CEMIG Earnings above Est. in 1Q13 - Analyst Blog

May 20 2013 - 1:40PM

Zacks

Brazil-based integrated electric

utility, Companhia Energetica de Minas Gerais

(CIG), also known as CEMIG reported its financial results for the

first quarter 2013 on May 17, 2013. Net earnings in the quarter

were R$865 million (US$432.5 million), up 37% year over year.

Earnings per share were R$1.01 or

US$0.51 per ADR. This was way above the Zacks Consensus Estimate of

US$0.24 per ADR.

Revenue

CEMIG in the first quarter 2013

generated net revenue of R$3,677.6 million (US$1,838.8 million), up

15.2% compared with the year-ago revenues. Despite a fall in a few

categories, including a 9.4% decline in revenues from sales to end

customers, more than a double increase in revenue from Supply

+Transactions in the CCEE category drove the results.

Electricity sold in the quarter was

down 1.8% year over year to 10,796 GWh.

Expenses/Income

Operational costs and expenses in

the quarter totaled R$2,456 million (US$1,228 million), up 7% year

over year. The expenses soared because of higher personnel costs,

post-retirement benefits, cost of materials and purchased energy

costs among others, although there was fall in a few other

expenses, including contracted services, royalties, operating

provisions among others on a year-over-year basis.

EBITDA was R$1,590 million (US$795

million) in the quarter, reflecting a year-over-year growth of 28%.

EBITDA margin was 43.2% versus 38.9% in the year-ago quarter.

Operating margin in the quarter came in at 33.2% compared with

28.0% in the year-ago quarter.

Balance Sheet/Cash

Flow

Exiting the first quarter 2013,

CEMIG had cash and cash equivalents of approximately R$2,041

million (US$1,020.5 million) versus R$2,485.8 million (US$1,212.6

million) in the previous quarter. Talking of long-term debts, a

drastic decline was witnessed in loans, financing and debentures

that came in at R$2,644 million (US$1,322 million).

CEMIG generated approximately R$374

million (US$187 million) in cash from operating activities,

registering a year-over-year decline of 11%. Capital spending on

addition of fixed and intangible assets plummeted 70% to R$219

million (US$109.5 million).

CEMIG is one of the largest

integrated electric utilities in Brazil with approximately 97% of

the company’s installed generation capacity being hydroelectric

power. The stock currently has a Zacks Rank #4 (Sell).

Other stocks to watch out for in

the industry are CPFL Energia S.A. (CPL) and

Empresa Nacional de Electricidad S.A. (EOC) with a

Zacks Rank #1 (Strong Buy) while ALLETE, Inc.

(ALE) with a Zacks Rank #2 (Buy).

ALLETE INC (ALE): Free Stock Analysis Report

CEMIG SA -ADR (CIG): Free Stock Analysis Report

CPFL ENERGI-ADR (CPL): Get Free Report

ENDESA-CHILE (EOC): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

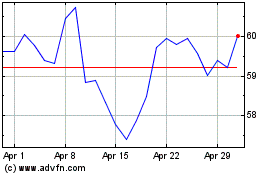

Allete (NYSE:ALE)

Historical Stock Chart

From May 2024 to Jun 2024

Allete (NYSE:ALE)

Historical Stock Chart

From Jun 2023 to Jun 2024