ALLETE, Inc. (NYSE:ALE) today reported 2010 earnings of $2.19

per share, a 16 percent increase over the $1.89 per share recorded

in 2009. ALLETE’s net income in 2010 was $75.3 million on total

operating revenue of $907 million, compared to $61 million of net

income and revenue of $759.1 million in 2009. Excluding a

nonrecurring 12 cent charge as a result of the Patient Protection

and Affordable Care Act, ALLETE’s pro forma earnings were $2.31 per

share in 2010. 2009 results included a 15 cent per share

nonrecurring charge.

“Improved power sales to our taconite customers was a reflection

of a healthier economy and positively impacted our earnings for the

year,” said ALLETE President and CEO Al Hodnik. “Megawatt-hour

sales to these customers increased by 104 percent from 2009 to

2010.”

Income from Regulated Operations rose to $79.8 million

during 2010 from $65.9 million in the previous year. The results

reflected the stronger megawatt-hour sales combined with interim

rate increases for Minnesota Power retail customers, and increased

transmission-related margins. These increases were significantly

offset by higher operating and maintenance, depreciation, interest

and income tax expenses.

The Investments and Other segment recorded a net loss of

$4.5 million during the year compared to a net loss of $4.9 million

in 2009.

An increase in the average number of common shares outstanding,

with issuance proceeds used to fund the company’s capital

expenditure program, had a dilutive impact of 14 cents per share in

2010.

Hodnik said the company expects to earn between $2.35 and $2.55

in 2011. The company recently increased its quarterly dividend to

44.5 cents per share.

“We anticipate building upon our strengths in 2011 and beyond,

to the benefit of our customers and shareholders, as the overall

economy improves and we continue to make capital investments in

renewable and transmission assets,” Hodnik said.

The company will host a conference call and webcast at 10:00

a.m. Eastern time today to discuss details of its performance for

the year. Interested parties may listen live by calling (877)

303-5852, or by accessing the webcast at www.allete.com. A replay

of the call will be available through February 20, 2011 by dialing

(800) 642-1687, pass code 38206714.

ALLETE’s corporate headquarters are in Duluth, Minnesota. In

addition to its electric utilities, Minnesota Power in northeast

Minnesota and Superior, Water, Light & Power Co. in northwest

Wisconsin, ALLETE owns BNI Coal in Center, N. D. and has an eight

percent equity interest in American Transmission Co. More

information about the company is available on ALLETE’s Web site at

www.allete.com.

The statements contained in this release and statements that

ALLETE may make orally in connection with this release that are not

historical facts, are forward-looking statements. Actual results

may differ materially from those projected in the forward-looking

statements. These forward-looking statements involve risks and

uncertainties and investors are directed to the risks discussed in

documents filed by ALLETE with the Securities and Exchange

Commission.

ALLETE’s press releases and other communications may include

certain non-Generally Accepted Accounting Principles (GAAP)

financial measures. A “non-GAAP financial measure” is defined as a

numerical measure of a company’s financial performance, financial

position or cash flows that excludes (or includes) amounts that are

included in (or excluded from) the most directly comparable measure

calculated and presented in accordance with GAAP in the company’s

financial statements.

Non-GAAP financial measures utilized by the Company include

presentations of earnings (loss) per share. ALLETE’s management

believes that these non-GAAP financial measures provide useful

information to investors by removing the effect of variances in

GAAP reported results of operations that are not indicative of

changes in the fundamental earnings power of the Company’s

operations. Management believes that the presentation of the

non-GAAP financial measures is appropriate and enables investors

and analysts to more accurately compare the company’s ongoing

financial performance over the periods presented.

