Xcel Energy Likely to Beat Earnings - Analyst Blog

May 01 2013 - 7:34AM

Zacks

We expect utility service provider Xcel Energy

Inc. (XEL) to surpass our expectation when it reports

first quarter 2013 results on May 2.

Why a Likely Positive Surprise?

Our proven model shows that Xcel Energy is likely to beat

earnings because it has the right combination of two key

ingredients.

Positive Zacks ESP: Expected Surprise

Prediction or ESP (Read: Zacks Earnings ESP: A Better Method),

which represents the difference between the Most Accurate estimate

and the Zacks Consensus Estimate, is at +4.65%. This is a

meaningful and leading indicator of a likely positive earnings

surprise for shares.

Zacks #2 Rank (Buy): Note that stocks with

Zacks Ranks of #1, #2 and #3 have a significantly higher chance of

beating earnings. The Sell rated stocks (#4 and #5) should never be

considered going into an earnings announcement.

The combination of Xcel Energy’s Zacks Rank #2 (Buy) and +4.65%

ESP makes us confident of an earnings beat on May 2.

What is Driving the Better-than-Expected

Earnings?

Xcel Energy’s high-end midstream projects, disciplined

cost-control initiatives and competitive power rate offerings are

expected to be the key factors triggering a positive earnings

surprise.

Consistent earnings surprises in the last four quarters resulted

in an average beat of 5.79%. Given the positive dynamics we expect

the same trend to continue in the first quarter as well.

The operational start-up of the Bemidji-Grand Rapids

Transmission line under its CapX2020 program will continue to

support Xcel Energy’s growth. Moreover, the company’s aggressive

investments in renewable generation especially wind will bode well

for Xcel Energy given the favorable climate for renewables in the

U.S. currently. With prices below the national average owing to its

technological efficiency, the company is well positioned to reap

gains from the market.

Other Stocks to Consider

Xcel Energy is not the only firm looking up this earnings

season. We also see likely earnings beats coming from these three

industry peers:

Brookfield Infrastructures Partners L.P. (BIP)

has an earnings ESP of +1.19% and carries a Zacks Rank #1 (Strong

Buy).

ALLETE Inc. (ALE) has an earnings ESP of +1.33%

and carries a Zacks Rank #2 (Buy).

Pinnacle West Capital Corporation (PNW) has an

earnings ESP of +200.0% and carries a Zacks Rank #3 (Hold).

ALLETE INC (ALE): Free Stock Analysis Report

BROOKFIELD INFR (BIP): Free Stock Analysis Report

PINNACLE WEST (PNW): Free Stock Analysis Report

XCEL ENERGY INC (XEL): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

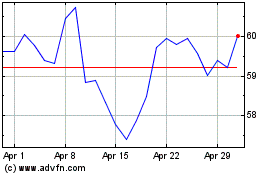

Allete (NYSE:ALE)

Historical Stock Chart

From May 2024 to Jun 2024

Allete (NYSE:ALE)

Historical Stock Chart

From Jun 2023 to Jun 2024