Form FWP - Filing under Securities Act Rules 163/433 of free writing prospectuses

May 21 2024 - 5:02PM

Edgar (US Regulatory)

Pricing Term Sheet

Filed Pursuant to Rule 433

to Preliminary Prospectus dated May 21, 2024

Registration Statement No. 333-278323

Date: May 21, 2024

Allegion plc

|

|

|

| Issuer: |

|

Allegion US Holding Company Inc. |

|

|

| Guarantor: |

|

Allegion plc |

|

|

| Security: |

|

Unsecured Senior Notes |

|

|

| Expected Ratings(1): |

|

Baa2 (Moody’s), BBB (S&P), BBB (Fitch) |

|

|

| Offering Format: |

|

SEC-Registered |

|

|

| Security Description: |

|

5.600% Senior Notes due 2034 (the “Notes”) |

|

|

| Maturity Date: |

|

May 29, 2034 |

|

|

| Principal Amount: |

|

$400,000,000 |

|

|

| Gross Proceeds: |

|

$398,668,000 |

|

|

| Net Proceeds (Before Expenses): |

|

$396,068,000 |

|

|

| Coupon: |

|

5.600% |

|

|

| Offering Price: |

|

99.667% of the principal amount |

|

|

| Yield to Maturity: |

|

5.644% |

|

|

| Spread to Benchmark Treasury: |

|

+ 123 bps |

|

|

| Benchmark Treasury: |

|

4.375% UST due May 15, 2034 |

|

|

| Benchmark Treasury Price and Yield: |

|

99-22; 4.414% |

|

|

| Trade Date: |

|

May 21, 2024 |

|

|

| Settlement Date(2): |

|

May 29, 2024 (T+5) |

|

|

|

| |

|

| Record Dates: |

|

Every May 14 and November 14 preceding each Interest Payment Date |

|

|

| Interest Payment Dates: |

|

Semi-annually on May 29 and November 29 of each year, beginning on November 29, 2024 |

|

|

| Make-Whole Call: |

|

Make-whole call at T + 20 bps prior to March 1, 2034 |

|

|

| Par Call: |

|

Beginning on March 1, 2034 |

|

|

| Special Redemption for Taxation Reasons: |

|

Special optional redemption at 100% of principal plus accrued and unpaid interest upon the occurrence of specified tax events described under the caption “Description of the Notes—Redemption for Taxation

Reasons” in the Preliminary Prospectus. |

|

|

| Change of Control Repurchase Event Put: |

|

At 101% of principal plus accrued and unpaid interest |

|

|

| Expected Listing: |

|

The Issuer will use its reasonable best efforts to list the Notes on the New York Stock Exchange. The Issuer cannot assure you that the Notes will be listed, or if listed, that such listing will be maintained for the term of

the Notes. |

|

|

| Denominations: |

|

$1,000 x $1,000 |

|

|

| Identifiers: |

|

CUSIP: 01748N AF1

ISIN: US01748NAF15 |

|

|

| Joint Book-Running Managers: |

|

BofA Securities, Inc.

Citigroup Global Markets Inc.

Wells Fargo Securities, LLC

Goldman Sachs & Co. LLC J.P. Morgan Securities

LLC PNC Capital Markets LLC |

|

|

| Co-Managers: |

|

BNP Paribas Securities Corp.

Huntington Securities, Inc. TD Securities (USA)

LLC U.S. Bancorp Investments, Inc. |

| (1) |

An explanation of the significance of ratings may be obtained from the rating agencies. Generally, rating

agencies base their ratings on such material and information, and such of their own investigations, studies and assumptions, as they deem appropriate. The rating of the Notes should be evaluated independently from similar ratings of other

securities. A credit rating of a security is not a recommendation to buy, sell or hold securities and may be subject to review, revision, suspension, reduction or withdrawal at any time by the assigning rating agency. |

2

| (2) |

We expect that delivery of the notes will be made against payment therefor on or about May 29, 2024, which

is the fifth business day following the date of pricing of the notes (this settlement cycle being referred to as “T+5”). Under Rule 15c6-1 of the Exchange Act, trades in the secondary market

generally are required to settle in two business days, unless the parties to any such trade expressly agree otherwise. Accordingly, purchasers who wish to trade notes on the date of pricing or the next four succeeding business days will be required,

by virtue of the fact that the notes initially will settle in T+5, to specify an alternate settlement cycle at the time of any such trade to prevent a failed settlement and should consult their own advisors. |

The Issuer has filed an effective registration statement with the U.S. Securities and Exchange Commission (SEC) for this offering and encourages investors to

read it (including the accompanying prospectus, the Preliminary Prospectus and the information incorporated by reference therein) for more complete information about the Issuer and this offering. You may obtain these documents for free by visiting

EDGAR on the SEC website at www.sec.gov. Alternatively, copies may also be obtained by contacting BofA Securities, Inc. at the following address:

NC1-022-02-25, 201 North Tryon Street, Charlotte, NC 28255-0001, Attn: Prospectus Department, or by calling 1-800-294-1322, or by emailing dg.prospectus_requests@bofa.com, or Citigroup Global Markets Inc., c/o Broadridge Financial Solutions,

1155 Long Island Avenue, Edgewood, NY 11717 or by telephone at 1-800-831-9146, or Wells Fargo Securities, LLC, 608 2nd Avenue

South, Suite 1000, Minneapolis, MN 55402, Attn: WFS Customer Service, or by telephone at 1-800-645-3751 or by email at

wfscustomerservice@wellsfargo.com.

This pricing term sheet is dated May 21, 2024. The information in this pricing term sheet supplements the

preliminary prospectus supplement of the Issuer, dated May 21, 2024 (the “Preliminary Prospectus”), and supersedes the information in the Preliminary Prospectus to the extent it is inconsistent with the information contained therein.

Financial information presented in the Preliminary Prospectus or incorporated by reference therein is deemed to have changed to the extent affected by the changes described herein. This pricing term sheet should be read together with the Preliminary

Prospectus, including the documents incorporated by reference therein, before making a decision in connection with an investment in the Notes.

Any

disclaimer or other notice that may appear below is not applicable to this communication and should be disregarded. Such disclaimer or notice was automatically generated as a result of this communication being sent by Bloomberg or another email

system.

3

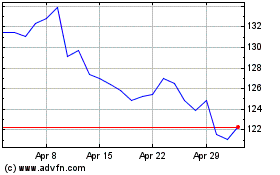

Allegion (NYSE:ALLE)

Historical Stock Chart

From May 2024 to Jun 2024

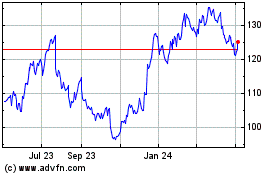

Allegion (NYSE:ALLE)

Historical Stock Chart

From Jun 2023 to Jun 2024