0001035443

false

0001035443

2023-08-28

2023-08-28

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

August 28, 2023

ALEXANDRIA REAL ESTATE EQUITIES, INC.

(Exact name of registrant as specified in

its charter)

| Maryland |

|

1-12993 |

|

95-4502084 |

|

(State or other jurisdiction

of

incorporation) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification No.) |

26

North Euclid Avenue

Pasadena, California |

| 91101 |

| (Address of principal executive offices) |

| (Zip Code) |

Registrant’s telephone number, including

area code: (626) 578-0777

N/A

(Former name or former address, if changed

since last report)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under

the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under

the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4 (c) under the Exchange Act (17 CFR

240.13e-4 (c)) |

Securities registered pursuant to Section 12(b) of the Exchange Act:

| Title of each class |

Trading

Symbol(s) |

Name of each exchange

on which

registered |

| Common Stock, $.01 par value per share |

ARE |

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of

the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ¨

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with

any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 5.02 |

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

Amendment of Compensatory Arrangement – Marc E. Binda

As previously reported by Alexandria Real Estate Equities, Inc. (the

“Company”) in a current report on Form 8-K filed with the Securities and Exchange Commission (the “SEC”) on August

17, 2023, the Company announced that, effective September 15, 2023, Marc E. Binda would serve as Chief Financial Officer and Treasurer.

The Company

previously entered into an executive employment agreement with Mr. Binda pursuant to his election as Executive Vice President –

Finance and Treasurer, effective as of June 3, 2019. On August 30, 2023, the Company entered into an amendment and restatement of the

executive employment agreement with Mr. Binda pursuant to his election as Chief Financial Officer and Treasurer, which will become effective

as of September 15, 2023 (the “Amended Binda Agreement”). The Amended Binda Agreement reflects Mr. Binda’s new position,

duties and reporting structure and provides that his annual base salary will be $615,000. Mr. Binda will continue to be eligible for

an annual bonus and periodic equity awards as the Board may determine. Additional terms of the Amended Binda Agreement are described

below under “Description of Binda Employment Agreement.”

Promotion and Election of Executive Officer – Daniel J. Ryan

On August 28, 2023, the Board of Directors (the “Board”)

of the Company elected Daniel J. Ryan as Co-President and Regional Market Director – San Diego, effective as of September 15, 2023.

Mr. Ryan, age 58, has served as Co-Chief Investment Officer since May 2018 and as Executive Vice President - Regional Market Director

– San Diego since May 2012. Mr. Ryan previously served the Company as Senior Vice President – Regional Market Director –

San Diego & Strategic Operations from August 2010 to May 2012. During his tenure with the Company, Mr. Ryan has been responsible for

the management of the Company’s San Diego region asset base and operations, as well as involvement with developments, redevelopments,

joint ventures, financing, leasing, and other strategic opportunities outside the San Diego region. Mr. Ryan is a board member of Biocom

California, a Southern California trade organization, the San Diego Economic Development Corporation, a not-for-profit regional body comprising

business, government, and civic leaders committed to maximizing economic growth, and the Policy Advisory Board of the University of San

Diego – School of Real Estate. He is also a member of the NAIOP and the Urban Land Institute, both public policy organizations focused

on public advocacy of the built environment. Mr. Ryan received his Bachelor of Science degree in Economics, cum laude, from the University

of Wisconsin–Madison and was admitted to Omicron Delta Epsilon, the honor society for excellence in achievement in the study of

economics.

No changes to Mr. Ryan’s base salary or other employment arrangements

are contemplated in connection with this promotion. The material terms of such arrangements are described in previous SEC filings, including

the Company’s Proxy Statement, filed with the SEC on April 14, 2023.

Promotion and Election of Executive Officer – Hunter L. Kass

On August 28, 2023, the Board of the Company elected Hunter L. Kass

as Co-President and Regional Market Director – Greater Boston, effective as of September 15, 2023. Mr. Kass, age 41, has served

as Executive Vice President – Regional Market Director – Greater Boston since January 2021. Mr. Kass previously served as

Senior Vice President – Strategic Market Director – Greater Boston since October 2019 and has been with the Company since

2018. In these roles, Mr. Kass focused on the Company’s strategic growth through leadership of the Greater Boston development team

and acquisitions and transactions within the Greater Boston region. Prior to joining the Company, Mr. Kass worked at MIT’s Endowment

(“MITIMCo”) as a Senior Investment Associate, then a Senior Real Estate Officer, and ultimately an Associate Director in the

Transaction Group of the Direct Real Estate Team. During his six-year tenure at MITIMCo, Mr. Kass was a leader in the team that executed

over 1 million square feet of leasing, completed multiple capital market transactions that in total exceeded $2 billion, and supported

the entitlement and permitting of several million square feet in Cambridge, Massachusetts. Mr. Kass received his Bachelor of Arts degree

from the University of Virginia, a Master of Business Administration from Babson College, and a Master of Science degree from the Center

for Real Estate at the Massachusetts Institute of Technology.

No changes to Mr. Kass’s base salary or other employment arrangements

are contemplated in connection with this promotion. The material terms of such arrangements are described in previous SEC filings, including

the Company’s Proxy Statement, filed with the SEC on April 14, 2023.

Confirming Title Change – Peter M. Moglia

In light of Mr. Ryan’s promotion to Co-President and Regional

Market Director – San Diego, as of September 15, 2023, Peter M. Moglia, currently Chief Executive Officer and Co-Chief Investment

Officer, will be the only executive officer of the Company responsible for the duties of a chief investment officer. Accordingly, Mr.

