0001789029false00017890292024-11-062024-11-060001789029aeva:WarrantsToPurchaseMember2024-11-062024-11-060001789029us-gaap:CommonStockMember2024-11-062024-11-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): November 06, 2024 |

Aeva Technologies, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-39204 |

84-3080757 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

555 Ellis Street |

|

Mountain View, California |

|

94043 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (650) 481-7070 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common stock, par value $0.0001 per share |

|

AEVA |

|

New York Stock Exchange LLC |

Warrants to purchase one share of common stock |

|

AEVA.WS |

|

New York Stock Exchange LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On November 6, 2024, Aeva Technologies, Inc. issued a press release announcing financial results for the third quarter ended September 30, 2024. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated by reference in this Item 2.02.

The information set forth in Item 2.02 (including Exhibit 99.1) shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

Aeva Technologies, Inc. |

|

|

|

|

Date: |

November 6, 2024 |

By: |

/s/ Saurabh Sinha |

|

|

|

Saurabh Sinha

Chief Financial Officer |

Exhibit 99.1

Aeva Reports Third Quarter 2024 Results

The Indoor Lab Awarded Aeva a Multi-year Production Program Agreement with Planned Deployments at Major U.S. Airports, Mass Transit and Other Large Venues

Strong Traction in Passenger Vehicle Programs, Including Selection by a Major European OEM for its Automated Vehicle Validation Program, and Advancing on Track with a Global Top 10 OEM’s Vehicle Program RFQ

Our Partners Torc Robotics and Daimler Truck using Aeva 4D as the Exclusive Long-Range LiDAR Successfully Validated Fully Driverless Operations at Highway Speeds

MOUNTAIN VIEW, Calif., Nov. 6, 2024 – Aeva® (NYSE: AEVA), a leader in next-generation sensing and perception systems, today announced its third quarter 2024 results.

Key Company Highlights

•Major industrial production win for security applications with The Indoor Lab to deploy Aeva 4D LiDAR at multiple planned locations, starting with John F. Kennedy International Airport in New York and San Francisco International Airport, and followed by yet to be disclosed airports, mass transit and other large venues across the U.S.

•A major European passenger vehicle OEM selected Aeva to leverage 4D LiDAR’s unique velocity data to validate its next-generation vehicle automation systems

•Continued to advance towards the finalization of the RFQ for a global top 10 passenger OEM’s vehicle program and ongoing progress on other passenger RFQs and engagements

•Torc Robotics using Aeva 4D LiDAR as the exclusive long and ultra-long range LiDAR successfully validated fully driverless operations at highway speeds up to 65 miles per hour, a key milestone towards commercialization for Daimler Truck’s autonomous truck production program by 2027

•Pulled forward first shipments of Aeva Atlas, our production-intent product, by approximately two quarters in order to meet growing demand from recent production wins for automotive and industrial applications; implementing plans to scale production for next year

“Aeva continues to convert the growing interest in our unique 4D LiDAR technology to new wins while also achieving critical milestones for our existing production programs,” said Soroush Salehian, Co-Founder and CEO at Aeva. “With more industries looking to adopt FMCW technology, we made the strategic decision and executed on pulling forward first shipments of Atlas to the third quarter to meet more of our strong demand. We believe this further places Aeva on the path to leading the market and expanding our commercial momentum with additional wins in automotive, industrial and beyond.”

Third Quarter 2024 Financial Highlights

•Cash, Cash Equivalents and Marketable Securities

oCash, cash equivalents and marketable securities of $134.8 million and available facility of $125.0 million as of September 30, 2024

oRevenue of $2.3 million in Q3 2024, compared to revenue of $0.8 million in Q3 2023

•GAAP and Non-GAAP Operating Loss*

oGAAP operating loss of $37.9 million in Q3 2024, compared to GAAP operating loss of $35.5 million in Q3 2023

oNon-GAAP operating loss of $31.4 million in Q3 2024, compared to non-GAAP operating loss of $30.3 million in Q3 2023

•GAAP and Non-GAAP Net Loss per Share*

oGAAP net loss per share of $0.70 in Q3 2024, compared to GAAP net loss per share of $0.75 in Q3 2023

oNon-GAAP net loss per share of $0.55 in Q3 2024, compared to non-GAAP net loss per share of $0.63 in Q3 2023

oWeighted average shares outstanding of 53.7 million in Q3 2024

*Tables reconciling GAAP to non-GAAP measures are provided at the end of this release.