Consolidated Statement

of Income For the Periods Ended December 31, 2010 and

2009

Millions Except Per Share Amounts

Quarter Ended Year to Date

2010

2009 2010

2009 Operating Revenue

Operating Revenue $ 238.1 $ 216.0 $ 907.0 $

766.7 Prior Year Rate Refunds –

– –

(7.6 ) Total Operating Revenue

238.1 216.0

907.0 759.1

Operating Expenses Fuel and Purchased Power 92.0 80.1 325.1

279.5 Operating and Maintenance 102.7 84.2 365.6 308.9

Depreciation 20.7

17.9 80.5

64.7 Total Operating Expenses

215.4 182.2

771.2 653.1

Operating

Income 22.7

33.8 135.8

106.0

Other Income (Expense) Interest Expense (11.1 )

(8.4 ) (39.2 ) (33.8 ) Equity Earnings in ATC 4.5 4.6 17.9 17.5

Other 0.8

(2.0 ) 4.6 1.8

Total Other Income (Expense)

(5.8 ) (5.8 )

(16.7 ) (14.5 )

Income Before

Non-Controlling Interest and Income Taxes 16.9 28.0 119.1 91.5

Income Tax Expense 3.8

9.3 44.3

30.8

Net Income

13.1 18.7

74.8 60.7 Less:

Non-Controlling Interest in Subsidiaries (0.2

) – (0.5 )

(0.3 )

Net Income Attributable to ALLETE

$ 13.3 $ 18.7

$ 75.3 $ 61.0

Average

Shares of Common Stock Basic 34.5 33.4 34.2 32.2 Diluted

34.7 33.5

34.3 32.2

Basic Earnings Per Share of Common Stock $ 0.38 $

0.56 $ 2.20 $ 1.89

Diluted Earnings Per Share of Common

Stock 0.38

0.56 2.19

1.89

Dividends Per Share of Common

Stock $ 0.44 $ 0.44

$ 1.76 $ 1.76

Consolidated Balance Sheet

Millions

Dec. 31, Dec. 31, Dec. 31 Dec.

31, 2010

2009

2010 2009 Assets

Liabilities and Equity Cash and Short-Term Investments $

51.6 $ 25.7 Current Liabilities $ 158.9 $ 133.1 Other Current

Assets 188.1 199.8 Long-Term Debt 771.6 695.8 Property, Plant and

Equipment 1,805.6 1,622.7 Other Liabilities 324.8 325.0 Regulatory

Assets 310.2 293.2 Regulatory Liabilities 43.6 47.1 Investment in

ATC 93.3 88.4 Deferred Income Taxes 325.2 253.1 Investments 126.0

130.5 Equity 985.0 939.0 Other 34.3

32.8

Total Assets $ 2,609.1

$ 2,393.1

Total Liabilities

and Equity $ 2,609.1 $ 2,393.1

Quarter Ended Year to Date ALLETE, Inc.

December 31, December 31, Income (Loss)

2010

2009

2010 2009

Millions Regulated

Operations $ 14.6 $ 20.9 $ 79.8 $ 65.9 Investments and Other

(1.3 )

(2.2 ) (4.5 )

(4.9 ) Net Income Attributable to ALLETE

$ 13.3 $

18.7 $ 75.3

$ 61.0

Diluted Earnings Per Share $ 0.38 $ 0.56 $

2.19 $ 1.89

Statistical Data Corporate Common Stock High $

37.95 $ 35.29 $ 37.95 $ 35.29 Low $ 34.81 $ 32.23 $ 29.99 $ 23.35

Close $ 37.26 $ 32.68 $ 37.26 $ 32.68 Book Value $ 27.19 $ 26.39 $

27.19 $ 26.39

Kilowatt-hours Sold Millions Regulated Utility

Retail and Municipals Residential 303 308 1,150 1,164 Commercial

359 358 1,433 1,420 Municipals 260 262 1,006 992 Industrial

1,848

1,294 6,804

4,475

Total Retail and Municipal

2,770 2,222 10,393 8,051 Other Power Suppliers

577 981

2,745

4,056 Total Regulated Utility 3,347 3,203

13,138 12,107 Non-regulated Energy Operations

31 41

118

203 Total Kilowatt-hours Sold

3,378 3,244

13,256

12,310

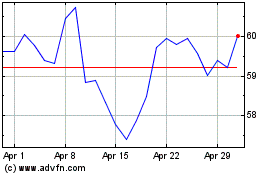

Allete (NYSE:ALE)

Historical Stock Chart

From Jun 2024 to Jul 2024

Allete (NYSE:ALE)

Historical Stock Chart

From Jul 2023 to Jul 2024