ALLETE Beats Earnings and Sales Ests. - Analyst Blog

May 09 2013 - 5:03AM

Zacks

ALLETE Inc. (ALE) reported first quarter 2013

earnings of 83 cents per share compared with 66 cents per share in

the year-ago quarter. ALLETE’s earnings beat the Zacks Consensus

Estimate by 10.6%.

Earnings received a boost from increased electric sales due to a

cold winter, start-up of renewable services and higher returns from

investments in American Transmission Company ("ATC").

Total Revenue

ALLETE’s first quarter revenue increased 9.9% to $263.8 million

from the year-ago quarter. Quarterly revenue also surpassed the

Zacks Consensus Estimate by 5.8%. Healthy sales across all customer

classes as well as benefits from renewable tax credits led to the

upsurge in the top line.

Operational Highlights

Sales from the regulated utility operations in the first quarter

stood at $241.4 million, up 10.4% from the prior-year quarter. This

was driven by increase in residential, commercial and municipal

sale volumes supported by volume growth in the non-regulated energy

business.

ALLETE's total electricity sale volume in the first quarter rose

3.1% year over year to 3,472 million Kilowatt-hours.

Total operating expenses were $219.4 million in the first

quarter 2013, up 8.8% from the year-ago quarter. A 12.2% rise in

cost of fuel and purchased power led to the cost escalation. This

was further compounded by a 4.8% surge in operations and

maintenance expenses.

Operating income in the first quarter jumped 15.6% to $44.4

million from the prior-year period. Profit rose on account of the

substantial increase in the top line despite the cost pressure.

Interest expense in the first quarter 2013 was $12.3 million

versus $11.0 million in the year-ago quarter.

Financial Update

Cash and short-term investments as of Mar 31, 2013 were $77.3

million versus $80.8 million as of Dec 31, 2012.

Long-term debt as of Mar 31, 2013 was $975.1 million compared

with $933.6 million at year-end 2012.

Guidance

ALLETE reiterated its 2013 earnings expectation of $2.58-$2.78

per share taking into account robust industrial demand, higher cost

recovery revenue, increased depreciation and interest expenses,

federal production tax credits and dilution from equity issuances

in the range 10-15 cents.

Other Utility Company Releases

Alliant Energy Corporation (LNT) reported first

quarter 2013 operating earnings of 72 cents per share, up 16.1%

from the Zacks Consensus Estimate of 62 cents.

TECO Energy Inc.’s (TE) first quarter 2013

operating earnings of 19 cents per share exceeded the Zacks

Consensus Estimate of 17 cents.

DTE Energy Company. (DTE) posted first quarter

earnings of $1.34 per share comfortably surpassing the Zacks

Consensus Estimate by 31 cents.

Our View

ALLETE has posted strong financial results in the first quarter

of 2013 with both the top and bottom line performing better than

expected. The company is expected to benefit from the Essar Steel

Minnesota midstream project which began operations from Apr

2013.

Furthermore, ALLETE’s ambitious Energy Forward plan is expected

to improve service quality thereby contributing to its

profitability. Its proposed scheme to add 100 megawatts of wind

capacity will also bode well for the company given the positive

climate for renewable generation in the U.S. ALLETE at present

carries a Zacks Rank #2 (Buy).

Based in Duluth, Minn., ALLETE together with its subsidiaries

primarily engages in the generation, transmission, and distribution

of coal-fired, hydro, wind, and biomass co-fired power in the

United States.

ALLETE INC (ALE): Free Stock Analysis Report

DTE ENERGY CO (DTE): Free Stock Analysis Report

ALLIANT ENGY CP (LNT): Free Stock Analysis Report

TECO ENERGY (TE): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

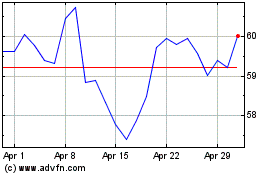

Allete (NYSE:ALE)

Historical Stock Chart

From Jun 2024 to Jul 2024

Allete (NYSE:ALE)

Historical Stock Chart

From Jul 2023 to Jul 2024