Conference Call Details

Aeva will host a conference call and live webcast to discuss results at 2:00 p.m. PT / 5:00 p.m. ET today, November 6, 2024. The live webcast and replay can be accessed at investors.aeva.com.

About Aeva Technologies, Inc. (NYSE: AEVA)

Aeva’s mission is to bring the next wave of perception to a broad range of applications from automated driving to industrial robotics, consumer electronics, consumer health, security and beyond. Aeva is transforming autonomy with its groundbreaking sensing and perception technology that integrates all key LiDAR components onto a silicon photonics chip in a compact module. Aeva 4D LiDAR sensors uniquely detect instant velocity in addition to 3D position, allowing autonomous devices like vehicles and robots to make more intelligent and safe decisions. For more information, visit www.aeva.com, or connect with us on X or LinkedIn.

Aeva, the Aeva logo, Aeva 4D LiDAR, Aeva Atlas, Aeries, Aeva Ultra Resolution, Aeva CoreVision, and Aeva X1 are trademarks/registered trademarks of Aeva, Inc. All rights reserved. Third-party trademarks are the property of their respective owners.

Forward-looking Statements

This press release contains certain forward-looking statements within the meaning of the federal securities laws. These forward-looking statements generally are identified by the words “believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,” “strategy,” “future,” “opportunity,” “plan,” “may,” “should,” “will,” “would,” “will be,” “will continue,” “will likely result,” and similar expressions. Forward-looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties. Forward-looking statements in this press release include our beliefs regarding our financial position and operating performance and business objectives for 2024, along with our expectations with respect to the production agreements with Daimler Truck and The Indoor Lab as well as engagement and deployments with other customers and partners, our future production plans and our ability to access capital under our preferred equity facility. Many factors could cause actual future events to differ materially from the forward-looking statements in this press release, including, but not limited to: (i) the fact that Aeva is an early stage company with a history of operating losses and may never achieve profitability, (ii) Aeva’s limited operating history and limited history of shipping significant product volumes, (iii) the ability to implement business plans, forecasts, and other expectations and to identify and realize additional opportunities, (iv) the ability for Aeva to have its products selected for inclusion in OEM products, (v) the ability to manufacture at volumes and costs needed for commercial programs, (vi) no assurance that any of our customers will ever complete such testing and validation with us or that we will receive any billings or revenues in connection with such programs, (vii) the need to conclude definitive deployment agreements with potential end

customers, including those mentioned in this release, (viii) that any validation orders will result in larger orders, (ix) that any programs into which our products may be designed will result in significant end customer sales, (x) that any of the locations referenced in this press release will result in significant deployments of our products, (xi) unforeseen project delays or product issues, such as difficulties or delays in shipping, manufacturing or installation, (xii) end customer acceptance of the platform, (xiii) revenue recognition rules, and (xiv) other material risks and other important factors that could affect our financial results that are further described in our filings with the SEC. Please refer to our filings with the SEC, including our most recent Form 10-K and Form 10-Q. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and Aeva assumes no obligation and does not intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise. Aeva does not give any assurance that it will achieve its expectations.

Non-GAAP Information

In addition to our financial results determined in accordance with U.S. GAAP, we present non-GAAP operating loss and non-GAAP net loss per share. “Non-GAAP operating loss” is defined as GAAP operating loss before stock-based compensation and litigation settlement, net. “Non-GAAP net loss per share” is defined as non-GAAP net loss divided by weighted average shares outstanding, basic and diluted. “Non-GAAP net loss” is defined as GAAP net loss before stock-based compensation, litigation settlement, net and change in fair value of warrant liability.