Moglia’s title will change to Chief Executive Officer and Chief Investment Officer, effective as of September 15, 2023.

Amendment of Compensatory Arrangement – Joel S. Marcus

On and effective August 30, 2023, the Company entered into a Letter

Amendment (the “Marcus Amendment”) to the Amended and Restated Executive Employment Agreement, effective January 1, 2015,

as amended pursuant to letter agreements dated July 3, 2017, March 20, 2018, January 15, 2019 and June 8, 2020 (collectively, the “Marcus

Agreement”), between the Company and Joel S. Marcus, the Company’s Executive Chairman.

The Marcus Amendment amends the last paragraph of Section 3.4(h)(iii)

of the Marcus Agreement such that, with respect to any equity or equity-based awards granted after the date of the Marcus Amendment, for

the treatment of such awards upon certain terminations of service for any reason other than Cause (as defined in the Marcus Agreement),

the requirement that any such termination occur on or after Mr. Marcus’s attainment of age 77 will not apply and will instead be

replaced with a requirement that any such termination occur on or after May 27, 2027.

The foregoing description of the Marcus Amendment does not purport

to be complete and is qualified in its entirety by reference to the full text of the Marcus Amendment, a copy of which will be filed as

an exhibit to the Company’s quarterly report on Form 10-Q for the quarter ending September 30, 2023.

Description of Binda Employment Agreement

The Amended Binda Agreement provides that Mr. Binda is employed at-will,

with the term of the Amended Binda Agreement beginning on September 15, 2023 and ending on the date that the Amended Binda Agreement is

terminated by either party pursuant to the provisions of the Amended Binda Agreement. The Amended Binda Agreement further provides that

Mr. Binda’s base salary shall increase annually by no less than a cost-of-living adjustment based on an index published by the United

States Department of Labor.

The Amended Binda Agreement provides that if Mr. Binda’s employment

terminates without cause or Mr. Binda resigns for good reason not in connection with a change in control of the Company, Mr. Binda is

entitled to receive severance generally equal to one year of Mr. Binda’s base salary and a cash incentive bonus equal to the cash

incentive bonus Mr. Binda earned for the previous year (or the year prior to the previous year if the cash incentive bonus for the previous

year has not been determined prior to termination). The Amended Binda Agreement also provides that if, upon or within two years following

a change in control of the Company, the Company terminates the Amended Binda Agreement without cause or Mr. Binda terminates the Amended

Binda Agreement for good reason, Mr. Binda is entitled to receive severance generally equal to a multiple of 1.5x Mr. Binda’s base

salary and a cash incentive bonus equal to a multiple of 1.5x of the cash incentive bonus amount Mr. Binda earned for the previous year

(or the year prior to the previous year if the cash incentive bonus for the previous year has not been determined prior to termination).

In any of the foregoing cases, all of Mr. Binda’s unvested shares of restricted stock in the Company will vest on Mr. Binda’s

last day of employment and Mr. Binda will receive a prorated grant of fully vested stock based on the Company’s grant to Mr. Binda

for the prior year and the number of days employed in the year of termination and an additional grant of restricted stock (on a fully

vested basis) equal to the higher of the number of shares of restricted stock that the Company had determined to grant to Mr. Binda for

the prior year, but had not yet granted as of termination, or the average number of shares of restricted stock granted to Mr. Binda for

the second, third and fourth years prior to the year in which Mr. Binda’s employment terminates.

The Amended Binda Agreement also provides that if the Company terminates

Mr. Binda’s employment without cause, or Mr. Binda terminates his employment for good reason, the Company will pay the applicable

premiums for Mr. Binda’s continued coverage under the Company’s health insurance plans pursuant to the Consolidated Omnibus

Budget Reconciliation Act of 1985 (“COBRA”) for up to 12 months after Mr. Binda’s last day of employment with the Company

or a taxable payment calculated such that the after-tax amount of the payment would be equal to the applicable COBRA health insurance

premiums if the Company determines that it cannot pay COBRA premiums without a substantial risk of violating applicable law.

To the extent required, the description of the Amended Binda Agreement

alone shall be deemed to supplement and amend the description of Mr. Binda’s promotion to the position of Chief Financial Officer

and Treasurer set forth in the Company’s Form 8-K filed with the SEC on August 17, 2023.

The foregoing description of the Amended Binda Agreement does not purport

to be complete and is qualified in its entirety by reference to the full text of the Amended Binda Agreement, a copy of which will be

filed as an exhibit to the Company’s quarterly report on Form 10-Q for the quarter ending September 30, 2023.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

ALEXANDRIA REAL ESTATE EQUITIES, INC. |

| |

|

| |

|

| Date: August 31, 2023 |

By: |

/s/ Dean A. Shigenaga |

| |

|

Dean A. Shigenaga |

| |

|

President and Chief Financial Officer |

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

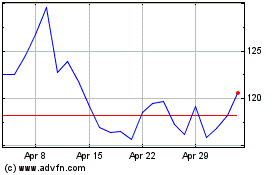

Alexandria Real Estate E... (NYSE:ARE)

Historical Stock Chart

From Jun 2024 to Jul 2024

Alexandria Real Estate E... (NYSE:ARE)

Historical Stock Chart

From Jul 2023 to Jul 2024