries 0.1

— 0.4

—

Net Income Attributable to ALLETE

$ 16.8 $ 14.0

$ 50.3 $ 46.5

Average

Shares of Common Stock Basic 42.1 39.4 41.7 39.2 Diluted

42.3 39.6

41.9 39.3

Basic Earnings Per Share of Common Stock $ 0.40 $ 0.36 $

1.21 $ 1.19

Diluted Earnings Per Share of Common Stock $

0.40 $ 0.35 $ 1.20 $ 1.18

Dividends Per Share of Common

Stock $ 0.49 $ 0.475

$ 0.98 $ 0.95

Consolidated Balance Sheet

Millions - Unaudited

Jun. 30, Dec. 31,

Jun. 30,

Dec. 31, 2014

2013 2014

2013 Assets Liabilities and

Shareholders’ Equity Cash and Cash Equivalents $ 83.6 $ 97.3

Current Liabilities $ 213.4 $ 230.2 Other Current Assets 209.9

209.7 Long-Term Debt 1,316.8 1,083.0 Property, Plant and Equipment

- Net 3,020.4 2,576.5 Deferred Income Taxes 496.3 479.1 Regulatory

Assets 270.8 263.8 Regulatory Liabilities 100.1 81.0 Investment in

ATC 118.8 114.6 Defined Benefit Pension & Other

Postretirement Benefit Plans

117.0 133.4 Other Investments 116.7 146.3 Other Non-Current

Liabilities 234.5 127.2 Other Non-Current Assets

75.4 68.6

Shareholders’ Equity 1,417.5

1,342.9

Total Assets $ 3,895.6

$ 3,476.8

Total Liabilities and

Shareholders’ Equity $ 3,895.6 $

3,476.8

Quarter Ended

Six Months Ended ALLETE, Inc. June 30, June

30, Income (Loss) 2014

2013 2014

2013 Millions Regulated

Operations $ 17.5 $ 16.3 $ 51.4 $ 48.4 Investments and Other

(0.7 ) (2.3 )

(1.1 ) (1.9 ) Net Income Attributable

to ALLETE $ 16.8 $ 14.0

$ 50.3 $ 46.5

Diluted

Earnings Per Share $ 0.40 $

0.35 $ 1.20 $ 1.18

Statistical Data

Corporate Common

Stock High $ 52.54 $ 52.25 $ 52.73 $ 52.25 Low $ 47.51 $ 46.85 $

47.51 $ 41.39 Close $ 51.35 $ 49.85 $ 51.35 $ 49.85 Book Value $

33.22 $ 31.12 $ 33.22 $ 31.12

Kilowatt-hours Sold

Millions Regulated Utility Retail and

Municipals Residential 249 251 647 605 Commercial 333 335 728 712

Municipals 198 225 440 499 Industrial 1,788

1,769 3,604

3,614 Total Retail and Municipal

2,568 2,580 5,419 5,430 Other Power Suppliers

631 610

1,331 1,201 Total Regulated

Utility 3,199 3,190 6,750 6,631 Non-regulated Energy Operations

30 33

64 64 Total

Kilowatt-hours Sold 3,229

3,223 6,814

6,695

Regulated Utility Revenue

Millions Regulated Utility Revenue Retail and

Municipals Residential $ 25.7 $ 24.7 $ 65.8 $ 59.8 Commercial 30.9

29.3 66.0 62.5 Municipals 14.5 15.8 31.0 32.4 Industrial

108.7 101.6

220.1 210.1 Total

Retail and Municipals 179.8 171.4 382.9 364.8 Other Power Suppliers

24.1 22.4 53.7 44.7 Other 25.7

22.0 57.2

47.7 Total Regulated Utility Revenue

$ 229.6 $ 215.8 $

493.8 $ 457.2

ALLETE, Inc.Investor Contact:Tim Thorp,

218-723-3953tthorp@allete.com

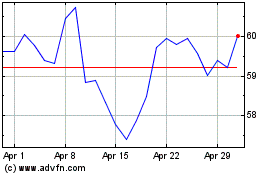

Allete (NYSE:ALE)

Historical Stock Chart

From May 2024 to Jun 2024

Allete (NYSE:ALE)

Historical Stock Chart

From Jun 2023 to Jun 2024