We believe that non-GAAP operating loss and non-GAAP net loss per share, when taken together with the corresponding U.S. GAAP financial measures, provide meaningful supplemental information regarding our performance by excluding certain items that may not be indicative of our core business, results of operations, or outlook. We consider non-GAAP operating loss and non-GAAP net loss per share to be important measures because they help illustrate underlying trends in our business and our historical operating performance on a more consistent basis.

However, non-GAAP financial information is presented for supplemental informational purposes only, has limitations as an analytical tool, and should not be considered in isolation or as a substitute for financial information presented in accordance with U.S. GAAP. Non-GAAP financial measures have limitations, including that they exclude certain expenses that are required under GAAP, which adjustments reflect the exercise of judgment by management. In addition, other companies, including companies in our industry, may calculate similarly-titled non-GAAP financial measures or ratios differently or may use other financial measures or ratios to evaluate their performance, all of which could reduce the usefulness of non-GAAP operating loss and non-GAAP net loss per share as tools for comparison. Reconciliations are provided at the end of this release to the most directly comparable financial measures in accordance with U.S. GAAP. Investors are encouraged to review our U.S. GAAP financial measures and not to rely on any single financial measure to evaluate our business.

Contacts

Investors:

Andrew Fung

investors@aeva.ai

Media:

Michael Oldenburg

press@aeva.ai

|

|

|

|

|

|

|

|

|

|

AEVA TECHNOLOGIES, INC. |

Condensed Consolidated Balance Sheets |

(Unaudited) |

(In thousands) |

|

|

|

|

|

|

|

|

|

|

September 30,

2024 |

|

|

December 31,

2023 |

|

|

|

|

|

|

|

|

|

|

ASSETS |

|

|

|

|

|

|

|

CURRENT ASSETS: |

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

30,462 |

|

|

$ |

38,547 |

|

|

Marketable securities |

|

|

104,355 |

|

|

|

182,481 |

|

|

Accounts receivable |

|

|

575 |

|

|

|

628 |

|

|

Inventories |

|

|

2,125 |

|

|

|

2,374 |

|

|

Other current assets |

|

|

7,752 |

|

|

|

5,195 |

|

|

Total current assets |

|

|

145,269 |

|

|

|

229,225 |

|

|

Operating lease right-of-use assets |

|

|

4,713 |

|

|

|

7,289 |

|

|

Property, plant and equipment, net |

|

|

11,389 |

|

|

|

12,114 |

|

|

Intangible assets, net |

|

|

1,950 |

|

|

|

2,625 |

|

|

Other noncurrent assets |

|

|

5,815 |

|

|

|

6,132 |

|

|

TOTAL ASSETS |

|

$ |

169,136 |

|

|

$ |

257,385 |

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

CURRENT LIABILITIES: |

|

|

|

|

|

|

|

Accounts payable |

|

$ |

3,010 |

|

|

$ |

3,602 |

|

|

Accrued liabilities |

|

|

4,632 |

|

|

|

2,648 |

|

|

Accrued employee costs |

|

|

4,456 |

|

|

|

6,043 |

|

|

Lease liability, current portion |

|

|

3,385 |

|

|

|

3,587 |

|

|

Other current liabilities |

|

|

18,132 |

|

|

|

2,524 |

|

|

Total current liabilities |

|

|

33,615 |

|

|

|

18,404 |

|

|

Lease liability, noncurrent portion |

|

|

1,306 |

|

|

|

3,767 |

|

|

Warrant liability |

|

|

4,955 |

|

|

|

6,772 |

|

|

TOTAL LIABILITIES |

|

|

39,876 |

|

|

|

28,943 |

|

|

STOCKHOLDERS’ EQUITY: |

|

|

|

|

|

|

|

Common stock |

|

|

6 |

|

|

|

5 |

|

|

Additional paid-in capital |

|

|

704,853 |

|

|

|

688,124 |

|

|

Accumulated other comprehensive income (loss) |

|

|

116 |

|

|

|

(87 |

) |

|

Accumulated deficit |

|

|

(575,715 |

) |

|

|

(459,600 |

) |

|

TOTAL STOCKHOLDERS’ EQUITY |

|

|

129,260 |

|

|

|

228,442 |

|

|

TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

$ |

169,136 |

|

|

$ |

257,385 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AEVA TECHNOLOGIES, INC. |

