NRG Energy Touches 52-Week High - Analyst Blog

May 21 2013 - 10:10AM

Zacks

On May 20, 2013, shares of

NRG Energy Inc. (NRG) climbed to a 52-week high of

$28.34. A string of high-end investments in solar generation and

the acquisition of GenOn Energy primarily lifted the company’s

stock to a new high.

NRG Energy boasted of four major

solar installations – the Avra Valley Solar Photovoltaic Facility

and Agua Caliente Project in Ariz. as well as the California Valley

Solar Ranch and Alpine Solar Generating Facility in Calif. – which

came into service in 2012.

Meanwhile, the company received contract extensions last year from

its clients Houston Technology Center and Washington-based St.

Tammany Electric and Claiborne Electric cooperatives for delivery

of power services. In addition, the company clinched two new

long-term power supply commitments with Comcast and the city of

Houston. We believe these contracts will ensure a stable earnings

stream.

NRG Energy’s disciplined step to

curb emission is evident from its continued pro-environment work on

the Big Cajun generating facility in Louisiana. These initiatives

enabled NRG Energy to perform well despite the challenges presented

by the energy market last year.

With the renewable market dynamics becoming more favorable in the

U.S., the company’s unrelenting pursuit of options to expand its

solar portfolio will certainly prove to be a key growth driver.

In early 2013, NRG Energy successfully brought online its

large-scale 720 megawatt Marsh Landing Generating Station in

Antioch as well as the Borrego I Solar Generating Station. Also, it

acquired a Gregory cogeneration plant in Corpus Christi, Texas, in

agreement with Atlantic Power Corporation, John Hancock Life

Insurance Company and Rockland Capital, LLC.

The current valuation also makes the shares of NRG Energy

attractive. The forward price/earnings (P/E) multiple of 29.4x is

higher than the peer group average of 17.4x, reflecting a premium

of 69%. The Zacks Consensus Estimate for 2013 represents a

projected increase of 138.7% to 95 cents from year-ago earnings of

40 cents.

Besides NRG Energy, utility stocks that are performing well and

hold a Zacks Rank #2 (Buy) include ALLETE Inc.

(ALE), Sempra Energy (SRE) and Entergy

Corporation (ETR).

Headquartered in Princeton, N.J., NRG Energy together with its

subsidiaries operates as an integrated wholesale power generation

and retail electricity company.

ALLETE INC (ALE): Free Stock Analysis Report

ENTERGY CORP (ETR): Free Stock Analysis Report

NRG ENERGY INC (NRG): Free Stock Analysis Report

SEMPRA ENERGY (SRE): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

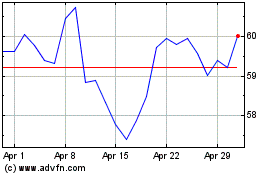

Allete (NYSE:ALE)

Historical Stock Chart

From Jul 2024 to Aug 2024

Allete (NYSE:ALE)

Historical Stock Chart

From Aug 2023 to Aug 2024