|

Condensed Consolidated Statements of Operations |

|

(Unaudited) |

|

(In thousands, except share and per share data) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

|

Nine Months Ended September 30, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Revenue |

|

$ |

2,250 |

|

|

$ |

810 |

|

|

$ |

6,369 |

|

|

$ |

2,701 |

|

Cost of revenue (1) |

|

|

2,971 |

|

|

|

2,525 |

|

|

|

9,330 |

|

|

|

7,715 |

|

Gross loss |

|

|

(721 |

) |

|

|

(1,715 |

) |

|

|

(2,961 |

) |

|

|

(5,014 |

) |

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Research and development expenses (1) |

|

|

27,116 |

|

|

|

23,787 |

|

|

|

78,324 |

|

|

|

76,306 |

|

General and administrative expenses (1) |

|

|

8,456 |

|

|

|

8,474 |

|

|

|

25,530 |

|

|

|

24,020 |

|

Selling and marketing expenses (1) |

|

|

1,583 |

|

|

|

1,520 |

|

|

|

5,818 |

|

|

|

5,603 |

|

Litigation settlement, net (2) |

|

|

— |

|

|

|

— |

|

|

|

11,500 |

|

|

|

— |

|

Total operating expenses |

|

|

37,155 |

|

|

|

33,781 |

|

|

|

121,172 |

|

|

|

105,929 |

|

Operating loss |

|

|

(37,876 |

) |

|

|

(35,496 |

) |

|

|

(124,133 |

) |

|

|

(110,943 |

) |

Interest income |

|

|

1,770 |

|

|

|

2,219 |

|

|

|

6,327 |

|

|

|

6,508 |

|

Other income (expense), net |

|

|

(1,268 |

) |

|

|

39 |

|

|

|

1,836 |

|

|

|

68 |

|

Loss before income taxes |

|

$ |

(37,374 |

) |

|

$ |

(33,238 |

) |

|

$ |

(115,970 |

) |

|

$ |

(104,367 |

) |

Income tax provision |

|

|

22 |

|

|

|

— |

|

|

|

145 |

|

|

|

— |

|

Net loss |

|

$ |

(37,396 |

) |

|

$ |

(33,238 |

) |

|

$ |

(116,115 |

) |

|

$ |

(104,367 |

) |

Net loss per share, basic and diluted |

|

$ |

(0.70 |

) |

|

$ |

(0.75 |

) |

|

$ |

(2.18 |

) |

|

$ |

(2.36 |

) |

Weighted-average shares used in computing net loss per share, basic and diluted |

|

|

53,704,039 |

|

|

|

44,565,164 |

|

|

|

53,149,318 |

|

|

|

44,200,670 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Includes stock-based compensation as follows: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

|

Nine Months Ended September 30, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Cost of revenue |

|

$ |

42 |

|

|

$ |

161 |

|

|

$ |

208 |

|

|

$ |

858 |

|

Research and development expenses |

|

|

4,261 |

|

|

|

3,094 |

|

|

|

12,439 |

|

|

|

12,717 |

|

General and administrative expenses |

|

|

1,983 |

|

|

|

1,654 |

|

|

|

3,803 |

|

|

|

3,989 |

|

Selling and marketing expenses |

|

|

219 |

|

|

|

240 |

|

|

|

680 |

|

|

|

589 |

|

Total stock-based compensation expense |

|

$ |

6,505 |

|

|

$ |

5,149 |

|

|

$ |

17,130 |

|

|

$ |

18,153 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(2) Relates to the settlement of litigation related to the de-SPAC transaction and Aeva's indemnification obligations related thereto. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AEVA TECHNOLOGIES, INC. |

|

Condensed Consolidated Statements of Cash Flows |

|

(Unaudited) |

|

(In thousands) |

|

|

|

Nine Months Ended September 30, |

|

|

|

2024 |

|

|

2023 |

|

Cash flows from operating activities: |

|

|

|

|

|

|

Net loss |

|

$ |

(116,115 |

) |

|

$ |

(104,367 |

) |

Adjustments to reconcile net loss to net cash used in operating activities: |

|

|

|

|

|

|

Depreciation and amortization |

|

|

4,042 |

|

|

|

3,145 |

|

Impairment of inventories |

|

|

883 |

|

|

|

170 |

|

Change in fair value of warrant liabilities |

|

|

(1,817 |

) |

|

|

(68 |

) |

Stock-based compensation |

|

|

17,130 |

|

|

|

18,153 |

|

Amortization of right-of-use assets |

|

|

2,576 |

|

|

|

2,278 |

|

Amortization of premium and accretion of discount on available-for-sale securities, net |

|

|

(2,932 |

) |

|

|

(2,102 |

) |

Other |

|

|

298 |

|

|

|

— |

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

Accounts receivable |

|

|

53 |

|

|

|

2,118 |

|

Inventories |

|

|

(634 |

) |

|

|

89 |

|

Other current assets |

|

|

(2,557 |

) |

|

|

(147 |

) |

Other noncurrent assets |

|

|

317 |

|

|

|

(204 |

) |

Accounts payable |

|

|

(563 |

) |

|

|

(2,402 |

) |

Accrued liabilities |

|

|

1,985 |

|

|

|

(6,291 |

) |

Accrued employee costs |

|

|

(1,626 |

) |

|

|

139 |

|

Lease liability |

|

|

(2,663 |

) |

|

|

(2,253 |

) |

Other current liabilities |

|

|

15,608 |

|

|

|

250 |

|

Net cash used in operating activities |

|

|

(86,015 |

) |

|

|

(91,492 |

) |

Cash flows from investing activities: |

|

|

|

|

|

|

Purchase of property, plant and equipment |

|

|

(2,969 |

) |

|

|

(3,423 |

) |

Purchase of available-for-sale securities |

|

|

(62,848 |

) |

|

|

(97,642 |

) |

Proceeds from maturities of available-for-sale securities |

|

|

144,108 |

|

|

|

165,597 |

|

Net cash provided by investing activities |

|

|

78,291 |

|

|

|

64,532 |

|

Cash flows from financing activities: |

|

|

|

|

|

|

Payments of taxes withheld on net settled vesting of restricted stock units |

|

|

(438 |

) |

|

|

(62 |

) |

Proceeds from exercise of stock options |

|

|

77 |

|

|

|

152 |

|

Net cash (used in) provided by financing activities |

|

|

(361 |

) |

|

|

90 |

|

Net decrease in cash and cash equivalents |

|

|

(8,085 |

) |

|

|

(26,870 |

) |

Beginning cash and cash equivalents |

|

|

38,547 |

|

|

|

67,420 |

|

Ending cash and cash equivalents |

|

$ |

30,462 |

|

|

$ |

40,550 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AEVA TECHNOLOGIES, INC. |

|

Reconciliation of GAAP to Non-GAAP Operating Results |

|

(Unaudited) |

|

(In thousands, except share and per share data) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reconciliation from GAAP to non-GAAP operating loss |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

|

Nine Months Ended September 30, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAAP operating loss |

|

$ |

(37,876 |

) |

|

$ |

(35,496 |

) |

|

$ |

(124,133 |

) |

|

$ |

(110,943 |

) |

Stock-based compensation |

|

|

6,505 |

|

|

|

5,149 |

|

|

|

17,130 |

|

|

|

18,153 |

|

Litigation settlement, net |

|

|

— |

|

|

|

— |

|

|

|

11,500 |

|

|

|

— |

|

Non-GAAP operating loss |

|

$ |

(31,371 |

) |

|

$ |

(30,347 |

) |

|

$ |

(95,503 |

) |

|

$ |

(92,790 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reconciliation from GAAP to non-GAAP net loss |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

|

Nine Months Ended September 30, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAAP net loss |

|

$ |

(37,396 |

) |

|

$ |

(33,238 |

) |

|

$ |

(116,115 |

) |

|

$ |

(104,367 |

) |

Stock-based compensation |

|

|

6,505 |

|

|

|

5,149 |

|

|

|

17,130 |

|

|

|

18,153 |

|

Litigation settlement, net |

|

|

— |

|

|

|

— |

|

|

|

11,500 |

|

|

|

— |

|

Change in fair value of warrant liability |

|

|

1,263 |

|

|

|

(40 |

) |

|

|

(1,817 |

) |

|

|

(68 |

) |

Non-GAAP net loss |

|

$ |

(29,628 |

) |

|

$ |

(28,129 |

) |

|

$ |

(89,302 |

) |

|

$ |

(86,282 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reconciliation between GAAP and non-GAAP net loss per share |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

|

Nine Months Ended September 30, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Shares used in computing GAAP net loss per share: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted |

|

|

53,704,039 |

|

|

|

44,565,164 |

|

|

|

53,149,318 |

|

|

|

44,200,670 |

|

GAAP net loss per share |

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted |

|

$ |

(0.70 |

) |

|

$ |

(0.75 |

) |

|

$ |

(2.18 |

) |

|

$ |

(2.36 |

) |

Stock-based compensation |

|

|

0.13 |

|

|

|

0.12 |

|

|

|

0.31 |

|

|

|

0.41 |

|

Litigation settlement, net |

|

|

— |

|

|

|

— |

|

|

|

0.22 |

|

|

|

— |

|

Change in fair value of warrant liability |

|

|

0.02 |

|

|

|

(0.00 |

) |

|

|

(0.03 |

) |

|

|

— |

|

Non-GAAP net loss per share |

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted |

|

$ |

(0.55 |

) |

|

$ |

(0.63 |

) |

|

$ |

(1.68 |

) |

|

$ |

(1.95 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

v3.24.3

Document And Entity Information

|

Nov. 06, 2024 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Nov. 06, 2024

|

| Entity Registrant Name |

Aeva Technologies, Inc.

|

| Entity Central Index Key |

0001789029

|

| Entity Emerging Growth Company |

false

|

| Entity File Number |

001-39204

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

84-3080757

|

| Entity Address, Address Line One |

555 Ellis Street

|

| Entity Address, City or Town |

Mountain View

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

94043

|

| City Area Code |

(650)

|

| Local Phone Number |

481-7070

|

| Entity Information, Former Legal or Registered Name |

Not Applicable

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Common Stock [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common stock, par value $0.0001 per share

|

| Trading Symbol |

AEVA

|

| Security Exchange Name |

NYSE

|

| Warrants to Purchase [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Warrants to purchase one share of common stock

|

| Trading Symbol |

AEVA.WS

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=aeva_WarrantsToPurchaseMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

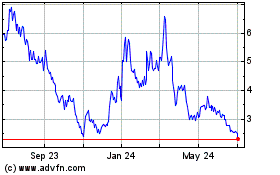

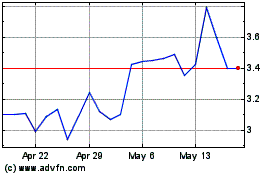

Aeva Technologies (NYSE:AEVA)

Historical Stock Chart

From Nov 2024 to Dec 2024

Aeva Technologies (NYSE:AEVA)

Historical Stock Chart

From Dec 2023 to Dec 2024